Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693704

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693704

France Tidal Power - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 95 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

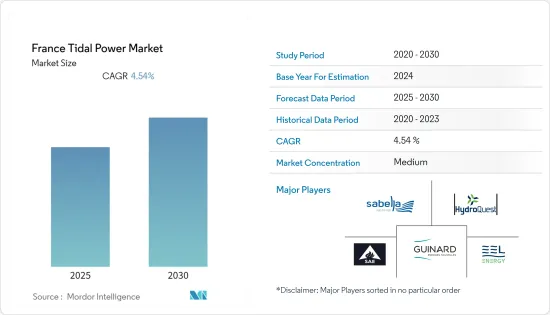

The France Tidal Power Market is expected to register a CAGR of 4.54% during the forecast period.

Key Highlights

- Over the long term, factors such as increasing investments in the tidal energy sector and upcoming projects are expected to drive the market in the forecast period.

- Conversely, the increasing adoption of alternative clean power sources hinders the country's Tidal Power Market growth.

- Nevertheless, growing technological advancements and research capabilities across the country related to floating tidal power platform is expected to be a significant opportunity for the France tidal power market in the forecast period.

France Tidal Power Market Trends

Horizontal Axis Turbine Segment is Expected to Dominate the Market

- Horizontal axis tidal turbines use blades positioned parallel (horizontal) to the direction of the flow of water. The turbines are like designs used for wind turbines, but due to the higher density of water, the blades are more minor and turn more slowly than wind turbines.

- Similar to wind turbines, horizontal tidal turbines can have several configurations such as Gravity base, Monopile, Piled Jacket, and Floating. Furthermore, they must withstand greater forces and movements than wind turbines. Horizontal axis tidal turbines are the most widely deployed commercial turbine model type as they have the lowest cost of electricity from tides compared with alternative tidal turbine designs.

- Additionally, horizontal designs offer higher reliability in field conditions and reduce maintenance costs and frequency to remain a sustainable source and cost-attractive exploitation of marine currents.

- Going ahead, in December 2022, Sabella received certification of the power curve for its s D10 turbine from Bureau Veritas according to IEC standards, immersed off Ushant in the FromveurPassage, a project funded by the TIGER project. This is a tidal energy project being developed by Sabella in collaboration with 56 Energies, which aims to install two experimental tidal turbines in the current of the Jument, at the entrance to the Gulf of Morbihan, for three years.

- Consequently, in January 2023, Sabella received approval to deploy its two 250 kW tidal energy turbines. The permit will allow Sabella to install the turbines for three years. The funding received from the TIGER project is estimated to be around USD 8.6 million.

- Owing to the above points and the recent developments, the Horizontal axis turbine segment is expected to dominate the France Tidal Power Market during the forecast period.

Increasing Investments and Upcoming Projects are Expected to Drive the Market

- France is a leading market for tidal power. According to Ocean Energy Europe (OEE), it is estimated that the country has the potential to deploy 3-5.5 GW of capacity. The most promising area is the Raz Blanchard, between the Normandy coastline and the Channel Island of Alderney, with an estimated potential of 2 GW of capacity. Some studies have estimated that the capacity in this region, considering Alderney's territorial waters, could be as high as 3.9-5.1 GW.

- France is home to several leading tidal power test sites. SEENEOH, located in Bordeaux, operates a tidal test site and supports EDF, a French state-owned integrated energy company at the Paimpol-Brehat site.

- Going ahead, favorable government policies promoting the development of renewables, such as Feed-in Tariff schemes and other financial incentives, have attracted more investors, who view renewable energy investments as secure and more viable long-term investments compared to fossil fuels such as coal and natural gas. The increasing investments in tidal power projects have been providing a significant boost to the growth of the tidal power sector in the country. Also, as of 2022, the marine energy installed capacity in the country reached 211 MW. The growing government initiative such as TIGER project in order to develop tidal energy will in turn culminate in the growth of the market.

- Moreover, in July 2022, the Dutch company Hydrokinetic power generation system (HPGS) announced the installation 25 kW tidal turbine demonstrator on the Seeneohtest site in Bordeaux. The turbines were connected to the Pont de Pierre in the Bordeaux electricity grid in December 2022.

- Additionally, France's next Multiannual Energy Plan has targeted to register between 0.5 and 1 GW of Tidal stream energy by 2030, with an overall target of 4 GW by 2050. Several upcoming projects are expected to enable the sector to become industrially structured and competitive and create jobs in the regions. Thus, the country's geographical location is expected to play a vital role in boosting investment in the country's tidal power market.

- Hence, owing to the above points, the increasing investments and upcoming projects are expected to drive the France Tidal Power Market during the forecast period.

France Tidal Power Industry Overview

The France Tidal Power Market is moderately fragmented in nature. Some major companies operating in the market (in no particular order) are Sabella SAS, SIMEC Atlantis Energy Ltd, Hydroquest SAS, Guinard Energies Nouvelles, and EEL Energy.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 93581

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Tidal Power Installed Capacity and Forecast in MW, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Investments in the Tidal Energy Sector and Upcoming Projects

- 4.5.2 Restraints

- 4.5.2.1 Increasing Adoption of Alternative Clean Power Source

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

5 MARKET SEGMENTATION

- 5.1 Power Generation Method

- 5.1.1 Tidal Barrage

- 5.1.2 Floating Tidal Power Platform

- 5.1.3 Tidal Stream Generation

- 5.1.4 Dynamic Tidal Power

- 5.2 Tidal Energy Converters

- 5.2.1 Horizontal Axis Turbine

- 5.2.2 Vertical Axis Turbine

- 5.2.3 Other Tidal Energy Converters

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Collaboration, and Joint Ventures

- 6.2 Strategies Adopted by Key Players

- 6.3 Company Profiles

- 6.3.1 Sabella SAS

- 6.3.2 Morbihan Hydro Energies SAS

- 6.3.3 Nova Innovation

- 6.3.4 SIMEC Atlantis Energy Ltd

- 6.3.5 Hydroquest SAS

- 6.3.6 EEL Energy

- 6.3.7 Guinard Energies Nouvelles

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Technological Advancements and Research Capabilities across the Country Related to Floating Tidal Power Platform

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.