PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690165

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690165

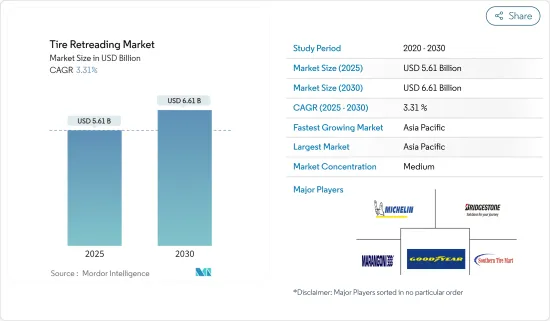

Tire Retreading - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Tire Retreading Market size is estimated at USD 5.61 billion in 2025, and is expected to reach USD 6.61 billion by 2030, at a CAGR of 3.31% during the forecast period (2025-2030).

In 2020, the global automotive industry faced significant challenges due to lockdowns imposed in response to the COVID-19 pandemic. These lockdowns halted manufacturing activities, including tire retreading, for several weeks in the year's first half, stunting market growth. Yet, by 2023, the automotive sector rebounded robustly, signaling a promising trajectory for the tire retreading market in the coming years.

Medium-term projections suggest that the tire retreading market will be bolstered by rising prices of new tires, particularly for sports utility vehicles. This surge in tire prices is largely due to escalating natural rubber costs and volatile crude oil prices. Additionally, the growing global fleet of commercial vehicles is set to further fuel the market's expansion.

Recognizing the burgeoning demand for tire retreading, tire manufacturers are diving deep into this technology. For instance,

Key Highlights

- In July 2023, Bridgestone unveiled its ambitious plans to bolster tire material recycling. Their focus is on crafting "rubber that can be readily reused," aiming to transform waste tires into new ones. Bridgestone is championing renewable resources and is advancing technologies like retreading-where a new tread is applied to worn tires-and chemical recycling, which repurposes waste tires into raw materials.

The eco-friendly advantages and cost savings of retreaded tires over new ones are set to propel the tire retreading market. Retreading not only conserves landfill space by reusing existing tires but also curbs carbon dioxide emissions and conserves millions of gallons of oil-an essential resource in new tire production.

Tire Retreading Market Trends

Commercial Vehicles is the Largest Segment in the Tire Retreading Market

Due to the high utilization and wear rates of tires, the commercial vehicle segment leads the tire retreading market. Trucks, buses, and heavy-duty transporters in this segment cover extensive daily distances, resulting in rapid tire degradation. For fleet operators, retreading presents a cost-effective alternative, significantly curtailing operating costs compared to buying new tires. Given that tire expenses constitute a major portion of a commercial fleet's maintenance costs, retreading stands out as a financially savvy choice, extending tire life and ensuring consistent performance.

Additionally, the environmental advantages of tire retreading play a pivotal role in its appeal within the commercial vehicle sector. Retreading consumes far fewer raw materials and energy than producing new tires, leading to a reduced carbon footprint. Fleet operators, increasingly cognizant of these environmental benefits, are keen to adopt sustainable practices, bolstering their corporate social responsibility image. Furthermore, with many regions' regulatory bodies promoting eco-friendly practices, the retreading market has gained traction as the go-to option for commercial vehicles.

Technological advancements and the reliability of retreading processes have further cemented the adoption of retreaded tires in the commercial vehicle sector. Modern techniques, like pre-cure and mold-cure processes, ensure retreaded tires match the performance and safety of new ones. This newfound reliability has fostered trust among fleet operators, who prioritize vehicle safety and performance. The widespread availability of quality retreading services and a robust network of retreading facilities further facilitate access to retreaded tires for commercial vehicle operators, reinforcing the segment's leadership in the tire retreading market.

Additionally, market players are rolling out discounts, cost-effective policies, and new product launches, likely fueling market growth in the coming years. For instance,

Continental Tires' Conti Bharosa program extends warranty coverage against manufacturing defects for five years, surpassing the traditional two to three-year coverage offered by Indian tire manufacturers. Furthermore, Conti Bharosa provides warranty coverage for the second life of tires, safeguarding against manufacturing defects post-first retread for those used in standard load applications.

Moreover, tire retreading is witnessing rapid growth among medium-duty vehicles, with last-mile delivery services and logistics companies increasingly deploying them. For instance, major parcel-delivery giants like UPS and FedEx are already utilizing retreads for their last-mile operations. Goodyear has acknowledged the growth of the medium-duty trucking segment and is ramping up investments in retreads as a strategic cost-saving measure.

Asia-Pacific Continues to be the Largest Market

China stands tall as a global automotive giant, boasting the world's largest fleet of passenger cars. This dominance not only underscores China's pivotal role in the production of both passenger and commercial vehicles but also signals a burgeoning demand for tire retreading. In 2023, China's production of passenger and commercial vehicles hit a notable 30.16 million units, marking a robust annual growth of 12%.

Japan, registering a total of 8.99 million vehicles, including 1.23 million commercial ones, is another key player in the tire retreading arena. The nation's significant commercial vehicle volume, paired with its technological prowess, bolsters the advancement and uptake of premium retreading processes. Japan's commitment to sustainability dovetails seamlessly with the eco-friendly advantages of tire retreading, which not only conserves raw materials but also curtails waste. Moreover, Japan's rigorous regulations guarantee that retreaded tires uphold superior safety and performance standards, rendering them a trustworthy and economical choice for commercial operators.

In India, the transportation and logistics sectors' heavy reliance on commercial vehicles fuels a robust demand for tire retreading services. Given India's cost-sensitive market, retreading emerges as a strategic advantage, allowing fleet operators to significantly curtail operational costs. Moreover, as infrastructure projects burgeon and road networks expand in India, the uptick in commercial vehicle usage further amplifies the tire retreading market's growth.

Additionally, the automobile tire market thrives, buoyed by a myriad of raw material suppliers and supportive government policies. Given the prominence of agricultural vehicles in nations like Japan, China, and South Korea, the demand for automotive tires in this sector is poised to remain strong.

Considering all these dynamics, coupled with the recent inauguration of new tire retreading manufacturing facilities, the tire retreading market is set for a promising trajectory in the coming years.

Tire Retreading Industry Overview

Bridgestone Corporation, Southern Tire Mart, TreadWright, Goodyear, and other key players dominate the tire retreading market. These industry leaders are pushing forward with sustainable solutions and innovative technologies, catering to commercial fleets and the broader transport sector. For instance,

- In December 2023, Bridgestone, set to participate in CES 2024, unveiled its commitment to sustainability and efficiency. Among the highlights will be Bridgestone Bandag's retreading service, a testament to extending tire life sustainably, alongside innovations like ENLITEN Technology and advanced fleet management solutions.

- In November 2023, Michelin took center stage at Solutrans 2023 in Lyon, France, showcasing its eco-conscious tire lineup. Featured products, including the Michelin X Multi HD Z and Agilis CrossClimate, emphasize reduced environmental footprints, leveraging expertise in rolling resistance and recycled materials. Additionally, Michelin rolled out its "Michelin Connected Mobility" suite of services.

- In September 2023, Michelin marked a milestone, announcing the retreadability of nearly all its truck and bus tires. Celebrating a century of retreading, Michelin proudly noted the renewal of around 30 million tires at its UK and German plants. This achievement not only underscores Michelin's prowess but also translates to a savings of 1.5 million tons in raw materials and a reduction of nearly 3.5 million tons in CO2 emissions. The MICHELIN Remix process, a hallmark of this initiative, ensures that the renewed tread matches the materials and technologies of new tires, upholding the brand's commitment to safety, traction, and grip.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Environmental Benefits Driving Growth

- 4.2 Market Restraints

- 4.2.1 Decreasing Rubber Production And Volatile Raw Material Cost

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value (USD)

- 5.1 Vehicle Type

- 5.1.1 Passenger Car

- 5.1.2 Light commercial vehicle

- 5.1.3 Medium and Heavy duty Truck

- 5.1.4 Bus

- 5.2 Production Method

- 5.2.1 Pre-cure

- 5.2.2 Mold Cure

- 5.3 Tire Type

- 5.3.1 Radial

- 5.3.2 Bias

- 5.3.3 Solid

- 5.4 Sales Channel

- 5.4.1 OEM

- 5.4.2 Independent Retreaders

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United State

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 India

- 5.5.3.2 China

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 Rest of the World

- 5.5.4.1 Brazil

- 5.5.4.2 Mexico

- 5.5.4.3 United Arab Emirates

- 5.5.4.4 Other Countries

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Bridgestone Corporation

- 6.2.2 Goodyear Tire and Rubber Company

- 6.2.3 Marangoni SpA

- 6.2.4 Michelin SCA

- 6.2.5 Oliver Rubber Company

- 6.2.6 Southern Tire Mart

- 6.2.7 Parrish Tire Company

- 6.2.8 Redburn Tire Company

- 6.2.9 Southern Tire Mart

- 6.2.10 TreadWright Tires

- 6.2.11 Sumitomo Rubber Industries, Ltd.

- 6.2.12 Rethread (Pty) Ltd

- 6.2.13 Pirelli & C. S.p.A.

- 6.2.14 MRF Limited

- 6.2.15 Vipal Rubber Corporation

7 MARKET OPPORTUNITIES AND FUTURE TRENDS