PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1689904

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1689904

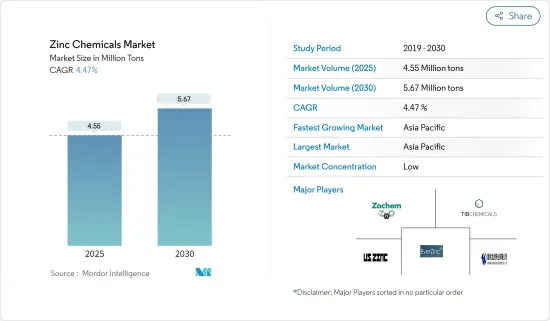

Zinc Chemicals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Zinc Chemicals Market size is estimated at 4.55 million tons in 2025, and is expected to reach 5.67 million tons by 2030, at a CAGR of 4.47% during the forecast period (2025-2030).

The outbreak of COVID-19 brought several short-term and long-term consequences in the construction, petrochemical, and other industries, which affected the zinc chemicals market across the world. However, presently, the market has returned to the pre-pandemic level.

Key Highlights

- Over the short term, the rising utilization in the automotive industry and increasing demand from the rubber tire industry are likely to drive the growth of the zinc chemicals market.

- On the flip side, factors such as health hazards related to zinc-based chemicals are expected to hinder the growth of the market.

- The emerging research and technological advancements in the field of zinc nanoparticles employed for diagnosis, imaging, and treatment of cancer are expected to offer great opportunities for the zinc market over the upcoming years.

- Asia-Pacific has dominated the market and is expected to continue dominating it during the forecast period.

Zinc Chemicals Market Trends

The Rubber Processing Segment to Dominate the Market

- The rubber processing segment is the dominating segment due to the large-scale consumption of zinc chemicals in galvanizing and manufacturing tires.

- Zinc chemicals are widely used in manufacturing tires and tubes commonly used in automobiles. The growing automobile industry is expected to augment the overall demand for zinc chemicals shortly.

- According to the International Rubber Study Group (IRSG), the global output of natural rubber reached nearly 6.5 million metric tons during the first six months of 2023, a significant rise compared to 2000, when it stood at approximately 6.8 million metric tons.

- As per the Association of Natural Rubber Producing Countries (ANRPC), in March 2023, worldwide demand for natural rubber increased by 7.9% to 1.306 million tons over the same timeframe.

- The growing popularity of electric vehicles is expected to drive the demand for automotive tires, thereby propelling the consumption of tires in the automotive industry, which, in turn, drives the zinc chemical market.

- Also, higher loadings of zinc oxide can improve hot air/heat aging properties, and too low a concentration of zinc oxide can lead to scorching problems. Furthermore, it reduces heat buildup and wear in tires, thus making it an important segment in the rubber tire industry. Thus, with the growth in the tire industry, the consumption of zinc oxide is also increasing concurrently.

- Asia-Pacific countries like China, India, Japan, South Korea, and Thailand are the primary producers of automobiles. Hence, the market studied is expected to register growth during the forecast period.

Asia-Pacific to Dominate the Market

- Asia-Pacific stands to be the dominant region in the market studied owing to the extensive application of zinc chemical derivatives in various applications, including rubber processing, chemical processing, and agriculture.

- China is a hub for chemical processing, accounting for most chemicals produced worldwide. Owing to the encouraging government initiatives and a vast consumer base, the chemical manufacturing sector in China is expected to increase at a consistent rate during the forecast period. The increasing production of chemicals is expected to create an opportunity for the growth of the market in the country in the near future.

- In India, 40 tire manufacturers and around 6,000 non-tire manufacturers produce seals, conveyor belts, and extruded and molded rubber profiles for automotive, railway, defense, aerospace, and other applications.

- Furthermore, India is home to over 2,500 decorative and 800 industrial coating manufacturers. This increasing demand for coatings has prompted the companies to increase their production and production capacities. This is expected to drive the demand for the liquid synthetic rubber market in the country, which may further boost the demand for zinc chemicals in the coming years.

- In China and India, the demand for zinc chemicals is expected to increase due to the growing agrochemical industry and economy. The low cost and easy availability of chemical fertilizers act as key factors in the growth of the market. Zinc sulfate is used as a fertilizer additive in chemical fertilizers, stimulating the zinc chemicals market.

- According to the IRSG (International Rubber Study Group) research, Asia and Oceania account for more than 70% of the world's rubber consumption, with China and Japan accounting for 40% and 6%, respectively.

- Japan possesses one of the world's largest rubber industries, as it is a major hub for tire production.

- Furthermore, the country is ranked third globally, only behind China and the United States, in terms of the total amount of rubber consumed. The largest producers of tires in Japan, like Tosoh Corporation, Zeon Corp., and Toyo Tire & Rubber Co. Ltd, are undergoing capacity additions, which is expected to present an exciting market arena for zinc chemicals from the rubber processing industry over the forecast period.

- Hence, all such market trends are expected to drive the demand for the zinc chemicals market in the region during the forecast period.

Zinc Chemicals Industry Overview

The zinc chemicals market is fragmented, with no player capturing a significant share. Some of the key companies in the market (not in any particular order) include US Zinc, Zochem Inc., EverZinc, TIB Chemicals AG, and Weifang Longda Zinc Industry Co. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rising Utilization in Automotive Industry

- 4.1.2 Increasing Demand from the Rubber Tires Industry

- 4.2 Restraints

- 4.2.1 Health Hazard Related to Zinc Chemical

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size by Volume)

- 5.1 Type

- 5.1.1 Zinc Oxide

- 5.1.2 Zinc Sulfate

- 5.1.3 Zinc Carbonate

- 5.1.4 Zinc Chloride

- 5.1.5 Other Types

- 5.2 End-user Industry

- 5.2.1 Agriculture

- 5.2.2 Chemicals and Petrochemicals

- 5.2.3 Ceramic

- 5.2.4 Pharmaceutical

- 5.2.5 Paints and Coatings

- 5.2.6 Rubber Processing

- 5.2.7 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Malaysia

- 5.3.1.6 Thailand

- 5.3.1.7 Indonesia

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 Turkey

- 5.3.3.7 Russia

- 5.3.3.8 NORDIC Countries

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 Nigeria

- 5.3.5.3 Qatar

- 5.3.5.4 Egypt

- 5.3.5.5 United Arab Emirates

- 5.3.5.6 South Africa

- 5.3.5.7 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 American Chemet Corporation

- 6.4.2 Changsha Lantian Chemical Co. Ltd

- 6.4.3 EverZinc

- 6.4.4 Flaurea Chemicals

- 6.4.5 Global Chemical Co. Ltd

- 6.4.6 Hakusui Tech

- 6.4.7 Intermediate Chemicals Company

- 6.4.8 L. Brugge-mann GmbH & Co. KG

- 6.4.9 Nexa

- 6.4.10 Old Bridge Chemicals Inc.

- 6.4.11 Pan-Continental Chemical Co. Ltd

- 6.4.12 Rech Chemical Co. Ltd

- 6.4.13 Rubamin

- 6.4.14 Seyang Zinc Technology (Huai An) Co. Ltd

- 6.4.15 Silox India Pvt. Ltd

- 6.4.16 TIB Chemicals AG

- 6.4.17 US Zinc

- 6.4.18 Weifang Longda Zinc Industry Co. Ltd

- 6.4.19 Zochem LLC

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 R&D in Application of Zinc Nanoparticle in Medical Industry

- 7.2 Growing Use in Electronics and Semiconductor Industry