PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690842

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690842

Latin America Cold Chain Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

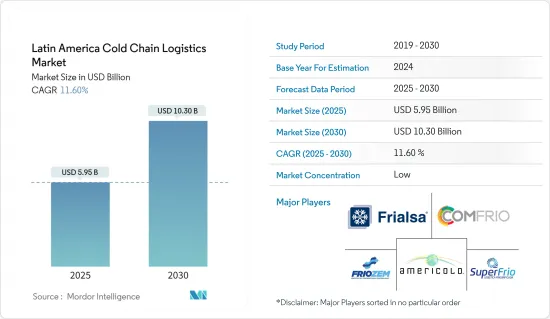

The Latin America Cold Chain Logistics Market size is estimated at USD 5.87 billion in 2025, and is expected to reach USD 10.15 billion by 2030, at a CAGR of 11.60% during the forecast period (2025-2030).

Latin American nations export a diverse range of products globally, with many reaching consumers in their natural state, emphasizing quality. These products, including meat, fish, fruits, and dairy, rely heavily on an uninterrupted cold chain. While North America, Europe, and even Latin America itself are primary destinations, certain products, notably pharmaceuticals like the Covid-19 vaccines, have found their way to Africa and South America.

The surge in demand for medicines, notably those requiring ultra-low temperatures like Pfizer/Biontech's Covid-19 vaccine, has propelled the cold chain sector in Latin America to innovate and expand. Yet, challenges persist, with labor shortages and inadequate infrastructure necessitating a unified political, social, and financial effort.

Latin America's vaccine trade, coupled with a rising appetite for frozen foods and dairy, has been pivotal in propelling the market. Brazil leads the pack, trailed by Mexico, Argentina, and Colombia. Projections suggest a significant uptick in processed food sales until 2025, presenting a lucrative opportunity for cold chain logistics and warehousing firms. Peru, poised for a 15.16% growth rate from 2020 to 2026, is set to join the region's leading cold chain players.

Despite challenges like workforce shortages and full-capacity warehouses, Latin America's perishable food supply chain remains resilient. These hurdles are prompting established regional players to bolster their technological prowess, aiming to combat the region's refrigerated space deficit.

In a notable move in October 2022, Uruguay's Montevideo-based Frigorifico Modelo (Frimosa) announced the sale of its cold storage operations to Emergent Cold Latin America (Emergent Cold LatAm). Emergent Cold LatAm, a key player in refrigerated storage and logistics in the region, will acquire Frimosa's primary facility in Polo Oeste, boasting 22,000 cold storage pallets, a bonded warehouse, and ample room for expansion. Additionally, Emergent Cold LatAm is set to purchase an 8,400-pallet warehouse in Asuncion, Paraguay.

In conclusion, the cold chain sector in Latin America is experiencing significant growth driven by increased demand for pharmaceuticals and perishable foods. Despite facing challenges such as labor shortages and infrastructure gaps, the sector is poised for further development through technological advancements and strategic investments. The ongoing consolidation and expansion efforts by key players like Emergent Cold LatAm highlight the region's potential to overcome these obstacles and meet the growing market demands.

Latin America Cold Chain Logistics Market Trends

Increasing investment in cold storage infrastructure

The increase in international trade in fresh food has led to an increase in the need for reliable cold chains. Companies operating in these markets must ensure the quality and safety of their products during internationaThe rise in global trade of fresh food has heightened the demand for robust cold chains. Companies in this space must prioritize effective cold chain management to guarantee product quality and safety during international transit.

Enabling seamless end-to-end connections for customers across nations is not just a strategic move but also a significant economic advantage. This approach streamlines supply chain operations, enhancing operational efficiency. Economically, it can lead to heightened profitability through cost savings and an expanded market share, positioning the company as a more valuable logistics partner.

Emergent Cold Latin America (Emergent Cold LatAm), the leading provider of temperature-controlled storage and logistics in the region, unveiled Chile's largest frozen food warehouse in Talcahuano. This milestone marks Emergent Cold's most substantial expansion in Latin America. Given Talcahuano's global reputation for seafood and fruit exports, this warehouse stands as a pivotal addition to the local cold chain infrastructure.

Boasting a storage capacity of 294,000 m3 and 37,000 pallets, this facility is set to create 150 direct jobs and an estimated 500 indirect job opportunities, bolstering the regional economy.

Backed by both local and international investors, a dedicated investment vehicle was established for the region. Historically, Latin America, barring a few exceptions in Brazil and Mexico, lacked a unified warehouse network. The primary aim was to create a pan-Latin American network, transcending individual borders, and offering a holistic food supply chain solution.

Brazil spearheads the surge in cold storage investments across Latin America, driven by rising market demands, technological progress, and the pressing need for more efficient and expansive cold chain logistics networks.

In conclusion, the expansion of cold chain infrastructure in Latin America, exemplified by Emergent Cold LatAm's new facility, highlights the region's growing importance in the global fresh food market. As investments continue to pour in, the region is poised to become a critical hub for temperature-controlled logistics, ensuring the safe and efficient transport of perishable goods across borders.

The cold chain logistics market is dominated by Brazil.

In recent years, the Brazil cold chain logistics market has seen notable expansion, primarily fueled by a rising appetite for perishable goods and the burgeoning pharmaceutical sector. Notably, Brazil's frozen food sector is buoyed by the purchases of its upper and middle-class consumers.

These consumers exhibit a noteworthy buying pattern: 25% purchase frozen food 4-5 times a month, 30% do so at least twice, and 40% make the purchase at least once monthly. Women, in particular, dominate this market, accounting for 73% of frozen food purchases. Among the frozen food offerings, meat (39%), pizzas (33%), and lasagnas (10%) stand out as the most favored.

The market is largely shaped by the high middle class (42%) and the low middle class (29%). The rise of Brazil's middle class, combined with the time constraints faced by working families, is a key driver behind the frozen food market's growth.

The industry boasts over 700 frozen food businesses in operation, with the majority (over 90%) classified as small enterprises. Brazil's role as a frozen meat exporter is substantial, offering a diverse range that includes frozen beef tripe, tenderloins, and various beef cuts.

Despite its prominence in the frozen food arena, Brazil's current cold storage capacity of 6 million cubic meters falls short by about 30%. This shortfall bears significant consequences for the frozen food market. Inadequate cold storage and transportation facilities can result in substantial product wastage, potentially affecting the supply and affordability of frozen foods.

To meet the escalating demand, Brazil must prioritize investments in expanding its cold chain infrastructure. Given its status as a leading exporter of fruits, meat, sugar, and soybeans, Brazil holds promising growth prospects, particularly in the global meat market.

The Brazil cold chain market is poised for accelerated growth. This is attributed to several factors, including the country's increased exports of refrigerated products, a surge in the adoption of modern technologies and automation, a rising appetite for meat, seafood, fruits, and vegetables, and notable improvements in infrastructure facilities. Furthermore, the market share of cold transport is expected to witness a rise, thanks to these enhanced infrastructure facilities.

In conclusion, the Brazil cold chain logistics market is on a robust growth trajectory, driven by the increasing demand for perishable goods and advancements in infrastructure. Addressing the current shortfall in cold storage capacity and leveraging modern technologies will be crucial for sustaining this growth. As Brazil continues to expand its role in the global market, particularly in meat exports, the cold chain logistics sector will play a pivotal role in ensuring the efficient and safe transportation of goods.

Latin America Cold Chain Logistics Industry Overview

In Latin America, the cold chain logistics sector stands out for its fragmentation, hosting a mix of local and global players. This diversity underlines a fiercely competitive landscape, where no single entity reigns supreme. Key contenders in this arena include Frialsa Frigorificos SA, Comfrio Solucoes Logisticas, Friozem Armazens Frigorificos, Superfrio Armazens Gerais, and Americold Logistics.

These companies are pivoting towards cutting-edge technologies like IoT, RFID, cloud storage, and electronic data interchange, amplifying the efficiency of their cold chain logistics. Mergers and acquisitions are on the rise, as firms seek to bolster their market foothold. For instance, Emergent Cold Latin America's acquisition of Frigorifico Modelo's operations in Uruguay and a new warehouse in Paraguay underscores this trend.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Market Overview (Current Scenario of the Cold Chain Logistics Market)

- 4.2 Market Dynamics

- 4.2.1 Drivers

- 4.2.1.1 Growth in E-commerce

- 4.2.1.2 Healthcare Sector is the market

- 4.2.2 Restraints

- 4.2.2.1 Supply Chain Disruptions

- 4.2.2.2 Lack of Temperature- Controlled Warehouses

- 4.2.3 Opportunities

- 4.2.3.1 Technological Innovations

- 4.2.1 Drivers

- 4.3 Government Regulations (Related to Cold Storage and Transport)

- 4.4 Insights into Refrigerants and Packaging Materials

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Impact of Geopolitics and Pandemic on the Market

5 MARKET SEGMENTATION

- 5.1 By Service

- 5.1.1 Cold Storage/Refrigerated Warehousing

- 5.1.2 Refrigerated Transportation

- 5.1.3 Value-added Services (Order Management, Blast Freezing, Labeling, Inventory Management, etc.)

- 5.2 By Temperature

- 5.2.1 Chilled

- 5.2.2 Frozen

- 5.2.3 Ambient

- 5.3 By End User

- 5.3.1 Fruits and Vegetables

- 5.3.2 Dairy Products (Milk, Butter, Cheese, Ice Cream, etc.)

- 5.3.3 Fish, Meat, and Seafood

- 5.3.4 Processed Food

- 5.3.5 Pharmaceutical (Includes Biopharma)

- 5.3.6 Bakery and Confectionery

- 5.3.7 Other End Users

- 5.4 By Country

- 5.4.1 Mexico

- 5.4.2 Brazil

- 5.4.3 Chile

- 5.4.4 Colombia

- 5.4.5 Rest of Latin America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Frialsa Frigorificos SA

- 6.2.2 Comfrio Solucoes Logisticas

- 6.2.3 Friozem Armazens Frigorificos Ltda

- 6.2.4 Superfrio Armazens Gerais Ltda

- 6.2.5 Americold Logistics

- 6.2.6 Brasfrigo

- 6.2.7 Arfrio Armazens Gerais Frigorificos

- 6.2.8 Ransa Comercial SA

- 6.2.9 Localfrio

- 6.2.10 Qualianz*

- 6.3 Other Companies (Key Information/Overview)

7 FUTURE OF THE MARKET

8 APPENDIX

- 8.1 Macroeconomic Factors

- 8.2 External Trade Statistics