PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690800

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690800

Automotive Smart Glass - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

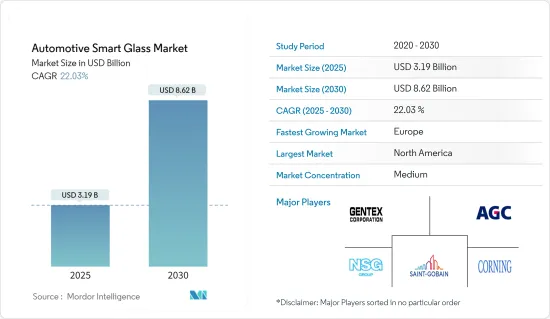

The Automotive Smart Glass Market size is estimated at USD 3.19 billion in 2025, and is expected to reach USD 8.62 billion by 2030, at a CAGR of 22.03% during the forecast period (2025-2030).

The Automotive Smart Glass Market is witnessing significant growth, driven by technological advancements and increasing consumer demand for advanced vehicle features. Smart glass, also known as switchable glass, offers functionalities such as tinting, transparency control, and heat reduction, enhancing both comfort and energy efficiency in automobiles.

Manufacturers are continually developing new materials and technologies to improve the performance and reliability of smart glass solutions. For instance, advancements in electrochromic and SPD (Suspended Particle Device) technologies have enabled faster response times, better energy efficiency, and enhanced durability of smart glass products.

Collaborations between automotive manufacturers, glass suppliers, and technology providers are also driving market expansion. Partnerships enable the integration of smart glass solutions into new vehicle models, leveraging the expertise of both glass manufacturers and automotive OEMs to meet consumer demands for advanced functionality and comfort.

Furthremore, the Automotive Smart Glass Market is poised for continued growth as automakers seek to differentiate their products with innovative features that enhance user experience, energy efficiency, and environmental sustainability. This evolution underscores the increasing importance of smart glass technologies in shaping the future of automotive design and functionality.

Automotive Smart Glass Market Trends

Rise in penetration of suspended particle devices (SPD) in vehicles

Passenger cars are driving the dominance of the Automotive Smart Glass Market, as evidenced by multiple factors and trends in the industry. In 2023, global car sales surged to approximately 65.2 million units, a significant increase from around 58.6 million in 2022. This upward trend in car sales reflects the growing demand for advanced automotive technologies, including smart glass solutions.

Suspended particle devices (SPD) are emerging as a critical innovation within the automotive sector. These devices enhance the driving experience by transforming car glass or plastic into a dynamically adjustable light-management system. This technology is particularly beneficial for sunroofs, windows, and visors, significantly improving user comfort and vehicle aesthetics.

SPD smart glasses stand out for their efficiency, consuming only 1.5 watts per square meter, compared to the 3 watts per square meter required by PDLC smart glass. This lower energy consumption translates into better fuel efficiency and reduced environmental impact. For example, Continental reports that SPD smart glass can reduce carbon dioxide emissions by 4 grams per kilometer and extend the driving range by 5.5%.

Moreover, SPD smart glass contributes to a more comfortable and luxurious driving experience by significantly reducing heat inside the vehicle. Mercedes-Benz has implemented SPD glass in high-end models like the S-class sedan and SL roadster, which has shown a reduction in interior temperature by up to 10 degrees Celsius (18 degrees Fahrenheit). This reduction not only enhances passenger comfort but also protects interior materials from premature aging caused by infrared and ultraviolet radiation.

Given the advancements in smart glass technology and its adoption by leading automotive manufacturers, passenger cars are positioned to continue their dominance in the Automotive Smart Glass Market. The ongoing investment in research and development by companies like Continental and the practical benefits demonstrated by luxury brands such as Mercedes-Benz ensure that smart glass will remain a key feature in the competitive landscape of the automotive industry.

This integration not only caters to consumer demand for comfort and efficiency but also aligns with broader environmental and sustainability goals, further solidifying the role of passenger cars in driving the market forward.

Europe is Expected to Grow at the Fastest Rate in the Market

The demand for luxury cars has surged across the region in recent years, particularly post-pandemic. This growth is driven by a significant shift from traditional features towards advanced convenience features, such as sunroofs and automatic tinted glass. This trend aligns with the increasing consumer preference for enhanced comfort and luxury in vehicles.

Several key factors are propelling the market's growth, including a rise in passenger car sales in major European markets, increasing sales of luxury cars, and a growing preference for vehicle sunroofs. The German automotive sector has been the backbone of the European industry for decades, evolving into a leader in high-tech automotive production and innovation. Notably, Germany has seen a net growth of over 60% in automotive R&D, highlighting its role as a critical innovation hub driving the demand for automotive smart glass. For instance,

- LG Chem Ltd., a leading South Korean chemical company, has entered the automotive smart glass film market by securing a contract to supply switchable glazing films to German auto parts supplier Webasto SE.

- Under the agreement announced in April 2024, LG Chem will provide its advanced switchable glass films to Webasto for use in manufacturing automotive sunroof systems. These systems, equipped with LG Chem's technology, will be supplied to car manufacturers across Europe.

Microsoft and Volkswagen collaborated to integrate augmented reality glasses into vehicles in May 2022. This partnership aims to bring augmented reality, a key element of future mobility concepts, closer to reality. Volkswagen has worked with Microsoft to make the HoloLens 2 mixed-reality glasses available in mobile vehicles, showcasing the future of mobility.

The market is further encouraged by several new car launches featuring smart glass, prompting manufacturers to expand their operations in this segment. Prominent car manufacturers like Audi, BMW, Nissan, and Range Rover are offering sunroof options in popular models such as the Q-series, X-series, Qashqai, and Evoque, respectively. This trend underscores the growing importance of advanced convenience features in the automotive industry, particularly within the luxury car segment.

Automotive Smart Glass Industry Overview

The automotive smart glass market is moderately consolidated, with a few major players such as Saint Gobin, AGC Inc., Nippon Sheet Glass Co. Ltd., Gentex Corporation, and Cornering Inc. having significant shares in the market due to their well-established and developed products among various automakers. The companies are focusing on innovative technologies and following strategies, like acquisition, licensing the technology, and partnership, to expand, sustain, and capture the potential demand for rapid adoption of technological trends in the automotive industry. For instance,

- In January 2023, Asahi India Glass partnered with Enormous Brands to create impactful brand films for AIS Windows, its doors and windows solutions brand. This move comes as the Indian system windows and doors market evolves, driven by changing lifestyles, urbanization, and smart city construction. AIS Windows caters to customer preferences with a range of aluminum and uPVC framing materials and diverse glass solutions, positioning itself to significantly impact the market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Rising Adoption Of Luxury And Premium Vehicles Equipped With Smart Glass Technologies

- 4.2 Market Restraints

- 4.2.1 High Initial Cost Is Anticipated To Restrain The Market Growth

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value USD Million)

- 5.1 By Technology Type

- 5.1.1 Electrochromic

- 5.1.2 Polymer Dispersed Liquid Device (PDLC)

- 5.1.3 Suspended Particle Device (SPD)

- 5.2 By Application Type

- 5.2.1 Rear and Side Windows

- 5.2.2 Sunroof Glass

- 5.2.3 Front and Rear Windshield

- 5.3 By Vehicle Type

- 5.3.1 Passenger Cars

- 5.3.2 Commercial Vehicles

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Rest of the World

- 5.4.4.1 Brazil

- 5.4.4.2 South Africa

- 5.4.4.3 Other Countries

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Corning Inc.

- 6.2.2 Guardian Industries

- 6.2.3 Saint-Gobain SA

- 6.2.4 AGP Glass

- 6.2.5 Hitachi Chemical Co. Ltd

- 6.2.6 Research Frontiers Inc.

- 6.2.7 Nippon Sheet Glass Co. Ltd

- 6.2.8 AGC Inc.

- 6.2.9 Gentex Corporation

- 6.2.10 Gauzy Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Integration with Vehicle Connectivity and Electronics