PUBLISHER: Parks Associates | PRODUCT CODE: 1584145

PUBLISHER: Parks Associates | PRODUCT CODE: 1584145

Home Security & Monitoring: Subscriber Churn and Retention

SYNOPSIS:

The security market has evolved to meet consumer demand for choice in systems, devices, installation methods, purchase methods, and monitoring services. Professional monitoring, video storage, and other recurring sources of revenue are critical to the sustainability of a security system or device business. Security providers must attract and retain subscribers, while maximizing ARPU through the delivery of new feature and services that provide real value.

INFOGRAPHICS

This Q4 2024 study assesses security subscription models, features, and pricing as well as strategies that can aid in subscriber retention.

Key questions addressed:

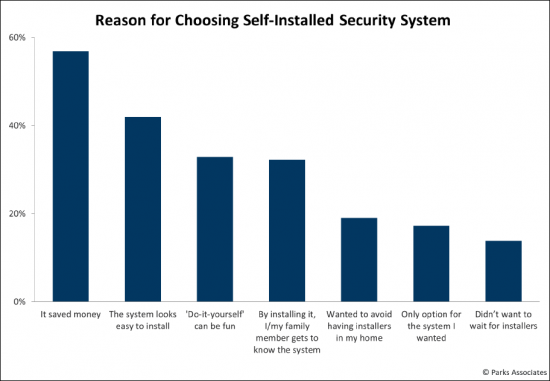

- 1. How are security segments shifting, between systems and devices and between installation and monitoring methods?

- 2. How are the competitive dynamics shifting between leading brands and service providers?

- 3. What are the most impactful triggers for purchasing security solutions?

ANALYST INSIGHT:

Table of Contents

Executive Summary

- Security Service Market Segments: Monitoring, Systems, and Devices

- Residential Security Solution Market

- Security Market Customer Profiles

- Security System Market Segments

- Paid Security System Services among Pro-Installed Security System HHs

- Paid Security System Services among Self-Installed Security System HHs

- Security System Service Provider NPS

- High Intention of Subscribing to Professional Monitoring for Security System in Next 6 Months

- Security System-attached Devices

- Opportunities to Expand Security Offerings

- Competitors Vie for Leadership Across Key Industry Metrics

Security Solutions: Adoption & Market Segments

Security System Purchase Journey

Competitive Landscape

Security Service Segments: Pro, Self, and Device-based Monitoring

System Services Deep Dive: ARPU, Churn, Retention

System Services Deep Dive: Self Monitoring

Next Wave of Services

Security Buyer Profiles

Appendix