PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690908

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690908

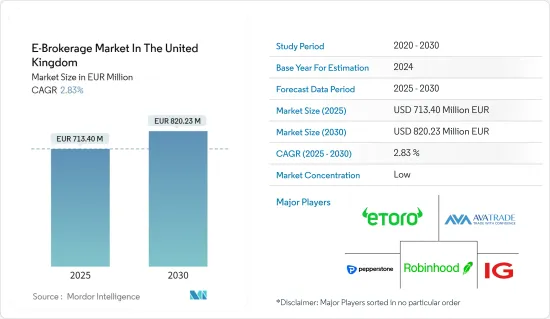

E-Brokerage In The United Kingdom - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The E-Brokerage Market In The United Kingdom Market size is estimated at EUR 713.40 million in 2025, and is expected to reach EUR 820.23 million by 2030, at a CAGR of 2.83% during the forecast period (2025-2030).

E-brokerage is one of the fastest-growing industries in the world due to its convenience and affordability, rapid digitalization, and growing internet penetration. However, the market is facing challenges such as security threats and regulatory issues. In contrast, technological innovation and the growing popularity of mobile trading platforms are driving the growth of the e-brokerage market.

The pandemic led to a surge in the use of digital technologies in various sectors, including finance. E-brokerage companies took advantage of this trend by providing easy-to-use and cutting-edge platforms. They introduced new features like mobile trading apps, sophisticated charting tools, and educational resources to entice and retain clients. The ease of use and accessibility of the platforms made them more attractive to investors. This, in turn, led to various growth opportunities for e-brokerages. Following the COVID-19 pandemic, asset under management (AUM) and revenue in the Neo-Brokerage market (E-brokerage being a segment of this) in the UK has been steadily growing and is driving the market for the e-brokerage segment within the UK.

Technological innovation has played a major role in the expansion of the services offered by E-brokerage platforms such as robo advisory, algo trading, predictive stock trading, etc. These tools have enabled retail investors to participate more in the financial markets. The increasing presence of international companies on the country's stock exchange is also contributing to the expansion of E- Brokerage services by increasing trading frequency.

UK E-Brokerage Market Trends

Rising Digital Innovation & Adoption of Artificial Intelligence (AI) and Machine Learning (ML)

UK E-brokerages are seeing a steady rise in revenue as the country accounts for a significant proportion of investing and trading within the European region. Robo advisors and Neo brokers continue to dominate the digital Investment market in the UK with a market value of over USD 100 Billion.

The use of Artificial Intelligence (AI) and Machine Learning (ML) by E-brokerage service providers has raised the user's risk awareness and helped them to choose the right stock without the need for a broker. The increasing Internet penetration in the country (around 90%) means that E-Brokerages are constantly growing their market share to offer solutions to diversify investments and to invest in stocks. By having the option of trading online through e-brokerages, investors can invest in international companies listed domestically and even in the global market. Digital innovations are driving the growth of the United Kingdom e-brokerage market with more competition between players.

Internet Penetration is on the Rise, Leading to an Increase in Investments From Retail Investors.

Retail investors in the United Kingdom hold more than USD 317 Billion in domestic shares with more than 23 Million shareholders in the country accounting for around 12% of the shares listed on the London stock exchanges. E-brokerage platforms such as Interactive Brokers, eToro, XTB, and SAXO bank are making trading more convenient for retail investors in the country by charging minimum amounts as transaction and commission fees.

Gen Z & Millenials make up over 50% of the population and are heavily involved in investment activities, driving the UK E-brokerage market. Over 13% of the United Kindom shares are owned by individuals, and this number continues to grow post-pandemic, with users looking for higher returns on investments in the market, leading to further growth in the E-brokerage market.

UK E-Brokerage Industry Overview

The E-brokerage market in the United Kingdom is fragmented with a large number of players existing in the market and providing brokerage services to both retail and institutional investors. Technological innovation by the E-Brokerage players is leading their efforts to capture a significant section of the market. Some of the players existing in the market are Toro, Peperstone, Plus500, Capital.com, IG Group, City Index, Robinhood, AvaTrade, Monesta Markets, etc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Convenience and Cost-Effectiveness

- 4.2.2 Real Time Analysis of Market Available In E-Brokerage Platforms

- 4.3 Market Restraints

- 4.3.1 Lack of Financial Knowledge Among the Population

- 4.3.2 Increase In Cyber Fraud with Rising Digital Investment

- 4.4 Market Opportunities

- 4.4.1 Rising Innovation of AI & ML in E-Brokerage Minimizing Brokers Requirement

- 4.5 Industry Attractiveness - Porters' Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Technological Innovations in the United Kingdom E-Brokerage Market

- 4.7 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Investor

- 5.1.1 Retail

- 5.1.2 Institutional

- 5.2 By Operation

- 5.2.1 Domestic

- 5.2.2 Foreign

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profile

- 6.2.1 eToro

- 6.2.2 Peperstone

- 6.2.3 Plus500

- 6.2.4 Capital.com

- 6.2.5 IG Group

- 6.2.6 City Index

- 6.2.7 Robinhood

- 6.2.8 AvaTrade

- 6.2.9 Monesta Markets

- 6.2.10 Stocktrade*

7 MARKET FUTURE TREND

8 DISCLAIMER AND ABOUT US