PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690915

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690915

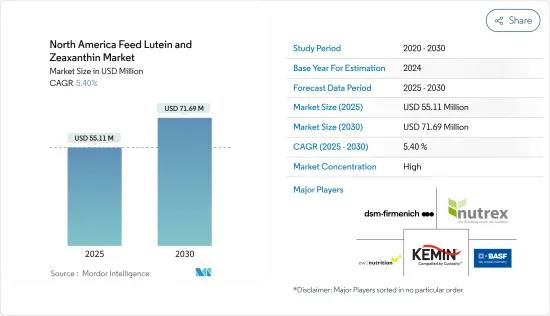

North America Feed Lutein And Zeaxanthin - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The North America Feed Lutein And Zeaxanthin Market size is estimated at USD 55.11 million in 2025, and is expected to reach USD 71.69 million by 2030, at a CAGR of 5.40% during the forecast period (2025-2030).

Zeaxanthin and lutein are carotenoid pigments from the xanthophylls subclass that mammals cannot synthesize naturally and must obtain through diet. These compounds are distributed to various tissues, particularly the retina. Both pigments are concentrated in the macula lutea, a yellowish-pigmented area at the center of the fovea, where they form the macular pigment. This pigment protects tissue through antioxidant, anti-inflammatory, and light-screening properties. In laying hens, aging can lead to health issues, with fatty liver hemorrhagic syndrome (FLHS) emerging as a prevalent metabolic disease during the late laying period. FLHS causes significant reductions in egg production and can lead to sudden death, resulting in substantial economic losses for poultry producers. The antioxidant and anti-inflammatory properties of lutein can help prevent fatty liver development in laying hens.

Feed lutein and zeaxanthin are essential components in modern livestock production. These additives improve animal health, productivity, and feed efficiency by enhancing nutrient absorption, and immune system function, and supporting growth and development. The feed lutein and zeaxanthin market is driven by increasing demand for high-quality animal products. As consumer preferences shift toward healthier and more nutritious meat and dairy products, livestock producers must adapt their practices accordingly. According to the United States Department of Agriculture, broiler meat consumption in the United States reached 45.1 kilograms per capita in 2023, with projections indicating an increase to 46.2 kilograms by 2024. The Dietary Guidelines for Americans, 2020-2025 (DGA) categorize poultry as chicken, turkey, duck, geese, guineas, and game birds (e.g., quail and pheasant). In the United States, chicken accounts for 13.9% of animal protein consumption and 7.2% of total protein intake, while turkey, duck, and other poultry contribute 0.2% of animal protein and 0.1% of total protein. This consumption pattern emphasizes the importance of optimized poultry feed, including the use of feed additives to promote efficient and healthy growth.

Lutein and zeaxanthin are essential additives in poultry and aquatic animal feed, used to enhance the color of skin, muscle, feathers, scales, and egg yolks. Consumer preferences for darker egg yolks, which indicate higher carotenoid content, drive the demand for lutein and zeaxanthin in poultry feed. The growing animal production, driven by population growth and rising living standards, combined with increased compound feed production, fuels the demand for lutein and zeaxanthin in the market.

North America Feed Lutein And Zeaxanthin Market Trends

Growing Livestock Industry Intensification Increases Lutein and Zeaxanthin Demand

Industrial livestock production requires high-quality feed to optimize production efficiency, improve feed conversion ratios, and increase animal muscle mass and protein content. The growing adoption of these practices is driving the demand for feed lutein and zeaxanthin in North America, as these components are essential for producing high-quality compound feed. According to the Food and Agriculture Organization (FAO), the United States maintained the largest cattle population in North America, with beef and dairy cattle reaching 88.8 million heads in 2023. Additionally, Canada's chicken population increased from 171,099 heads in 2022 to 171,487 heads in 2023. The expansion in livestock production, driven by increasing demand for animal products, has resulted in higher requirements for quality feed, consequently boosting the consumption of feed lutein and zeaxanthin.

According to the World Bank, industrialized meat production is growing six times faster than traditional meat production methods. The industry is shifting toward landless meat production facilities. In the United States, California leads production, with over 18,552.8 million kilograms of milk produced in 2023, as reported by the National Agricultural Statistics Service. The livestock production industry continues to consolidate, particularly through concentrated animal feed operations (CAFO). These operations have expanded rapidly in the United States over the past decade, and similar models are gaining adoption across North America, supported by government and financial institutions.

Appearance and color play a crucial role in evaluating the quality of poultry and fish products. Consumer preferences vary regarding egg yolk coloration, leading producers to use feed additives like lutein and zeaxanthin to control the color of egg yolks and broiler skin. These additives help livestock producers enhance product appearance and improve marketability. The growth of indoor animal-raising systems, driven by industrialization, has increased alongside higher quality standards for animal products.

Poultry Dominates Market

The poultry segment is a major consumer of feed lutein and zeaxanthin in North America, driven by increasing population and rising poultry meat demand. Poultry producers focus on improving feed conversion ratios and animal growth rates, increasing the use of feed additives. The poultry industry extensively uses feed carotenoids, including lutein and zeaxanthin, in both meat and egg production. Consumer awareness of lutein and zeaxanthin health benefits has increased egg consumption in the United States. This has influenced consumer preferences for darker egg yolks, which are perceived as indicators of higher carotenoid content.

According to Statistics Canada, in 2023, the country's poultry and egg products were valued at USD 6.8 billion, accounting for 6.9% of farming operations' cash receipts. The industry comprised 2,853 regulated chicken producers, 513 registered turkey producers, 243 broiler-hatching egg producers, and 1,243 egg producers, totaling 4,852 commercial poultry and egg producers, alongside numerous associated businesses. In 2023, Canadian chicken production reached 1.4 billion kilograms, with Quebec and Ontario accounting for 62% of the total production. The country's poultry exports included chicken meat and products, breeding stock, hatching eggs, live birds, turkey, ducks, geese, other poultry products, and eggs in various forms. Canada exported 14.1 million chicks and poults valued at USD 61.8 million to 24 countries, with the United States being the primary market, representing 71% of exports by value. Other significant export destinations included Mexico, Guatemala, the Philippines, and Turkiye.

The country also exported 3.3 million hatching eggs of various species, valued at over USD 86 million, to 19 countries in 2023. The United States remained the dominant market, receiving 64% of exports by value, followed by Russia, Chile, and Brazil. Additionally, Canada exported more than 3 million kilograms of processed eggs worth USD 15 million and 24.2 million shell eggs valued at over USD 3.6 million. This growth in poultry consumption is projected to drive increased poultry feed production, subsequently raising the demand for quality feed lutein and zeaxanthin.

Synthetic xanthophylls (lutein and zeaxanthin) are used as feed additives in poultry farming to achieve optimal coloration of broiler skin and egg yolk. Color is a key attribute and selection criterion for consumers when purchasing food products. Poultry producers are implementing high-quality standards by focusing on diet and feed additives that increase the intake of carotenoids, including lutein and zeaxanthin. In poultry feed, these compounds enhance egg yolk color and meat quality, which is anticipated to drive market growth during the forecast period.

North America Feed Lutein And Zeaxanthin Industry Overview

The North America feed lutein and zeaxanthin market is consolidated, with a few global players leading the market with a highly diversified product portfolio and several acquisitions and agreements taking place to gain a major share in the industry. Some of the major players in the industry include Kemin Industries Inc., DSM-Firmenich, Nutrex, BASF SE, and EW Nutrition are some of the major players who are operating in the region. The companies are not only competing based on product quality or product promotion but are also focused on other strategic moves, like acquisitions and expansions, to acquire a larger share and expand their acquired market size.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Industrial Livestock Production

- 4.2.2 Increased Compound Feed Production

- 4.2.3 Growing Focus on Animal Health and Nutrition

- 4.3 Market Restraints

- 4.3.1 Rising Cost of Raw Materials

- 4.3.2 Stringent Government Regulations

- 4.4 Porter's Five Force Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Animal Type

- 5.1.1 Ruminants

- 5.1.2 Poultry

- 5.1.3 Swine

- 5.1.4 Aquaculture

- 5.1.5 Other Animal Type

- 5.2 Geography

- 5.2.1 United States

- 5.2.2 Canada

- 5.2.3 Mexico

- 5.2.4 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Kemin Industries Inc.

- 6.3.2 DSM-Firmenich

- 6.3.3 Nutrex

- 6.3.4 BASF SE

- 6.3.5 EW Nutrition

- 6.3.6 PIVEG Inc.

- 6.3.7 FENCHEM

- 6.3.8 Allied Biotech Corporation

- 6.3.9 Synthite Industries Private Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS