Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1692544

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1692544

Asia Pacific Road Freight Transport - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 283 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

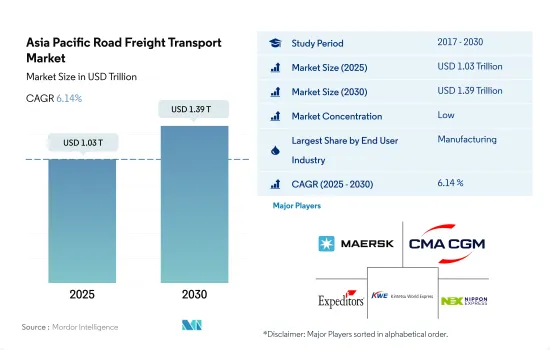

The Asia Pacific Road Freight Transport Market size is estimated at 1.03 trillion USD in 2025, and is expected to reach 1.39 trillion USD by 2030, growing at a CAGR of 6.14% during the forecast period (2025-2030).

The Government of Australia is focusing on the Modern Manufacturing Strategy project by investing more than USD 1.5 billion

- Manufacturing is a key component of the Government of Australia's plan to deliver a strong, modern, and resilient economy for the Australian people. The USD 1.5 billion Modern Manufacturing Strategy project aims to build Australia's reputation as a high-quality and sustainable manufacturing nation by setting the right economic conditions for business, promoting science and technology for industries, focusing on the areas of manufacturing advantage, and building national resilience for a stronger economy.

- In India, the total foodgrain production in the country in 2022-23 was estimated to go up to a record 330.5 million tons (MT) from 315.6 million MT. The government has taken a lot of initiatives to create reliable and connected agri logistics networks across the country for transporting agricultural products. The government has introduced the "Kisan Rath" smartphone app to make it easy for farmers, FPOs, and traders to rent vehicles to transport agri-products.

Enhancement of truck digitalization and growth of truckload segments boosting the market in the region

- Australia is a close third in terms of trade volumes in Asia-Pacific. The Australian e-commerce sector is witnessing robust growth, with the e-commerce market reaching USD 42.7 billion by 2024. This surge in the market is driving a heightened need for warehousing facilities. Responding to this trend, major players like DHL Supply Chain are making significant investments. DHL, for instance, has earmarked USD 101.86 million for automation and robotics in its Australian warehouses, with plans to deploy 1,000 new assisted picking robots by 2025.

- In India, in a notable collaboration, 15 prominent companies joined forces in July 2023, aligning with both the Zero Emission Vehicles Emerging Markets Initiative (ZEV-EMI) and the Indian government's E-FAST (Electric Freight Accelerator for Sustainable Transport) initiative. This alliance, announced at the G20 and Clean Energy Ministerial event, unveiled several pilot projects. With these initiatives gaining momentum, the demand for electric trucks (e-trucks) in India is projected to surpass 5,000 by 2027 and reach approximately 7,700 by 2030.

Asia Pacific Road Freight Transport Market Trends

Asia-Pacific freight demand is driven by global seaborne trade, which is triggering transport sector investments

- On May 17, 2024, a fair at Tokyo Station in Japan highlighted the growing use of high-speed passenger trains for light freight. This shift, driven by a shortage of commercial drivers and new overtime laws, has increased road delivery costs by up to 20%. Since August 2023, JR East has been running a same-day delivery service from Niigata to Tokyo using a dedicated 12-car Series E trainset. Items transported include fresh food, confectionery, drinks, flowers, precision components, and medical supplies. In September 2023, JR East launched a freight-only service on the Tohoku Shinkansen and now offers Hakobyun-branded freight services across its high-speed and Limited Express networks.

- In the 14th Five-Year Plan (2021-2025), China revealed goals for expanding its transportation network. By 2025, high-speed railways will extend to 50,000 kms, up from 38,000 kms in 2020, with 95% of cities with populations above 500,000 covered by 250-km lines. The country aims to increase its railway length to 165,000 kms, civil airports to over 270, subway lines in cities to 10,000 kms, expressways to 190,000 kms, and high-level inland waterways to 18,500 kms by 2025. The primary objective is to achieve integrated development by 2025, emphasizing advancements in the transformation of the transportation system and its contribution to GDP.

Owing to global uncertainties, crude oil prices are soaring in the Asian economies as most of them are net oil importers

- In 2023, China's crude oil imports rose by 11% to 563.99 MMT, driven by higher global oil prices due to the Russia-Ukraine War. In early 2024, imports increased by 5.1% YoY, reaching 88.31 MMT, as China capitalized on lower prices earlier. Brent futures peaked at USD 97.69 in September 2023, dropped to USD 72.29 in December, and rose to USD 84.05 by March 2024. OPEC+'s decision in March 2024 to extend output cuts has further boosted prices, raising concerns about global demand and potentially slowing China's imports in H2 2024.

- Australia's federal government will introduce a new fuel efficiency standard for passenger and light commercial vehicles starting January 1, 2025. This follows a one-month consultation period before drafting the new laws. Announced as part of the 2023 budget and linked to the EV strategy released in April 2023, the standard sets average CO2 targets for vehicle manufacturers. These targets will gradually decrease, requiring the production of more fuel-efficient and low or zero-emissions vehicles.

Asia Pacific Road Freight Transport Industry Overview

The Asia Pacific Road Freight Transport Market is fragmented, with the major five players in this market being A.P. Moller - Maersk, CMA CGM Group (including CEVA Logistics), Expeditors International of Washington, Inc., Kintetsu Group Holdings Co., Ltd. and Nippon Express Holdings. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 92361

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 GDP Distribution By Economic Activity

- 4.2 GDP Growth By Economic Activity

- 4.3 Economic Performance And Profile

- 4.3.1 Trends in E-Commerce Industry

- 4.3.2 Trends in Manufacturing Industry

- 4.4 Transport And Storage Sector GDP

- 4.5 Logistics Performance

- 4.6 Length Of Roads

- 4.7 Export Trends

- 4.8 Import Trends

- 4.9 Fuel Pricing Trends

- 4.10 Trucking Operational Costs

- 4.11 Trucking Fleet Size By Type

- 4.12 Major Truck Suppliers

- 4.13 Road Freight Tonnage Trends

- 4.14 Road Freight Pricing Trends

- 4.15 Modal Share

- 4.16 Inflation

- 4.17 Regulatory Framework

- 4.18 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 End User Industry

- 5.1.1 Agriculture, Fishing, and Forestry

- 5.1.2 Construction

- 5.1.3 Manufacturing

- 5.1.4 Oil and Gas, Mining and Quarrying

- 5.1.5 Wholesale and Retail Trade

- 5.1.6 Others

- 5.2 Destination

- 5.2.1 Domestic

- 5.2.2 International

- 5.3 Truckload Specification

- 5.3.1 Full-Truck-Load (FTL)

- 5.3.2 Less than-Truck-Load (LTL)

- 5.4 Containerization

- 5.4.1 Containerized

- 5.4.2 Non-Containerized

- 5.5 Distance

- 5.5.1 Long Haul

- 5.5.2 Short Haul

- 5.6 Goods Configuration

- 5.6.1 Fluid Goods

- 5.6.2 Solid Goods

- 5.7 Temperature Control

- 5.7.1 Non-Temperature Controlled

- 5.7.2 Temperature Controlled

- 5.8 Country

- 5.8.1 Australia

- 5.8.2 China

- 5.8.3 India

- 5.8.4 Indonesia

- 5.8.5 Japan

- 5.8.6 Malaysia

- 5.8.7 Thailand

- 5.8.8 Vietnam

- 5.8.9 Rest of Asia Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 A.P. Moller - Maersk

- 6.4.2 C.H. Robinson

- 6.4.3 CMA CGM Group (including CEVA Logistics)

- 6.4.4 DHL Group

- 6.4.5 Expeditors International of Washington, Inc.

- 6.4.6 Kintetsu Group Holdings Co., Ltd.

- 6.4.7 Nippon Express Holdings.

- 6.4.8 Rhenus Group

7 KEY STRATEGIC QUESTIONS FOR ROAD FREIGHT CEOS

8 APPENDIX

- 8.1 Global Logistics Market Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (Market Drivers, Restraints & Opportunities)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

- 8.7 Currency Exchange Rate

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.