PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687941

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687941

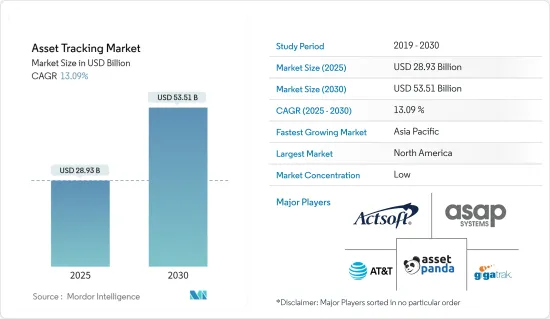

Asset Tracking - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Asset Tracking Market size is estimated at USD 28.93 billion in 2025, and is expected to reach USD 53.51 billion by 2030, at a CAGR of 13.09% during the forecast period (2025-2030).

Key Highlights

- Asset management and tracking solutions are essential to achieve greater operational efficiencies in the current market scenario of rapid digitalization in manufacturing environments and office spaces. The asset tracking technology is deployed as hardware, including GPS, RFID, BLE, QR codes, and software for on-premises and cloud deployment.

- Recent advancements in IoT technology have enabled several end users, such as transportation and logistics, manufacturing, and food and beverage, to acquire economical and efficient asset-tracking hardware. For instance, in the healthcare segment, hospitals and other healthcare facilities must closely monitor the status of medical equipment due to its high cost to deter theft and ensure ongoing accessibility. The hospital tracking system enables real-time monitoring of supplies and equipment. It may give patients the care they need and significantly raise the standard of patient care.

- Industry 4.0 has aided early digitalization adopters in the industrial segment by saving time and resources on new projects. Asset tracking is the most beneficial and necessary aspect of this digitization. Mobile application tools and cloud-based asset tracking and monitoring significantly reduce the time and effort required to find and track assets. With continuous, real-time location and condition tracking and commodity evaluation, these systems improve efficiency at building sites. Corporate leaders prefer solution providers that offer cloud solutions as they require a robust asset monitoring solution with the proper IoT technology ability for large sites and operations.

- Post-pandemic, the market is witnessing considerable growth driven by the proliferation of IoT in various end-user industries, coupled with the growing demand to track and manage assets effectively. In addition, the market has witnessed substantial technological advancements in hardware and software in asset-tracking technology, positively impacting the growth of the asset-tracking market post-pandemic.

- Although the high initial costs are restraining the market growth, it is stimulated by the rising demand from third-party logistics players through value-added tracking services and the growing adoption of IoT devices for asset tracking. IoT-based asset tracking is gaining substantial traction as it leverages sensors and connected devices to remotely monitor and track an asset's geo position and movements. Also, IoT technology offers significant growth opportunities for monitoring assets, achieving efficiency gains, and implementing new business models for companies, notably in the industrial, transport, and logistics services.

Asset Tracking Market Trends

Manufacturing to be the Largest End-user Industry

- With the growing popularity of Industry 4.0 and smart factories, it has become necessary for manufacturing sectors to adopt advanced digital technologies to improve manufacturing processes. Industries widely adopt asset tracking to track and monitor asset location and status.

- Asset monitoring technologies are widely used in manufacturing facilities to monitor the movement and storage of raw materials, work-in-progress, and finished goods. Due to real-time tracking data, the supply chain's operations are streamlined, and stockouts are minimized.

- Advanced asset tracking technology, such as IoT and Bluetooth Low Energy (BLE), is rapidly gaining traction in the manufacturing industry. BLE tags come in many sizes, shapes, and capabilities, making it easy for manufacturers to tackle that first use case. Whether parts or equipment, asset tracking incorporates internet of things (IoT) advancements with thin tags that may be automatically tracked throughout the factory or yard. These advanced asset-tracking solutions with IoT are expected to enrich the asset-tracking solutions in the manufacturing sector, thus increasing the market's growth.

- The need to monitor multiple plant locations simultaneously to get real-time information about the process, operations, and inventory is expected to boost the growth of asset tracking in the manufacturing sector. Innovative asset-tracking solutions with IoT and Industrial IoT are anticipated to enrich the asset-tracking solutions. The growing IoT connectivity is leading to increasing demand for IoT asset-tracking devices.

- For instance, according to Telenor IoT, there are approximately 14 billion connected IoT devices in deployment, which exceeds the number of non-IoT connected devices, such as smartphones, tablets, PCs, and fixed-line telephones. This number is expected to grow to 30 billion in 2025. These devices play a crucial role in monitoring, locating, and managing assets remotely, which can enhance efficiency, improve security, and optimize utilization across various industries. The expanding IoT ecosystem is driving the adoption of such tracking devices to better manage and monitor assets in real-time.

- The growing shift toward smart factories, Industry 4.0, and digitization of the manufacturing sector is expected to provide a promising future for the market's growth during the forecast period.

North America Holds Largest Market Share

- North America is expected to account for a significant market share of the asset tracking market, owing to the high adoption rate of advanced technologies in countries across the United States and Canada.

- Canada and the United States have suffered similar supply chain logistics challenges, such as road and rail bottlenecks near borders and key ports. Significant weather disasters, worker shortages, security interruptions, and work stoppages due to material scarcity have underscored the necessity of redundancy and planning.

- The significant growth in the food and beverage segment in the United States and Canada and the adoption of advanced technologies contribute to the market's growth rate. The food and beverage segment is vital to the US economy. The industry accounts for around 5% of the nation's GDP and 10% of employment, including agriculture, manufacturing, retail, and foodservice. The US Committee for Economic Development reports that the food and beverage segment includes nearly 27,000 businesses and employs around 1.5 million people.

- Canada is also setting up its independent Supply Chain Task Force to confer with business leaders, employees, and industry experts to develop recommendations for both immediate and long-term solutions to logistical supply chain issues. Their shared determination to address supply chain logistics issues supports long-standing cooperation in transport logistics between Canada and the United States. This partnership ranges from joint management of the Great Lakes St. Lawrence Seaway System to implementing intelligent transportation systems, which allow commercial vehicles access to real-time border delay information.

- As the healthcare segment in the region is also witnessing incremental growth, the key players are innovating asset-tacking solutions. For instance, in February 2024, Geotab Inc. launched the Geotab GO Anywhere asset tracker. This hardware solution is designed to improve how companies manage and monitor their assets across various industries, such as transportation, shipping and supply chain, mining, construction, and government.

- These strategic collaborations and product launches aim to provide various industries, such as logistics, manufacturing, and food and beverages, with solutions that meet the current demand and technologies, boost the adoption rate, and consequently result in a growth rate in the region.

Asset Tracking Market Overview

The asset tracking market is highly competitive, with many significant vendors and the emergence of new market vendors. Solution providers are heavily investing in multiple R&D activities to improve existing asset-tracking solutions and launch new solutions by integrating the latest technological developments. Companies view global expansion as a path to attracting maximum market share. Some of the key players in the market are Asset Panda LLC, ActSoft Inc., Touma Incorporated (ASAP Systems), AT&T Inc., and GigaTrak (P&T Solutions Inc.).

- March 2024: HSBC Asset Management launched the India Tech Ucits ETF. This ETF aims to give investors global access to a broad spectrum of technology-driven Indian enterprises. It encompasses a variety of sectors, showcasing companies deeply entrenched in digital technology, communication, and software-related activities.

- January 2024: BioConnect acquired Silent Partner Technologies Inc., a leading RFID Inventory and asset management software provider. This acquisition will help BioConnect expand its leading Trusted Security Platform to create the most advanced cloud-based smart safes, lockers, cabinets, rooms, and vehicles for the intelligent "chain of custody" and security assurance for any critical asset.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Value Chain Analysis

- 4.4 Assessment of Impact of Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand from Third-party Logistics Players through Value-add Tracking Services

- 5.1.2 Increasing Adoption of IoT Devices for Asset Tracking

- 5.2 Market Restraints

- 5.2.1 High Initial Cost of Asset Tracking Software

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Hardware

- 6.1.2 Software

- 6.2 By Deployment Type

- 6.2.1 On-cloud

- 6.2.2 On-premise

- 6.3 By End-user Industry

- 6.3.1 Transportation and Logistics

- 6.3.2 Aviation

- 6.3.3 Healthcare

- 6.3.4 Manufacturing

- 6.3.5 Food and Beverages

- 6.3.6 Other End-user Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia

- 6.4.4 Australia and New Zealand

- 6.4.5 Latin America

- 6.4.6 Middle East and Africa

7 CONSUMER ASSET TRACKING MARKET

- 7.1 Consumer Asset Tracking Market Overview

- 7.2 By Consumer Asset Tracking Type

- 7.2.1 Family and Child Tracking

- 7.2.2 Pet Tracking

- 7.2.3 Consumer Vehicle Tracking

- 7.2.4 Other Consumer Asset Tracking Types

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Actsoft Inc.

- 8.1.2 Touma Incorporated (ASAP Systems)

- 8.1.3 Asset Panda

- 8.1.4 AT & T Inc.

- 8.1.5 GigaTrak (P&T Solutions Inc.)

- 8.1.6 OnAsset Intelligence Inc.

- 8.1.7 Fleet Complete

- 8.1.8 Oracle Corporation

- 8.1.9 Spireon Inc.

- 8.1.10 Trimble Inc.

- 8.1.11 Zebra Technologies Corporation

- 8.1.12 Verizon Communications Inc.

- 8.1.13 Ubisense Limited

- 8.1.14 TIVE

9 INVESTMENT ANALYSIS

10 MARKET OPPORTUNITIES AND FUTURE TRENDS