PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1692487

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1692487

United States Lawn Care - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

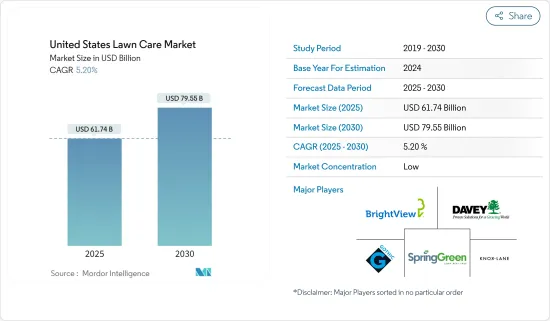

The United States Lawn Care Market size is estimated at USD 61.74 billion in 2025, and is expected to reach USD 79.55 billion by 2030, at a CAGR of 5.2% during the forecast period (2025-2030).

Lawns are a fundamental feature of most American households. The United States Census Bureau reports 145.3 million housing units in the country, driving increased demand for landscaping services across suburban lawns, golf courses, sports fields, and public parks. Lawn care services require specialized knowledge, time, and financial investment in equipment, fertilizers, agrochemicals, and seeds. The United States, home to the world's largest landscape industry, offers numerous opportunities for companies and operators in the lawn care sector. Lawns have become deeply ingrained in American middle-class culture, symbolizing comfort and stability. Notably, lawn grass is the most extensively grown crop in the United States, surpassing edible crops like corn, wheat, and sunflower.

Additionally, the government is prioritizing the expansion and preservation of green spaces as part of environmental sustainability efforts. In 2023, the United States government announced a USD 1 billion initiative to increase access to trees and green spaces in urban and community forests, where more than 84% of Americans reside. Such initiatives are expected to bolster the demand for lawn care services and tools in the coming years, further solidifying the importance of lawns in American society and the economy.

United States Lawn Care Market Trends

Growing Demand from Residential Landscaping and Golf Course Maintenance

The lawn care market is experiencing growth, as evidenced by increasing average household expenditure on landscaping activities. According to the United States Bureau of Labor Statistics, the Consumer Price Index for lawn care is 0.347, indicating that spending on lawn care products and services constitutes 0.347% of the typical household expenditure in 2024. This growth is further supported by the rise in residential and commercial construction, as well as health-conscious millennials engaging in vegetable gardening. A significant trend shaping the lawn care industry is the increasing demand for residential outdoor landscaping from younger households across the country, following a decline after the economic recession. The growing demand for gardens in residential constructions is a primary contributor to the expansion of the lawn care market.

Moreover, the expanding golf industry, one of the most popular sports in the United States, is also driving increased lawn care activities. According to the National Golf Foundation, the number of golf courses in the country increased from 15,500 in 2023 to 16,000 in 2024. This growth in golf courses, coupled with the rising interest of millennial and younger consumers in gardening activities and lawn care maintenance as part of residential outdoor landscaping, is expected to further propel the lawn care industry in the United States. The combination of these factors - increased household spending, expanding golf industry, and growing interest among younger generations - is creating a robust environment for the continued growth and development of the lawn care market.

Lawn Care Services Are Widely Used In The Commercial Sector

The market offers various commercial services, including holiday lighting installation, fertilization and pest control, flower and garden bed maintenance, landscape design and installation, lawn and grounds upkeep, as well as parking lot services, among others. The primary commercial clients include schools, banks, hotels, and similar entities. As per the Irrigation Association Survey 2023, 82% of landscape businesses cater to commercial markets.

In recent years, market providers have started offering annual and seasonal packages at competitive rates specifically for the commercial sector. This has attracted new clients and is expected to further enhance market growth in the area. The California government is committed to expanding outdoor spaces by investing in improvements to public parks. In 2022, local and state officials in California allocated nearly USD 15 million for the growth of outdoor facilities. This increase in outdoor amenities nationwide is likely to drive the demand for commercial lawn care services in the future.

The growing trend of commercial locations choosing green spaces is having a direct impact on the expansion of the commercial lawn care service market in the United States. The National Association of Landscape Professionals reports there are 661,000 landscaping service businesses operating in the United States as of 2023.

United States Lawn Care Industry Overview

The United States lawn care market is highly fragmented. Some prominent players in the industry are BrightView Holdings Inc., The Davey Tree Expert Co., Spring Green Lawn Care Corp., Knox Lane (Ruppert Landscape), and Gothic Landscape Inc. Mergers and acquisitions are the primary strategy among the key players. Partnerships are also one of the most adopted strategies by service providers in the country.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Demand for Residential Landscaping and Golf Course Maintenance

- 4.2.2 Technological Advancements Boosting the Adoption

- 4.2.3 Rising Homeownership and Landscaping Trends

- 4.3 Market Restraints

- 4.3.1 Shortage of Skilled Labor

- 4.3.2 Wastage of High Amount of Water For Irrigating Lawns

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Service Type

- 5.1.1 Maintainance Service

- 5.1.2 Ancilliary Service

- 5.2 Application

- 5.2.1 Commercial

- 5.2.2 Residential

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 BrightView Holdings Inc.

- 6.3.2 The Davey Tree Expert Co.

- 6.3.3 Spring Green Lawn Care Corp.

- 6.3.4 Knox Lane

- 6.3.5 Augusta Lawn Care Services

- 6.3.6 Park West Companies

- 6.3.7 Gothic Landscape Inc.

- 6.3.8 Gibbs Landscape Company

- 6.3.9 Landscape Development Inc.

- 6.3.10 Argonne (Schill Grounds Maintenance)

7 MARKET OPPORTUNITIES AND FUTURE TRENDS