PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690913

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690913

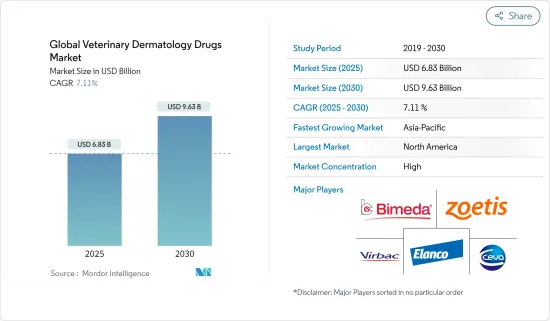

Global Veterinary Dermatology Drugs - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Global Veterinary Dermatology Drugs Market size is estimated at USD 6.83 billion in 2025, and is expected to reach USD 9.63 billion by 2030, at a CAGR of 7.11% during the forecast period (2025-2030).

Factors such as an increasing burden of dermatological diseases in pet animals and increasing pet adoption and animal care are expected to garner the demand for the availability of dermatology drugs available for veterinary use. They are anticipated to drive the overall market growth during the forecast period.

Most animals globally are affected by major skin diseases like parasitic skin diseases, alopecia, dander-related skin disorders, intrinsic skin infections, mild to harmful skin cancer, autoimmune skin diseases, and other internal skin abnormalities. For instance, according to a study published in the Veterinary Sciences Journal in July 2022, atopic dermatitis (AD) is one of the most common pet allergies. In dogs, the prevalence has become increasingly common due to rising exposure to indoor environments and processed foods for pets. Hence, the burden of AD among canines is rising and is creating demand for the availability of dermatology drugs. This is anticipated to fuel the growth of the market in the country.

Moreover, increasing pet adoption is expected to contribute to the growth of the market over the forecast period. For instance, According to the 2023-2024 American Pet Product Association (APPA) National Pet Owners Survey, about 66% of households in the United States owned a pet, which translates to about 86.9 million homes. Cats and dogs were the major pets, with a total population of 45.3 million and 69 million, respectively.

Furthermore, the growing availability of research sources and company research and development activities to innovate new products are the factors fueling competitiveness in the market. For instance, in September 2022, Boehringer Ingelheim announced today the U.S. Food and Drug Administration has approved SPEVIGO, the first approved treatment option for generalized pustular psoriasis (GPP) flares in adults. SPEVIGO is a novel, selective antibody that blocks the activation of the interleukin-36 receptor (IL-36R), a key part of a signaling pathway within the immune system shown to be involved in the cause of GPP. As better dermatological health is crucial for pets, pet owners, and livestock animals, the increasing number of products is expected to contribute to the growth of the veterinary dermatology drugs market.

However, the low availability and lack of awareness of the drugs might restrain the market growth over the analysis period.

Veterinary Dermatology Drugs Market Trends

Companion Animal Segment is Expected to have Significant Growth Over the Forecast period

The companion animal segment is likely to witness significant growth during the forecast period. The demand for companion animal dermatological drugs has been observing a significant rise in the global market, owing to factors such as increasing pet adoption, rising prevalence of companion animal diseases, and rising awareness about companion animal health.

According to the annual report of the FEDIAF in July 2022, cats and dogs are the most popular companion animals in Europe, with 26% of all pet-owning households owning a cat, amounting to 110 million household cats, and 25% owning dogs, amounting to 90 million dogs. As per the above source, Russia has the most cats (22.9 million), followed by Germany (16.7 million) and France (15.1 million). Russia also has the most dogs, with 17.5 million, followed by the United Kingdom with 12.0 million and Germany with 10.3 million in 2021. This is likely to lead to more dermatological care for pet animals since skin infections and diseases are the most common health problems in companion animals. Hence it is anticipated to fuel the segment's growth.

Furthermore, similar to human allergies, canine allergies, such as atopic dermatitis (AD), are becoming more common. Chronic allergies are characterized by pruritus and recurring inflammatory lesions. For instance, as per a research article published by MDPI in December 2022, concerns regarding canine health have grown along with the large growth in the number of dog owners in recent years. Dogs typically attend veterinary clinics for skin illnesses, including allergies, infections, and endocrine issues. Hence, the rising burden of skin diseases in pets likely increases the demand for dermatology drugs for treatment and is expected to drive the growth of the segment.

Moreover, new product launches by market players for companion animals play a major role in the growth of the market. For example, in October 2023, Pet King Brands, Inc. added three new products to the line of veterinarian-recommended ZYMOX Enzymatic Dermatology products to help cats and kittens with problems with their ears and skin. These new product launches increase the product portfolios of major players in veterinary dermatology drugs and will drive the market over the forecast period.

North America is Expected to Hold a Significant Share in the Market Over the Forecast Period

North America is anticipated to witness a high growth rate in the veterinary dermatology drugs market during the forecast period, owing to the high prevalence of pruritus, sores, alopecia, masses, eruptions, scales, seborrhea, pustules, and draining tracts in animals.

The growth of the veterinary dermatology drugs market in developed countries such as the United States and Canada is driven by increased pet adoption, awareness about animal health, and animal health expenses.According to data from the Canadian Animal Health Institute (CAHI) in September 2022, more than half of Canadian households (60%) own at least one dog or cat in 2022. Additionally, the dog population increased to 7.9 million, and the cat population increased to 8.5 million in the same year.

In the North American region, the United States is expected to hold a significant share of the veterinary oncology market due to having one of the highest numbers of animals in the region, coupled with high animal health expenditure and a high burden of animal cancer cases. According to the 2023-2024 American Pet Product Association (APPA) National Pet Owners Survey, about 66% of households in the United States owned a pet, which translates to about 86.9 million homes. Cats and dogs were the major pets, with a total population of 45.3 million and 69 million, respectively. Hence, increasing pet adoption along with rising expenditure on the healthcare of animals, which also includes veterinary dermatological disease management, is expected to drive the market in the region.

The major players are actively making strategic plans and new developments, along with new product approvals and launches, to contribute to the market. For instance, in November 2022, Vetoquinol Canada announced that veterinarians across the country now have a new tool available to try and address many of today's challenges in the field of pet dermatology. Owing to the increasing number of recent developments and new product launches by market players, the North American region for the studied market is growing faster and will witness a prominent growth rate during the forecast period for the veterinary dermatology drugs market.

Veterinary Dermatology Drugs Industry Overview

The veterinary dermatology drugs market is moderately competitive, with few key players. In the current scenario, the number of mergers and acquisitions among market players is increasing, which is fueling the veterinary dermatology drugs market. The major players in the market are engaged in product development and strategic alliances to strategically cater to the growing global demand for the market and to gain a robust place in it. Major companies in the studied market include Elanco, Bimeda, Inc., Merck & Co., Inc., Virbac, Ceva, Mars Incorporated (Virginia, USA), Zoetis, Inc., and Nestle S.A., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Burden of Dermatological Diseases in Pets

- 4.2.2 Increasing Pet adoption and Animal Care

- 4.3 Market Restraints

- 4.3.1 Low availability and Lack of awareness of the drugs

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD)

- 5.1 By Animal

- 5.1.1 Companion Animal

- 5.1.2 Livestock Animal

- 5.2 By Route Of Administration

- 5.2.1 Topical

- 5.2.2 Injectable

- 5.2.3 Oral

- 5.3 By Indication

- 5.3.1 Parasitic Infections

- 5.3.2 Allergic Infections

- 5.3.3 Other Indications

- 5.4 By Distribution Channel

- 5.4.1 Retail

- 5.4.2 Hospital Pharmacies

- 5.4.3 E-commerce

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 France

- 5.5.2.3 Germany

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 India

- 5.5.3.2 China

- 5.5.3.3 Japan

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 COMPANY PROFILES AND COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Elanco

- 6.1.2 Bimeda, Inc.

- 6.1.3 Merk & Co. Inc.

- 6.1.4 Virbac

- 6.1.5 Ceva

- 6.1.6 Mars, Incorporated

- 6.1.7 Zoetis, Inc.

- 6.1.8 Leti Pharma

- 6.1.9 Vivaldis

- 6.1.10 Bioiberica S.A.U

- 6.1.11 Indian Immunologicals Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS