PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1689727

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1689727

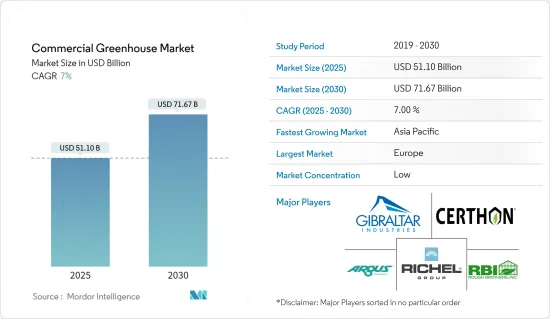

Commercial Greenhouse - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Commercial Greenhouse Market size is estimated at USD 51.10 billion in 2025, and is expected to reach USD 71.67 billion by 2030, at a CAGR of 7% during the forecast period (2025-2030).

A commercial greenhouse is a specialized structure designed for cultivating crops intended for sale. These greenhouses are equipped with advanced technology to optimize the growth of specific plants, including vegetables, flowers, trees, cannabis, and shrubs. Some have transparent roofs to harness natural sunlight, while others use artificial lighting. When exposed to sunlight, commercial greenhouses trap warm air, creating a temperature-controlled environment that shields plants from cold weather. The growing global population, increased food demand, rising global warming, and the need to enhance crop productivity drive the commercial greenhouse market. Advanced greenhouse techniques are being implemented in Europe, especially in countries like Italy, Spain, and the Netherlands, where significant areas are dedicated to greenhouse cultivation.

The diminishing availability of cultivable land contributes to the rise of greenhouse farming. For example, Germany experienced reduced agricultural land from 166.6 million hectares in 2019 to 165.0 million hectares in 2023. Consequently, maximizing crop yield within the limited land area to meet food demand propels the greenhouse farming market. Additionally, climate fluctuations are encouraging farmers across the world to adopt greenhouse farming methods, leading to the market's growth. However, high initial setup costs and a lack of technical expertise among farmers may hinder market expansion during the forecast period.

Commercial Greenhouse Market Trends

Declining Agricultural Land is Boosting the Usage of Commercial Greenhouse

Global agricultural land is diminishing due to urban expansion and infrastructure development encroaching on fertile areas. This reduction in available land puts strain on existing agricultural resources, leading to soil degradation and decreased food security. To tackle these challenges, investments in commercial greenhouse farming and controlled-environment agriculture (CEA) within commercial greenhouses are rising.

Over the past decade, Europe has witnessed a decline in agricultural land. The EU Agriculture Outlook predicts that by 2030, Europe's total arable land will decrease further due to urbanization, emphasizing the need to utilize agricultural areas efficiently. With population growth and rapid urban development, there is a pressing demand to enhance crop yields in the coming decades. Consequently, the adoption of cultivation methods like commercial greenhouse farming is increasing to achieve higher productivity.

Globally, significant portions of arable land have been lost due to erosion and pollution over the past 40 years. This loss has potentially dire consequences for the global food supply. Rising temperatures, unpredictable rainfall patterns, and extreme weather events, such as droughts and floods, render large areas unsuitable for traditional agriculture. As a result, there is an increasing demand for climate-resilient crops and adaptation technologies, including heat-resistant commercial greenhouses, which are expected to increase adoption during the forecast period.

Europe Holds the Largest Share in Commercial Greenhouse Installment

Germany has traditionally been at the forefront of implementing advanced techniques in smart greenhouse horticulture. The total area under commercial greenhouse cultivation in Germany was 1300 hectares in 2023. Most of this area was occupied by tomato crops, with an acreage of 382.74 hectares. Similarly, the cultivation area under cucumber was 215 hectares. The most extensive areas of commercial greenhouse vegetable cultivation in Germany are North Rhine Westphalia, Rhineland Palatinate, and Lower Saxony. Additionally, subsidies for energy-efficient greenhouses, covering up to 60% of eligible expenses, help reduce operating costs.

Moreover, the commercial growth of greenhouses has increased on a massive scale in the United Kingdom. Many companies in the United Kingdom are leveraging new technologies. For instance, in March 2022, Tomtech designed and produced industrial control and monitoring equipment for commercial greenhouses. Their systems use sensors to automatically track and regulate light, heat, air circulation, irrigation, fertigation, and fertilizer dosing to maintain the greatest possible growth environment.

Commercial Greenhouse Industry Overview

The commercial greenhouse market is highly fragmented, with numerous large, small, and medium-sized manufacturers. The top players in the market include Richel Group, Rough Brothers Inc., Argus Control System Ltd, Certhon, and Gibraltar Industries (Nexus Corporation). Along with innovations and expansions, investments in R&D and developing novel product portfolios are crucial strategies to enter the market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Declining Agricultural Land is Boosting the Commercial Greenhouse Usage

- 4.2.2 Increased Demand for Food is Boosting the Market

- 4.2.3 Fluctuating Climatic Conditions are Fueling the Commercial Greenhouse Market

- 4.3 Market Restraints

- 4.3.1 High Initial Investments Preventing Farmers from Adopting Commercial Greenhouses

- 4.3.2 Requirement of Precision Agriculture for Increasing Productivity

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Equipment Type

- 5.1.1 Heating Systems

- 5.1.2 Cooling Systems

- 5.1.3 Other Equipment Types

- 5.2 Crop Type

- 5.2.1 Horticulture Crops

- 5.2.1.1 Fruits and Vegetables

- 5.2.1.2 Flowers and Ornamentals

- 5.2.1.3 Herbs

- 5.2.2 Other Crop Types

- 5.2.1 Horticulture Crops

- 5.3 Greenhouse Type

- 5.3.1 Glass Greenhouses

- 5.3.2 Plastic Greenhouse

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Russia

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 South Africa

- 5.4.5.2 Egypt

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Richel Group

- 6.3.2 Argus Control Systems Ltd

- 6.3.3 Rough Brothers Inc.

- 6.3.4 Certhon

- 6.3.5 Logiqs BV

- 6.3.6 Lumigrow Inc.

- 6.3.7 Gibraltar Industries (Nexus Corporation)

- 6.3.8 International Greenhouse Company

- 6.3.9 Heliospectra AB

- 6.3.10 Agra Tech Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS