PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851082

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851082

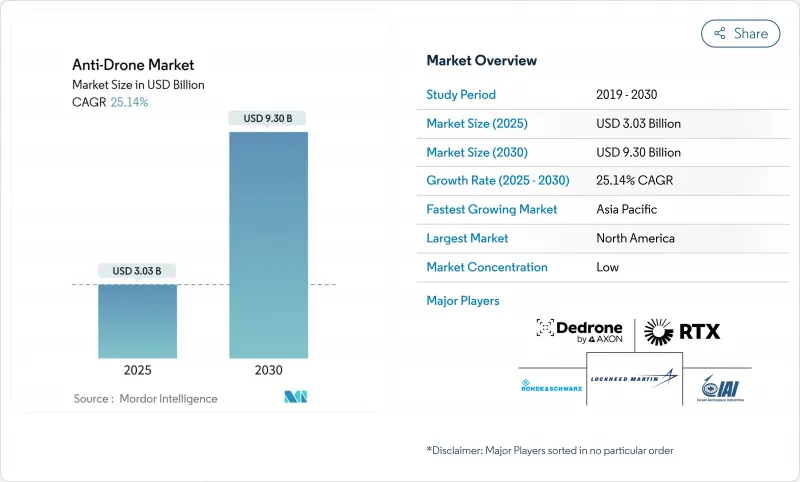

Anti-Drone - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The anti-drone market size reached USD 3.03 billion in 2025 and is forecasted to climb to USD 9.3 billion by 2030, advancing at a 25.14% CAGR.

Rapid scale-up reflects the shift from niche perimeter security toward indispensable layered air-defense, spurred by weaponized-drone proliferation in active conflict zones and rising threats to national energy grids. North America accounts for the largest slice of 2024 revenue at 41.25% because federal aviation rules mandate airport UAS detection, and the Pentagon redirected USD 50 billion to counter-UAS programs. Asia-Pacific records the fastest growth at a 25.66% CAGR through 2030 as joint Japan-US microwave projects and China's drone-production boom alter regional force balances. Detection systems dominate current demand with a 55.43% share, yet neutralization solutions post the quickest gains, underscoring procurement priorities moving from situational awareness to hard-kill effects. Platform preferences mirror this evolution: ground-fixed arrays still lead, but drone-mounted interceptors are scaling fast as drone-on-drone engagements grow common on modern battlefields.

Global Anti-Drone Market Trends and Insights

Proliferation of Low-Cost Commercial Drones Enabling Asymmetric Threats

Commercial quadcopters converted into loitering munitions now flood battlefields, with Ukraine alone procuring an annual 2.5 million units under contracts spanning 76 domestic firms. The capacity of USD 500 hobby drones to disable multi-million-dollar armor has upended traditional cost-exchange ratios, accelerating anti-drone market demand among armed forces that historically relied on conventional air defense. NORAD logged 350 unauthorized UAV events at US military facilities in one year, a data point that broadened the perceived risk envelope to homeland installations. Similar incidents targeting pipelines, depots, and transport hubs prove that critical infrastructure is equally exposed. Procurement agencies consequently favor scalable counter-UAS networks that marry fixed sensors with mobile effectors to counter this diffuse threat profile. The supply push from emergent domestic drone makers and cheap online component availability ensures that proliferation pressures will remain high through the decade.

Stringent Air-Space Security Mandates

The FAA's phased evaluations in New Jersey, New Mexico, North Dakota, and Mississippi produced 46 actionable directives for integrating drone-detection and mitigation tools into the National Airspace System.[1]Through EASA's updated Remote ID and cybersecurity rules, parallel European regulatory consolidation forces airports, heliports, and critical infrastructure to field certified counter-UAS suites. Compliance triggers immediate capital-expenditure cycles because operators must prove real-time situational awareness and response capability to retain operating licenses. Insurance carriers amplify urgency by linking coverage to the presence of approved technologies at venues that host crowds above 30,000. These intertwined mandates transform counter-drone adoption from discretionary spend into a regulated necessity, broadening the anti-drone market beyond military contracting.

Ambiguous Legality of RF Jamming and Kinetic Interdiction

Statutory authority for active drone neutralization is largely confined to a handful of US federal departments, leaving state and local law enforcement hamstrung when rogue UAVs threaten stadiums or chemical plants. Internationally, similar legal gray zones limit market uptake for RF jammers and directed-energy interceptors outside military domains. The proposed Defense Act seeks to grant vetted public-safety entities access to approved counter-drone tools, yet its passage timeline remains uncertain. In Europe, electronic-warfare emissions face strict spectrum-management rules, curbing the rapid deployment of high-power devices. Until global regulators harmonize rules on proportional use of force in civilian skies, many operators will deploy detection-only solutions, tempering revenue growth for effectors inside the anti-drone market.

Other drivers and restraints analyzed in the detailed report include:

- Drone Incursions Around Critical Energy Assets

- AI-Powered Sensor-Fusion Boosting Detection Accuracy in Urban RF Clutter

- High False-Alarm Rates in 5G-Dense Urban Zones

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Detection platforms generated 55.43% of 2024 revenue, underscoring their role as the entry point into the anti-drone market. Early deployments revolved around stand-alone radar or RF finders at runways, forward operating bases, and energy hubs. Software-defined upgrades now allow sensor-fusion overlays that elevate multi-modal accuracy without additional hardware swaps. AI-driven classification further trims operator workload, a critical benefit as threat volumes escalate. Moving forward, procurement budgets increasingly bundle detection nodes with command-and-control software that visualizes airspace on common operating pictures accessible to civilian and military stakeholders in real time.

Neutralization technologies, while smaller today, are scaling at a 29.52% CAGR as operators move beyond "see" to "stop". Directed-energy systems such as Lockheed Martin's HELIOS laser have recorded at-sea interceptions that cost pennies per shot compared with missiles. Radio-frequency high-power microwave guns are entering serial production, providing short-burst pulses that fry drone electronics without kinetic debris. Kinetic interceptors, from networked 40mm smart rounds to micro-UAV dogfighters, give commanders layered options across engagement ranges. These advances significantly broaden the anti-drone market appeal among end users who must comply with safety rules prohibiting falling shrapnel over populated areas. The technology race centres on open-architecture command software that can accept future effectors without forcing expensive rip-and-replace cycles, reinforcing vendor lock-in for early movers.

Ground-fixed arrays controlled 42.12% of 2024 spending as airports, prisons, and petrochemical sites installed mast-mounted radars, panoramic cameras, and electronic warfare emitters. Their broad coverage and continuous power supply fit static facilities that must secure defined perimeters around the clock. Integration with access-control and emergency-response networks helps operators maintain compliance with the dashboards regulators require. Advances in containerized shelters now let fixed systems relocate within hours, supporting expeditionary bases that need semi-permanent coverage.

UAV-mounted counter-UAS platforms post a striking 26.32% CAGR because drone-on-drone engagements excel in dynamic theatres where ground line-of-sight is obstructed. Autonomous interceptors such as the MARSS Interceptor-MR chase hostile drones beyond 5km and terminate threats without explosives, reducing collateral risk. Ground-mobile systems mounted on MRAPs fill the gap between static sites and airborne hunters, enabling maneuver units to protect convoys. Hand-held jammers and rifle-shaped disruptors give individual soldiers last-ditch options inside 1km bubbles. Naval forces adopt deck-mounted lasers and RF disruptors as unmanned threats migrate offshore, signalling that no domain of operation is exempt from the expanding anti-drone market.

The Anti-Drone Market Report is Segmented by Application (Detection Systems and Neutralization/Counter-Measure Systems), Platform Type (Ground-Fixed, UAV-Based Counter UAS, and More), End-Use Vertical (Military and Defense, Critical Infrastructure, and More), Operating Range (Short-Range, Medium-Range, and More), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retains leadership with 41.25% of 2024 revenue. Federal rule-making compels airports to field detection networks, while the Pentagon's USD 50 billion realignment funds multi-tier counter-UAS architectures. Domestic primes such as RTX and Northrop Grumman secure serial production lots, and venture-backed challengers like Anduril win AI-centric contracts from the Marine Corps. Consolidation continues: Axon's Dedrone deal and AeroVironment's BlueHalo buyout aim to fold niche capabilities into broader command-and-control stacks. Municipal demand accelerates as insurance firms insist that stadiums and city festivals integrate approved gear before issuing coverage, deepening civilian uptake across the anti-drone market.

Asia-Pacific is the fastest climber at a 25.66% CAGR. Tokyo and Washington co-develop high-power microwave weapons while Beijing expands laser-based counter-UAS production lines under CASIC. Seoul's naval drone-carrier concepts underscore how regional forces design blue-water platforms around integrated unmanned threat envelopes. Defense modernization funds across Australia, India, and Taiwan allocate record shares to counter-drone, hoping to blunt mass-swarm tactics observed during recent conflicts. Dual-use industrial programs receive government subsidies, ensuring domestic supply resilience as export-control regimes tighten. This convergence of military urgency and industrial policy propels sustained anti-drone market expansion across the region.

Europe delivers steady uptake on the back of coordinated procurement under the European Defence Fund. Projects like the Thales-led EISNET consortium knit 23 companies into a shared roadmap for integrated air-and-missile defense against drone swarms. The UK bankrolls DragonFire lasers, Germany fields CICADA interceptors, and France procures PARADE systems for national events. Regulatory harmonization through EASA removes cross-border hurdles, letting airports deploy common Remote ID and cybersecurity baselines. Domestic champions push sovereign supply chains to reduce exposure to imported gallium nitride power amps. These initiatives cement Europe as a technology innovator and significant consumer within the global anti-drone market.

- Dedrone Holdings, Inc.

- RTX Corporation

- Rohde & Schwarz India Pvt. Ltd.

- Lockheed Martin Corporation

- Israel Aerospace Industries Ltd.

- Saab AB

- Thales Group

- QinetiQ Group

- Anduril Industries, Inc.

- Leonardo S.p.A

- Northrop Grumman Corporation

- Rheinmetall AG

- CACI International Inc

- Honeywell International, Inc.

- Meteksan Defence Industry Inc.

- Drone Defence Services Ltd.

- DeTect, Inc

- Chess Technologies Ltd.

- OpenWorks Engineering Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Proliferation of low-cost commercial drones enabling asymmetric threats

- 4.2.2 Stringent air-space security mandates (FAA Airport UAS Detection, EU U-space)

- 4.2.3 Drone incursions around critical energy assets

- 4.2.4 AI-powered sensor-fusion boosting detection accuracy in urban RF clutter

- 4.2.5 Defense budget reallocation post Ukraine conflict toward layered C-UAS

- 4.2.6 Insurance-led liability clauses for stadiums and events

- 4.3 Market Restraints

- 4.3.1 Ambiguous legality of RF jamming and kinetic interdiction in civilian airspace

- 4.3.2 High false-alarm rates in 5G-dense urban zones

- 4.3.3 SWaP constraints for mobile/tactical platforms

- 4.3.4 GaN power-amp supply bottlenecks for high-energy lasers

- 4.4 Value Chain Analysis

- 4.5 Regulatory and Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Technology

- 5.1.1 Detection Systems

- 5.1.2 Neutralization/Counter-Measure Systems

- 5.2 By Platform Type

- 5.2.1 Ground-Fixed

- 5.2.2 Ground-Mobile (Vehicle-mounted)

- 5.2.3 Hand-Held

- 5.2.4 UAV-based Counter-UAS

- 5.2.5 Naval-based

- 5.3 By End-Use Vertical

- 5.3.1 Military and Defense

- 5.3.2 Homeland Security and Law Enforcement

- 5.3.3 Critical Infrastructure

- 5.3.4 Commercial and Public Venues (Stadiums, Theme Parks)

- 5.3.5 VIP Protection

- 5.4 By Operating Range

- 5.4.1 Short-Range (Less than 1 km)

- 5.4.2 Medium-Range (1-5 km)

- 5.4.3 Long-Range (Greater than 5 km)

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Rest of Europe

- 5.5.4 Middle East and Africa

- 5.5.4.1 Middle East

- 5.5.4.1.1 Saudi Arabia

- 5.5.4.1.2 United Arab Emirates

- 5.5.4.1.3 Rest of Middle East

- 5.5.4.2 Africa

- 5.5.4.2.1 South Africa

- 5.5.4.2.2 Rest of Africa

- 5.5.5 Asia-Pacific

- 5.5.5.1 China

- 5.5.5.2 India

- 5.5.5.3 Japan

- 5.5.5.4 South Korea

- 5.5.5.5 Rest of Asia-Pacific

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials, Strategic Info, Market Rank/Share, Products and Services, Recent Developments)

- 6.3.1 Dedrone Holdings, Inc.

- 6.3.2 RTX Corporation

- 6.3.3 Rohde & Schwarz India Pvt. Ltd.

- 6.3.4 Lockheed Martin Corporation

- 6.3.5 Israel Aerospace Industries Ltd.

- 6.3.6 Saab AB

- 6.3.7 Thales Group

- 6.3.8 QinetiQ Group

- 6.3.9 Anduril Industries, Inc.

- 6.3.10 Leonardo S.p.A

- 6.3.11 Northrop Grumman Corporation

- 6.3.12 Rheinmetall AG

- 6.3.13 CACI International Inc

- 6.3.14 Honeywell International, Inc.

- 6.3.15 Meteksan Defence Industry Inc.

- 6.3.16 Drone Defence Services Ltd.

- 6.3.17 DeTect, Inc

- 6.3.18 Chess Technologies Ltd.

- 6.3.19 OpenWorks Engineering Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment