PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1689913

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1689913

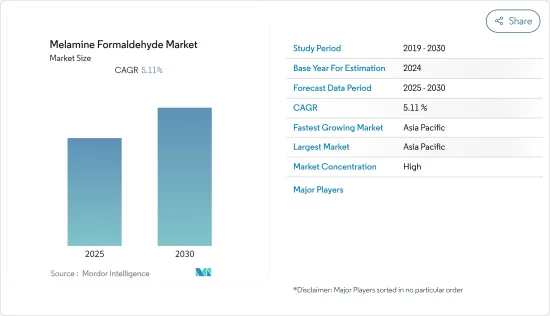

Melamine Formaldehyde - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Melamine Formaldehyde Market is expected to register a CAGR of 5.11% during the forecast period.

COVID-19 negatively impacted the melamine formaldehyde market due to the abrupt production halt in various end-user industries. Also, a ban on export and imports disrupted the supply chain, thus hampering the overall market growth. However, the market is now estimated to reach pre-pandemic levels and is expected to grow steadily.

Key Highlights

- The major factors driving the market studied are the growing demand for formica laminated furniture and high growth in the construction industry.

- The decline in the automobile industry is expected to hinder the market's growth.

- The increasing usage of melamine formaldehyde in rigid polyurethane foam will likely be an opportunity for the market studied in the coming years.

- The Asia-Pacific region is likely to dominate the global market, owing to the increasing demand from the furniture industry in China and India.

Melamine Formaldehyde Market Trends

Laminates Segment to Dominate the Market

- Melamine formaldehyde resins are applied in manufacturing high-pressure laminates used in tabletops, kitchen cabinets, flooring, furniture, etc.

- Melamine laminated sheet is in a multilayer structure, including surface paper, decoration paper, and bottom paper. The surface paper protects patterns and designs on the decorative paper, makes the surface brighter, solider, and harder, and provides better wear and corrosion resistance.

- High durability and ease of installation are major factors driving the demand for laminated flooring.

- Globally, there is a significant undersupply to meet the demand for housing in Asia-Pacific. In China, property development investment dropped 5.8% year on year to CNY 2.6 trillion (USD 377.8 billion) in the first quarter of 2023.

- Canada's investment in building construction decreased by 1.3% to USD 20.2 billion in March 2023. Statistics Canada said the residential sector declined 2.1% to USD 14.6 billion in March 2023.

- With the growing customization trend, furniture players started designing customized RTA furniture to increase their customer base and sales. The growing demand for laminated furniture, especially from the RTA (Ready to assemble furniture), is expected to drive the demand.

- Oxford Economics estimates that building activity will increase from USD 9.7 trillion in 2022 to USD 13.9 trillion in 2037, led by markets for construction in China, the United States, and India. The demand for laminates composed of melamine formaldehyde is anticipated to rise during the projected period due to the rise in construction activities.

- Based on the aspects above, the laminates segment is expected to dominate the market in the forecast period.

China to Dominate the Asia-Pacific Market

- The Chinese furniture industry is one of the biggest furniture industries in the world. It is also among the leading furniture producers, consumers, and exporters.

- The production side of the Chinese furniture industry accounts for nearly 40% of the world's furniture production. Also, according to China Daily, China is likely to witness the construction of 7,000 more shopping centers, estimated to be opened by 2025.

- Residential furniture sales dominated retail sales due to the availability and innovation of many new residential furniture products in varied designs and material combinations.

- Among residential furniture, the demand for living and dining room furniture steadily grew in China. The living room and dining room furniture dominated the market with a share of nearly 38% in the overall furniture market, followed by the dining room and kitchen furniture.

- All these factors are driving the demand for lamination, wood adhesives, and wood coatings in China, providing impetus to the country's wood adhesives and wood coatings products.

- China's wood adhesive industry is fragmented and dominated by many local players. The industry's sales are expected to witness a CAGR of over 5% during the next five years.

- According to International Trade Agency, China's overall investment in new infrastructure during the 14th Five-Year Plan period (2021-2025) will reach roughly USD 4.2 trillion.

- All the above factors are expected to make China dominant in the Asia-Pacific region.

Melamine Formaldehyde Industry Overview

The melamine formaldehyde market is highly fragmented, where the major players account for a negligible global market share. Some of the major companies in the market (in no particular order) include BASF SE, Hexion, Arclin Inc., Prefere Resins Holding GmbH, and Georgia Pacific Chemicals, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand for Formica Laminated Furniture

- 4.1.2 Growth in the Construction Industry

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Decline in the Automotive Industry

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Price Analysis

- 4.6 Technological Snapshot

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Type

- 5.1.1 Iso-butylated Melamine Formaldehyde Resin

- 5.1.2 n-butylated Melamine Formaldehyde Resin

- 5.1.3 Other Types

- 5.2 Application

- 5.2.1 Laminates

- 5.2.2 Wood Adhesives

- 5.2.3 Molding Compounds

- 5.2.4 Paints and Coatings

- 5.2.5 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) Analysis**/Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 AkzoNobel NV

- 6.4.2 Allnex GMBH

- 6.4.3 Arclin, Inc.

- 6.4.4 BASF SE

- 6.4.5 Cornerstone Chemical

- 6.4.6 Frati Luigi S.p.A

- 6.4.7 Hexion

- 6.4.8 Metadynea Metafrax Group

- 6.4.9 Pacific Texchem Private Limited

- 6.4.10 Sprea Misr

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 The Increasing Usage of Melamine Formaldehyde in the Rigid Polyurethane Foam

- 7.2 Other Opportunities