Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1689911

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1689911

Fatty Acid Ester - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 190 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

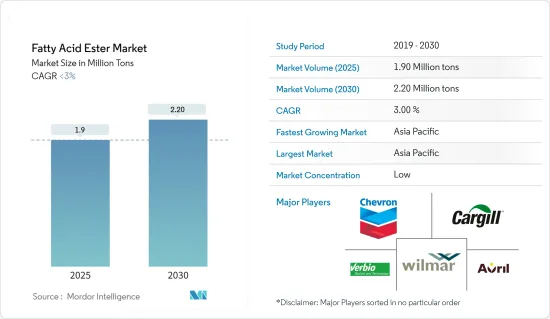

The Fatty Acid Ester Market size is estimated at 1.90 million tons in 2025, and is expected to reach 2.20 million tons by 2030, at a CAGR of less than 3% during the forecast period (2025-2030).

Key Highlights

- The major factors driving the fatty acid ester market are a growing preference for biodiesels and a rising demand for personal care products.

- On the other hand, performance limitations associated with fatty acid esters are likely to hamper the market's growth during the forecast period.

- Emerging applications and recycling of fatty acid esters are likely to act as opportunities for the market studied in the coming years.

- Asia-Pacific is expected to be the largest and fastest-growing market, registering the highest CAGR during the forecast period.

Fatty Acid Ester Market Trends

Increasing Demand for Fatty Acid Ester from Biofuel Applications

- Biodiesel produces a higher level of toxic pollutants and greenhouse gases than petroleum diesel. It is made from a wide range of renewable sources, such as fatty acid esters. Some of the commonly used renewable sources are fatty acid methyl and ethyl esters.

- These fatty acid esters can be utilized in their pure form or blended with petroleum diesel. Blends include B2 (2% biodiesel, 98% petroleum diesel), B5 (5% biodiesel, 95% petroleum diesel), and larger concentrations like B20 and B100. Notably, large trucking companies often use biodiesel in its purest form, B100.

- According to the United States Energy Information Administration, biodiesel production in the United States reached approximately 1.7 billion gallons in 2023.

- At the same time, Brazil emerged as South America's leading biofuel producer. In 2023, daily oil production hit 455 thousand barrels, marking an 18.5% rise, according to the Energy Institute's Statistical Review of World Energy.

- In response to rising biodiesel demand, companies are ramping up production capacities. For example, Binatural, a prominent Brazilian biodiesel producer, announced plans in December 2023 to boost its annual output by 20%, targeting 650 million liters per annum by the end of 2026.

- These developments indicate a robust demand for various kinds of fatty acid esters in biofuel production.

Asia-Pacific Projected to Dominate the Market

- Asia-Pacific is the biggest market for fatty acid esters (FAEs) owing to the huge demand for biofuels, synthetic lubricants, and other applications.

- As per the 2024 Statistical Review of World Energy, Asia-Pacific emerged as the dominant biodiesel producer. In 2023, the region accounted for over 33% of global biodiesel output, churning out approximately 320,000 barrels daily, up from 290,000 barrels in 2022.

- Fatty acid esters are also used in the production of synthetic lubricants such as greases, hydraulic fluids, and others.

- In recent times, various companies have invested in setting up production plants to meet the growing demand for various lubricants in India. For instance, in March 2023, Exxon Mobil announced the investment of USD 110 million in setting up a lubricant production plant in Mumbai, India. The plant is expected to be operational by the end of 2025 and will have a production capacity of 159,000 kilotons of finished lubricants every year.

- In May 2024, Kluber Lubrication, another global manufacturer of lubricants, announced an investment of EUR 15.6 million (USD 17.20 million) in expanding its lubricant manufacturing plant in Mysore, India.

- In March 2024, Shell Indonesia announced that it would set up its first grease manufacturing plant in India. The plant is expected to have a production capacity of 12 kilotons of grease every year and will produce grease products under the trademark of Shell Gadus, which are used in applications such as bearings and gears.

- Such investments are expected to have a positive impact on the consumption of fatty acid esters in Asia-Pacific.

Fatty Acid Ester Industry Overview

The fatty acid ester market is fragmented in nature, with only a few major players dominating it. Some of the major companies (not in a particular order) are Wilmar International Ltd, Avril, Chevron Corporation, Verbio Vereinigte Bioenergie AG, and Cargill Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 69276

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Growing Preference toward Biodiesel

- 4.1.2 Rising Demand for Personal Care Products

- 4.2 Market Restraints

- 4.2.1 Performance Limitations Associated with Fatty Acid Ester

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 By Type

- 5.1.1 Fatty Acid Methyl Esters (FAME)

- 5.1.2 Polyol Esters

- 5.1.3 Sorbitan Esters

- 5.1.4 Sucrose Esters

- 5.1.5 Other Types (Ethyl Esters, Propyl Esters, Sucrose Esters, etc.)

- 5.2 By Application

- 5.2.1 Synthetic Lubricants

- 5.2.2 Pharmaceuticals

- 5.2.3 Personal Care Products

- 5.2.4 Food

- 5.2.5 Biofuel Applications

- 5.2.6 Other Applications

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Malaysia

- 5.3.1.6 Thailand

- 5.3.1.7 Indonesia

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Spain

- 5.3.3.6 NORDIC countries

- 5.3.3.7 Turkey

- 5.3.3.8 Russia

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 Qatar

- 5.3.5.3 United Arab Emirates

- 5.3.5.4 Nigeria

- 5.3.5.5 Egypt

- 5.3.5.6 South Africa

- 5.3.5.7 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Avril

- 6.4.2 Cargill Incorporated

- 6.4.3 Chevron Corporation

- 6.4.4 Cremer Oleo Gmbh & Co. KG

- 6.4.5 Croda International PLC

- 6.4.6 DuPont

- 6.4.7 Granol

- 6.4.8 Inolex Incorporated

- 6.4.9 IOI Corporation Berhad

- 6.4.10 KLK Oleo

- 6.4.11 P&G Chemicals

- 6.4.12 Sasol

- 6.4.13 Stepan Company

- 6.4.14 Verbio Vereinigte Bioenergie AG

- 6.4.15 Wilmar International Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Emerging Applications and Recycling of Fatty Acid Ester

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.