PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1689765

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1689765

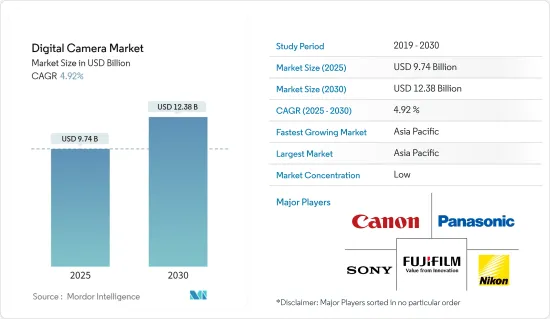

Digital Camera - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Digital Camera Market size is estimated at USD 9.74 billion in 2025, and is expected to reach USD 12.38 billion by 2030, at a CAGR of 4.92% during the forecast period (2025-2030).

The rising demand for high-quality photography and videography, particularly among amateur and professional photographers, is a major market driver. Advancements in sensor technology, image processing algorithms, and lens design are enabling cameras to capture stunning images and videos.

Additionally, the incorporation of advanced features, such as AI-driven scene recognition and object tracking, is elevating the user experience. The surging trend of vlogging, coupled with the prominence of social media and content creation, is driving the demand for compact, high-performance digital cameras. With the relentless evolution of technology and shifting consumer preferences, the digital camera market is poised for dynamism, presenting substantial growth prospects.

Artificial Intelligence (AI) Integration in Cameras for Image Processing

Key Highlights

- Advancements in artificial intelligence and other recent technologies are driving the growth of the digital camera market. These innovations enable cameras to become smaller and more capable. Artificial intelligence enhances image quality and reduces noise in low-light conditions. The smallest functional camera is now the size of a grain of rice. Modern technology allows security companies to maintain high resolution while minimizing the camera's footprint.

- In response, market players are adopting AI in their offerings. For instance, Canon Inc. is incorporating AI technology. The Canon EOS R3 features an AI-based autofocus system that can track subjects with incredible accuracy. The camera also has an AI-based image processor that can fix most major digital photo issues, such as distortion, vignetting, and chromatic aberration.

- Furthermore, in November 2024, SONY Group CORPORATION launched the Alpha 1 II, the second-generation model of its flagship full-frame mirrorless camera. As the successor to the acclaimed Alpha 1, this new model features numerous upgrades, combining high resolution, speed, and advanced AI-driven autofocus technology designed for both professional photographers and videographers.

- In this way, AI is transforming the photography industry. From improving autofocus systems to enhancing the quality of photographs and automating the editing process, AI is making it easier and more efficient to capture quality images. As AI continues to advance, more innovative developments in the world of photography are expected adding growth to the AI-enabled digital cameras.

Smartphone Photography Challenging Market Growth

Key Highlights

- The digital camera market is currently facing significant challenges from competing devices and shifting consumer preferences. Modern smartphones are equipped with advanced cameras that deliver high-quality images wthatmeet or even exceed the needs of average consumers. According to GSMA, the smartphone penetration rate as a share of the population has increased to 69% in 2023 from 68% in 2022, registering significant growth post-pandemic.

- Consequently, many consumers are choosing not to purchase dedicated digital cameras. Smartphones, with their all-in-one convenience, have become the preferred choice. The ability to use smartphones as both cameras and multifunctional tools reduces the perceived value of standalone cameras. This trend is particularly evident since digital cameras often do not provide significant advantages over smartphone cameras in terms of features or usability.

However, as social media content creators continue to proliferate, a key opportunity arises to engage consumers with compact, user-friendly digital cameras that deliver exceptional stills and videos. The market increasingly caters to niche demands, underscoring the growing sophistication and awareness of today's buyers. By keeping pace with consumer trends across various segments and regions, brands and retailers can position themselves against competition from smartphones.

Digital Camera Market Trends

Mirrorless Holds Major Market Share

- Mirrorless digital cameras are cameras that do not include a reflex mirror (the major component of the DSLR that reflects the light up to the viewfinder) and an optical viewfinder. In these cameras, the imaging sensor is constantly exposed to light and gives users a preview of the image on the electronic viewfinder (EVF), which is a Liquid Crystal Display (LCD) screen on the back of the camera.

- The demand for mirrorless digital cameras is rapidly growing due to their compact and lightweight design, making them highly portable and appealing to photographers who prioritize mobility. Also, the advanced image processing capabilities of mirrorless cameras, coupled with high-resolution sensors, produce superior image quality.

- According to MPB GmbH, an authority on camera pricing, the adoption of mirror-less cameras has significantly influenced Average Purchase Values (APVs) in both the new and used camera markets. As consumers gravitate towards mirrorless cameras for their advanced features, the primary market witnessed a surge in APVs. This trend, fueled by the rising appeal of mirrorless models, also boosts the resale value and demand in the secondary market.

- The growing use of mirrorless cameras has increased innovations to make the devices more user-friendly. Furthermore, businesses have invested heavily in developing unique and improved products. For instance, Fujifilm claimed that the company expects the demand for mirrorless cameras to surpass DSLRs in the near future. The company also asserted that mirrorless cameras have already surpassed DSLRs in global markets, such as Europe and the United States. With these growth prospects, the demand for mirrorless cameras would likely grow throughout the forecast period.

North America has the Major Market Share

- Asia-Pacific stands out for its innovative fusion of cutting-edge technology and time-honored expertise. Key industry players prioritize stringent production standards, with a pronounced emphasis on sustainability and energy efficiency. Notable companies, including Sony, Canon, and Nikon, are amplifying their regional presence through strategic initiatives. Furthermore, digital cameras are pivotal in the region, catering to professional photographers, videographers, and enthusiasts seeking superior specifications and enhanced image control.

- Furthermore, while Kodak and Fuji concentrated on film, Sony seized the opportunity to enter the camera market. Leveraging its electronics expertise, Sony crafted user-friendly digital cameras tailored for a younger, tech-savvy demographic. These cameras catered to photographers and anyone eager to capture moments sans the complexities of film. Through consistent enhancements in quality and ease of use, Sony captivated a broad audience and cultivated a base of loyal customers. As Sony ventured into the camera market, it drew on its vast expertise in electronics to develop innovative and technologically advanced cameras.

- Moreover, in February 2024, Canon Inc. announced that its interchangeable-lens digital cameras, encompassing both digital SLR and mirrorless variants, have dominated the global market for an impressive 21 consecutive years, from 2003 to 2023. In 2023, Canon not only led the demand for mirrorless cameras but also broadened its offerings with an expanded lineup of EOS R series cameras and lenses. This new lineup featured the EOS R50, launched in March 2023, boasting user-friendly functions in an APS-C size mirrorless design; the compact yet high-performing full-frame EOS R8, unveiled in April 2023; and the EOS R100, which made its debut in June 2023.

- Nikon reported that several camera companies have recently faced losses, leading some competitors to exit the photography business entirely. This trend is largely attributed to the meteoric rise of the smartphone market and the enhanced quality of smartphone cameras. However, Nikon highlighted that India, with its vast population, continues to show a robust demand for cameras, particularly in the professional wedding sector. According to IBEF, India witnesses approximately 10 million weddings annually, making its wedding industry the second largest globally, with an impressive annual expenditure of USD 130 billion. Such factors may enhance the market's growth.

- The growing popularity of social media platforms, including YouTube, Instagram, and TikTok, has significantly fueled the rise of content creation, contributing to the market's expansion. Influencers, vloggers, and content creators increasingly favor digital cameras over smartphones, valuing their superior image quality and video shooting flexibility. For example, in China, platforms like WeChat, Weibo, Douyin (TikTok), and Kuaishou have surged in popularity, drawing millions of users who actively create, share, and engage with diverse digital content. These dynamics are poised to propel the market's growth substantially.

Digital Camera Industry Overview

The digital camera market is fiercely competitive, dominated by key players such as Canon Inc., SONY Group CORPORATION, Nikon Corporation, Fujifilm Holdings Corporation, and Panasonic Holdings Corporation. Competition is intensifying as both established players and emerging brands compete for greater market share. Leading manufacturers are focusing on innovation to differentiate their products, introducing advanced features like AI-driven image processing, high-resolution sensors, improved autofocus systems, and compact designs.

Additionally, the rise of smartphone photography has heightened competition, compelling camera manufacturers to innovate and offer unique selling points. The entry of new players has further intensified competition by providing budget-friendly alternatives to established brands. As a result, consumers now have a broader range of choices, driving down prices and fostering technological advancements in the digital camera market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Anticipated Increase in Sales of Mirrorless Lens

- 5.1.2 Demand for Specialized Products from Niche Customer Base

- 5.2 Market Challenges

- 5.2.1 Strong Competition from Smartphones with Advanced Features

- 5.2.2 Growing Trend Toward Camera Rentals

- 5.3 Key Technological Innovations - Mirrorless Lens and Accessories

- 5.4 Historical Trend Analysis of Digital Camera Sales (1999-2023)

6 MARKET SEGMENTATION

- 6.1 By Lens Type

- 6.1.1 Built-in

- 6.1.2 Interchangeable

- 6.2 By Camera Type

- 6.2.1 Compact Digital Camera

- 6.2.2 DSLR (Digital Single-Lens Reflex)

- 6.2.3 Mirrorless

- 6.3 By End User

- 6.3.1 Pro Photographers

- 6.3.2 Prosumers

- 6.3.3 Hobbyists

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia

- 6.4.4 Australia and New Zealand

- 6.4.5 Latin America

- 6.4.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Vendor Market Share Analysis

- 7.2 Company Profiles

- 7.2.1 Nikon Corporation

- 7.2.2 Canon Inc.

- 7.2.3 Panasonic Holdings Corporation

- 7.2.4 Fujifilm Holdings Corporation

- 7.2.5 SONY Group CORPORATION

- 7.2.6 Eastman Kodak Company

- 7.2.7 OM Digital Solutions Corporation

- 7.2.8 Sigma Corporation

- 7.2.9 Leica Camera AG

- 7.2.10 Victor Hasselblad AB

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET