Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1689795

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1689795

Solar Tracker - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 140 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

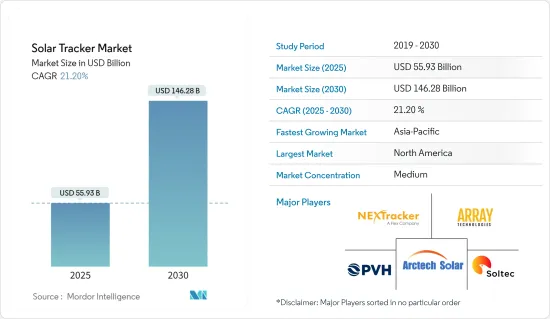

The Solar Tracker Market size is estimated at USD 55.93 billion in 2025, and is expected to reach USD 146.28 billion by 2030, at a CAGR of 21.2% during the forecast period (2025-2030).

Key Highlights

- Over the long term, increasing solar PV installations are expected to create demand for solar trackers in the forecast period.

- On the other hand, the high initial investment required to install a tracking system, design complexity, maintenance cost, and limited capacity of solar tracking systems is expected to restrain the usage of solar trackers.

- Nevertheless, factors such as supportive government policies and efforts to meet the increasing power demand using renewable energy sources are expected to create a favorable market for solar panels and for solar trackers in the coming years.

- North America has dominated the solar trackers market, where the United States emerged as a significant customer with solar trackers installed in more than 70% of projects by the end of 2023.

Solar Tracker Market Trends

Increasing Solar PV Installations Across The Globe to Dominate the Market

- Using solar tracking technology, solar collectors, reflectors, and photovoltaic panels are oriented toward the sun. As the sun moves across the sky, a tracking device ensures that solar collectors maintain a position in which they receive the maximum amount of solar radiation as it moves across the sky. Solar tracker's ability to track the sun can improve PV system efficiency by as much as 25 to 35 percent.

- The installed capacity of solar photovoltaic (PV) projects has been growing significantly over the last decade due to increasing investments in the renewable energy industry supported by favorable government policies and ambitious renewable energy targets set by several countries. According to IRENA Renewable Energy Capacity Statistics 2024, the cumulative global installed solar PV capacity grew by 32.39%, i.e., from 1066.5 GW in 2022 to 1412.0 GW in 2023.

- Countries such as China, the United States, Japan, Germany, India, and Australia account for most of the installed PV capacity globally, which is expected to play a significant role in the solar tracker market.

- The Chinese market grew with 216 GW of newly installed PV capacity in 2023, representing more than 55.26% of the global market. Industry projections estimate that this significant acceleration is set to continue with about 165 GW expected to be added in 2024 and 170 GW in 2025. The developments in the solar energy industry is expected to witness China's cumulative solar PV capacity reach over 700 GW by 2024 and increase to close to 900 GW by the end of 2025.

- The European region has been witnessing significant developments in the solar industry. According to SolarPower Europe, In 2023, nearly 55.9 GW of new solar PV capacity was installed across the 27 Member States, representing a 40% growth rate from 2022 levels. The cumulative EU solar PV fleet amounts to 263 GW, up 27% from the 207 GW in 2022. Germany continues to be the largest contributor with 82 GW.

- Additionally, several solar projects are either in the planning or construction phase. For instance, In September 2023, Germany's energy provider Vattenfall noted the development of an Agri-Photovoltaic power plant in Tutzpatz of 79 MW using solar trackers to optimally generate electricity. Vatenfall has also inked a power purchase agreement with Power and Air Condition Solution Management (PASM) to supply clean electricity for ten years.

- Thus, owing to the above points, the increasing Solar PV installations across the globe are expected to dominate the market in the forecast period.

North America to Dominate the Market

- The United States is one of the major markets for solar trackers worldwide, with a majority of the demand coming from states like California, Arizona, Nevada, Texas, Florida, North Carolina, etc. As per the International Renewable Energy Agency (IRENA), the solar energy installed capacity in the United States of America was about 139 GW in 2023, an increase of about 21% since the previous year.

- The use of single-axis tracking in the United States's utility PV market has grown steadily over the past decade. At the end of 2023, about 22.5 GW of utility-scale solar installations were executed in the United States, where the solar tracker systems had a substantial share in the projects

- Canada's solar tracker market is in its development phase, with the majority of the demand coming from provinces like Alberta, Manitoba, Ontario, and Saskatchewan. The market for solar trackers has been gaining momentum in recent years due to their increased efficiency and declining costs. Multiple projects have been commissioned in the country.

- In July 2023, the country witnessed the commencement of two solar projects, the Scotford Project (81MW) and the Saddlebtook Project (101 MW) in Alberta. The projects, being developed by Qcells and Alltrade Industrial Contractors, would use fixed-tilt trackers to generate electricity from bifacial solar modules.

- In addition to the United States's big markets for solar trackers, states like Indiana, Virginia, and Nevada, among others, have a significantly large number of solar PV projects in the pipeline, which is expected to create significant demand for solar trackers during the forecast period.

- In February 2024, Soltec, the manufacturer and supplier of solar trackers, bagged a contract from Blue Ridge Power to supply about 164 MW of SF7 solar trackers to be located in Virginia. The SF7 solar tracker requires fewer components and supports to complete the project quickly. The power plant, upon completion, is likely to curtail over 294,000 tons of emissions, which could power about 17000 households.

- According to the data from the Solar Energy Industries Association (SEIA), around 5 GW of solar PV capacity is expected to be installed in Indiana by 2026, ranking the state's pipeline as the sixth-largest in the country. On the other hand, SEIA estimates that Nevada will install more than 4 GW over the same period, making the state the seventh-largest in terms of solar PV pipelines.

- Therefore, factors such as upcoming solar PV tracking systems projects, supportive government policies, and efforts to reduce reliance on fossil fuel-based power are expected to drive the solar tracker market in the region.

Solar Tracker Industry Overview

The solar tracker market is semi-consolidated. Some of the major players in the market (in no particular order) include NexTracker Inc., Array Technologies Inc., PV Hardware Solutions S.L.U., Arctech Solar Holding Co. Ltd, and Soltec Power Holdings SA.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 68308

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definiton

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Solar PV Installations

- 4.5.2 Restraints

- 4.5.2.1 High Initial Investment

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 Market Segmentation

- 5.1 Axis Type

- 5.1.1 Single Axis

- 5.1.2 Dual Axis

- 5.2 Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Mexico

- 5.2.1.3 Rest of North America

- 5.2.2 Europe

- 5.2.2.1 Germany

- 5.2.2.2 France

- 5.2.2.3 United Kingdom

- 5.2.2.4 Italy

- 5.2.2.5 Spain

- 5.2.2.6 NORDIC

- 5.2.2.7 Turkey

- 5.2.2.8 Russia

- 5.2.2.9 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 India

- 5.2.3.3 Japan

- 5.2.3.4 South Korea

- 5.2.3.5 Malaysia

- 5.2.3.6 Thailand

- 5.2.3.7 Indonesia

- 5.2.3.8 Vietnam

- 5.2.3.9 Rest of Asia-Pacific

- 5.2.4 Middle-East and Africa

- 5.2.4.1 Saudi Arabia

- 5.2.4.2 United Arab Emirates

- 5.2.4.3 South Africa

- 5.2.4.4 Qatar

- 5.2.4.5 Nigeria

- 5.2.4.6 Egypt

- 5.2.4.7 Rest of Middle East and Africa

- 5.2.5 South America

- 5.2.5.1 Brazil

- 5.2.5.2 Colombia

- 5.2.5.3 Chile

- 5.2.5.4 Rest of South America

- 5.2.1 North America

6 Competitive Landscape

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Soltec Power Holdings SA

- 6.3.2 Arctech Solar Holdings Co Ltd.

- 6.3.3 Meca Solar

- 6.3.4 Ideematec Deutschland GmbH

- 6.3.5 Nextracker Inc.

- 6.3.6 Trina Solar

- 6.3.7 Valmont Industries Inc.

- 6.3.8 PV Hardware Solutions S.L.U.

- 6.3.9 Solar Flexrack

- 6.3.10 Array Technologies Inc.

- 6.4 List of Other Prominent Companies (Company Name, Headquarter, Relevant Products & Services, Contact Details, etc.)

- 6.5 Market Ranking Analysis

7 Market Opportunities and Future Trends

- 7.1 Increasing Power Demand

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.