PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851201

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851201

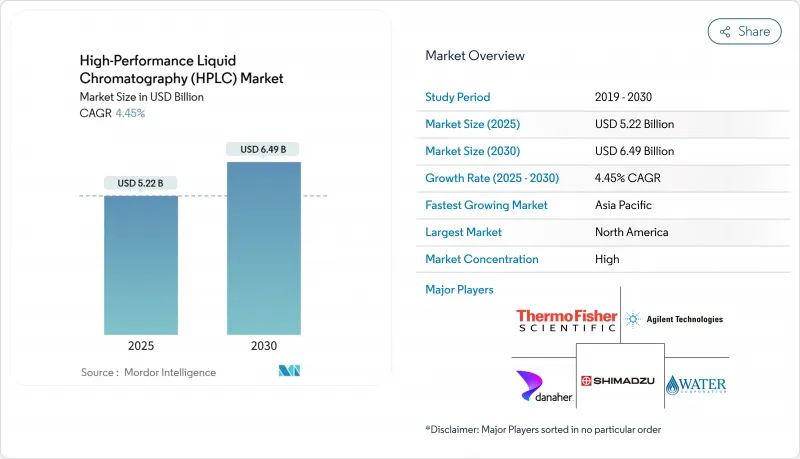

High-Performance Liquid Chromatography (HPLC) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The high-performance liquid chromatography market is valued at USD 5.22 billion in 2025 and is tracking toward USD 6.49 billion by 2030 at a 4.45% CAGR.

Advancing column chemistries, ultra-high-pressure pumps, and automation software are lifting system productivity while lowering solvent use. Wider uptake in pharmaceutical quality control, real-time bioprocess monitoring, and clinical diagnostics is widening the installed base, and new per- and polyfluoroalkyl substance (PFAS) regulations are adding fresh demand in environmental testing. Vendors are also embedding artificial intelligence into instrument control and data processing to shorten method development time, sharpen peak identification, and cut repeat runs. Together, these technologies and compliance forces are deepening replacement cycles and accelerating first-time purchases, especially in Asia Pacific, where rising healthcare spending aligns with local manufacturing incentives.

Global High-Performance Liquid Chromatography (HPLC) Market Trends and Insights

Advancements in HPLC Technologies: Miniaturization Drives Portability Revolution

Compact instruments are moving analyses from centralized labs to field sites, enabling immediate decision-making in remote locations. The University of Tasmania's self-contained units illustrate how real-time nutrient and PFAS monitoring can shrink solvent use by up to 80%. Dual LED detectors in portable ion chromatographs now resolve multiple analytes simultaneously, which shortens turnaround for agricultural runoff testing. Faster detectors and sub-2 µm columns elevate throughput without compromising resolution, encouraging laboratories to switch from traditional systems as depreciation cycles close. Instrument makers are adding IoT-enabled diagnostics that anticipate maintenance windows, reduce downtime, and lengthen column life. These innovations are broadening the addressable base, particularly among environmental agencies that must comply with new PFAS screening mandates.

Pharmaceutical & Biopharma R&D Expansion: Biologics Complexity Demands Advanced Analytics

Continuous processing workflows require real-time data to control critical quality attributes. At-line HPLC platforms monitoring ribonucleotide concentrations during in vitro transcription are improving mRNA yields and shortening batch release times. Deeper integration with mass spectrometry is enhancing characterization of post-translational modifications, essential for monoclonal antibodies and antibody-drug conjugates. Process Analytical Technology frameworks recommended by regulators are accelerating the adoption of these live analytics and creating virtuous feedback loops that refine process parameters. Funding for biologics in China and India is expanding demand for robust analytical platforms, while contract manufacturers invest in multiproduct suites that support both small-molecule and biologic pipelines. As a result, laboratories are upgrading to UHPLC systems that handle higher viscosity samples and maintain peak capacity under elevated pressures.

High Capital & Operating Costs: Refurbished Equipment Market Emerges as Strategic Alternative

A complete UHPLC package can exceed USD 50,000, and consumables plus service contracts often add 15-20% of that figure annually. Budget-constrained laboratories are turning into certified pre-owned systems tested by third-party refurbishes, which lower entry costs without sacrificing performance. Manufacturers are also redesigning flow paths for narrow-bore columns that cut solvent use by up to 80%, lowering disposal fees and extending pump seal life. Energy-efficient cooling modules reduce heat output, easing facility HVAC loads. Collectively, these measures mitigate operational expenditure, yet initial capital outlay remains a hurdle for small institutions.

Other drivers and restraints analyzed in the detailed report include:

- Regulatory Focus on Food Safety & Environment: PFAS Regulations Reshape Testing Protocols

- Growth of Clinical Diagnostics & Precision Medicine: Liquid Biopsy Advances Drive HPLC Adoption

- Shortage of Skilled Chromatographers: Industry-Academic Partnerships Address Talent Gap

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Consumables delivered 7.5% CAGR prospects for 2025-2030, surpassing instrument revenue despite instruments owning 45.1% of the high-performance liquid chromatography market share in 2024. Frequent replacement of columns, solvents, and vials ensures recurring cash flow even when capital budgets tighten. Columns with Fused-Core particles boost efficiency at lower back pressures, reducing pump strain and extending system life. Eco-conscious packaging, such as 100% recyclable ocean plastic, meets corporate sustainability goals without compromising shelf stability. Demand for ultrapure water mirrors this trend, with the pharmaceutical water segment's USD 39.85 billion size in 2023 pointing to robust replenishment cycles for HPLC-grade reagents.

Instruments remain pivotal to the high-performance liquid chromatography market size because laboratories typically standardize workflows around branded hardware ecosystems. Shimadzu's Nexera series integrates automatic mobile-phase blending, IoT alerts, and analytics dashboards that quantify utilization rates in real time. Accessories, though smaller in value, are increasingly critical; optimized fluidic paths can raise mass-spectrometric peak intensity between 1.8X and 3.8X, directly affecting detection limits. Suppliers are therefore bundling fitting kits and laser-etched tubing with new instruments to ensure performance is preserved after installation.

Conventional platforms continued to generate the largest revenue pool, yet UHPLC adoption is expanding at 8.9% CAGR as laboratories upgrade to sub-2 µm columns that shorten run times. Operating pressures above 15,000 psi compress gradients into sub-five-minute windows, preserving throughput while slashing solvent consumption by up to 70%. Hybrid systems pair UHPLC separations with time-of-flight or Orbitrap detectors, allowing comprehensive structural elucidation within a single injection. Microfluidic chip-HPLC prototypes integrate sample cleanup and separation on silicon substrates, demonstrating performance comparable to benchtop instruments while using microliter solvent volumes.

Nano-HPLC serves proteomics teams that handle scarce samples, providing heightened sensitivity without sample dilution. Fused-Core particle columns offer a midpoint between traditional fully porous particles and sub-2 µm media, delivering 40% higher efficiency at moderate backpressure. These incremental improvements democratize high-speed separations for facilities lacking ultra-high-pressure pumps. As a result, the high-performance liquid chromatography market size for mid-tier instruments is expected to widen, bridging the gap between entry-level and flagship platforms.

The High-Performance Liquid Chromatography Market is Segmented by Product Type (Instruments, Consumables, and More), Technology (Conventional HPLC, UHPLC, and More), Application (Pharmaceutical Quality-Control, Clinical Research, and Others), by End User (Pharmaceutical & Biotechnology Companies, and More), and Geography (North America, Europe, and More). The Market Sizes and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America captured 31.5% of global revenue in 2024 supported by intensive pharmaceutical R&D, strong bioprocessing infrastructure, and a stringent regulatory environment that mandates advanced analytical testing. The FDA's 2024 guidance on nitrosamine impurities in drug products now requires laboratories to detect carcinogenic compounds at sub-ppm levels, driving additional UHPLC-MS installations. Instrument vendors headquartered in the United States dominate early commercialization of AI-enabled software and predictive maintenance modules, reinforcing regional leadership. Portable HPLC systems are also gaining traction in environmental monitoring, supporting onsite analysis of river contaminants after industrial spills.

Asia Pacific is forecast to grow at 6.5% CAGR to 2030 as China and India expand vaccine, biosimilar, and small-molecule manufacturing capacity. Local regulatory harmonization with International Council for Harmonization (ICH) guidelines pushes companies to invest in compliant analytical platforms. Japanese suppliers continue to innovate hardware designs celebrating 150 years of HPLC evolution. Government programs that subsidize laboratory modernization lower acquisition barriers for provincial centers tasked with water and food safety oversight. Rising middle-class healthcare spending further widens the customer base for clinical diagnostic laboratories, creating steady pull-through for consumables.

Europe shows mature but technology-intensive demand. The European Medicines Agency is grappling with looming retirements that could slow dossier reviews, indirectly influencing instrument validation timelines. Pending PFAS restrictions may affect formulations of more than 600 medicines, requiring reformulation and additional stability testing. Green chromatography initiatives resonate strongly; research demonstrates that bio-based solvents can achieve equivalent separation performance with lower environmental footprints. Collectively, these dynamics sustain the high-performance liquid chromatography market size in Europe even as overall instrument penetration remains high.

- Waters Corporation

- Agilent Technologies

- Thermo Fisher Scientific

- Shimadzu

- Merck

- Danaher

- Bio-Rad Laboratories

- PerkinElmer

- Gilson

- Mitsubishi Chemical

- Tosoh

- Hitachi

- Hamilton Company

- JASCO Inc.

- KNAUER Wissenschaftliche Gerate GmbH

- Phenomenex Inc.

- YMC Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Advancements in HPLC technologies

- 4.2.2 Pharmaceutical & biopharma R&D expansion

- 4.2.3 Regulatory focus on food-safety & environment

- 4.2.4 Growth of clinical diagnostics & precision-medicine

- 4.2.5 Real-time PAT needs in continuous bioprocessing

- 4.2.6 AI-enabled predictive & self-optimising HPLC

- 4.3 Market Restraints

- 4.3.1 High capital & operating costs

- 4.3.2 Shortage of skilled chromatographers

- 4.3.3 Substitution by alternate separation techniques

- 4.3.4 Supply-chain risk for ultrapure solvents & columns

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Product

- 5.1.1 Instruments

- 5.1.2 Consumables

- 5.1.3 Accessories

- 5.2 By Technology

- 5.2.1 Conventional HPLC

- 5.2.2 UHPLC

- 5.2.3 Nano-HPLC

- 5.2.4 Microfluidic-chip HPLC

- 5.3 By Application

- 5.3.1 Pharmaceutical Quality-Control

- 5.3.2 Clinical Research

- 5.3.3 Biopharmaceutical Manufacturing

- 5.3.4 Food & Beverage Testing

- 5.3.5 Environmental Analysis

- 5.3.6 Forensic & Toxicology

- 5.3.7 Other Applications

- 5.4 By End-User

- 5.4.1 Pharmaceutical & Biotechnology Companies

- 5.4.2 CROs & CMOs

- 5.4.3 Academic & Research Institutes

- 5.4.4 Clinical Diagnostic Laboratories

- 5.4.5 Food & Environmental Testing Labs

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Waters Corporation

- 6.3.2 Agilent Technologies Inc.

- 6.3.3 Thermo Fisher Scientific Inc.

- 6.3.4 Shimadzu Corporation

- 6.3.5 Merck KGaA

- 6.3.6 Danaher Corporation (Cytiva)

- 6.3.7 Bio-Rad Laboratories Inc.

- 6.3.8 PerkinElmer Inc.

- 6.3.9 Gilson Inc.

- 6.3.10 Mitsubishi Chemical Corporation

- 6.3.11 Tosoh Corporation

- 6.3.12 Hitachi High-Tech Corporation

- 6.3.13 Hamilton Company

- 6.3.14 JASCO Inc.

- 6.3.15 KNAUER Wissenschaftliche Gerate GmbH

- 6.3.16 Phenomenex Inc.

- 6.3.17 YMC Co., Ltd.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment