PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1689696

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1689696

India Contract Manufacturing Organization (CMO) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

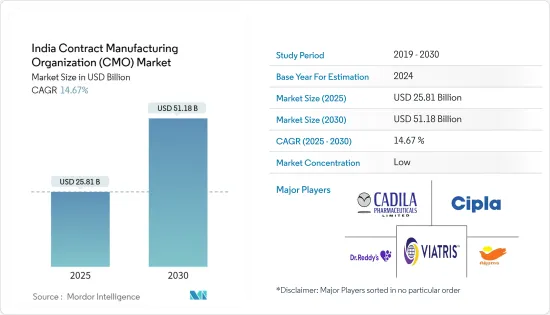

The India CMO Market size is estimated at USD 22.51 billion in 2024, and is expected to reach USD 44.63 billion by 2029, at a CAGR of 14.67% during the forecast period (2024-2029).

Contract manufacturing organizations (CMOs) provide drug development and manufacturing services to the pharmaceutical industry under contractual agreements. With a rising demand for injectable drugs, especially in cancer research, the contract manufacturing market is set to expand. Injectable drugs promise higher returns than other formulations and demonstrate superior therapeutic efficiency.

Key Highlights

- CMOs adhere to stringent regulations and boast a skilled workforce, cutting-edge manufacturing facilities, and a cost-effective service portfolio. Heightened competition in the pharmaceutical sector underscores the urgency of swiftly launching products, aiming for a pioneering market position. Consequently, the push for earlier product launches, mounting pricing pressures, and the advantages offered by CMOs-like reduced timelines and high-quality products at competitive costs-serve as primary market drivers.

- The Indian pharmaceutical landscape encompasses significant segments, including generic drugs, OTC medicines, vaccines, bulk drugs, contract research and manufacturing, biosimilars, and biologics. Notably, India stands out as a leading supplier of affordable vaccines.

- Boasting 60% of the global vaccine production, India meets 40-70% of the World Health Organization's (WHO) demand for diphtheria, pertussis, and tetanus (DPT) and Bacillus Calmette-Guerin (BCG) vaccines, alongside a dominant 90% share for the measles vaccine. Such vast production capabilities position India as a potential growth driver for the studied market.

- In 2023, the Indian government, as per the Central Drugs Standard Control Organization, greenlit 21 new drugs targeting various genetic diseases. This move paves the way for local players to establish new facilities, addressing the surging medicine demand. Additionally, India plays a pivotal role as a pharmaceutical exporter, with the U.S. notably relying on Indian imports and establishing plants there.

- However, challenges loom on the horizon. Stringent government regulations and declining approvals for small molecules and biologics in specific regions could stifle market growth. Moreover, smaller CDMOs face heightened error risks due to a lack of advanced technology. Concerns over subpar quality and pricing challenges further complicate market expansion efforts.

India CMO Market Trends

Rise in Outsourcing Volume by Big Pharma Companies

- The Indian Drug Manufacturers Association (IDMA) highlighted that rising costs and regulatory pressures in developed markets are compelling global pharmaceutical companies to reduce their internal capacities in research, development, and manufacturing. Instead, these companies are increasingly turning to contract manufacturing, research services, and outsourcing of research and clinical trials in developing nations. Additionally, ageing manufacturing facilities in Europe have led companies to shift their research and manufacturing operations to India.

- Developing a biological Active Pharmaceutical Ingredient (API) is a technically challenging and capital-intensive, making its production cost significantly higher than conventional drugs. Notably, around 75% of the revenue from outsourcing biologics is derived from API production. Recognizing the high value and margins associated with biologic drugs, Contract Manufacturing Organizations (CMOs) heavily invest in expanding their capacities. However, pharmaceutical companies prioritize supply security over direct investments in manufacturing.

- The trend of rising outsourcing in the pharmaceutical sector is paving the way for successful partnerships, with contract manufacturing becoming a vital component of their value chains. The market is witnessing substantial growth, driven by an increasing number of large pharmaceutical companies in India seeking to outsource products domestically.

- As per the Union Budget of India, the pharmaceutical industry's budget allocation in 2020 was INR 3.34 billion (approximately USD 0.04 billion). This allocation was projected to surge to INR 40.9 billion (around USD 0.49 billion) by 2024. The global market is expanding, largely due to the cost-effective resources available in developing nations like India.

- India stands out as a favored destination for CMOs, boasting over 100 US FDA-approved manufacturing facilities, a number that's on the rise. The robust presence of major players like Zydus Cadila and LUPIN further strengthens the country's pharmaceutical landscape.

The Active Pharmaceutical Ingredient (API) and Intermediates Segment to Witness Growth

- The manufacturing of APIs has consistently increased over the past few years. This will continue to rise steadily, with further patent expiries expected in the future and a significant increase in global generic production capacities. Most businesses in the industry emphasize creating biological APIs and boosting API production.

- Furthermore, increased initiatives by the Indian government in the healthcare field, biologics innovation, and an increase in cancer and age-related disorders are just a few of the vital reasons propelling the expansion of the API manufacturing industry. The expansion could also be due to expanding R&D on medication, rising chronic illness rates, growing generic relevance, and rising biopharmaceutical usage.

- The Indian pharmaceutical industry produces a variety of bulk pharmaceuticals, which are active pharmaceutical ingredients that serve as the basic raw materials for formulations. Formulations comprise the remaining four-fifths of the industry's output, with bulk pharmaceuticals making up about one-fifth. The nation also possesses expertise in active pharmaceutical ingredients (APIs), as it is the manufacturer of more than 500 APIs and the source of 60,000 generic brands in 60 therapeutic categories.

- India also benefits from expanding the domestic CMO market by encouraging investments in pharmaceutical businesses to establish wholly-owned or joint venture facilities. According to the data by Invest India on the distribution of pharmaceutical exports from India as of April 2023, formulations and biologicals took the top position with 73.31%, followed by bulk drugs, intermediates, and other components. The cost structure in China and India has also diverged as China has become a more expensive outsourcing destination. Also, companies from the United States and Europe aim to diversify their supply chains, benefiting India.

- India, a significant player in the production and export of generic medications, has grown wary of its reliance on China. To bolster domestic production, the Indian government has initiated several measures. Responding to the stark realization of India's heavy dependence on Chinese imports, the government unveiled a substantial USD 400 million grant to bolster the country's API production. This move triggered a significant surge in the stock prices of key API players, including Lasa Supergenerics, Shilpa Medicare, Gujarat Themis, and Solara Active Pharma.

India CMO Industry Overview

Contract manufacturing organizations (CMOs) offer production services tailored for pharmaceutical and biotechnology firms. Acting on behalf of these entities, CMOs produce drugs, medicines, and therapies. They take a developed drug formula and scale production based on the client's demand. CMOs prioritize safety, consistency, and adherence to regulatory standards in their production processes.

The Indian contract manufacturing organization (CMO) market is fragmented, with the top vendors accounting for a significant market share. Apart from these major players, several players in the market are investing in innovations and partnerships to gain an increased market share. Therefore, the intensity of competitive rivalry is high. The key players are Dr Reddy's Laboratories, Cadila Pharmaceuticals Limited, and Cipla Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Ecosystem Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Availability of Skilled Labor at Relatively Lower Cost

- 5.1.2 Sustained Increase in Outsourcing Volumes by Big Pharma Companies

- 5.1.3 Geographical Advantage in the Form of Access to Large Markets in the APAC Region

- 5.2 Market Restraint

- 5.2.1 The Existence of Stringent Government Restrictions and a Decrease in the Approval of Numerous Small Molecules and Biologics in Specific Regions of the Nation

- 5.3 Overview of the Global Pharmaceutical CMO Industry and Major Cues Identified in the Indian Market

- 5.4 Overview of Major Markets in Asia-Pacific

- 5.5 Major Hotspots for CMO Facilities in Maharashtra and Telangana

- 5.6 Recent Private Equity Investments in the CMO Industry in India

6 MARKET SEGMENTATION

- 6.1 By Service Type

- 6.1.1 API and Intermediates

- 6.1.2 Finished Dose

- 6.1.2.1 Solids

- 6.1.2.2 Liquids

- 6.1.2.3 Semi-solids and Injectables

7 STRATEGIC RECOMMENDATIONS ON INDIA CMO INDUSTRY

- 7.1 India Remains a High Proposition for New Vendors Planning to Set Up Their CMO Facilities, Specifically in the Injectables Domain, Mainly Due to Growth in Domestic Demand and Generic Drugs

- 7.2 Cost Advantages and Access to Talent Pool

- 7.3 Regulatory Approval Pipeline and Base Case Scenarios

- 7.4 Analysis of Potential M&A Targets in India

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Dr. Reddy's Laboratories

- 8.1.2 Cadila Healthcare Limited

- 8.1.3 MSN Laboratories Pvt Ltd

- 8.1.4 Viatris Inc (Mylan Laboratories Ltd)

- 8.1.5 Medipaams India Pvt Ltd

- 8.1.6 Cipla Ltd.

- 8.1.7 Eisai Pharmaceuticals India Pvt Ltd

- 8.1.8 Delwis Healthcare Pvt Ltd

- 8.1.9 Maxheal Pharmaceuticals India Ltd

- 8.1.10 Rhydburg Pharmaceuticals Ltd

- 8.1.11 Theon Pharmaceuticals Limited

- 8.1.12 BDR Pharmaceuticals International

- 8.1.13 Akums Drugs and Pharmaceuticals Limited

- 8.1.14 Wockhardt Limited

- 8.1.15 Unichem Laboratories Ltd

- 8.1.16 Ciron Drugs & Pharmaceuticals Pvt Ltd

9 FUTURE OUTLOOK OF THE MARKET