PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1689812

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1689812

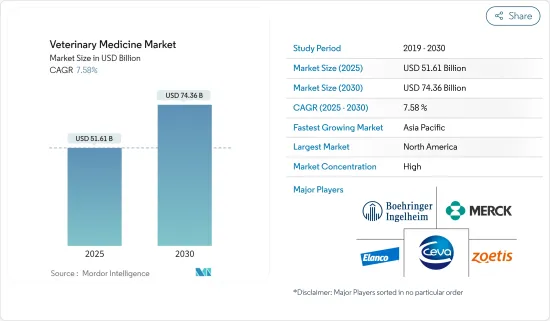

Veterinary Medicine - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Veterinary Medicine Market size is estimated at USD 51.61 billion in 2025, and is expected to reach USD 74.36 billion by 2030, at a CAGR of 7.58% during the forecast period (2025-2030).

Megatrends and Macro Growth Drivers: The Veterinary Medicine Market is witnessing substantial expansion, propelled by several critical megatrends. Chief among these is the increasing humanization of pets, which elevates the importance of pet healthcare, along with a growing awareness of animal health. Rising demand for animal-derived products-both in agriculture and human healthcare-further drives this market. These factors are supported by additional growth drivers such as the increasing burden of chronic diseases in animals, a shift toward pharmaceutical interventions by pet and poultry farm owners, and a heightened demand for meat and other animal-based products.

Growing Burden of Chronic Disease Conditions in Animals, Coupled with the Increasing Adoption of Animals: Chronic diseases in companion animals are becoming more prevalent, with one in four dogs now expected to be diagnosed with cancer during their lifetime. Conditions like osteoarthritis affect an estimated 20% of dogs older than one year. This increase in chronic conditions aligns with a growing rate of pet ownership. In the U.S., approximately 70% of households own a pet, further driving the demand for veterinary pharmaceuticals, diagnostics, and treatments. Pet owners, concerned with the health and longevity of their pets, are actively seeking advanced animal healthcare products.

Increase in Drug Preferences by Pet and Poultry Farm Owners: Pet owners and poultry farmers are increasingly turning to pharmaceutical solutions for treating both infectious and chronic diseases. Non-steroidal anti-inflammatory drugs (NSAIDs) are widely used to manage osteoarthritis in dogs, while glucocorticoids are becoming more common in treating chronic respiratory conditions in companion animals. In poultry farming, systemic ectoparasitic drugs like fluralaner are preferred for addressing infestations. This shift towards pharmaceutical interventions for animal disease treatment is spurring growth in the veterinary drug market, especially in sectors focusing on livestock health management and pet medication.

Increased Demand for Meat and Animal-based Products in Agriculture and Human Healthcare: The global demand for meat is on the rise, with beef and veal consumption projected to reach 76,386 kt cwe by 2031, according to the OECD-FAO Agricultural Outlook Report. Similarly, pig meat consumption is expected to grow by over 18,000 kt cwe in the same period. This growth demands healthier livestock, which fuels the need for veterinary healthcare products, including vaccines and nutritional supplements. The rise of animal-derived products in human healthcare, such as pharmaceuticals like enoxaparin and lactose, also underscores the importance of maintaining animal health to meet industry needs.

Veterinary Medicine Market Trends

Drugs: Dominating the Veterinary Medicine Landscape Segment Overview:

The Drugs segment is at the forefront of the Veterinary Medicine Market, representing 51% of the market's total size. This segment includes a broad spectrum of veterinary pharmaceuticals, such as antibiotics, anti-inflammatory medications, and parasiticides, all essential for addressing the health issues faced by both companion animals and livestock. This focus on veterinary drugs for disease treatment and prevention is key to ensuring the wellbeing of animals globally.

Growth Drivers: The increasing prevalence of chronic conditions in animals, such as cancer, osteoarthritis, and respiratory diseases, has created a growing demand for pharmaceutical interventions. Pet owners and livestock producers alike are seeking solutions to manage these conditions, pushing the veterinary pharmaceutical market to expand. In livestock farming, the need to ensure the safe production of meat and animal-based products also supports the demand for veterinary pharmaceuticals, especially in regions focused on livestock health management.

Competitive Landscape: As the Drugs segment continues to dominate, market players are focusing on innovation. Research and development efforts are being directed toward creating novel drug formulations with better efficacy and fewer side effects. Moreover, companies are exploring alternatives to antibiotics and developing more sustainable and eco-friendly products. These efforts, coupled with a focus on expanding product portfolios through acquisitions, are critical for maintaining market competitiveness.

Asia-Pacific: The Epicenter of Veterinary Medicine Growth Regional Dynamics:

Asia-Pacific is emerging as the fastest-growing region for veterinary medicine, with a projected CAGR of 8.5% through 2029. This surge in demand is driven by rapid urbanization, increased disposable incomes, and shifting attitudes toward pet ownership in countries like China, India, and Japan. The growing prevalence of zoonotic diseases has also heightened awareness of animal healthcare products, prompting government initiatives aimed at disease control and prevention.

Market Catalysts: The region's rapidly growing livestock industry is a major driver of demand for veterinary vaccines and pharmaceuticals. Countries like China and India are seeing increased consumption of meat products, which necessitates better livestock health management practices. Furthermore, the rise in pet humanization, particularly in urban centers, has resulted in higher spending on companion animal care, spurring the growth of the veterinary clinics and products market.

Strategic Imperatives: To succeed in the Asia-Pacific region, market players are increasingly localizing products to meet specific cultural preferences and health requirements. Partnerships with local distributors and investments in regional manufacturing facilities are helping global companies penetrate the market more effectively. Additionally, educating veterinarians and pet owners about advanced healthcare options is becoming a core component of market strategy, especially as consumers demand more comprehensive veterinary diagnostics and surgery options.

Veterinary Medicine Industry Overview

Market Characteristics: Global Players Dominate Consolidated Market The global Veterinary Medicine Market is characterized by a high level of consolidation, with several key players commanding a significant share of the market. Companies such as Zoetis, Merck & Co. Inc., Boehringer Ingelheim, and Elanco dominate, leveraging their global reach and extensive product offerings. These companies benefit from strong brand recognition and robust distribution networks, allowing them to maintain a competitive edge in the animal healthcare products market.

Major Players: Innovation and Diverse Product Offerings Key market players like Zoetis and Merck Animal Health continuously invest in research and development to address emerging health concerns and improve veterinary pharmaceuticals. Zoetis, for example, has diversified its portfolio with products ranging from respiratory vaccines to specialized pet medication like Convenia. Strategic acquisitions also play a pivotal role, with companies such as Virbac acquiring firms like iVet LLC to strengthen their companion animal care offerings. These efforts underline the importance of innovation and expansion in maintaining leadership in a competitive market.

Strategies for Future Success: Research and Market Expansion To sustain growth, leading players must continue investing in research and market expansion. Emerging markets, particularly in regions with rising pet adoption rates, offer substantial opportunities. Geographic diversification and a focus on developing veterinary telemedicine solutions will help companies meet the growing demand for accessible animal healthcare. Additionally, companies that prioritize sustainability and environmentally friendly practices in product development will be better positioned to capture a share of the Veterinary Medicine Market's projected growth.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Burden of Chronic Disease Conditions in Animals, Coupled with the Increasing Adoption of Animals

- 4.2.2 Increase in Drug Preferences by Pet and Poultry Farm Owners

- 4.2.3 Increased Demand for Meat and Animal-based Products in Agriculture and Human Healthcare

- 4.3 Market Restraints

- 4.3.1 High Costs Associated with Animal Healthcare

- 4.3.2 Lack of Awareness about Animal Health in the Emerging Nations

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD)

- 5.1 By Product Type

- 5.1.1 Drugs

- 5.1.1.1 Anti-infectives

- 5.1.1.2 Anti-inflammatory

- 5.1.1.3 Parasiticides

- 5.1.1.4 Other Drugs

- 5.1.2 Vaccines

- 5.1.2.1 Inactive Vaccines

- 5.1.2.2 Attenuated Vaccines

- 5.1.2.3 Recombinant Vaccines

- 5.1.2.4 Other Vaccines

- 5.1.3 Medicated Feed Additives

- 5.1.3.1 Aminoacids

- 5.1.3.2 Antibiotics

- 5.1.3.3 Other Medicated Feed Additives

- 5.1.1 Drugs

- 5.2 By Animal Type

- 5.2.1 Companion Animals

- 5.2.1.1 Dogs

- 5.2.1.2 Cats

- 5.2.1.3 Other Companion Animals

- 5.2.2 Livestock Animals

- 5.2.2.1 Cattle

- 5.2.2.2 Poultry

- 5.2.2.3 Swine

- 5.2.2.4 Sheep

- 5.2.2.5 Other Livestock Animals

- 5.2.1 Companion Animals

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 South Korea

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 Middle East and Africa

- 5.3.4.1 GCC

- 5.3.4.2 South Africa

- 5.3.4.3 Rest of Middle East and Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Boehringer Ingelheim

- 6.1.2 Ceva Animal Health LLC

- 6.1.3 China Animal Husbandry Co. Ltd

- 6.1.4 Dechra Pharmaceuticals PLC

- 6.1.5 Elanco

- 6.1.6 Merck & Co. Inc.

- 6.1.7 Neogen Corporation

- 6.1.8 Phibro Animal Health Corporation

- 6.1.9 Sanofi SA

- 6.1.10 Vetoquinol SA

- 6.1.11 Virbac

- 6.1.12 Zoetis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS