PUBLISHER: Parks Associates | PRODUCT CODE: 1703511

PUBLISHER: Parks Associates | PRODUCT CODE: 1703511

Smarter Energy at Home: Intelligence, Coordination, Services

SYNOPSIS:

Data centers and the rise of AI processing are creating incredible demands for energy on the grid. In the consumer market, rising electrification of home appliances and growing adoption and charging of EVs at home are placing new electricity demand for consumers and straining the grid further. Smart home products provide a growing foundation for utilities and energy providers to shift demand to better manage the grid. Greater intelligence and coordination among smart energy-consuming devices empower consumers to lower energy costs and serve advance utilities' demand-response capabilities.

This research explores US households' engagement with smart energy solutions and programs. It examines familiarity, adoption, and satisfaction with energy-efficient equipment and programs, including EV charging, solar and demand response. The survey assesses consumers' attitudes toward managing energy usage through smart devices, AI and services, to identify barriers and motivators for adopting energy innovations.

INFOGRAPHICS

Key questions addressed:

- 1. How do households perceive and manage their energy costs?

- 2. What insights do consumers desire about their energy consumption and from what market players do they most prefer to receive insights?

- 3. What is the level of familiarity and participation in energy programs like time-of-use tariffs, and demand response programs?

- 4. What motivates or hinders participation in demand response programs, and what is the experience for participants?

- 5. What is the current adoption of major energy equipment like solar, smart electric panels, and home battery storage?

- 6. What are consumers' preferences for energy storage use cases, including backup for outages, calling on batteries when rates are high, and coordinating battery use with EV charging?

- 7. What are the drivers for electric vehicle (EV) adoption and home charging solutions, and what are consumers' charger installation preferences?

ANALYST INSIGHT:

"Consumers are actively seeking ways to reduce energy consumption, with simple actions like adjusting settings and shifting usage to off-peak hours leading the way. Consumers are also open to demand response programs, especially with real-time incentives like instant bill credits, and energy security is a growing priority due to grid instability and rising demand." - Daniel Holcomb, Senior Analyst, Parks Associates.

Table of Contents

Introducing Energy Monitoring

Executive Summary

- Attitudes Towards Home Energy Consumption

- Energy Saving Actions

- Net Promoter Scores (NPS) by Sector

- Electricity Provider NPS, by Energy Program Familiarity and Participation

- Participation in Energy Programs

- Preferred Incentive to Allow Electricity Provider Adjust Thermostat

- Willingness to Share Energy Usage Data Between Devices

- Purpose of Smart Home Device Integration

- Interest in Energy Management Tools, by Smart Home Device Adoption

- Interest in Electricity Storage Solutions

- Appeal of Home and Portable Battery Solutions

Energy Costs and Consumption

- Average Monthly Expenditure

- Average Electricity Price to Residential Customers

- Consumer Perception of Monthly Electricity Bill

- Consumer Perception of Monthly Electricity Bill by Home Size

- Consumer Perception of Monthly Electricity Bill by Family Size

- Attitudes Towards Home Energy Consumption

- Not Enough Time/Info to Reduce Energy by Households with Kids

- Energy-Saving Actions Taken Over the Past 12 Months

- Energy Saving Actions

- Trends of Likelihood of Starting Major Home Renovation Projects

- Purpose of Starting Home Renovation Project

- % Selecting Energy Efficiency as Driver for Home Renovations

Smart Thermostats: Adoption, Intentions, NPS

- Smart Thermostat Adoption and Recent Purchases

- Overall Smart Thermostat Purchase Intention

- Overall Smart Thermostat Purchase Intention among Those Likely to Move in the next 6 months

- Overall Smart Thermostat Purchase Intention among Those Likely to Start a Home Renovation in the Next 6 Months

- Net Promoter Score: Smart Energy Devices

- Smart Thermostat NPS, Trending

Energy Programs: Familiarity & Use

- High Familiarity with Energy Programs Offered

- Participation in Energy Programs

- Energy Program Use

- Energy Program Use Details

- Likelihood of Participating in Utility Programs in the Future

Satisfaction with Electricity Provider

- Attitudes Toward Electricity Provider

- Net Promoter Scores (NPS) by Sector

- Electricity Provider NPS, by Energy Program Familiarity and Participation

Demand Response: Incentives, Churn, and UX

- Demand Response Participation

- Information Source for Demand Response Programs

- Top Motivation to Participant in Demand Response Program

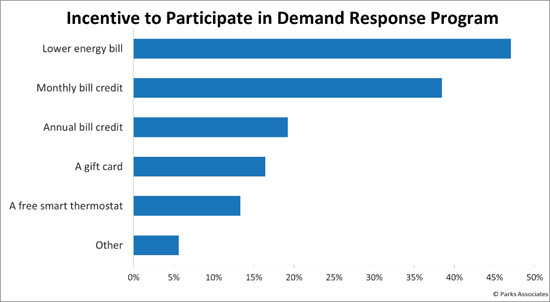

- Incentive to Participate in Demand Response Program

- Estimated Number of Demand Response Events Called in Past 12 Months

- Duration of Demand Response Event

- Demand Response Event Experience

- Reasons for Not Participating in Demand Response Program

- Barriers to Demand Response Participation by Gender

- Barriers to Demand Response Participation by Age

- Reasons for Churning Demand Response Program

Smart Home Devices & Demand Response

- Products Consumers are Willing to Adjust Themselves During Peaks

- Products Consumers Will Allow Manufacturer or Utility to Adjust During Peaks

- Willingness to Adjust Products During Peaks, Among Smart Product Owners

- Preferred Incentive to Allow Electricity Provider Adjust Thermostat

Tracking & Monitoring Tools: Consumer Use and Interest

- Receive Electricity Consumption Breakdown from Energy Provider

- Frequency of Reviewing Consumption Breakdown

- Electricity Consumption Breakdown Review Methods

- Monitoring Home Energy Usage Through Other Applications among All US Internet Households

- Monitoring Home Energy Usage Through Other Applications among Owners of Specified Devices

- Valuable Tools of Home Energy Consumption Management

- Interest in Energy Management Tools, by Smart Home Device Adoption

Preferred Providers and Willingness to Share Data

- Willingness to Share Energy Usage Data Between Devices

- Willingness to Share Energy Usage Data Between Devices, by Device Ownership

- Current Integration of Multiple Smart Home Devices Work Together

- Purpose of Smart Home Device Integration

- Preferred Provider for Energy Usage Monitoring and Optimization App

Tracking Equipment Adoption: Solar, Storage, Electric Panels, EVs

- High Familiarity with Major Home Energy Equipment

- Ownership of Major Home Energy Equipment

- High Intention of Purchasing Major Home Energy Equipment

EV Ownership and Charging

- Ownership of Plug-in Electric Vehicles

- Vehicle Purchase Intentions: 12 Month Outlook

- Type of Vehicle Intenders

- BEV/PHEV Purchased in the Last 12 Months

- Reasons for Choosing an EV Over a Gas-Powered/Hybrid Vehicle

- Attitudes Toward Electric Vehicles by EV Ownership

- Preferred Charging Location of Electric Vehicles among EV Owners & Intenders

- Preferred Charging Location of Electric Vehicles by EV Owners or Intenders in Q4 2024

- EV Charging Equipment At Home

- Acquisition Channel of Home Chargers

- EV Charging Pain Points

- Information Source of Special Plan for EV Owners

Solar, Storage Drivers and Benefits

- Solar Ownership

- Solar Purchase High Intentions

- Reasons for Not Purchasing Solar Power Products

- Interest in Electricity Storage Solutions

- Appeal of Home and Portable Battery Solutions

- Adoption of Battery Storage

- Frequency of Using Home Battery to Power Home

- Home Battery Purchase Timing

Appendix