PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1689808

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1689808

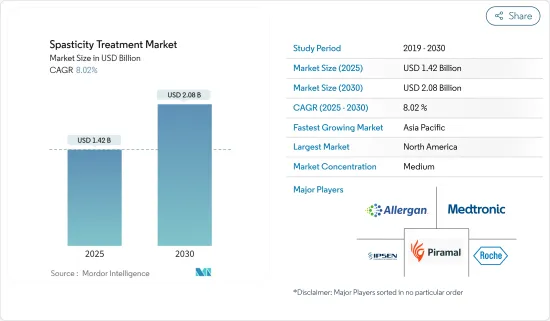

Spasticity Treatment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Spasticity Treatment Market size is estimated at USD 1.42 billion in 2025, and is expected to reach USD 2.08 billion by 2030, at a CAGR of 8.02% during the forecast period (2025-2030).

The major factors attributing to the market's growth are a growing prevalence of multiple sclerosis, cerebral palsy, and encephalitis around the globe, a rise in awareness programs, and the adoption of novel technologies.

The rising cases of spasticity and the adoption of new technologies for spasticity treatment are the key drivers for the market. For instance, according to the journal published by the Physicians Group LLC in December 2023, around 12.0 million people worldwide suffer from spasticity. The same source also stated that contemporary physical therapy approaches, including robotic-assisted therapy, electrical stimulation therapies, and virtual reality therapy, showcased high efficiency in enhancing motor function and reducing spasticity in patients. Also, according to the study published in February 2023, robotic-assisted sensorimotor therapy exercises were applied on stroke subjects with severe spasticity and have showcased significant achievement. The study also stated that active therapy with rehabilitation devices can lead to various benefits in spasticity treatment.

Rising approvals and the launching specialty products to treat spasticity are anticipated to drive market growth. For instance, in June 2022, LYVISPAH, a baclofen oral granules (5, 10, and 20 mg) specialty product approved by the United States FDA for the treatment of spasticity related to multiple sclerosis and other spinal cord disorders, was commercially launched. Amneal Pharmaceutical has developed the product in the form of rapidly dissolving flavored granules to provide an alternative for spasticity patients who have difficulty swallowing pills.

Also, the rising research and development on advanced therapeutics for treating spasticity is anticipated to drive market growth further. For instance, in March 2023, Saol Therapeutics shared its Phase II results of the clinical development of SL-1002 for lower limb muscle spasticity. The phase transition success rate (PTSR) indication standard for Phase II medicines for Lower Limb Muscle Spasticity was found to be 100%. In addition, a pipeline drug, STI-103, is under clinical development by Sentynl Therapeutics and is currently in Phase I. The Phase I drug for muscle spasticity has a 74% phase transition success rate (PTSR) indication benchmark for progressing into Phase II. Therefore, the positive results of spasticity drugs are expected to have the launch of advanced therapeutics for spasticity in the market, thereby anticipated to drive the market growth during the forecast period.

However, the high cost of the treatment is expected to reduce the adoption rate of spasticity treatment, which is expected to hinder the market growth during the forecast period.

Spasticity Treatment Market Trends

The Cerebral Palsy Segment is Expected to Hold the Major Market Share in the Spasticity Treatment Market

The cerebral palsy (CP) segment is expected to account for the largest of the spasticity drugs market. Factors such as an increase in cerebral palsy cases and a rise in benefits offered by spasticity drugs in treating cerebral palsy are expected to drive the segment growth during the forecast period.

Cerebral palsy is one of the most common childhood disorders witnessed around the globe. An increase in cerebral palsy cases and recurring spasticity is expected to drive the demand for the spasticity treatment market, fueling the segment growth during the forecast period. For instance, as per the January 2024 update by Cerebral Palsy Guidance, around 764,000 people in the United States (including children and adults) have at least one symptom of cerebral palsy. Also, around 10,000 babies are born each year with cerebral palsy. Between 1,200 and 1,500 school-aged children are diagnosed with cerebral palsy each year.

Also, the approval to conduct clinical trials related to CP further facilitates the segment growth during the forecast period. For instance, in January 2024, Neurotech International received approval from the Human Research Ethics Committee (HREC) and clearance from the Therapeutic Goods Administration (TGA) to begin a Phase I/II clinical trial of NTI164 for the treatment of cerebral palsy (CP). The study will investigate the efficacy and safety of NTI164 in pediatric patients with spastic CP, the most prevalent form of CP.

Therefore, owing to the increase in CP cases, growing CP clinical trials, rise in awareness programs, and adoption of spasticity therapies among CP patients, the segment is predicted to grow during the forecast period.

North America is Expected to Dominate the Market During the Forecast Period

North America is expected to dominate the spasticity drugs market owing to the increasing funding for multiple sclerosis (MS) related research coupled with the development of drug delivery solutions in the country. Hence, the following factors and market players' initiatives to develop drugs to treat spasticity are projected to support the market growth and maintain a similar trend during the forecast period.

The increasing number of people affected by diseases causing spasticity symptoms is likely to drive market growth in the country. According to MS Canada's February 2024 update, Canada has one of the world's highest rates of multiple sclerosis (MS), with around 90,000 Canadians living with the condition. On average, 12 Canadians receive an MS diagnosis every day. Most people are diagnosed with MS between the ages of 20 and 49, and the effects of the disease, which can be unpredictable, persist throughout their lives.

Research on the benefits of drugs in spasticity management is increasing. The research assists in comprehending the advantages of spasticity drugs supported by scientific evidence and enhancing the usage of the drugs. For instance, a study published in March 2023 by the University of Texas Southwestern in the National Library of Medicine concluded that enteral baclofen is a safe and effective medication for treating spasticity in cerebral palsy. This medication is easy to administer and has minimal side effects.

The growing incidence rates of multiple sclerosis and the accessibility of the treatment have supported the country's growth in the market. Additionally, the increasing availability of cost-effective treatment in the country is anticipated to surge the market growth during the forecast period.

Spasticity Treatment Industry Overview

The spasticity treatment market is moderately competitive and consists of several major players. In terms of market share, a few of the major players currently dominating the market are developing new products to address unmet challenges in the market. For instance, in October 2023, Medtronic received US Food and Drug Administration (FDA) approval for its next-generation SynchroMed III intrathecal drug delivery system for patients with chronic pain, cancer pain, and severe spasticity. Some companies dominating the market are Medtronic PLC, Piramal Enterprises Ltd, Allergan PLC, Ipsen, and F. Hoffmann-La Roche Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rise in Awareness Programs and Adoption of Novel Technologies

- 4.2.2 Launch of Advanced Therapeutics and Increased Affordability

- 4.3 Market Restraints

- 4.3.1 High Cost of Treatment

- 4.3.2 Stringent Regulatory Framework

- 4.4 Porter's Five Force Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Drug Class

- 5.1.1 GABA Agonist

- 5.1.2 Alpha2-adrenergic Agonists

- 5.1.3 Botulinum Toxins

- 5.1.4 Other Drug Class

- 5.2 Indication

- 5.2.1 Multiple Sclerosis (MS)

- 5.2.2 Cerebral Palsy (CP)

- 5.2.3 Traumatic Brain Injury (TBI)

- 5.2.4 Other Indications

- 5.3 Route of Administration

- 5.3.1 Oral

- 5.3.2 Parenteral

- 5.4 End User

- 5.4.1 Pediatrics

- 5.4.2 Adults

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Medtronic PLC

- 6.1.2 Sun Pharmaceuticals Industries Ltd

- 6.1.3 Saol Therapeutics Inc.

- 6.1.4 Piramal Enterprises Ltd

- 6.1.5 Par Pharmaceuticals LLC

- 6.1.6 Allergan PLC

- 6.1.7 Ipsen

- 6.1.8 F. Hoffmann-La Roche Ltd

- 6.1.9 US WorldMeds LLC

- 6.1.10 Taj Pharmaceuticals Limited

7 MARKET OPPORTUNITIES AND FUTURE TRENDS