PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1689810

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1689810

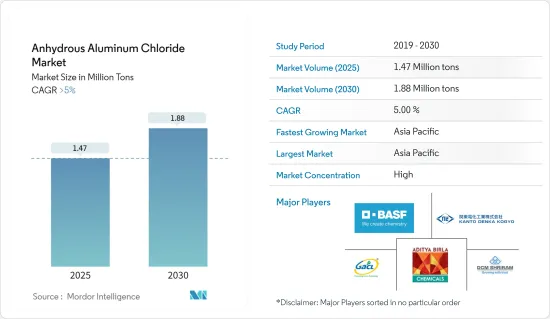

Anhydrous Aluminum Chloride - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Anhydrous Aluminum Chloride Market size is estimated at 1.47 million tons in 2025, and is expected to reach 1.88 million tons by 2030, at a CAGR of greater than 5% during the forecast period (2025-2030).

The COVID-19 pandemic negatively impacted the anhydrous aluminum chloride market. However, the market recovered significantly in 2021, owing to rising applications in pharmaceuticals, pesticides, chemical manufacturing, pigments, and others.

Key Highlights

- The growing demand from the chemical manufacturing and pigment industry and rising demand from the pharmaceutical sector are likely to be the main drivers of the anhydrous aluminum chloride market's growth over the medium term.

- However, the difficulties in storing anhydrous aluminum chloride are expected to limit the growth of the anhydrous aluminum chloride market.

- Nevertheless, growth in flavors, fragrances, and oral care industries is likely to create lucrative growth opportunities for the global market soon.

- Asia-Pacific represents the largest market, and it is also expected to be the fastest-growing market over the forecast period, owing to the increasing consumption from countries such as China, India, and Japan.

Anhydrous Aluminum Chloride Market Trends

Increasing Demand from Pigments Sector

- Anhydrous aluminum chloride is widely used in manufacturing pigments and dyes as catalysts. It is primarily used to manufacture CPC green, anthraquinone, and other derivatives. CPC green pigments are broad-spectrum organic pigments widely used in the textile industry and printing applications. Anthraquinones are widely used as dyes for synthetic and natural fibers.

- The demand for dyes and pigments in the market is expected to strongly benefit from the growing textile industry and infrastructure activities across the world. Pigments and dyes are key raw materials used in manufacturing various paints, coatings, and other end-user applications in the plastic and textile industry.

- According to the Indian Brand Equity Foundation (IBEF), the Indian textile industry witnessed its exports grow by 41% year on year in FY 22, reaching USD 44.4 billion in valuation during the same period. India is a major producer of cotton, with production projected to reach 7.2 million tons by 2030.

- Additionally, according to the Department for Promotion of Industry and Internal Trade (India), the proposed investment value in textiles of India has reached INR 113.81 Billion (USD 1.38 billion) in 2022 and registered a growth compared to previous years.

- According to the National Council of Textile Organizations (NCTO), the total shipments of textiles and apparel reached USD 65.8 billion in 2022.

- The growing paints and coatings industry is also expected to strongly contribute to the growing demand for pigments in the market. A few factors driving the growth of the paints and coatings industry are rising demand from the construction segment, automotive industry, and other end-user applications.

- Owing to all the factors mentioned above, the market for anhydrous aluminum chloride is expected to grow rapidly over the forecast period.

Asia-Pacific Region to Dominate the Market

- The Asian-Pacific region dominated the global market share. With growing applications in countries such as China, Japan, and India, the utilization of anhydrous aluminum chloride is increasing in the region.

- China is currently the world's largest market for dyes and pigments, accounting for approximately 30% of global consumption. The growing textile industry and the increasing demand for paints and coatings in the country are the main drivers of this growth. Moreover, the growing population and increasing disposable income of consumers are expected to drive the demand for dyes and pigments in China in the coming years.

- China is expected to grow fastest in the region due to rapid industrialization, and the demand for anhydrous aluminum chloride to be used as a raw material and catalyst is increasing in various manufacturing industries.

- Increased government spending on industrial development, namely textile, chemical manufacturing, pharmaceuticals, and petrochemical, in countries like China and India is expected to stimulate market demand over the forecast period.

- According to the National Bureau of Statistics, in 2022, the petrochemical and chemical industries' overall economic operation (excluding oil and gas extraction) was stable. In 2022, the production declined, while the capacity utilization rate of the chemical raw material and the chemical product manufacturing industry recorded above 76%, year-on-year.

- Furthermore, according to the India Brand Equity Foundation (IBEF), the country has allowed 100% foreign direct investment (FDI) in the textile sector under the automatic route. The INR 10,683 crore (USD 1.44 billion) PLI scheme is expected to be a major booster for textile manufacturers.

- Moreover, under the Union Budget 2022-23, the total allocation for the textile sector was INR 12,382 crore (USD 1.62 billion). Out of this, INR 133.83 crore (USD 17.5 million) was for Textile Cluster Development Scheme, INR 100 crore (USD 13.07 million) for National Technical Textiles Mission, and INR 15 crore (USD 1.96 million) each for PM Mega Integrated Textile Region and Apparel parks scheme and the Production Linked Incentive Scheme. Such allocations will support the growth of the textile industry in the country, which will further enhance the demand for anhydrous aluminum chloride from the textile segment in the years to come.

- Therefore, these aforementioned factors are expected to accelerate the applications of anhydrous aluminum chloride in various end-use applications, thereby propelling industry growth during the forecast period.

Anhydrous Aluminum Chloride Industry Overview

The anhydrous aluminum chloride market is consolidated, with players accounting for a marginal share of the market studied. A few major companies in the market (not in any particular order) include BASF SE, Gujarat Alkalies and Chemical Limited, Aditya Birla Chemicals, DCM Shriram, and Kanto Denka Kogyo Co. Ltd, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand from the Chemical Manufacturing and Pigment Industry

- 4.1.2 Rising Demand from the Pharmaceutical Sector

- 4.1.3 Other drivers

- 4.2 Restraints

- 4.2.1 Difficult to Store Anhydrous Aluminum Chloride

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Form

- 5.1.1 Powder

- 5.1.2 Granules

- 5.1.3 Crystals

- 5.2 Application

- 5.2.1 Pharmaceuticals

- 5.2.2 Pesticides

- 5.2.3 Chemical Manufacturing

- 5.2.4 Pigments

- 5.2.5 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Aditya Birla Chemicals

- 6.4.2 Anmol Chloro Chem

- 6.4.3 Base Metal Group

- 6.4.4 BASF SE

- 6.4.5 DCM Shriram

- 6.4.6 Gujarat Alkali & Chemicals Ltd

- 6.4.7 Gulbrandsen Manufacturing Inc.

- 6.4.8 Kanto Denka Kogyo Co. Ltd

- 6.4.9 Nippon Light Metal Company Ltd

- 6.4.10 Shandong Kunbao New Materials Group Co. Ltd

- 6.4.11 Upra Chem Pvt. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growth in Flavors and Fragrances and Oral Care Industries

- 7.2 Other Opportunities