PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690938

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690938

Indonesia Defense - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

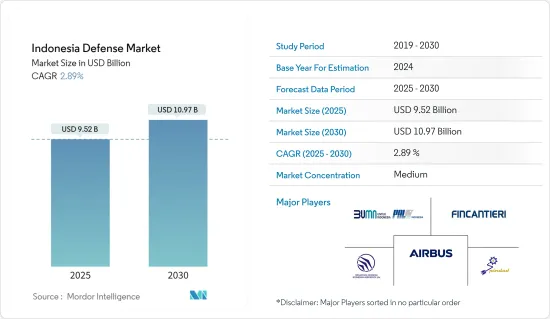

The Indonesia Defense Market size is estimated at USD 9.52 billion in 2025, and is expected to reach USD 10.97 billion by 2030, at a CAGR of 2.89% during the forecast period (2025-2030).

Indonesia is intensifying its focus on bolstering the local defense industry in response to rising demand for advanced military equipment. The government's strategy involves procuring weapons and defense systems, emphasizing technology transfers from leading OEMs to pave the way for long-term self-sufficiency. Domestically, Indonesian entities are honing their expertise in land vehicles, arms, missiles, and UAVs. In the coming years, they plan to venture into more intricate systems like flight controls, warheads, and jet engines.

Under the MEF initiative, Indonesia is adopting a capability-based defense approach to fortify its armed forces. This strategy entails acquiring defense assets aligned with threat assessments and financial capabilities. Notably, Indonesia and other ASEAN nations are embroiled in territorial conflicts with China in the South China Sea, prompting heightened military investments from the Indonesian government.

Furthermore, Indonesia is contemplating a significant overhaul of its aging defense systems to better navigate the evolving strategic landscape. This modernization thrust is propelling the market's growth, with projections indicating a positive trajectory during the forecast period.

Indonesia Defense Market Trends

Ammunition Segment Expected to Show Highest Growth

Indonesia's rising geopolitical tensions and increased defense budgets have fueled market demand. In 2023, Indonesia's defense spending reached USD 9.48 billion. The current administration faces challenges in meeting its minimum essential force (MEF) target. This delay primarily stems from budget constraints and political uncertainties. In June 2022, Indonesia revised its MEF target to 70% for the 2019-2024 phase. Driven by its military ambitions and regional security concerns, Indonesia bolstered its defense spending. The nation's military comprises approximately 404,500 personnel across its Army, Navy, and Air Force, all equipped with various firearms. This heightened demand is evident in recent procurement activities. For instance, in July 2023, the Indonesian police secured 1,857 riot guns worth USD 3.3 million.

Indonesia is poised to prioritize local firms for its modernization needs, aiming to lessen its reliance on foreign suppliers. The nation also plans to emphasize technology transfers and offsets to bolster its domestic defense industry. A notable move in this direction was seen in August 2023 when Indonesia sought assistance from Saudi Arabia to enhance its defense sector. During the discussions, state-owned arms manufacturers like Pinbad showcased their capabilities, signaling a push toward self-sufficiency in defense production. Thus, growing investment in enhancing defense capabilities and rising procurement of advanced ammunition are driving the growth of the segment.

Air-based Vehicles to Dominate the Market During the Forecast Period

Indonesia's presidential office has outlined an ambitious military modernization plan, earmarking a substantial USD 125 billion investment through the mid-2040s. This plan underscores Indonesia's ongoing reliance on foreign loans. Specifically, the proposal allocates USD 79 billion for defense equipment, another USD 32.5 billion for sustainment over 25 years, and the remaining USD 13.4 billion to service interest on foreign loans.

Documents from the Ministry of Finance indicate that in 2022, approximately 32% of the defense budget was earmarked for modernization projects, covering procurement and sustainment. Notably, the country is bolstering its fixed-wing aircraft fleet. In January 2024, Indonesia saw the final installment of 18 Rafale aircraft come into effect. This followed the earlier deliveries of 6 and 18 Rafale aircraft in September 2022 and August 2023, respectively, culminating in fulfilling the 42-aircraft order placed by Indonesia in February 2022. In February 2024, Indonesia ordered three more CN235-220 transport aircraft from the state-owned aerospace company PT Dirgantara Indonesia (PTDI) for USD 85 million. The CN-235, designed to be lighter and more compact than the widely acclaimed C-130 Hercules, is a complementary asset, especially when using a larger transport platform like the C-130 would be inefficient. These procurement endeavors are poised to necessitate a larger share of the defense budget, potentially posing a challenge for the incumbent government.

Indonesia Defense Market Industry Overview

Indonesia's defense market is semi-consolidated. In the past, Indonesia depended on foreign defense contractors to procure major military equipment. However, in recent years, Indonesia has focused more on developing its state-owned companies. PT PAL Indonesia, PT Pindad, PT Dirgantara Indonesia, Airbus SE, and FINCANTIERI SpA are some of the major players in the market.

Recent defense contracts from the government helped the local companies to prosper. However, budget constraints can hamper the growth opportunities of these companies soon. Close relationships with other Asian countries like Japan and India helped the country's defense industry grow and contribute to the economy through exports. Joint defense production plans can further enhance the future supply chain of the local defense industry. Thus, as Indonesia plans for a major military equipment modernization, defense companies have a significant growth opportunity to increase their presence in the Indonesian defense market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Personnel Training and Protection

- 5.1.2 Communication Systems

- 5.1.3 Weapons and Ammunitions

- 5.1.3.1 Artillery and Mortar Systems

- 5.1.3.2 Infantry Weapons

- 5.1.3.3 Missile and Missile Defense Systems

- 5.1.3.4 Ammunition

- 5.1.4 By Vehicles

- 5.1.4.1 Land-based Vehicles

- 5.1.4.2 Sea-based Vehicles

- 5.1.4.3 Air-based Vehicles

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 PT PAL Indonesia

- 6.1.2 PT Pindad

- 6.1.3 PT. Dirgantara Indonesia

- 6.1.4 PT Len Industri

- 6.1.5 PT. Dahana

- 6.1.6 SCYTALYS

- 6.1.7 Leonardo SpA

- 6.1.8 Airbus SE

- 6.1.9 BAE Systems PLC

- 6.1.10 FINCANTIERI SpA

- 6.1.11 Kongsberg Gruppen ASA

- 6.1.12 Daewoo Shipbuilding & Marine Engineering Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS