Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693472

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693472

South America Seed - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 435 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

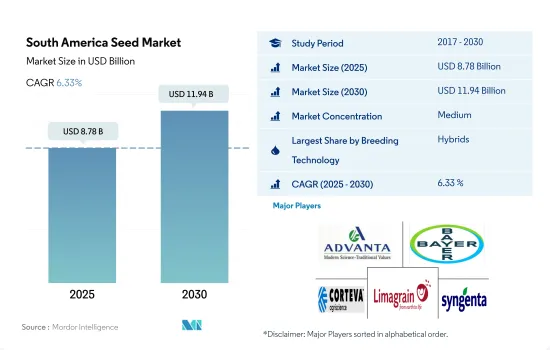

The South America Seed Market size is estimated at 8.78 billion USD in 2025, and is expected to reach 11.94 billion USD by 2030, growing at a CAGR of 6.33% during the forecast period (2025-2030).

Highest number of GM seeds approved with different applications such as food and animal feed industry is anticipated to help the growth of row crops, especially corn and Alfalfa

- In 2022, hybrids had a larger share in the South American seed market as growers prefer hybrids to earn high profits and obtain higher yields. South America has a larger share of transgenic hybrid seeds due to highly profitable crops such as corn, soybean, and alfalfa approved for cultivation in the region.

- Corn is the largest crop segment among hybrids as it is a high-profit crop, and growers want a higher yield with a high nutritional value and seeds that adapt quickly to different soil and weather conditions. Moreover, the higher usage in biofuel production is helping in the adoption of hybrid corn seeds.

- Wheat is estimated to be the fastest-growing sub-segment in the South American hybrid seed market at a CAGR of 9.9% during the forecast period as it is exported to other countries in Europe and Africa due to the war between Russia and Ukraine. European countries also use wheat to make pizza bases. Therefore, the demand for wheat seeds is expected to grow at a faster rate.

- Alfalfa is projected to be one of the fastest-growing forage segments at a CAGR of 3.1% during the forecast period, as both transgenic and non-transgenic seeds are approved for cultivation in South America. It is used as feed due to its high protein content and is easily digestible by livestock. It has herbicide tolerance that offers protection against weeds. Therefore, these uses are anticipated to help in increasing the sales of Alfalfa.

- The hybrids segment is projected to grow in the region, with an anticipated CAGR of 6.6% during the forecast period because of higher resistance to diseases and pests and wider adaptability.

Brazil dominates the South American seed market due to availability of improved seeds and new technology to increase the production of crops

- In 2022, South America accounted for 11.1% of the global seed market. This is because the region has abundant natural resources, diverse climates, technological adoption, and global export potential. This growing demand is driving the seed market in the region.

- The protected cultivation segment accounted for only 0.01% of the South American seed market in 2022 because medium-scale and small farmers cannot have a high initial investment, and there is no government support for setting up new greenhouse structures in South American countries. Therefore, it can restrain the growth of the protected cultivation segment during the forecast period.

- South America's adoption rate of hybrids is estimated to grow faster than open-pollinated seed varieties between 2023 and 2030 because of their ability to increase the yield by 10%-15%, good quality, and better quality return on investment.

- Brazil is the leading country in South America because of the availability of improved seeds, highly profitable crops such as corn and tomato grown in the country, and new technology to increase the production of crops. Therefore, it is anticipated that the market will increase during the forecast period in South America with a CAGR of 7.4%. In 2022, Argentina accounted for 20.8% of the South American seed market. Argentina is emerging in agriculture, which will increase the demand for seeds to meet the demand of farmers to grow good-quality crops.

- Therefore, the aforementioned factors, such as higher yield, new technologies, and government initiatives to provide loans at low-interest rates, are anticipated to augment the South American seed market during the forecast period.

South America Seed Market Trends

Oilseeds dominate South America row crops seed market, with soybean as the major contributor, driven by high export demand from oil processing as well as food and beverage industries

- In South America, row crops dominated the acreage under cultivation, accounting for more than 95% of the cultivated area in 2022. The major row crops cultivated in the region are soybean, corn, wheat, pulses, alfalfa, and rice. In 2022, oilseeds held a major share of 44.1% in the row crops segment. Additionally, the area under row crops increased by 16.7% from 2017 to 2022 due to increased wheat, corn, and soybean acreages. Globally, South America is the largest producer of soybeans, and the area under soybeans was 61.7 million hectares, with a production of 196.8 million metric tons in 2021. The major area under soybean is due to increased export value, high global demand from oil processing industries, availability of arable land compared to other major producing countries, and higher profit margins.

- Brazil is the major country cultivating different field crops, such as corn and soybeans. It accounted for 53% of the region's area used to cultivate row crops in 2022. The higher area under row crops is due to the increased demand from food and beverage industries and the high demand for bio-fuel generation using corn. Furthermore, corn is the major crop cultivated in the region. It accounted for 27.6% of South America's area for row crops in 2022. There was a 34.1% increase in the cultivated area for corn from 2017 to 2022 as it was one of the most consumed crops globally, and due to an increase in demand from corn-based oil-generating industries.

- The demand for oil generation, the high export potential of oilseeds, especially soybean, and the increasing demand for bio-fuel generation in the global market are increasing the area of cultivation for field crops during the forecast period.

Disease resistant and herbicide-tolerant are the popular traits in South America corn and wheat cultivation due to the significant impact of diseases on crop productivity and agricultural sustainability in the region.

- Corn and wheat are the major cereal crops grown in the South American region. These highly profitable crops are used for domestic consumption and export to other countries. In the region, especially in Brazil, herbicide-tolerant corn seeds are extensively cultivated. These seeds are tolerant to glyphosate, which helps control broad-spectrum weeds and improves yields and quality. Major companies like Bayer, Limagrain, and Corteva Agriscience offer such herbicide-tolerant varieties, with Dekalb being a popular brand from Bayer. In addition to herbicide tolerance, farmers in the region prefer corn varieties that are more adaptable to different growing conditions. These seeds serve dual purposes: grain, fodder, and resistance to early rots and leaf diseases.

- Wheat is another major staple cereal grain widely cultivated in South America. Farmers in the region mainly cultivate wheat cultivars resistant to diseases like Septoria, Fusarium, and rust to minimize crop losses and ensure productive tillers and panicles. In 2020, Argentina's government approved the cultivation of genetically modified (GM) wheat, and in 2020, Brazil also approved GM wheat cultivation. The HB4 drought-tolerant varieties, developed by Bioceres company, covered 55,000 hectares in Argentina and accounted for 0.85 of the total wheat cultivated area in 2021.

- Other popular wheat traits in the region include high tillering capacity, adaptability to various climatic conditions, and high milling quality. Therefore, with increasing export demand and advancements in breeding technology, such as the development of transgenic varieties, the demand for wheat and corn cultivars with multiple traits is projected to increase during 2023-2030.

South America Seed Industry Overview

The South America Seed Market is moderately consolidated, with the top five companies occupying 40.76%. The major players in this market are Advanta Seeds - UPL, Bayer AG, Corteva Agriscience, Groupe Limagrain and Syngenta Group (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 92535

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Area Under Cultivation

- 4.1.1 Row Crops

- 4.1.2 Vegetables

- 4.2 Most Popular Traits

- 4.2.1 Corn & Wheat

- 4.2.2 Onion & Lettuce

- 4.2.3 Soybean & Alfalfa

- 4.2.4 Tomato, Pumpkin & Squash

- 4.3 Breeding Techniques

- 4.3.1 Row Crops & Vegetables

- 4.4 Regulatory Framework

- 4.5 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Breeding Technology

- 5.1.1 Hybrids

- 5.1.1.1 Non-Transgenic Hybrids

- 5.1.1.2 Transgenic Hybrids

- 5.1.1.2.1 Herbicide Tolerant Hybrids

- 5.1.1.2.2 Insect Resistant Hybrids

- 5.1.1.2.3 Other Traits

- 5.1.2 Open Pollinated Varieties & Hybrid Derivatives

- 5.1.1 Hybrids

- 5.2 Cultivation Mechanism

- 5.2.1 Open Field

- 5.2.2 Protected Cultivation

- 5.3 Crop Type

- 5.3.1 Row Crops

- 5.3.1.1 Fiber Crops

- 5.3.1.1.1 Cotton

- 5.3.1.1.2 Other Fiber Crops

- 5.3.1.2 Forage Crops

- 5.3.1.2.1 Alfalfa

- 5.3.1.2.2 Forage Corn

- 5.3.1.2.3 Forage Sorghum

- 5.3.1.2.4 Other Forage Crops

- 5.3.1.3 Grains & Cereals

- 5.3.1.3.1 Corn

- 5.3.1.3.2 Rice

- 5.3.1.3.3 Sorghum

- 5.3.1.3.4 Wheat

- 5.3.1.3.5 Other Grains & Cereals

- 5.3.1.4 Oilseeds

- 5.3.1.4.1 Canola, Rapeseed & Mustard

- 5.3.1.4.2 Soybean

- 5.3.1.4.3 Sunflower

- 5.3.1.4.4 Other Oilseeds

- 5.3.1.5 Pulses

- 5.3.1.5.1 Pulses

- 5.3.2 Vegetables

- 5.3.2.1 Brassicas

- 5.3.2.1.1 Cabbage

- 5.3.2.1.2 Carrot

- 5.3.2.1.3 Cauliflower & Broccoli

- 5.3.2.1.4 Other Brassicas

- 5.3.2.2 Cucurbits

- 5.3.2.2.1 Cucumber & Gherkin

- 5.3.2.2.2 Pumpkin & Squash

- 5.3.2.2.3 Other Cucurbits

- 5.3.2.3 Roots & Bulbs

- 5.3.2.3.1 Garlic

- 5.3.2.3.2 Onion

- 5.3.2.3.3 Potato

- 5.3.2.3.4 Other Roots & Bulbs

- 5.3.2.4 Solanaceae

- 5.3.2.4.1 Chilli

- 5.3.2.4.2 Eggplant

- 5.3.2.4.3 Tomato

- 5.3.2.4.4 Other Solanaceae

- 5.3.2.5 Unclassified Vegetables

- 5.3.2.5.1 Asparagus

- 5.3.2.5.2 Lettuce

- 5.3.2.5.3 Okra

- 5.3.2.5.4 Peas

- 5.3.2.5.5 Spinach

- 5.3.2.5.6 Other Unclassified Vegetables

- 5.3.1 Row Crops

- 5.4 Country

- 5.4.1 Argentina

- 5.4.2 Brazil

- 5.4.3 Rest of South America

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Advanta Seeds - UPL

- 6.4.2 BASF SE

- 6.4.3 Bayer AG

- 6.4.4 Corteva Agriscience

- 6.4.5 DLF

- 6.4.6 Groupe Limagrain

- 6.4.7 KWS SAAT SE & Co. KGaA

- 6.4.8 Rijk Zwaan Zaadteelt en Zaadhandel BV

- 6.4.9 Sakata Seeds Corporation

- 6.4.10 Syngenta Group

7 KEY STRATEGIC QUESTIONS FOR SEEDS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Global Market Size and DROs

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.