Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693399

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693399

Japan Sealants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 156 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

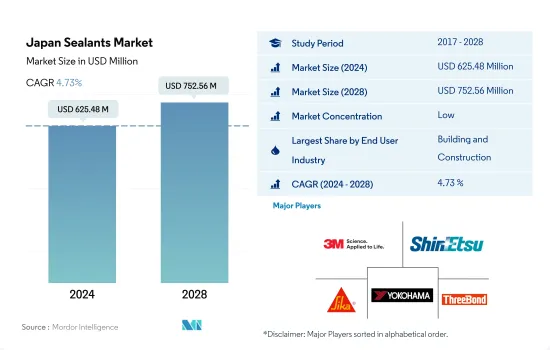

The Japan Sealants Market size is estimated at 625.48 million USD in 2024, and is expected to reach 752.56 million USD by 2028, growing at a CAGR of 4.73% during the forecast period (2024-2028).

Emerging automotive market and building & construction industry are expected to boost the consumption of sealants in Japan

- The construction industry holds the major share in the Japanese sealants market, followed by other end-user industries due to diverse applications of sealants in building and construction activities such as waterproofing, weather-sealing, cracks-sealing, and joint-sealing. Moreover, construction sealants are designed for longevity and ease of application on different substrates. The Japanese construction sector achieved about 5.3% of the nation's GDP in 2019 and is likely to register considerable growth in the upcoming years. The Japanese government focuses on the quality of buildings and promotes sustainable development, which will likely proliferate sealants demand over the forecast period.

- A variety of sealants are used in electrical equipment manufacturing for potting and protecting applications. They are used for sealing sensors and cables. The Japanese electronics market registered nearly 6% of revenue share in 2021 and is likely to have promising growth in the upcoming years owing to the rapid adoption of consumer electronics among the high and middle-income groups. This, in terms, will foster the demand for sealants in the other end-user segment. Moreover, Japan has well-established facilities to produce locomotive engines around the world will drive the demand for required sealants by 2028.

- Sealants are used in diverse applications in the automotive industry, mostly used for engines and car gaskets, and exhibit extensive bonding to various substrates. Japan has been marked as one of the leading producers in the automotive industry over the years due to extensive production facilities and the strong presence of major carmakers, which is likely to create demand for sealants in the coming years.

Japan Sealants Market Trends

Rising commercial and infrastructure projects to lead the construction industry

- The construction sector in the country is expected to record moderate growth over the next five years, owing to the increasing investments in public and private infrastructure and commercial projects. The Japanese construction adhesives and sealants market is projected to record a CAGR of about 2.89% in volume and 5.35% in value during the forecast period 2022 to 2028.

- Japan is a major area in the field of skyscrapers and high-rise buildings, making it a significant market for consumption. The country hosts various high-rise buildings (nearly 290), with Tokyo being a major hub for such buildings. The planning and construction of such buildings are witnessing decent growth in Japan in the short term. Some construction projects include two high-rise towers for Tokyo Stations, a 37-story and 230 m tall office tower, and a 61-story and 390 m tall office tower, due for completion in 2027. One of the most significant redevelopment projects includes the Yaesu redevelopments project for old buildings to new offices, hotels, residential, retail, and educational facilities, which are due to be completed by 2023.

- In Japan, major construction companies, such as Shimizu, Kajima, Obayashi, Taisei, and Daiwa House, suspended construction work. Although the government has begun to ease its measures to combat the COVID-19 pandemic, it is difficult to predict to what extent work will return to normal. In recent years, before the COVID-19 pandemic, the number and volume of construction and infrastructure projects in Japan had been increasing. As Japan recovers from the pandemic, construction and infrastructure projects should also re-commence. These factors are expected to lead to an increase in the demand for adhesives and sealants.

In addition to being home to renowned automotive manufacturers including Toyota, Honda, and Nissan, the demand for EVs is rising the automotive industry

- Japan is home to the world's largest automotive companies, such as Toyota, Honda, and Nissan, of which Toyota is the world's second-largest company in terms of market capitalization. Toyota's sales revenue showed a 15% Y-o-Y growth in the fiscal year ending March 2022, suggesting an increasing trend of automotive market growth in Japan. Passenger vehicle sales in Japan are expected to reach 3951.71 thousand units by 2027.

- Due to the impact of the COVID-19 pandemic, the sales of automobiles reduced drastically because of nationwide lockdowns, overall economic slowdown, decreased exports, supply chain disruptions, etc. These factors led to a decrease in the sales volume of automobiles in 2020 as passenger car sales fell from 3997 thousand in 2019 to 3841 thousand in 2020.

- Japan witnessed a decrease in automotive market revenue in 2021 compared to 2020 because of the increasing awareness of environmental concerns and increased use of public transport in the cities of Japan. The government is also supporting the cause by making public transport more efficient than before. The railways cover nearly 72% of the public transportation system in Japan.

- Japan witnessed peak sales of electric vehicles in 2017 because of the launch of new plug-in hybrid vehicles, which appealed to consumers. The electric vehicles segment of the automotive industry is expected to record a CAGR of 24.39% in 2022-2027. The number of electric vehicles sold in Japan is expected to be 165.5 thousand by 2027. This will lead to an increase in the overall revenue of the automotive industry in Japan.

Japan Sealants Industry Overview

The Japan Sealants Market is fragmented, with the top five companies occupying 26.31%. The major players in this market are 3M, Shin-Etsu Chemical Co., Ltd., Sika AG, THE YOKOHAMA RUBBER CO., LTD. and ThreeBond Holdings Co., Ltd. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 92455

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 End User Trends

- 4.1.1 Aerospace

- 4.1.2 Automotive

- 4.1.3 Building and Construction

- 4.2 Regulatory Framework

- 4.2.1 Japan

- 4.3 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2028 and analysis of growth prospects)

- 5.1 End User Industry

- 5.1.1 Aerospace

- 5.1.2 Automotive

- 5.1.3 Building and Construction

- 5.1.4 Healthcare

- 5.1.5 Other End-user Industries

- 5.2 Resin

- 5.2.1 Acrylic

- 5.2.2 Epoxy

- 5.2.3 Polyurethane

- 5.2.4 Silicone

- 5.2.5 Other Resins

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 3M

- 6.4.2 Arkema Group

- 6.4.3 CEMEDINE Co.,Ltd.

- 6.4.4 Henkel AG & Co. KGaA

- 6.4.5 SEKISUI FULLER

- 6.4.6 SHARP CHEMICAL IND. CO.,LTD.

- 6.4.7 Shin-Etsu Chemical Co., Ltd.

- 6.4.8 Sika AG

- 6.4.9 THE YOKOHAMA RUBBER CO., LTD.

- 6.4.10 ThreeBond Holdings Co., Ltd.

7 KEY STRATEGIC QUESTIONS FOR ADHESIVES AND SEALANTS CEOS

8 APPENDIX

- 8.1 Global Adhesives and Sealants Industry Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework (Industry Attractiveness Analysis)

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Drivers, Restraints, and Opportunities

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.