Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693627

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693627

Electric Truck - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 333 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

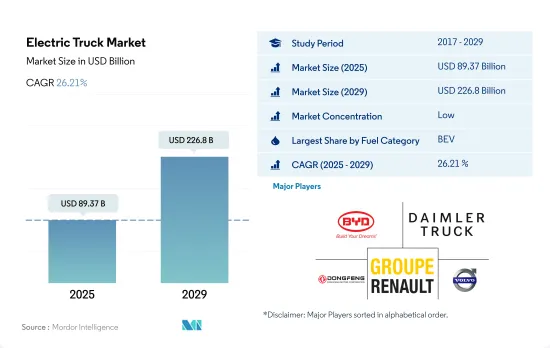

The Electric Truck Market size is estimated at 89.37 billion USD in 2025, and is expected to reach 226.8 billion USD by 2029, growing at a CAGR of 26.21% during the forecast period (2025-2029).

The global market for electric medium and heavy-duty trucks is poised for significant growth, driven by the imperative for cleaner transportation solutions

- The global electric truck market, covering medium and heavy-duty segments, witnessed significant growth in 2023, reflecting a rising demand for sustainable freight and logistics solutions. This expansion is a direct response to the urgent need to curb transportation emissions and the global push for vehicle electrification. In 2024, the market is poised to sustain its growth momentum, propelled by advancements in electric vehicle (EV) technology, falling battery costs, and stricter environmental regulations emphasizing cleaner commercial transportation.

- Government policies worldwide, such as EV purchase incentives, investments in charging infrastructure, and mandates to reduce carbon footprints in logistics and transportation, are bolstering the upswing in electric truck adoption. These measures, coupled with a growing corporate focus on sustainability, are hastening the shift to electric trucks. Businesses are aligning their operations with environmental goals and meeting consumer expectations for greener supply chains.

- In the coming years, the global electric truck market is set for robust growth, fueled by increased investments from vehicle manufacturers in developing more efficient and longer-range electric trucks. Ongoing advancements in EV technology are making electric trucks increasingly viable across a broader range of transport applications. As more cities and countries establish low-emission zones and zero-emission logistics targets, the demand for electric trucks is poised to surge.

Globally, the electric truck market is experiencing significant growth across all regions, driven by technological advancements, regulatory policies, and shifting market dynamics toward sustainability

- China's dominant market presence, ambitious environmental policies, and significant investments in EV technology and infrastructure are propelling the APAC region to the forefront of the global electric truck market. Japan and South Korea are also key players, emphasizing innovation and supportive policies for electric vehicle adoption. The APAC market benefits from robust government subsidies, rapid technological advancements, and a heightened recognition of the importance of sustainable transportation.

- The European electric truck market stands out for its stringent emissions regulations, strong focus on environmental sustainability, and ambitious targets for reducing carbon footprints in the transport sector. The European Union's Green Deal and its pro-zero-emission vehicle policies have further expedited the adoption of electric trucks across the continent. European manufacturers and logistics firms are swiftly embracing electric trucks to align with these regulations.

- The North American electric truck market is growing gradually, driven by a mix of regulatory initiatives, technological advancements, and evolving consumer preferences. The United States and Canada are intensifying their efforts to curb greenhouse gas emissions from transportation, offering incentives at federal and state levels to promote electric vehicle adoption.

- The South American electric truck market is nascent, with countries like Brazil and Chile spearheading electrification despite challenges such as economic volatility and infrastructure gaps. The introduction of electric buses in these countries has laid the groundwork for the broader adoption of electric commercial vehicles, including trucks.

Electric Truck Market Trends

The rising global demand and government support propel electric vehicle market growth

- Electric vehicles (EVs) have become indispensable in the automotive industry, driven by their potential to enhance energy efficiency and reduce greenhouse gas and pollution emissions. This surge is primarily attributed to growing environmental concerns and supportive government initiatives. Notably, global EV sales witnessed a robust 10.82% growth in 2022 compared to 2021. Projections indicate that annual sales of electric passenger cars will surpass 5 million by the end of 2025, accounting for approximately 15% of total vehicle sales.

- Leading manufacturers and organizations, like the London Metropolitan Police & Fire Service, have been actively pursuing their electric mobility strategies. For instance, they have set a target of a zero-emission fleet by 2025, with a goal of electrifying 40% of their vans by 2030 and achieving full electrification by 2040. Similar trends are expected globally, with the period from 2024 to 2030 witnessing a surge in demand and sales of electric vehicles.

- Asia-Pacific and Europe are poised to dominate electric vehicle production, driven by their advancements in battery technology and vehicle electrification. In May 2020, Kia Motors Europe unveiled its "Plan S," signaling a strategic shift toward electrification. This decision came on the heels of record-breaking sales of Kia's EVs in Europe. Kia has ambitious plans to introduce 11 EV models globally by 2025, spanning various segments like passenger vehicles, SUVs, and MPVs. The company aims to achieve annual global EV sales of 500,000 by 2026.

Electric Truck Industry Overview

The Electric Truck Market is fragmented, with the top five companies occupying 21.50%. The major players in this market are BYD Auto Co. Ltd., Daimler Truck Holding AG, Dongfeng Motor Corporation, Groupe Renault and Volvo Group (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 93015

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Population

- 4.1.1 Africa

- 4.1.2 Asia-Pacific

- 4.1.3 Europe

- 4.1.4 Middle East

- 4.1.5 North America

- 4.1.6 South America

- 4.2 GDP Per Capita

- 4.2.1 Africa

- 4.2.2 Asia-Pacific

- 4.2.3 Europe

- 4.2.4 Middle East

- 4.2.5 North America

- 4.2.6 South America

- 4.3 Consumer Spending For Vehicle Purchase (cvp)

- 4.3.1 Africa

- 4.3.2 Asia-Pacific

- 4.3.3 Europe

- 4.3.4 Middle East

- 4.3.5 North America

- 4.3.6 South America

- 4.4 Inflation

- 4.4.1 Africa

- 4.4.2 Asia-Pacific

- 4.4.3 Europe

- 4.4.4 Middle East

- 4.4.5 North America

- 4.4.6 South America

- 4.5 Interest Rate For Auto Loans

- 4.6 Impact Of Electrification

- 4.7 EV Charging Station

- 4.8 Battery Pack Price

- 4.8.1 Africa

- 4.8.2 Asia-Pacific

- 4.8.3 Europe

- 4.8.4 Middle East

- 4.8.5 North America

- 4.8.6 South America

- 4.9 New Xev Models Announced

- 4.10 Logistics Performance Index

- 4.10.1 Africa

- 4.10.2 Asia-Pacific

- 4.10.3 Europe

- 4.10.4 Middle East

- 4.10.5 North America

- 4.10.6 South America

- 4.11 Fuel Price

- 4.12 Oem-wise Production Statistics

- 4.13 Regulatory Framework

- 4.14 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Vehicle Configuration

- 5.1.1 Trucks

- 5.1.1.1 Heavy-duty Commercial Trucks

- 5.1.1.2 Medium-duty Commercial Trucks

- 5.1.1 Trucks

- 5.2 Fuel Category

- 5.2.1 BEV

- 5.2.2 FCEV

- 5.2.3 HEV

- 5.2.4 PHEV

- 5.3 Region

- 5.3.1 Africa

- 5.3.1.1 South Africa

- 5.3.2 Asia-Pacific

- 5.3.2.1 China

- 5.3.2.2 India

- 5.3.2.3 Japan

- 5.3.2.4 South Korea

- 5.3.3 Europe

- 5.3.3.1 France

- 5.3.3.2 Germany

- 5.3.3.3 Italy

- 5.3.3.4 Spain

- 5.3.3.5 Rest-of-Europe

- 5.3.4 Middle East

- 5.3.4.1 Rest-of-Middle East

- 5.3.5 North America

- 5.3.5.1 Canada

- 5.3.5.2 Mexico

- 5.3.5.3 US

- 5.3.6 South America

- 5.3.6.1 Brazil

- 5.3.6.2 Rest-of-South America

- 5.3.1 Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 BYD Auto Co. Ltd.

- 6.4.2 Daimler Truck Holding AG

- 6.4.3 Dongfeng Motor Corporation

- 6.4.4 Groupe Renault

- 6.4.5 Hino Motors Ltd.

- 6.4.6 Isuzu Motors Limited

- 6.4.7 Navistar International Transportation Corporation

- 6.4.8 PACCAR Inc.

- 6.4.9 Scania AB

- 6.4.10 Volvo Group

7 KEY STRATEGIC QUESTIONS FOR VEHICLES CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.