PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911290

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911290

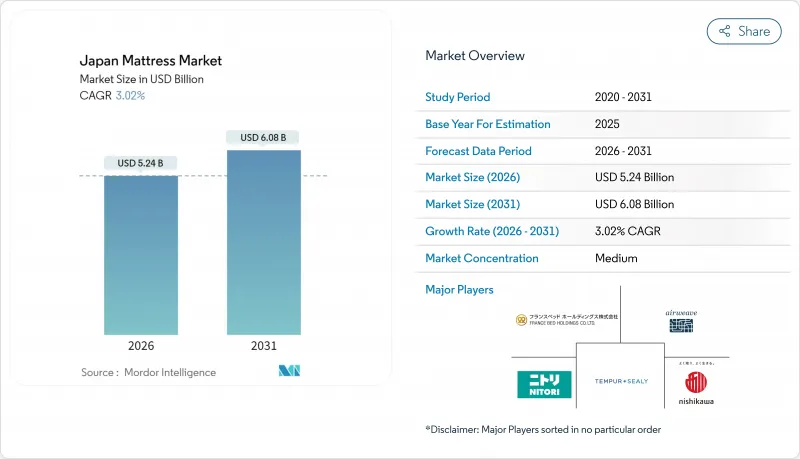

Japan Mattress - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Japan Mattress Market size in 2026 is estimated at USD 5.24 billion, growing from 2025 value of USD 5.09 billion with 2031 projections showing USD 6.08 billion, growing at 3.02% CAGR over 2026-2031.

This steady expansion rests on Japan's demographic reality as the world's first super-aged society, the premiumization of sleep products, and the widening corporate view that restorative rest underpins workforce productivity. An aging cohort exceeding 29% of the population is pushing demand for pressure-relief technologies, while e-commerce adoption enables data-rich, customized buying journeys that once required in-store trials. Large-scale hotel upgrades tied to the Osaka-Kansai Expo 2025 add a parallel commercial demand wave that supplements household replacement cycles. Currency weakness has lifted imported latex costs, yet legacy brands wield resilient supply networks that cushion margin pressure. Stringent recycling rules elevate disposal fees, lengthening replacement cycles but also driving design shifts toward modular, recyclable builds. Collectively, these drivers and frictions anchor a predictable yet opportunity-rich trajectory for the Japan mattress market.

Japan Mattress Market Trends and Insights

Accelerated Aging Population Demanding Pressure-Relief Bedding

Japan's baby-boomer wave is crossing age 75, lifting the elderly population to nearly 22 million and intensifying needs for medical-grade pressure relief. Health expenditures are projected to reach JPY 89 trillion (USD 605.4 billion) by 2040, and policymakers view restorative sleep as a preventive-care lever. Insurers such as Sompo incorporate AI sensors in senior facilities, turning sleep data into actionable care insights. Mattress makers now bundle geriatric ergonomics with smart monitoring to migrate purchases from discretionary to health-essential budgets. Firms that certify products under Japan's emerging medical-device guidelines gain priority in reimbursements, tightening links between bedding and healthcare. The demographic surge, therefore, transforms product messaging from comfort to clinically validated support, widening the premium ceiling.

Rising E-Commerce Penetration in Furniture & Interiors

Japan's BtoC online sales hit JPY 24.8 trillion (USD 168.7 billion) in 2024, posting 9.23% growth and lifting furniture's digital share by 25% year over year. AI-driven 3D visualization now lets shoppers virtually test firmness, and 51% of users plan repeat usage, proving that virtual showrooms can close sensory gaps. Direct-to-consumer entrants bypass store markups, apply dynamic pricing, and funnel savings into R&D on cooling foams and odor-resistant covers. The digital channel favors memory-foam and hybrid categories because their value proposition rests on spec sheets rather than tactile trial. Logistics partners refine vacuum-roll packaging that fits narrow elevators, solving a decisive last-mile hurdle in dense Japanese cities. As same-day delivery expands outside megacities, online conversion rates climb, moving the Japan mattress market from showroom-centric to algorithm-guided.

High Real-Estate Costs Limiting Bedroom Size & King-Size Demand

The average Japanese home size has shrunk to 92 square meters, a 30-year low that restricts space for large beds. Micro-apartments dominate new urban builds, compelling residents to choose semi-double mattresses or foldable futons. Hotels, facing identical space economics, specify slimmer profile mattresses to free walking clearance, muting ASP growth. Brands answer with rollable cores and modular layering, yet profit margins thin because compact units use less material. Retail floor sets increasingly feature storage-bed hybrids that trade height for under-bed drawers, altering design priorities. Space scarcity, therefore, imposes a structural ceiling on premium expansion even as per-unit technology costs climb.

Other drivers and restraints analyzed in the detailed report include:

- Corporate Sleep-Health Programs Boosting Bulk Procurement

- AI-Enabled 3D Body-Scanning Retail Experience Driving Premium Upgrades

- Price-Sensitive Senior Segment Delaying Replacement Cycles

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Spring mattresses maintained 46.72% share of Japan mattress market size in 2025 on the back of cultural leaning toward firm support. Memory foam, posting an 7.72% CAGR, benefits from pressure-relief attributes that cater to the aging demographic and corporate wellness programs that prioritize spine alignment. Latex continues as a niche, challenged by import-cost hikes amid yen volatility but defended by environmental appeal to eco-conscious households. Hybrid and air-fiber designs sit in the "other" bucket and ride a health-performance narrative popular among athletes, further diversifying consumer options. Showa Nishikawa's AI-driven fitting showcases how technology underpins foam's ascent by de-risking comfort uncertainty, while spring remains resilient in value-oriented segments and multi-generational homes that equate firmness with longevity.

Upgrades in hospital beds and senior facilities lean toward viscoelastic layers, embedding memory foam deeper into healthcare procurement streams. Spring makers innovate with zoned coils that mimic foam contouring without sacrificing bounce, but they face rising steel costs that compress margins. Retail merchandising now groups products by "sleep outcome" rather than material, subtly steering shoppers toward foam for pain relief narratives. Durability studies published by domestic testing institutes debunk early sag myths, boosting consumer confidence in foam. This shift in perception solidifies foam's role as a credible alternative and positions it to capture incremental gains as ergonomic literacy spreads.

The Japan Mattress Market Report is Segmented by Type (Spring Mattresses, Memory Foam Mattresses, Latex Mattresses, Other Mattresses), Distribution Channel (Online, Offline), End User (Residential, Commercial), and Geography (Hokkaido, Tohoku, Kanto, Chubu, Kansai, Chugoku, Shikoku, Kyushu & Okinawa). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Nishikawa Co., Ltd.

- France Bed Holdings Co., Ltd.

- Nitori Holdings Co., Ltd.

- Airweave Inc.

- Tempur Sealy Japan

- Showa Nishikawa Co., Ltd.

- Serta Simmons Bedding Japan

- Paramount Bed Holdings Co., Ltd.

- Tokyo Bed Co., Ltd.

- IDC Otsuka Furniture Co., Ltd.

- Koala Sleep Japan

- IKEA Japan K.K.

- Muji (Ryohin Keikaku Co., Ltd.)

- Sealy Japan Ltd.

- Magniflex Japan

- Nissin Medical Industries Co., Ltd.

- ASLEEP (Aisin Corp.)

- Simmons Japan Ltd.

- Korokoro Futon Works

- Nichias Bedding Solutions

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerated ageing population demanding pressure-relief bedding

- 4.2.2 Rising e-commerce penetration in furniture & interiors

- 4.2.3 Hotel refurbishment boom ahead of Osaka-Kansai Expo 2025

- 4.2.4 Corporate "sleep-health" programs boosting bulk procurement

- 4.2.5 AI-enabled 3D body-scanning retail experience driving premium upgrades

- 4.2.6 Surging inbound tourism fostering futon-to-mattress conversion in rentals

- 4.3 Market Restraints

- 4.3.1 High real-estate costs limiting bedroom size & king-size demand

- 4.3.2 Price-sensitive senior segment delaying replacement cycles

- 4.3.3 Stringent recycling law inflating disposal fees

- 4.3.4 Supply-chain reliance on imported latex amid yen volatility

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Type

- 5.1.1 Spring Mattresses

- 5.1.2 Memory Foam Mattresses

- 5.1.3 Latex Mattresses

- 5.1.4 Other Mattresses

- 5.2 By Distribution Channel

- 5.2.1 Online

- 5.2.2 Offline

- 5.3 By End User

- 5.3.1 Residential

- 5.3.2 Commercial

- 5.4 By Region

- 5.4.1 Hokkaido

- 5.4.2 Tohoku

- 5.4.3 Kanto

- 5.4.4 Chubu

- 5.4.5 Kansai

- 5.4.6 Chugoku

- 5.4.7 Shikoku

- 5.4.8 Kyushu & Okinawa

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Nishikawa Co., Ltd.

- 6.4.2 France Bed Holdings Co., Ltd.

- 6.4.3 Nitori Holdings Co., Ltd.

- 6.4.4 Airweave Inc.

- 6.4.5 Tempur Sealy Japan

- 6.4.6 Showa Nishikawa Co., Ltd.

- 6.4.7 Serta Simmons Bedding Japan

- 6.4.8 Paramount Bed Holdings Co., Ltd.

- 6.4.9 Tokyo Bed Co., Ltd.

- 6.4.10 IDC Otsuka Furniture Co., Ltd.

- 6.4.11 Koala Sleep Japan

- 6.4.12 IKEA Japan K.K.

- 6.4.13 Muji (Ryohin Keikaku Co., Ltd.)

- 6.4.14 Sealy Japan Ltd.

- 6.4.15 Magniflex Japan

- 6.4.16 Nissin Medical Industries Co., Ltd.

- 6.4.17 ASLEEP (Aisin Corp.)

- 6.4.18 Simmons Japan Ltd.

- 6.4.19 Korokoro Futon Works

- 6.4.20 Nichias Bedding Solutions

7 Market Opportunities & Future Outlook

- 7.1 Smart-sensor add-on layer for legacy mattresses enabling sleep-data monetisation

- 7.2 Subscription-based mattress recycling & replacement service targeting urban singles