PUBLISHER: Roots Analysis | PRODUCT CODE: 1616887

PUBLISHER: Roots Analysis | PRODUCT CODE: 1616887

Deep Learning Market in Drug Discovery and Diagnostics by Therapeutic Area and Key Geographical Regions : Industry Trends and Global Forecasts, Till 2035

DEEP LEARNING MARKET IN DRUG DISCOVERY AND DIAGNOSTICS: OVERVIEW

As per Roots Analysis, the global deep learning market in drug discovery and diagnostic is estimated to grow from USD 3.6 billion in the current year to USD 34.5 billion by 2035, at a CAGR of 21.9% during the forecast period, till 2035.

The market sizing and opportunity analysis has been segmented across the following parameters:

Therapeutic Areas

- Oncological Disorders

- Infectious Diseases

- Neurological Disorders

- Immunological Disorders

- Endocrine Disorders

- Cardiovascular Disorders

- Respiratory Disorders

- Eye Disorders

- Musculoskeletal Disorders

- Inflammatory Disorders

- Other Disorders

Key Geographical Regions

- North America

- Europe

- Asia-Pacific

- Rest of the World

DEEP LEARNING MARKET IN DRUG DISCOVERY AND DIAGNOSTICS: GROWTH AND TRENDS

Deep learning is a complex machine learning algorithm that has the ability to process a large amount of data using neural networks. Over the past few years, deep learning has evolved as an excellent computational resource, as a result of which, various technology developers are shifting their focus towards this industry. Intelligent machines backed by relevant deep learning models are already producing significant results across various segments of the industry. The potential applications of the technique in feature extraction, medical imaging, diagnostics, and drug discovery and development have significantly assisted the healthcare and life sciences domain. Additionally, recent advancements in the deep learning market have demonstrated its potential in other healthcare-associated segments, such as molecular profiling, AI in medical imaging, data analysis and virtual screening. Owing to high investments, rising adoption of deep learning technologies and the ongoing pace of innovation, deep learning market in healthcare and drug discovery is projected to witness significant growth in the coming years.

DEEP LEARNING MARKET IN DRUG DISCOVERY AND DIAGNOSTICS: KEY INSIGHTS

The report delves into the current state of the deep learning market in drug discovery and diagnostics, and identifies potential growth opportunities within the industry. Some key findings from the report include:

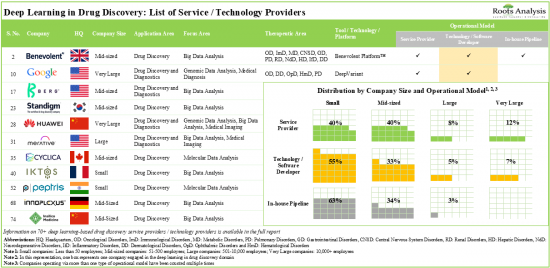

1. Presently, more than 70 players across the globe claim to offer deep learning technologies for potential applications across various steps of drug discovery and development process.

2. Majority (70%) of the stakeholders employ proprietary deep learning-based technologies in drug discovery to offer big data analysis.

3. Nearly 50% of the deep learning-based diagnostic providers are based in North America; most such players offer technologies for use across medical imaging and medical diagnosis related applications.

4. Around 70% of the players engaged in offering deep learning solutions for diagnostics have been established post-2011; majority of the players offer solutions focused on oncological disorders.

5. Foreseeing the lucrative potential, a large number of players have made investments worth over USD 15 billion, across 210 funding instances, to advance the initiatives undertaken by industry stakeholders.

6. Over the past few years, more than 704,000 patients have been recruited / enrolled in clinical trials registered for deep learning-based solutions / diagnostics across different geographies.

7. Some players have managed to establish strong competitive positions; in the near future, we expect multiple acquisitions to take place wherein the relative valuation of a firm is likely to be a key determinant.

8. Increasing adoption of deep learning technologies in the life sciences and healthcare industry is anticipated to create profitable business opportunities for technology developers.

9. The market opportunity associated with deep learning in drug discovery is expected to witness an annualized growth rate of 23% over the coming 12 years.

DEEP LEARNING MARKET IN DRUG DISCOVERY AND DIAGNOSTICS: KEY SEGMENTS

Oncological Disorders Segment Accounts for the Largest Share of the Deep Learning Market for Drug Discovery and Diagnostics

Based on the therapeutic area, the market is segmented into oncological disorders, infectious diseases, neurological disorders, immunological disorders, endocrine disorders, cardiovascular disorders, respiratory disorders, eye disorders, musculoskeletal disorders, inflammatory disorders and other disorders. While oncological disorders account for a relatively higher market share, it is worth highlighting that the musculoskeletal disorders segment is expected to witness substantial market growth in the coming years.

North America Accounts for the Largest Share of the Market

Based on key geographical regions, the market is segmented into North America, Europe, Asia-Pacific and Rest of the world. Majority share is expected to be captured by technology developers based in North America and Europe. It is worth highlighting that, over the years, the market for Asia-pacific is expected to grow at a higher CAGR.

Example Players in the Deep Learning Market in Drug Discovery and Diagnostics

- Aegicare

- Aiforia Technologies

- Ardigen

- Berg

- Huawei

- Merative

- Nference

- Nvidia

- Owkin

- Phenomic AI

- Pixel AI

Primary Research Overview

The opinions and insights presented in this study were influenced by discussions conducted with multiple stakeholders. The research report features detailed transcripts of interviews held with the following industry stakeholders:

- Chief Executive Officer, Advenio Technosys

- Founder and Chief Executive Officer, AlgoSurg

- Former Vice President of Product and Software Development, Arterys

- Head of Strategy and Marketing, Arterys

- Chief Technical Officer and Chief Operating Officer, Arya.ai

- Former Research Scientist, ContextVision

- Chief Executive Officer, Mediwhale

- Chief Executive Officer, Nucleai

DEEP LEARNING MARKET IN DRUG DISCOVERY AND DIAGNOSTICS: RESEARCH COVERAGE

- Market Sizing and Opportunity Analysis: The report features an in-depth analysis of the deep learning market in drug discovery and diagnostics, focusing on key market segments, including [A] therapeutic area and [B] geographical regions.

- Market Landscape 1: A comprehensive evaluation of deep learning companies offering technologies and services for the purpose of drug discovery, considering various parameters, such as [A] year of establishment, [B] company size, [C] location of headquarters, [D] application area, [E] focus area, [F] therapeutic area, [G] operational model, along with information on the [H] company's service and product centric models.

- Market Landscape 2: A comprehensive evaluation of deep learning companies offering technologies / services for diagnostics, considering various parameters, such as [A] year of establishment, [B] company size, [C] location of headquarters, [D] application area, [E] focus area, [F] therapeutic area, [G] type of offering / solution, along with information on various [H] compatible device (CT, MRI, Ultrasound, X-Ray, Mammography, PET and others).

- Company Profiles: In-depth profiles of key deep learning technology and service providers based in North America, Europe and Asia Pacific, focusing on [A] company overviews, [B] financial information (if available), [C] service portfolio, [D] recent developments and [D] an informed future outlook.

- Porter's Five Forces: A qualitative analysis, highlighting the five competitive forces prevalent in deep learning industry, including threats for new entrants, bargaining power of companies using deep learning-based drug discovery and diagnostics, bargaining power of drug developers, threats of substitute technologies and rivalry among existing competitors.

- Clinical Trial Analysis: Examination of completed, ongoing, and planned clinical studies that involve deep learning in diagnostics based on parameters like [A] trial registration year, [B] trial status, [C] patient enrollment, [D] type of sponsor / collaborator, [E] therapeutic area, [F] trial focus area, [G] study design, [H] geography and [I] most active industry and non-industry players (in terms of number of clinical trials conducted).

- Funding and Investment Analysis: A detailed evaluation of the investments made in the deep learning domain, based on several parameters, such as [A] year of funding, [B] amount invested, [C] type of funding, [D] focus area, [E] therapeutic area, [F] geography, [G] most active players (in terms of number of funding instances and amount invested) and [H] key investors (in terms of number of funding instances).

- Start-up Health Indexing: An analysis of the start-ups engaged in the deep learning market focused on drug discovery and diagnostics, based on several relevant parameters, such as focus area, therapeutic area, operational model, compatible device, type of offering and start-up health indexing.

- Company Valuation Analysis: An elaborate valuation analysis of companies that are involved in the deep learning in drug discovery and diagnostics market, based on our proprietary, multi-variable dependent valuation model to estimate the current valuation / net worth of industry players.

KEY QUESTIONS ANSWERED IN THIS REPORT

- How many companies are currently engaged in this market?

- Which are the leading companies in this market?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

REASONS TO BUY THIS REPORT

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

ADDITIONAL BENEFITS

- Complimentary PPT Insights Packs

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 10% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

1. PREFACE

- 1.1. Introduction

- 1.2. Key Market Insights

- 1.3. Scope of the Report

- 1.4. Research Methodology

- 1.5. Frequently Asked Questions

- 1.6. Chapter Outlines

2. EXECUTIVE SUMMARY

3. INTRODUCTION

- 3.1. Humans, Machines and Intelligence

- 3.2. The Science of Learning

- 3.2.1. Teaching Machines

- 3.2.1.1. Machines for Computing

- 3.2.1.2. Artificial Intelligence

- 3.2.1. Teaching Machines

- 3.3. The Big Data Revolution

- 3.3.1. Overview of Big Data

- 3.3.2. Role of Internet of Things (IoT)

- 3.3.3. Key Application Areas of Big Data

- 3.3.3.1. Big Data Analytics in Healthcare

- 3.3.3.2. Machine Learning

- 3.3.3.3. Deep Learning

- 3.4. Deep Learning in Healthcare

- 3.4.1. Personalized Medicine

- 3.4.2. Lifestyle Management

- 3.4.3. Drug Discovery

- 3.4.4. Clinical Trial Management

- 3.4.5. Diagnostics

- 3.5. Concluding Remarks

4. MARKET OVERVIEW: DEEP LEARNING IN DRUG DISCOVERY

- 4.1. Chapter Overview

- 4.2. Deep Learning in Drug Discovery: Overall Market Landscape of Service / Technology Providers

- 4.2.1. Analysis by Year of Establishment

- 4.2.2. Analysis by Company Size

- 4.2.3. Analysis by Location of Headquarters

- 4.2.4. Analysis by Application Area

- 4.2.5. Analysis by Focus Area

- 4.2.6. Analysis by Therapeutic Area

- 4.2.7. Analysis by Operational Model

- 4.2.7.1. Analysis by Service Centric Model

- 4.2.7.2. Analysis by Product Centric Model

5. MARKET OVERVIEW: DEEP LEARNING IN DIAGNOSTICS

- 5.1. Chapter Overview

- 5.2. Deep Learning in Diagnostics: Overall Market Landscape of Service / Technology Providers

- 5.2.1. Analysis by Year of Establishment

- 5.2.2. Analysis by Company Size

- 5.2.3. Analysis by Location of Headquarters

- 5.2.4. Analysis by Application Area

- 5.2.5. Analysis by Focus Area

- 5.2.6. Analysis by Therapeutic Area

- 5.2.7. Analysis by Type of Offering / Solution

- 5.2.8. Analysis by Compatible Device

6. COMPANY PROFILES

- 6.1. Chapter Overview

- 6.2. Aegicare

- 6.2.1. Company Overview

- 6.2.2. Service Portfolio

- 6.2.3. Recent Developments and Future Outlook

- 6.3. Aiforia Technologies

- 6.3.1. Company Overview

- 6.3.2. Financial Information

- 6.3.3. Service Portfolio

- 6.3.4. Recent Developments and Future Outlook

- 6.4. Ardigen

- 6.4.1. Company Overview

- 6.4.2. Financial Information

- 6.4.3. Service Portfolio

- 6.4.4. Recent Developments and Future Outlook

- 6.5. Berg

- 6.5.1. Company Overview

- 6.5.2. Service Portfolio

- 6.5.3. Recent Developments and Future Outlook

- 6.6. Google

- 6.6.1. Company Overview

- 6.6.2. Financial Information

- 6.6.3. Service Portfolio

- 6.6.4. Recent Developments and Future Outlook

- 6.7. Huawei

- 6.7.1. Company Overview

- 6.7.2. Financial Information

- 6.7.3. Service Portfolio

- 6.7.4. Recent Developments and Future Outlook

- 6.8. Merative

- 6.8.1. Company Overview

- 6.8.2. Service Portfolio

- 6.8.3. Recent Developments and Future Outlook

- 6.9. Nference

- 6.9.1. Company Overview

- 6.9.2. Service Portfolio

- 6.9.3. Recent Developments and Future Outlook

- 6.10. Nvidia

- 6.10.1. Company Overview

- 6.10.2. Financial Information

- 6.10.3. Service Portfolio

- 6.10.4. Recent Developments and Future Outlook

- 6.11. Owkin

- 6.11.1. Company Overview

- 6.11.2. Service Portfolio

- 6.11.3. Recent Developments and Future Outlook

- 6.12. Phenomic AI

- 6.12.1. Company Overview

- 6.12.2. Service Portfolio

- 6.12.3. Recent Developments and Future Outlook

- 6.13. Pixel AI

- 6.13.1. Company Overview

- 6.13.2. Service Portfolio

- 6.13.3. Recent Developments and Future Outlook

7. PORTER'S FIVE FORCES ANALYSIS

- 7.1. Chapter Overview

- 7.2. Methodology and Assumptions

- 7.3. Key Parameters

- 7.3.1. Threats of New Entrants

- 7.3.2. Bargaining Power of Companies Using Deep Learning for Drug Discovery and Diagnostics

- 7.3.3. Bargaining Power of Drug Developers

- 7.3.4. Threats of Substitute Technologies

- 7.3.5. Rivalry Among Existing Competitors

- 7.4. Concluding Remarks

8. CLINICAL TRIAL ANALYSIS

- 8.1. Chapter Overview

- 8.2. Scope and Methodology

- 8.3. Deep Learning Market: Clinical Trial Analysis

- 8.3.1. Analysis by Trial Registration Year

- 8.3.2. Analysis by Trial Status

- 8.3.3. Analysis by Trial Registration Year and Patient Enrollment

- 8.3.4. Analysis by Trial Registration Year and Trial Status

- 8.3.5. Analysis by Type of Sponsor / Collaborator

- 8.3.6. Analysis by Therapeutic Area

- 8.3.7. Word Cloud: Trial Focus Area

- 8.3.8. Analysis by Study Design

- 8.3.9. Geographical Analysis by Number of Clinical Trials

- 8.3.10. Geographical Analysis by Trial Registration Year and Patient Population

- 8.3.11. Leading Organizations: Analysis by Number of Registered Trials

9. FUNDING AND INVESTMENT ANALYSIS

- 9.1. Chapter Overview

- 9.2. Types of Funding

- 9.3. Deep Learning Market: Funding and Investment Analysis

- 9.3.1. Analysis by Year of Funding

- 9.3.2. Analysis by Amount Invested

- 9.3.3. Analysis by Type of Funding

- 9.3.4. Analysis by Year and Type of Funding

- 9.3.5. Analysis by Focus Areas

- 9.3.6. Analysis by Therapeutic Area

- 9.3.7. Analysis by Geography

- 9.3.8. Most Active Players: Analysis by Number of Funding Instances

- 9.3.9. Most Active Players: Analysis by Amount Invested

- 9.3.10. Most Active Investors: Analysis by Number of Funding Instances

10. START-UP HEALTH INDEXING

- 10.1. Chapter Overview

- 10.2. Start-ups Focused on Deep Learning in Drug Discovery

- 10.2.1. Methodology and Key Parameters

- 10.2.2. Analysis by Location of Headquarters

- 10.3. Benchmarking Analysis of Start-ups Focused on Deep Learning in Drug Discovery

- 10.3.1. Analysis by Focus Area

- 10.3.2. Analysis by Therapeutic Area

- 10.3.3. Analysis by Operational Model

- 10.3.4. Start-up Health Indexing: Roots Analysis Perspective

- 10.4. Start-ups Focused on Deep Learning in Diagnostics

- 10.4.1. Methodology and Key Parameters

- 10.4.2. Analysis by Location of Headquarters

- 10.5. Benchmarking Analysis of Start-ups Focused on Deep Learning in Diagnostics

- 10.5.1. Analysis by Focus Area

- 10.5.2. Analysis by Therapeutic Area

- 10.5.3. Analysis by Compatible Device

- 10.5.4. Analysis by Type of Offering

- 10.5.5. Start-up Health Indexing: Roots Analysis Perspective

11. COMPANY VALUATION ANALYSIS

- 11.1. Chapter Overview

- 11.2. Company Valuation Analysis: Key Parameters

- 11.3. Methodology

- 11.4. Company Valuation Analysis: Roots Analysis Proprietary Scores

12. MARKET SIZING AND OPPORTUNITY ANALYSIS: DEEP LEARNING IN DRUG DISCOVERY

- 12.1. Chapter Overview

- 12.2. Key Assumptions and Methodology

- 12.3. Overall Deep Learning in Drug Discovery Market, till 2035

- 12.3.1. Deep Learning in Drug Discovery Market: Analysis by Therapeutic Area, till 2035

- 12.3.1.1. Deep Learning in Drug Discovery Market for Oncological Disorders, till 2035

- 12.3.1.2. Deep Learning in Drug Discovery Market for Infectious Diseases, till 2035

- 12.3.1.3. Deep Learning in Drug Discovery Market for Neurological Disorders, till 2035

- 12.3.1.4. Deep Learning in Drug Discovery Market for Immunological Disorders, till 2035

- 12.3.1.5. Deep Learning in Drug Discovery Market for Endocrine Disorders, till 2035

- 12.3.1.6. Deep Learning in Drug Discovery Market for Cardiovascular Disorders, till 2035

- 12.3.1.7. Deep Learning in Drug Discovery Market for Respiratory Disorders, till 2035

- 12.3.1.8. Deep Learning in Drug Discovery Market for Other Disorders, till 2035

- 12.3.2. Deep Learning in Drug Discovery Market: Analysis by Geography, till 2035

- 12.3.2.1. Deep Learning in Drug Discovery Market in North America, till 2035

- 12.3.2.1.1. Deep Learning in Drug Discovery Market in the US, till 2035

- 12.3.2.1.2. Deep Learning in Drug Discovery Market in Canada, till 2035

- 12.3.2.2. Deep Learning in Drug Discovery Market in Europe, till 2035

- 12.3.2.2.1. Deep Learning in Drug Discovery Market in the UK, till 2035

- 12.3.2.2.2. Deep Learning in Drug Discovery Market in France, till 2035

- 12.3.2.2.3. Deep Learning in Drug Discovery Market in Germany, till 2035

- 12.3.2.2.4. Deep Learning in Drug Discovery Market in Spain, till 2035

- 12.3.2.2.5. Deep Learning in Drug Discovery Market in Italy, till 2035

- 12.3.2.2.6. Deep Learning in Drug Discovery Market in Rest of Europe, till 2035

- 12.3.2.3. Deep Learning in Drug Discovery Market in Asia Pacific, till 2035

- 12.3.2.3.1. Deep Learning in Drug Discovery Market in China, till 2035

- 12.3.2.3.2. Deep Learning in Drug Discovery Market in India, till 2035

- 12.3.2.3.3. Deep Learning in Drug Discovery Market in Japan, till 2035

- 12.3.2.3.4. Deep Learning in Drug Discovery Market in Australia, till 2035

- 12.3.2.3.5. Deep Learning in Drug Discovery Market in South Korea, till 2035

- 12.3.2.4. Deep Learning in Drug Discovery Market in Rest of the World, till 2035

- 12.3.2.1. Deep Learning in Drug Discovery Market in North America, till 2035

- 12.3.3. Deep Learning in Drug Discovery: Cost Saving Analysis

- 12.3.3.1. Overall Cost Saving Potential Associated with the Use of Deep Learning in Drug Discovery, till 2035

- 12.3.1. Deep Learning in Drug Discovery Market: Analysis by Therapeutic Area, till 2035

13. MARKET SIZING AND OPPORTUNITY ANALYSIS: DEEP LEARNING IN DIAGNOSTICS

- 13.1. Chapter Overview

- 13.2. Key Assumptions and Methodology

- 13.3. Overall Deep Learning in Diagnostics Market, till 2035

- 13.3.1. Deep Learning in Diagnostics Market: Analysis by Target Therapeutic Area, till 2035

- 13.3.1.1. Deep Learning in Diagnostics Market for Oncological Disorders, till 2035

- 13.3.1.2. Deep Learning in Diagnostics Market for Cardiovascular Disorders, till 2035

- 13.3.1.3. Deep Learning in Diagnostics Market for Neurological Disorders, till 2035

- 13.3.1.4. Deep Learning in Diagnostics Market for Endocrine Disorders, till 2035

- 13.3.1.5. Deep Learning in Diagnostics Market for Respiratory Disorders, till 2035

- 13.3.1.6. Deep Learning in Diagnostics Market for Ophthalmic Disorders, till 2035

- 13.3.1.7. Deep Learning in Diagnostics Market for Infectious Diseases, till 2035

- 13.3.1.8. Deep Learning in Diagnostics Market for Musculoskeletal Disorders, till 2035

- 13.3.1.9. Deep Learning in Diagnostics Market for Inflammatory Disorders, till 2035

- 13.3.1.10. Deep Learning in Diagnostics Market for Other Disorders, till 2035

- 13.3.2. Deep Learning in Diagnostics Market: Analysis by Geography, till 2035

- 13.3.2.1. Deep Learning in Diagnostics Market in North America, till 2035

- 13.3.2.2. Deep Learning in Diagnostics Market in Europe, till 2035

- 13.3.2.3. Deep Learning in Diagnostics Market in Asia Pacific, till 2035

- 13.3.2.4. Deep Learning in Diagnostics Market in Rest of the World, till 2035

- 13.3.1. Deep Learning in Diagnostics Market: Analysis by Target Therapeutic Area, till 2035

14. DEEP LEARNING IN HEALTHCARE: EXPERT INSIGHTS

- 14.1. Chapter Overview

- 14.2. Sean Lane, Chief Executive Officer (Olive)

- 14.3. Junaid Kalia, Founder (NeuroCare.AI) and Adeel Memon, Assistant Professor, Neurology Specialist (West Virginia University Hospitals)

- 14.4. David Reich, President / Chief Operating Officer (The Mount Sinai Hospital) and Robbie Freeman, Vice President of Clinical Innovation (The Mount Sinai Hospital)

- 14.5. Elad Benjamin, Vice President, Business Leader Clinical Data Services (Philips) and Jonathan Laserson, Senior Deep Learning Researcher (Apple)

- 14.6. Kevin Lyman, Founder and Chief Science Officer (Enlitic)

15. CONCLUDING REMARKS

16. INTERVIEW TRANSCRIPTS

- 16.1. Chapter Overview

- 16.2. Nucleai

- 16.2.1. Company Overview

- 16.2.2. Interview Transcript: Avi Veidman, Chief Executive Officer and Emily Salerno, Commercial Strategy and Operations Lead

- 16.3. Mediwhale

- 16.3.1. Company Overview

- 16.3.2. Interview Transcript: Kevin Choi, Chief Executive Officer

- 16.4. Arterys

- 16.4.1. Company Overview

- 16.4.2. Interview Transcript: Babak Rasolzadeh, Former Vice President of Product and Software Development

- 16.5. AlgoSurg

- 16.5.1. Company Overview

- 16.5.2. Interview Transcript: Vikas Karade, Founder, Chief Executive Officer

- 16.6. ContextVision

- 16.6.1. Company Overview

- 16.6.2. Interview Transcript: Walter de Back, Former Research Scientist

- 16.7. Advenio Technosys

- 16.7.1. Company Overview

- 16.7.2. Interview Transcript: Mausumi Acharya, Chief Executive Officer

- 16.8. Arterys

- 16.8.1. Company Overview

- 16.8.2. Interview Transcript: Carla Leibowitz, Head of Strategy and Marketing

- 16.9. Arya.ai

- 16.9.1. Company Overview

- 16.9.2. Interview Transcript: Deekshith Marla, Founder, Chief Technology Officer and Sanjay Bhadra, Chief Business Officer

17. APPENDIX 1: TABULATED DATA

18. APPENDIX 2: LIST OF COMPANIES AND ORGANIZATIONS

List of Tables

- Table 3.1 Machine Learning: A Brief History

- Table 4.1 Deep Learning in Drug Discovery: List of Service / Technology Providers

- Table 4.2 Deep Learning in Drug Discovery Services / Technology Providers: Information on Application Area, Focus Area, Therapeutic Area and Operational Model

- Table 4.3 Deep Learning in Drug Discovery Services / Technology Providers: Information on Operational Model

- Table 4.4 Deep Learning in Drug Discovery Services / Technology Providers: Information on Service Centric Model

- Table 4.5 Deep Learning in Drug Discovery Services / Technology Providers: Information on Product Centric Model

- Table 5.1 Deep Learning in Diagnostics: List of Service / Technology Providers

- Table 5.2 Deep Learning in Diagnostics Services / Technology Providers: Information on Application Area, Focus Area and Therapeutic Area

- Table 5.3 Deep Learning in Diagnostics Services / Technology Providers: Information on Type of Offering / Solution and Compatible Device

- Table 6.1 List of Companies Profiled

- Table 6.2 Aegicare: Company Overview

- Table 6.3 Aiforia Technologies: Company Overview

- Table 6.4 Aiforia Technologies: Recent Developments and Future Outlook

- Table 6.5 Ardigen: Company Overview

- Table 6.6 Ardigen: Recent Developments and Future Outlook

- Table 6.7 Berg: Company Overview

- Table 6.8 Berg: Recent Developments and Future Outlook

- Table 6.9 Google: Company Overview

- Table 6.10 Google: Recent Developments and Future Outlook

- Table 6.11 Huawei: Company Overview

- Table 6.12 Huawei: Recent Developments and Future Outlook

- Table 6.13 Merative: Company Overview

- Table 6.14 Nference: Company Overview

- Table 6.15 Nference: Recent Developments and Future Outlook

- Table 6.16 Nvidia: Company Overview

- Table 6.17 Nvidia: Recent Developments and Future Outlook

- Table 6.18 Owkin: Company Overview

- Table 6.19 Owkin: Recent Developments and Future Outlook

- Table 6.20 Phenomic AI: Company Overview

- Table 6.21 Pixel AI: Company Overview

- Table 9.1 Deep Learning Market: List of Funding and Investments, since 2019

- Table 9.2 Funding and Investment Analysis: Summary of Investments

- Table 9.3 Funding and Investment Analysis: Summary of Venture Capital Funding

- Table 10.1 List of Start-ups Focused on Deep Learning in Drug Discovery

- Table 10.2 List of Start-ups Focused on Deep Learning in Diagnostics

- Table 11.1 Company Valuation Analysis: Scoring Sheet

- Table 11.2 Company Valuation Analysis: Estimated Valuation by Years of Experience

- Table 11.3 Company Valuation Analysis: Estimated Valuation by Employee Strength

- Table 16.1 Mediwhale: Key Highlights

- Table 16.2 Advenio Technosys: Key Highlights

- Table 16.3 Arterys: Key Highlights

- Table 16.4 Arya.ai: Key Highlights

- Table 17.1 Deep Learning in Drug Discovery: Distribution by Year of Establishment

- Table 17.2 Deep Learning in Drug Discovery: Distribution by Company Size

- Table 17.3 Deep Learning in Drug Discovery: Distribution by Location of Headquarters (Region-wise)

- Table 17.4 Deep Learning in Drug Discovery: Distribution by Location of Headquarters (Country-wise)

- Table 17.5 Deep Learning in Drug Discovery: Distribution by Application Area

- Table 17.6 Deep Learning in Drug Discovery: Distribution by Focus Area

- Table 17.7 Deep Learning in Drug Discovery: Distribution by Therapeutic Area

- Table 17.8 Deep Learning in Drug Discovery: Distribution by Operational Model

- Table 17.9 Deep Learning in Drug Discovery: Distribution by Company Size and Operational Model

- Table 17.10 Deep Learning in Drug Discovery: Distribution by Service Centric Model

- Table 17.11 Deep Learning in Drug Discovery: Distribution by Product Centric Model

- Table 17.12 Deep Learning in Diagnostics: Distribution by Year of Establishment

- Table 17.13 Deep Learning in Diagnostics: Distribution by Company Size

- Table 17.14 Deep Learning in Diagnostics: Distribution by Location of Headquarters (Region-wise)

- Table 17.15 Deep Learning in Diagnostics: Distribution by Location of Headquarters (Country-wise)

- Table 17.16 Deep Learning in Diagnostics: Distribution by Application Area

- Table 17.17 Deep Learning in Diagnostics: Distribution by Focus Area

- Table 17.18 Deep Learning in Diagnostics: Distribution by Therapeutic Area

- Table 17.19 Deep Learning in Diagnostics: Distribution by Type of Offering / Solution

- Table 17.20 Deep Learning in Diagnostics: Distribution by Company Size and Type of Offering / Solution

- Table 17.21 Deep Learning in Diagnostics: Distribution by Compatible Device

- Table 17.22 Aiforia Technologies: Annual Revenues, FY 2019 Onwards (EUR Thousand)

- Table 17.23 Ardigen: Annual Revenues, FY 2019 Onwards (EUR Million)

- Table 17.24 Google: Annual Revenues, FY 2019 Onwards (USD Billion)

- Table 17.25 Huawei: Annual Revenues, FY 2019 Onwards (CNY Billion)

- Table 17.26 Nvidia: Annual Revenues, FY 2019 Onwards (USD Billion)

- Table 17.27 Clinical Trial Analysis: Distribution by Trial Registration Year

- Table 17.28 Clinical Trial Analysis: Distribution by Trial Status

- Table 17.29 Clinical Trial Analysis: Distribution by Trial Registration Year and Patient Enrollment, since 2019

- Table 17.30 Clinical Trial Analysis: Distribution by Trial Registration Year and Trial Status

- Table 17.31 Clinical Trial Analysis: Distribution by Type of Sponsor / Collaborator

- Table 17.32 Clinical Trial Analysis: Distribution by Therapeutic Area

- Table 17.33 Clinical Trial Analysis: Distribution by Study Design

- Table 17.34 Clinical Trial Analysis: Geographical Distribution of Trials

- Table 17.35 Clinical Trial Analysis: Geographical Distribution by Trial Registration Year and Enrolled Patient Population

- Table 17.36 Leading Organizations: Distribution by Number of Registered Trials

- Table 17.37 Funding and Investment Analysis: Cumulative Distribution of Number of Instances by Year, since 2019

- Table 17.38 Funding and Investment Analysis: Cumulative Distribution of Amount Invested, since 2019 (USD Million)

- Table 17.39 Funding and Investment Analysis: Distribution of Instances by Type of Funding

- Table 17.40 Funding and Investment Analysis: Distribution of Amount Invested by Type of Funding (USD Million)

- Table 17.41 Funding and Investment Analysis: Distribution of Instances by Year and Type of Funding

- Table 17.42 Funding and Investments: Distribution of Instances by Focus Area

- Table 17.43 Funding and Investment Analysis: Distribution of Instances by Therapeutic Area

- Table 17.44 Funding and Investment Analysis: Geographical Distribution of Funding Instances

- Table 17.45 Funding and Investment Analysis: Geographical Distribution by Amount Invested (USD Million)

- Table 17.46 Most Active Players: Distribution by Number of Funding Instances

- Table 17.47 Most Active Players: Distribution by Amount Invested (USD Million)

- Table 17.48 Most Active Investors: Distribution by Number of Funding Instances

- Table 17.49 Start-ups Focused on Deep Learning in Drug Discovery: Distribution by Location of Headquarters

- Table 17.50 Start-ups Focused on Deep Learning in Drug Discovery: Distribution by Focus Area

- Table 17.51 Start-ups Focused on Deep Learning in Drug Discovery: Distribution by Therapeutic Area

- Table 17.52 Start-ups Focused on Deep Learning in Drug Discovery: Distribution by Operational Model

- Table 17.53 Start-ups Focused on Deep Learning in Diagnostics: Distribution by Location of Headquarters

- Table 17.54 Start-ups Focused on Deep Learning in Diagnostics: Distribution by Focus Area

- Table 17.55 Start-ups Focused on Deep Learning in Diagnostics: Distribution by Therapeutic Area

- Table 17.56 Start-ups Focused on Deep Learning in Diagnostics: Distribution by Compatible Device

- Table 17.57 Start-ups Focused on Deep Learning in Diagnostics: Distribution by Type of Offering

- Table 17.58 Overall Deep Learning in Drug Discovery Market: Conservative, Base and Optimistic Scenarios, till 2035 (USD Billion)

- Table 17.59 Deep Learning in Drug Discovery Market: Distribution by Therapeutic Area, till 2035 (USD Million)

- Table 17.60 Deep Learning in Drug Discovery Market for Oncological Disorders: Conservative, Base and Optimistic Scenarios, till 2035 (USD Million)

- Table 17.61 Deep Learning in Drug Discovery Market for Infectious Diseases: Conservative, Base and Optimistic Scenarios, till 2035 (USD Million)

- Table 17.62 Deep Learning in Drug Discovery Market for Neurological Disorders: Conservative, Base and Optimistic Scenarios, till 2035 (USD Million)

- Table 17.63 Deep Learning in Drug Discovery Market for Immunological Disorders: Conservative, Base and Optimistic Scenarios, till 2035 (USD Million)

- Table 17.64 Deep Learning in Drug Discovery Market for Endocrine Disorders: Conservative, Base and Optimistic Scenarios, till 2035 (USD Million)

- Table 17.65 Deep Learning in Drug Discovery Market for Cardiovascular Disorders: Conservative, Base and Optimistic Scenarios, till 2035 (USD Million)

- Table 17.66 Deep Learning in Drug Discovery Market for Respiratory Disorders: Conservative, Base and Optimistic Scenarios, till 2035 (USD Million)

- Table 17.67 Deep Learning in Drug Discovery Market for Other Disorders: Conservative, Base and Optimistic Scenarios, till 2035 (USD Million)

- Table 17.68 Deep Learning in Drug Discovery Market: Distribution by Geography, till 2035 (USD Billion)

- Table 17.69 Deep Learning in Drug Discovery Market in North America: Conservative, Base and Optimistic Scenarios, till 2035 (USD Million)

- Table 17.70 Deep Learning in Drug Discovery Market in the US: Conservative, Base and Optimistic Scenarios, till 2035 (USD Million)

- Table 17.71 Deep Learning in Drug Discovery Market in Canada: Conservative, Base and Optimistic Scenarios, till 2035 (USD Million)

- Table 17.72 Deep Learning in Drug Discovery Market in Europe: Conservative, Base and Optimistic Scenarios, till 2035 (USD Million)

- Table 17.73 Deep Learning in Drug Discovery Market in the UK: Conservative, Base and Optimistic Scenarios, till 2035 (USD Million)

- Table 17.74 Deep Learning in Drug Discovery Market in France: Conservative, Base and Optimistic Scenarios, till 2035 (USD Million)

- Table 17.75 Deep Learning in Drug Discovery Market in Germany: Conservative, Base and Optimistic Scenarios, till 2035 (USD Million)

- Table 17.76 Deep Learning in Drug Discovery Market in Spain: Conservative, Base and Optimistic Scenarios, till 2035 (USD Million)

- Table 17.77 Deep Learning in Drug Discovery Market in Italy: Conservative, Base and Optimistic Scenarios, till 2035 (USD Million)

- Table 17.78 Deep Learning in Drug Discovery Market in Rest of Europe: Conservative, Base and Optimistic Scenarios, till 2035 (USD Million)

- Table 17.79 Deep Learning in Drug Discovery Market in Asia Pacific: Conservative, Base and Optimistic Scenarios, till 2035 (USD Million)

- Table 17.80 Deep Learning in Drug Discovery Market in China: Conservative, Base and Optimistic Scenarios, till 2035 (USD Million)

- Table 17.81 Deep Learning in Drug Discovery Market in India: Conservative, Base and Optimistic Scenarios, till 2035 (USD Million)

- Table 17.82 Deep Learning in Drug Discovery Market in Japan: Conservative, Base and Optimistic Scenarios, till 2035 (USD Million)

- Table 17.83 Deep Learning in Drug Discovery Market in Australia: Conservative, Base and Optimistic Scenarios, till 2035 (USD Million)

- Table 17.84 Deep Learning in Drug Discovery Market in South Korea: Conservative, Base and Optimistic Scenarios, till 2035 (USD Million)

- Table 17.85 Deep Learning in Drug Discovery Market in Rest of the World: Conservative, Base and Optimistic Scenarios, till 2035 (USD Million)

- Table 17.86 Overall Cost Saving Potential Associated with the Use of Deep Learning in Drug Discovery, till 2035 (USD Billion)

- Table 17.87 Overall Deep Learning in Diagnostics Market: Conservative, Base and Optimistic Scenarios, till 2035 (USD Billion)

- Table 17.88 Deep Learning in Diagnostics Market: Distribution by Therapeutic Area, till 2035 (USD Billion)

- Table 17.89 Deep Learning in Diagnostics Market for Oncological Disorders: Conservative, Base and Optimistic Scenarios, till 2035 (USD Million)

- Table 17.90 Deep Learning in Diagnostics Market for Cardiovascular Disorders: Conservative, Base and Optimistic Scenarios, till 2035 (USD Million)

- Table 17.91 Deep Learning in Diagnostics Market for Neurological Disorders: Conservative, Base and Optimistic Scenarios, till 2035 (USD Million)

- Table 17.92 Deep Learning in Diagnostics Market for Endocrine Disorders: Conservative, Base and Optimistic Scenarios, till 2035 (USD Million)

- Table 17.93 Deep Learning in Diagnostics Market for Respiratory Disorders: Conservative, Base and Optimistic Scenarios, till 2035 (USD Million)

- Table 17.94 Deep Learning in Diagnostics Market for Ophthalmic Disorders: Conservative, Base and Optimistic Scenarios, till 2035 (USD Million)

- Table 17.95 Deep Learning in Diagnostics Market for Infectious Diseases: Conservative, Base and Optimistic Scenarios, till 2035 (USD Million)

- Table 17.96 Deep Learning in Diagnostics Market for Musculoskeletal Disorders: Conservative, Base and Optimistic Scenarios, till 2035 (USD Million)

- Table 17.97 Deep Learning in Diagnostics Market for Inflammatory Disorders: Conservative, Base and Optimistic Scenarios, till 2035 (USD Million)

- Table 17.98 Deep Learning in Diagnostics Market for Other Disorders: Conservative, Base and Optimistic Scenarios, till 2035 (USD Million)

- Table 17.99 Deep Learning in Diagnostics Market: Distribution by Geography, till 2035 (USD Billion)

- Table 17.100 Deep Learning in Diagnostics Market in North America: Conservative, Base and Optimistic Scenarios, till 2035 (USD Million)

- Table 17.101 Deep Learning in Diagnostics Market in Europe: Conservative, Base and Optimistic Scenarios, till 2035 (USD Million)

- Table 17.102 Deep Learning in Diagnostics Market in Asia Pacific: Conservative, Base and Optimistic Scenarios, till 2035 (USD Million)

- Table 17.103 Deep Learning in Diagnostics Market in Rest of the World: Conservative, Base and Optimistic Scenarios, till 2035 (USD Million)

List of Figures

- Figure 2.1 Executive Summary: Market Overview (Deep Learning in Drug Discovery)

- Figure 2.2 Executive Summary: Market Overview (Deep Learning in Diagnostics)

- Figure 2.3 Executive Summary: Clinical Trial Analysis

- Figure 2.4 Executive Summary: Funding and Investment Analysis

- Figure 2.5 Executive Summary: Start-up Health Indexing

- Figure 2.6 Executive Summary: Company Valuation Analysis

- Figure 2.7 Executive Summary: Market Sizing and Opportunity Analysis (Deep Learning in Drug Discovery)

- Figure 2.8 Executive Summary: Market Sizing and Opportunity Analysis (Deep Learning in Diagnostics)

- Figure 3.1 Key Stages of Observational Learning

- Figure 3.2 Understanding Neurons and the Human Brain: Key Scientific Contributors

- Figure 3.3 Big Data: The Three V's

- Figure 3.4 Internet of Things: Framework

- Figure 3.5 Internet of Things: Applications in Healthcare

- Figure 3.6 Big Data: Application Areas

- Figure 3.7 Big Data: Opportunities in Healthcare

- Figure 3.8 Machine Learning Algorithm: Workflow

- Figure 3.9 Neural Networks: Architecture

- Figure 3.10 Deep Learning: Image Recognition

- Figure 3.11 Deep Learning Frameworks: Relative Performance

- Figure 3.12 Personalized Medicine: Applications in Healthcare

- Figure 4.1 Deep Learning in Drug Discovery: Distribution by Year of Establishment

- Figure 4.2 Deep Learning in Drug Discovery: Distribution by Company Size

- Figure 4.3 Deep Learning in Drug Discovery: Distribution by Location of Headquarters (Region-wise)

- Figure 4.4 Deep Learning in Drug Discovery: Distribution by Location of Headquarters (Country-wise)

- Figure 4.5 Deep Learning in Drug Discovery: Distribution by Application Area

- Figure 4.6 Deep Learning in Drug Discovery: Distribution by Focus Area

- Figure 4.7 Deep Learning in Drug Discovery: Distribution by Therapeutic Area

- Figure 4.8 Deep Learning in Drug Discovery: Distribution by Operational Model

- Figure 4.9 Deep Learning in Drug Discovery: Distribution by Company Size and Operational Model

- Figure 4.10 Deep Learning in Drug Discovery: Distribution by Service Centric Model

- Figure 4.11 Deep Learning in Drug Discovery: Distribution by Product Centric Model

- Figure 5.1 Deep Learning in Diagnostics: Distribution by Year of Establishment

- Figure 5.2 Deep Learning in Diagnostics: Distribution by Company Size

- Figure 5.3 Deep Learning in Diagnostics: Distribution by Location of Headquarters (Region-wise)

- Figure 5.4 Deep Learning in Diagnostics: Distribution by Location of Headquarters (Country-wise)

- Figure 5.5 Deep Learning in Diagnostics: Distribution by Application Area

- Figure 5.6 Deep Learning in Diagnostics: Distribution by Focus Area

- Figure 5.7 Deep Learning in Diagnostics: Distribution by Therapeutic Area

- Figure 5.8 Deep Learning in Diagnostics: Distribution by Type of Offering / Solution

- Figure 5.9 Deep Learning in Diagnostics: Distribution by Company Size and Type of Offering / Solution

- Figure 5.10 Deep Learning in Diagnostics: Distribution by Compatible Device

- Figure 6.1 Aegicare: Deep Learning Derived Service Portfolio

- Figure 6.2 Aiforia Technologies: Annual Revenues, FY 2019 Onwards (EUR Thousand)

- Figure 6.3 Aiforia Technologies: Deep Learning Derived Service Portfolio

- Figure 6.4 Ardigen: Annual Revenues, FY 2019 Onwards (EUR Million)

- Figure 6.5 Ardigen: Deep Learning Derived Service Portfolio

- Figure 6.6 Berg: Deep Learning Derived Service Portfolio

- Figure 6.7 Google: Annual Revenues, FY 2019 Onwards (USD Billion)

- Figure 6.8 Google: Deep Learning Derived Service Portfolio

- Figure 6.9 Huawei: Annual Revenues, FY 2019 Onwards (CNY Billion)

- Figure 6.10 Huawei: Deep Learning Derived Service Portfolio

- Figure 6.11 Merative: Deep Learning Derived Service Portfolio

- Figure 6.12 Nference: Deep Learning Derived Service Portfolio

- Figure 6.13 Nvidia: Annual Revenues, FY 2019 Onwards (USD Billion)

- Figure 6.14 Nvidia: Deep Learning Derived Service Portfolio

- Figure 6.15 Owkin: Deep Learning Derived Service Portfolio

- Figure 6.16 Phenomic AI: Deep Learning Derived Service Portfolio

- Figure 6.17 Pixel AI: Deep Learning Derived Service Portfolio

- Figure 7.1 Porter's Five Forces: Key Parameters

- Figure 7.2 Porter's Five Forces: Harvey Ball Analysis

- Figure 8.1 Clinical Trial Analysis: Scope and Methodology

- Figure 8.2 Clinical Trial Analysis: Distribution by Trial Registration Year

- Figure 8.3 Clinical Trial Analysis: Distribution by Trial Status

- Figure 8.4 Clinical Trial Analysis: Distribution by Trial Registration Year and Patient Enrollment, since 2019

- Figure 8.5 Clinical Trial Analysis: Distribution by Trial Registration Year and Trial Status

- Figure 8.6 Clinical Trial Analysis: Distribution by Type of Sponsor / Collaborator

- Figure 8.7 Clinical Trial Analysis: Distribution by Therapeutic Area

- Figure 8.8 Word Cloud: Trial Focus Area

- Figure 8.9 Clinical Trial Analysis: Distribution by Study Design

- Figure 8.10 Clinical Trial Analysis: Geographical Distribution of Trials

- Figure 8.11 Clinical Trial Analysis: Geographical Distribution by Trial Registration Year and Patient Enrollment

- Figure 8.12 Leading Organizations: Distribution by Number of Registered Trials

- Figure 9.1 Funding and Investment Analysis: Cumulative Distribution of Number of Instances by Year, since 2019

- Figure 9.2 Funding and Investment Analysis: Cumulative Distribution of Amount Invested, since 2019 (USD Million)

- Figure 9.3 Funding and Investment Analysis: Distribution of Instances by Type of Funding

- Figure 9.4 Funding and Investment Analysis: Distribution of Amount Invested by Type of Funding (USD Million)

- Figure 9.5 Funding and Investment Analysis: Distribution of Instances by Year and Type of Funding

- Figure 9.6 Funding and Investment Analysis: Distribution of Instances by Focus Area

- Figure 9.7 Funding and Investment Analysis: Distribution Instances by Therapeutic Area

- Figure 9.8 Funding and Investment Analysis: Geographical Distribution of Funding Instances

- Figure 9.9 Funding and Investment Analysis: Geographical Distribution by Amount Invested (USD Million)

- Figure 9.10 Most Active Players: Distribution by Number of Funding Instances

- Figure 9.11 Most Active Players: Distribution by Amount Invested (USD Million)

- Figure 9.12 Most Active Investors: Distribution by Number of Funding Instances

- Figure 9.13 Summary of Funding and Investments, since 2019 (USD Million)

- Figure 10.1 Start-ups Focused on Deep Learning in Drug Discovery: Distribution by Location of Headquarters

- Figure 10.2 Start-ups Focused on Deep Learning in Drug Discovery: Distribution by Focus Area

- Figure 10.3 Start-ups Focused on Deep Learning in Drug Discovery: Distribution by Therapeutic Area

- Figure 10.4 Start-ups Focused on Deep Learning in Drug Discovery: Distribution by Operational Model

- Figure 10.5 Start-ups Focused on Deep Learning in Drug Discovery: Roots Analysis Perspective

- Figure 10.6 Start-ups Focused on Deep Learning in Drug Discovery: Wind Rose Analysis

- Figure 10.7 Start-ups Focused on Deep Learning in Diagnostics: Distribution by Location of Headquarters

- Figure 10.8 Start-ups Focused on Deep Learning in Diagnostics: Distribution by Focus Area

- Figure 10.9 Start-ups Focused on Deep Learning in Diagnostics: Distribution by Therapeutic Area

- Figure 10.10 Start-ups Focused on Deep Learning in Diagnostics: Distribution by Compatible Device

- Figure 10.11 Start-ups Focused on Deep Learning in Diagnostics: Distribution by Type of Offering

- Figure 10.12 Start-ups Focused on Deep Learning in Diagnostics: Roots Analysis Perspective

- Figure 10.13 Start-ups Focused on Deep Learning in Diagnostics: Wind Rose Analysis

- Figure 12.1 Overall Deep Learning in Drug Discovery Market, till 2035 (USD Billion)

- Figure 12.2 Deep Learning in Drug Discovery Market: Distribution by Target Therapeutic Area, till 2035 (USD Million)

- Figure 12.3 Deep Learning in Drug Discovery Market for Oncological Disorders, till 2035 (USD Million)

- Figure 12.4 Deep Learning in Drug Discovery Market for Infectious Diseases, till 2035 (USD Million)

- Figure 12.5 Deep Learning in Drug Discovery Market for Neurological Disorders, till 2035 (USD Million)

- Figure 12.6 Deep Learning in Drug Discovery Market for Immunological Disorders, till 2035 (USD Million)

- Figure 12.7 Deep Learning in Drug Discovery Market for Endocrine Disorders, till 2035 (USD Million)

- Figure 12.8 Deep Learning in Drug Discovery Market for Cardiovascular Disorders, till 2035 (USD Million)

- Figure 12.9 Deep Learning in Drug Discovery Market for Respiratory Disorders, till 2035 (USD Million)

- Figure 12.10 Deep Learning in Drug Discovery Market for Other Disorders, till 2035 (USD Million)

- Figure 12.11 Deep Learning in Drug Discovery Market: Distribution by Geography, till 2035 (USD Million)

- Figure 12.12 Deep Learning in Drug Discovery Market in North America, till 2035 (USD Million)

- Figure 12.13 Deep Learning in Drug Discovery Market in the US, till 2035 (USD Million)

- Figure 12.14 Deep Learning in Drug Discovery Market in Canada, till 2035 (USD Million)

- Figure 12.15 Deep Learning in Drug Discovery Market in Europe, till 2035 (USD Million)

- Figure 12.16 Deep Learning in Drug Discovery Market in the UK, till 2035 (USD Million)

- Figure 12.17 Deep Learning in Drug Discovery Market in France, till 2035 (USD Million)

- Figure 12.18 Deep Learning in Drug Discovery Market in Germany, till 2035 (USD Million)

- Figure 12.19 Deep Learning in Drug Discovery Market in Spain, till 2035 (USD Million)

- Figure 12.20 Deep Learning in Drug Discovery Market in Italy, till 2035 (USD Million)

- Figure 12.21 Deep Learning in Drug Discovery Market in Rest of Europe, till 2035 (USD Million)

- Figure 12.22 Deep Learning in Drug Discovery Market in Asia Pacific, till 2035 (USD Million)

- Figure 12.23 Deep Learning in Drug Discovery Market in China, till 2035 (USD Million)

- Figure 12.24 Deep Learning in Drug Discovery Market in India, till 2035 (USD Million)

- Figure 12.25 Deep Learning in Drug Discovery Market in Japan, till 2035 (USD Million)

- Figure 12.26 Deep Learning in Drug Discovery Market in Australia, till 2035 (USD Million)

- Figure 12.27 Deep Learning in Drug Discovery Market in South Korea, till 2035 (USD Million)

- Figure 12.28 Deep Learning in Drug Discovery Market in Rest of the World, till 2035 (USD Million)

- Figure 12.29 Overall Cost Saving Potential Associated with the Use of Deep Learning in Drug Discovery, till 2035 (USD Billion)

- Figure 13.1 Overall Deep Learning in Diagnostics Market, till 2035 (USD Billion)

- Figure 13.2 Deep Learning in Diagnostics Market: Distribution by Target Therapeutic Area, till 2035 (USD Million)

- Figure 13.3 Deep Learning in Diagnostics Market for Oncological Disorders, till 2035 (USD Million)

- Figure 13.4 Deep Learning in Diagnostics Market for Cardiovascular Disorders, till 2035 (USD Million)

- Figure 13.5 Deep Learning in Diagnostics Market for Neurological Disorders, till 2035 (USD Million)

- Figure 13.6 Deep Learning in Diagnostics Market for Endocrine Disorders, till 2035 (USD Million)

- Figure 13.7 Deep Learning in Diagnostics Market for Respiratory Disorders, till 2035 (USD Million)

- Figure 13.8 Deep Learning in Diagnostics Market for Ophthalmic Disorders, till 2035 (USD Million)

- Figure 13.9 Deep Learning in Diagnostics Market for Infectious Diseases, till 2035 (USD Million)

- Figure 13.10 Deep Learning in Diagnostics Market for Musculoskeletal Disorders, till 2035 (USD Million)

- Figure 13.11 Deep Learning in Diagnostics Market for Inflammatory Disorders, till 2035 (USD Million)

- Figure 13.12 Deep Learning in Diagnostics Market for Other Disorders, till 2035 (USD Million)

- Figure 13.13 Deep Learning in Diagnostics Market: Distribution by Geography, till 2035 (USD Million)

- Figure 13.14 Deep Learning in Diagnostics Market in North America, till 2035 (USD Million)

- Figure 13.15 Deep Learning in Diagnostics Market in Europe, till 2035 (USD Million)

- Figure 13.16 Deep Learning in Diagnostics Market in Asia Pacific, till 2035 (USD Million)

- Figure 13.17 Deep Learning in Diagnostics Market in Rest of the World, till 2035 (USD Million)

- Figure 15.1 Concluding Remarks: Market Overview (Deep Learning in Drug Discovery)

- Figure 15.2 Concluding Remarks: Market Overview (Deep Learning in Diagnostics)

- Figure 15.3 Concluding Remarks: Clinical Trial Analysis

- Figure 15.4 Concluding Remarks: Funding and Investment Analysis

- Figure 15.5 Concluding Remarks: Start-up Health Indexing

- Figure 15.6 Concluding Remarks: Company Valuation Analysis

- Figure 15.7 Concluding Remarks: Market Sizing and Opportunity Analysis (Deep Learning in Drug Discovery)

- Figure 15.8 Concluding Remarks: Market Sizing and Opportunity Analysis (Deep Learning in Diagnostics)