PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911329

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911329

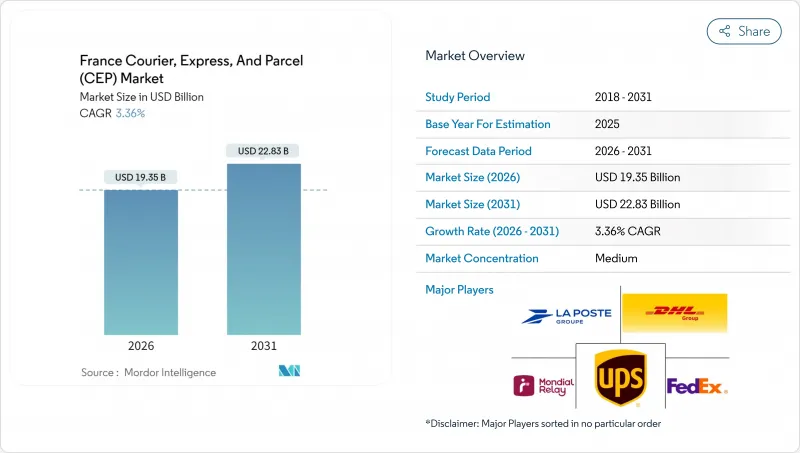

France Courier, Express, And Parcel (CEP) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The France courier, express, and parcel market was valued at USD 18.72 billion in 2025 and estimated to grow from USD 19.35 billion in 2026 to reach USD 22.83 billion by 2031, at a CAGR of 3.36% during the forecast period (2026-2031).

E-commerce growth, cross-border flows from Asia, and regulatory changes that favor low-emission operations shape this trajectory. Parcel volumes climb as online spending grows faster than store-based retail, while out-of-home (OOH) networks help operators raise stop density and limit failed deliveries. International marketplaces drive inbound small-parcel flows that boost line-haul mileage yet compress margins because of their low declared value. Meanwhile, sustainability mandates such as France's 25 active low-emission zones (ZFE-M) accelerate fleet electrification and cargo-bike adoption in dense city cores, permanently shifting last-mile cost structures. Competitive intensity rises as incumbents and new entrants race to upgrade hubs, digital tools, and alternative-fuel fleets in order to preserve service quality while meeting cost and environmental targets.

France Courier, Express, And Parcel (CEP) Market Trends and Insights

E-Commerce Penetration Surge

National online retail sales grew 8.4% year-on-year in Q2 2024, widening the parcel pool in every major city. Higher stop density lifts vehicle utilization, while omnichannel retailers add home-delivery and click-and-collect flows that broaden shipment origin points. Dark-store operators in Paris now target sub-two-hour service windows, forcing carriers to redesign routing for micro-fulfillment zones. Pickup-point expansion underpins cost control, as La Poste operates 128,000 sites that lower failed-delivery risk and shorten trunk routes. E-commerce shoppers increasingly favor sustainable options, and carriers that certify carbon-reduced services gain pricing power within premium delivery tiers.

Rising Cross-Border Parcel Flows from Asia

About 4.6 billion small parcels entered Europe in 2024, with 91% dispatched from China, reshaping domestic network economics. Operators must process vast volumes of low-value items that occupy capacity yet generate slender margins. Partnerships between Chinese marketplaces and global express firms, such as Temu's tie-ups with DHL, channel traffic through French airports that already handle peak e-commerce flows. Proposed EU tax reforms on low-value consignments inject strategic uncertainty but could also lift yields if minimum-value exemptions disappear. Domestic players respond by automating customs data capture and expanding bonded sortation space at gateway hubs to speed clearance and cut handling costs.

Margin Squeeze from Price Wars and Labor Costs

Road-transport company insolvencies rose 35.4% in Q4 2024 as operators struggled to pass wage and fuel hikes onto shippers. Fierce bidding for large e-commerce contracts keeps line-haul rates low, even as last-mile wages climb in dense cities where employment alternatives abound. Global integrators rationalize headcounts FedEx cut up to 2,000 European jobs in 2025 to protect margins in a soft-pricing environment. Fragmented owner-driver subcontracting further dampens pricing discipline because capacity outstrips demand on many lanes.

Other drivers and restraints analyzed in the detailed report include:

- Demand for Faster Last-Mile and OOH Options

- Sustainability Push for Zero-Emission Fleets

- Urban Land-Use and ZFE-M Restrictions

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Manufacturing produced 33.01% of 2025 revenue, anchored by automotive, aerospace, and machinery exports that require precise B2B deliveries. E-commerce, advancing at a 4.24% CAGR between 2026-2031, injects high-volume residential drops that reshape network design. Healthcare and financial services stay niche yet high-margin due to regulatory and security requirements.

Diversified demand shields carriers from sector-specific slowdowns. Fixed-interval industrial collections fill off-peak van capacity, while evening residential rounds improve asset utilization. Operators that balance industrial and consumer flows are positioned to outperform in the France courier, express, and parcel market.

International services grew faster than domestic in 2025 and are on course for a 4.05% CAGR between 2026-2031, even though the France courier, express, and parcel market size remains dominated by domestic deliveries at 65.62% share in 2025. Low-value imports from Asian platforms swell parcel counts at Paris-CDG and Lyon Saint-Exupery, compelling carriers to refine customs-clearance automation to protect transit times. Domestic volumes benefit from dense pickup-point networks and short lead times that align with consumer expectations, yet face yield pressure when shippers benchmark prices against cross-border offers.

Operators differentiate through duty-paid options and real-time tracking to win shopper trust on international consignments. La Poste's 52% jump in cross-border OOH traffic in 2024 demonstrates that flexible collection mitigates last-mile cost inflation. Carriers that master customs data capture and offer end-to-end visibility are expected to secure higher margins on the expanding cross-border segment of the France courier, express, and parcel market.

The France Courier, Express, and Parcel Market Report is Segmented by End User Industry (E-Commerce and More), Destination (Domestic and International), Speed of Delivery (Express and Non-Express), Shipment Weight (Heavy Weight Shipments and More), Mode of Transport (Air, Road, and Others), and Model (Business-To-Business, Business-To-Consumer, and Consumer-To-Consumer). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- DHL Group

- FedEx

- GEODIS

- Integer Capital Group

- International Distributions Services (including GLS)

- La Poste Group

- STERNE Group

- United Parcel Service (UPS)

- Walden Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Demographics

- 4.3 GDP Distribution by Economic Activity

- 4.4 GDP Growth by Economic Activity

- 4.5 Inflation

- 4.6 Economic Performance and Profile

- 4.6.1 Trends in E-Commerce Industry

- 4.6.2 Trends in Manufacturing Industry

- 4.7 Transport and Storage Sector GDP

- 4.8 Export Trends

- 4.9 Import Trends

- 4.10 Fuel Price

- 4.11 Logistics Performance

- 4.12 Infrastructure

- 4.13 Regulatory Framework

- 4.14 Value Chain and Distribution Channel Analysis

- 4.15 Market Drivers

- 4.15.1 E-Commerce Penetration Surge

- 4.15.2 Rising Cross-Border Parcel Flows from Asia

- 4.15.3 Demand for Faster Last-Mile and OOH Options

- 4.15.4 Sustainability Push for Zero-Emission Fleets

- 4.15.5 Paris-2024 Logistics Upgrades (Cargo-Bike Zones)

- 4.15.6 Gen-Z Second-Hand Marketplace Boom (C2C)

- 4.16 Market Restraints

- 4.16.1 Margin Squeeze from Price Wars and Labor Costs

- 4.16.2 Urban Land-Use and ZFE-M Restrictions

- 4.16.3 Low-Value Parcels from Asian Sites Erode Yields

- 4.16.4 Sparse High-Power EV Charging at Peri-Urban Depots

- 4.17 Technology Innovations in the Market

- 4.18 Porter's Five Forces Analysis

- 4.18.1 Threat of New Entrants

- 4.18.2 Bargaining Power of Buyers

- 4.18.3 Bargaining Power of Suppliers

- 4.18.4 Threat of Substitutes

- 4.18.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Value, USD)

- 5.1 Destination

- 5.1.1 Domestic

- 5.1.2 International

- 5.2 Speed of Delivery

- 5.2.1 Express

- 5.2.2 Non-Express

- 5.3 Model

- 5.3.1 Business-to-Business (B2B)

- 5.3.2 Business-to-Consumer (B2C)

- 5.3.3 Consumer-to-Consumer (C2C)

- 5.4 Shipment Weight

- 5.4.1 Heavy Weight Shipments

- 5.4.2 Light Weight Shipments

- 5.4.3 Medium Weight Shipments

- 5.5 Mode of Transport

- 5.5.1 Air

- 5.5.2 Road

- 5.5.3 Others

- 5.6 End User Industry

- 5.6.1 E-Commerce

- 5.6.2 Financial Services (BFSI)

- 5.6.3 Healthcare

- 5.6.4 Manufacturing

- 5.6.5 Primary Industry

- 5.6.6 Wholesale and Retail Trade (Offline)

- 5.6.7 Others

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Key Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, and Recent Developments)

- 6.4.1 DHL Group

- 6.4.2 FedEx

- 6.4.3 GEODIS

- 6.4.4 Integer Capital Group

- 6.4.5 International Distributions Services (including GLS)

- 6.4.6 La Poste Group

- 6.4.7 STERNE Group

- 6.4.8 United Parcel Service (UPS)

- 6.4.9 Walden Group

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment