Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693446

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693446

Canola Seed (seed For Sowing) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 379 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

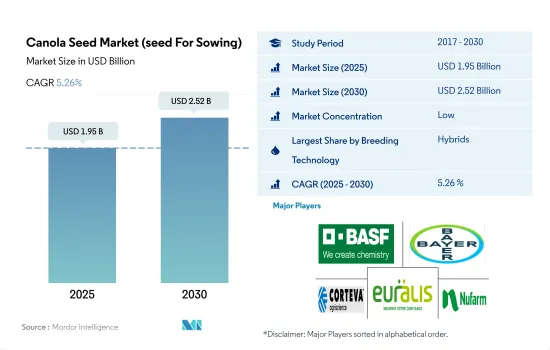

The Canola Seed Market (seed For Sowing) size is estimated at 1.95 billion USD in 2025, and is expected to reach 2.52 billion USD by 2030, growing at a CAGR of 5.26% during the forecast period (2025-2030).

Hybrids dominated the global canola seed market, with North America accounting for a major share due to its highest number of GM seed approvals

- Hybrids, known for their high yields and adaptability, dominate canola cultivation, surpassing both open-pollinated varieties (OPVs) and their derivatives.

- Within the canola seed market in 2022, non-transgenic hybrids outshone their transgenic counterparts. This preference stems from the global ban on transgenic crop cultivation and the rising consumer demand for non-GMO food, which is expected to expand the sowing area for non-transgenic varieties.

- In 2022, North America led the way in transgenic hybrids, capturing 88.7% of the market. This dominance can be attributed to the region's numerous approvals and lenient FDA policies.

- Asia-Pacific, with a 34.4% share, emerged as the leader in canola OPVs in 2022, driven by the region's significant adoption of OPVs, primarily due to the expanding organic farming sector, which prohibits the use of transgenic seeds.

- On a global scale, hybrids are outpacing OPVs in terms of growth rates, with projected CAGRs of 5.3% and 5.1% in the canola seed market, respectively, during the forecast period. The surge in hybrid adoption, driven by the desire for higher yields, farm-saved seeds, and organic cultivation, is fueling this trend.

- With a projected CAGR of 9.3%, Mexico is poised to be the fastest-growing market for hybrid canola seeds in the coming years. This growth is underpinned by a rising preference for non-transgenic hybrids.

- The increased demand for animal feed and canola oil, coupled with its ease of cultivation compared to competing crops like corn or wheat, is expected to propel the canola seed market at a CAGR of 5.3% during the forecast period.

Canada dominates canola cultivation, hybrid seeds gain traction globally

- North America is the largest canola, rapeseed, and mustard producer, accounting for 56.1% of the global canola seed market in 2022. This is because canola is highly used for crop rotation practices in North America. Additionally, the strong export market provides a significant economic incentive for farmers to continue producing canola.

- Asia-Pacific accounted for the second-largest canola seed market globally, with a value of USD USD 485.7 million in 2022. This is due to its large area dedicated to canola cultivation.

- Canada accounted for 47.1% of the global canola seed market by value in 2022, and it is the leading exporter of canola seeds. According to the Canola Council of Canada, the country exported about 8.4 million metric ton of canola seeds in 2022, while the major importing countries were the United States, China, and Japan.

- South America and Europe are poised to witness the highest growth rates in the canola seed market, with projected CAGRs of 6.9% and 6.7%, respectively, during the forecast period. This surge is driven by rising consumer demand for canola as an edible oil. Europe, in particular, saw a notable 21.8% uptick in its canola seed market from 2017 to 2022, buoyed by its expanding usage of bio-lubricants.

- In 2022, hybrids accounted for the major share of the global canola seed market, led by Canada and China, which are the major countries. Globally, the hybrid seed segment for canola, rapeseed, and mustard is projected to record a CAGR of 5.3% during the forecast period due to their resistance to different diseases, tolerance to drought, and higher yield.

- Therefore, higher demand from the processing industries and increased cultivation areas may help boost the canola seed market during the forecast period.

Global Canola Seed Market (seed For Sowing) Trends

Asia-Pacific dominated the area under canola cultivation due to high domestic demand and suitable climatic conditions

- Canola, rapeseed, and mustard are prominent oilseed crops cultivated worldwide. From 2016 to 2022, global canola acreage witnessed a 15.4% surge, with Asia-Pacific leading the way. In 2022, the region's canola acreage reached 19.2 million hectares, capturing a commanding 49.0% of the global share. Within Asia-Pacific, India and China emerged as the key players, with cultivated areas of 8.0 million hectares and 6.9 million hectares, respectively, in 2022. Together, they accounted for a significant 77.5% of the region's total. India, in particular, stands as the world's largest canola producer, experiencing a remarkable 39.1% growth in acreage from 2016 to 2022. This surge was primarily driven by robust domestic demand, especially in northern India, where canola is a popular cooking oil.

- North America ranks as the second-largest canola-producing region, representing 25.6% of the global acreage in 2022. Over the 2016-2022 period, the region witnessed a 9.3% growth. Canada dominates this landscape, commanding a staggering 91.0% of the region's canola acreage in 2022. Canadian acreages saw an 8.1% rise from 2016 to 2022, contributing to 20% of the world's canola production, largely driven by surging demand from the food and fuel sectors.

- In 2022, Europe accounted for 24.0% of the global canola acreage, marking an 11.8% increase from 2017 to 2022. Russia emerged as the major producer in the region, commanding 21.4% of the total canola acreage, with a notable 93% surge from 2016 to 2022. South America and Africa held a modest 0.7% and 0.4% share, respectively, of the global canola acreage in 2022. Given the rising demand from the oil industry, a further uptick in acreages is anticipated during the forecast period.

The demand for traits with disease resistance, quality attributes, high oleic content, and drought tolerance for improving the yield of canola is increasing

- Canola dominates as the primary oilseed crop in several countries, finding applications in edible oil, feed, and feed meals. Key quality attributes, including plant height, leaf and ear size, shape, color, maturity, and winter resilience, are being emphasized by major players like Bayer AG, Land O' Lakes, and Corteva Agriscience. Notably, Corteva Agriscience's PT279CL and Bayer AG's Truflex exemplify these quality attributes.

- Disease resistance is a pivotal trait, given canola's vulnerability to ailments like light leaf spots, club roots, black legs, verticillium stem stripe, and sclerotinia. Corteva Agriscience's PT303 and PX131n showcase resistance to light leaf spot and Sclerotinia. Nufarm's Nuseed brand, on the other hand, offers resistance to black legs, club roots, and anti-shatter diseases. Additionally, the trait of wider adaptability is gaining traction, driven by evolving weather patterns and diverse soil types across regions.

- Other sought-after traits, such as high oleic content, lodging resistance, and drought tolerance, are commanding premium prices. In Australia, for instance, canola traits in demand include drought tolerance and early maturity, aligning with the country's changing climate and escalating dry spells. Land O' Lakes' seed varieties, like Surt and Roundup Ready, boast drought tolerance and lodging resistance.

- Seed companies are equipping growers with traits that enhance disease resistance and exhibit high-quality attributes, which may foster market growth in the coming years.

Canola Seed (seed For Sowing) Industry Overview

The Canola Seed Market (seed For Sowing) is fragmented, with the top five companies occupying 27.66%. The major players in this market are BASF SE, Bayer AG, Corteva Agriscience, Euralis Semences and Nufarm (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 92508

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Area Under Cultivation

- 4.2 Most Popular Traits

- 4.3 Breeding Techniques

- 4.4 Regulatory Framework

- 4.5 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Breeding Technology

- 5.1.1 Hybrids

- 5.1.1.1 Non-Transgenic Hybrids

- 5.1.1.2 Transgenic Hybrids

- 5.1.1.2.1 Herbicide Tolerant Hybrids

- 5.1.1.2.2 Other Traits

- 5.1.2 Open Pollinated Varieties & Hybrid Derivatives

- 5.1.1 Hybrids

- 5.2 Region

- 5.2.1 Africa

- 5.2.1.1 By Breeding Technology

- 5.2.1.2 By Country

- 5.2.1.2.1 Ethiopia

- 5.2.1.2.2 Kenya

- 5.2.1.2.3 South Africa

- 5.2.1.2.4 Rest of Africa

- 5.2.2 Asia-Pacific

- 5.2.2.1 By Breeding Technology

- 5.2.2.2 By Country

- 5.2.2.2.1 Australia

- 5.2.2.2.2 Bangladesh

- 5.2.2.2.3 China

- 5.2.2.2.4 India

- 5.2.2.2.5 Japan

- 5.2.2.2.6 Myanmar

- 5.2.2.2.7 Pakistan

- 5.2.2.2.8 Vietnam

- 5.2.2.2.9 Rest of Asia-Pacific

- 5.2.3 Europe

- 5.2.3.1 By Breeding Technology

- 5.2.3.2 By Country

- 5.2.3.2.1 France

- 5.2.3.2.2 Germany

- 5.2.3.2.3 Italy

- 5.2.3.2.4 Netherlands

- 5.2.3.2.5 Poland

- 5.2.3.2.6 Romania

- 5.2.3.2.7 Russia

- 5.2.3.2.8 Spain

- 5.2.3.2.9 Turkey

- 5.2.3.2.10 Ukraine

- 5.2.3.2.11 United Kingdom

- 5.2.3.2.12 Rest of Europe

- 5.2.4 Middle East

- 5.2.4.1 By Breeding Technology

- 5.2.4.2 By Country

- 5.2.4.2.1 Iran

- 5.2.5 North America

- 5.2.5.1 By Breeding Technology

- 5.2.5.2 By Country

- 5.2.5.2.1 Canada

- 5.2.5.2.2 Mexico

- 5.2.5.2.3 United States

- 5.2.6 South America

- 5.2.6.1 By Breeding Technology

- 5.2.6.2 By Country

- 5.2.6.2.1 Argentina

- 5.2.6.2.2 Brazil

- 5.2.6.2.3 Rest of South America

- 5.2.1 Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Advanta Seeds - UPL

- 6.4.2 Anhui Tsuen Yin Hi-Tech Seed Industry Co. Ltd

- 6.4.3 BASF SE

- 6.4.4 Bayer AG

- 6.4.5 Corteva Agriscience

- 6.4.6 Euralis Semences

- 6.4.7 KWS SAAT SE & Co. KGaA

- 6.4.8 Land O'Lakes Inc.

- 6.4.9 Nufarm

- 6.4.10 RAGT Group

7 KEY STRATEGIC QUESTIONS FOR SEEDS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Global Market Size and DROs

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.