Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1689958

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1689958

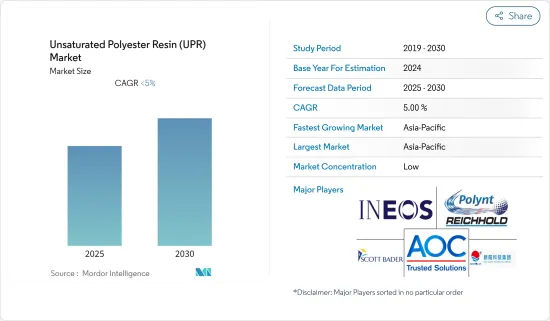

Unsaturated Polyester Resin (UPR) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 180 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

The Unsaturated Polyester Resin Market is expected to register a CAGR of less than 5% during the forecast period.

COVID-19 negatively impacted the market in 2020. However, the market has now been estimated to have reached pre-pandemic levels and is forecasted to grow steadily.

Key Highlights

- The growing production of glass fiber-reinforced plastics (GRP) in Europe and the desirable properties of unsaturated polyester resins are expected to fuel market expansion over the projection period.

- However, a decline in the automotive industry is expected to hinder the market growth.

- Advancements in hydro and ice-phobic property induction methodologies of UPR are the key market opportunity expected to drive the market in the coming years.

- The Asia-Pacific region represents the largest market and is expected to be the fastest-growing market over the forecast period due to increasing consumption from countries such as China, India, and Japan.

Unsaturated Polyester Resin (UPR) Market Trends

Building and Construction Industry to Dominate the Market

- UPR is extensively used in the building and construction sector for tiles of roofs, building panels, concrete forming pans, reinforcement, household structure composites, bathroom accessories, etc.

- Unsaturated polyester resins are used significantly to produce glass fiber-reinforced plastic (GRP), which has applications in the building and construction industry for flat and corrugated sheets, light domes and skylights, rain gutters, complete covers for sewage water treatment plants, washbasins, shower cabins, dormer windows, and door ornaments.

- The building construction sector is expanding rapidly across the globe. For example, China's growth is fueled mainly by rapid expansion in the residential and commercial building sectors. China is encouraging and enduring a continuous urbanization process, with a projected rate of 70% by 2030. Also, China's construction output peaked in 2021 at a value of about 29.3 trillion yuan. As a result, these factors tend to increase the demand for UPR across the globe.

- The benefits of GRP, including the freedom of design, high dimensional accuracy of the product, and excellent compatibility with other construction materials, are also factors influencing the growth of the market studied.

- Glass fiber-reinforced UP resins are extensively used in chemical plants, owing to their properties to withstand harsh conditions, such as exposure to water, acids, and solvents, oxidizing media, and changing temperature conditions.

- Several chemical and pharmaceutical construction projects are going on across the globe that is expected to fuel the market growth-for example, the construction of a Mononitrobenzene manufacturing plant worth USD 375 million. The project is expected to finish in Q2 2024, with a production capacity of 300,000 tons per annum in South Korea.

- Several bridge construction projects are undergoing across the globe. For example, in the United States, in January 2023, Biden-Harris Administration accounted USD 2.1 Billion to construct and improve four nationally significant bridges. These grants will fund the construction of four bridge projects. These projects are likely to increase the demand for unsaturated polyester resins used in the construction of bridges.

- Owing to all of the factors above, the building and construction sector is likely to dominate the global unsaturated polyester resins market over the forecast period.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific is expected to dominate the market due to major consumer and producer countries, such as China, India, and Japan.

- The expansion of the automotive segment in China is anticipated to benefit the demand for unsaturated polyester resins as they are widely used in the automotive industry. According to the International Organization of Motor Vehicle Manufacturers (OICA), China is the largest producer of automobiles. The country alone produced 2,60,82,220 units of vehicles in 2021.

- Furthermore, several other countries in the region are putting efforts to enhance the Automotive sector by investing heavily in electric cars to achieve net zero emissions. For example, in Japan, over 8,600 of the 20,000 new EVs delivered in 2021 were imported electric vehicles. Compared to the previous year, the number of foreign automobile registrations of newly imported EVs increased nearly thrice.

- The Indian electronics industry is one of the fastest-growing industries globally. The domestic electronics manufacturing sector has been expanding at a steady rate, owing to favorable government policies, such as 100% foreign direct investment (FDI), no requirement for industrial licenses, and the technological transformation from manual to automatic production processes.

- The Japanese construction industry is expected to be blooming, owing to the events to be hosted in the country. Tokyo hosted the Olympics in 2021, and Osaka will host the World Expo in 2025. Construction in Japan is mainly driven by redevelopment and recovery from natural disasters.

- Furthermore, South Korean builders' overseas building orders have surpassed USD 30 billion for the third consecutive year in 2022, owing to strong demand from Asia, North American and Pacific Ocean regions.

- Hence, based on the aforementioned factors, the Asia-Pacific region is expected to dominate the global unsaturated polyester resins market over the forecast period.

Unsaturated Polyester Resin (UPR) Industry Overview

The unsaturated polyester resin market is fragmented in nature. Some of the major players in the market include AOC, Polynt-Reichhold Group, INEOS, Scott Bader Company Ltd., and Xinyang Technology Group, among others (in no particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 69530

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand for Manufacturing Glass Fiber-reinforced Plastics (GRP) in Europe

- 4.1.2 Desirable Properties of Unsaturated Polyester Resins

- 4.2 Restraints

- 4.2.1 Challenges in Automotive Industry

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Ortho-resins

- 5.1.2 Isoresins

- 5.1.3 Dicyclopentadiene (DCPD)

- 5.1.4 Other Types

- 5.2 End-user Industry

- 5.2.1 Building and Construction

- 5.2.2 Chemical

- 5.2.3 Electrical and Electronics

- 5.2.4 Paints and Coatings

- 5.2.5 Transportation

- 5.2.6 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 AOC

- 6.4.2 BASF SE

- 6.4.3 Crystic Resins India Pvt. Ltd

- 6.4.4 DIC Corporation

- 6.4.5 INEOS

- 6.4.6 Interplastic Corporation

- 6.4.7 Reichhold LLC

- 6.4.8 Scott Bader Company Ltd

- 6.4.9 Showa Denko KK

- 6.4.10 Tianhe Resin

- 6.4.11 Xinyang Technology Group

- 6.4.12 Zhangzhou Yabang Chemical Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Advancements in Hydro and Icephobic Property Induction Methodologies of UPR

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.