PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910564

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910564

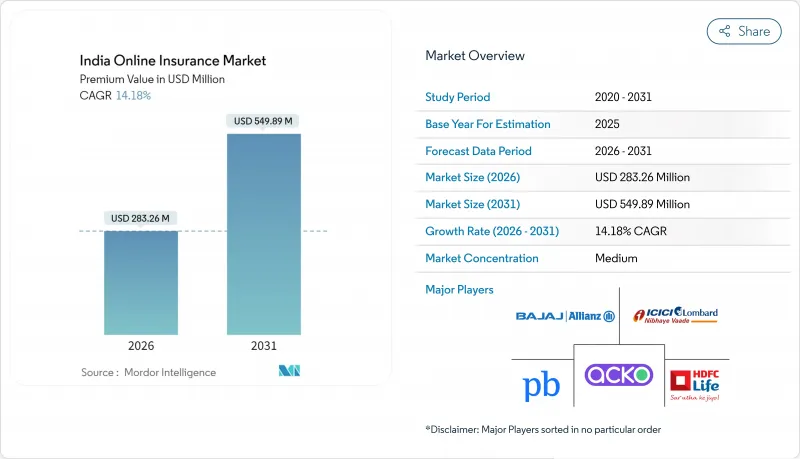

India Online Insurance - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

India online insurance market size in 2026 is estimated at USD 283.26 million, growing from 2025 value of USD 248.08 million with 2031 projections showing USD 549.89 million, growing at 14.18% CAGR over 2026-2031.

Rapid smartphone adoption, the proliferation of UPI-based recurring payments, and IRDAI's push toward e-insurance are the primary growth engines propelling the India online insurance market. Lower digital acquisition costs encourage insurers to double down on mobile-first design, while sandbox approvals accelerate the rollout of usage-based products that rely on real-time data. Embedded insurance collaborations with e-commerce and BNPL players continue to open new customer funnels, and rising specialty-line demand fosters product diversification. Competitive intensity remains moderate as digital aggregators, insurtech carriers, and legacy insurers pursue differentiated technology strategies within the India online insurance market.

India Online Insurance Market Trends and Insights

Smartphone-Driven First-Time Policy Purchases

Surging to 600 million users, smartphones provide the first digital insurance touchpoint for many Indians, especially in tier-2 and tier-3 cities where agency networks are sparse. Vernacular interfaces guide new buyers through policy features, while Aadhaar-based KYC cuts issuance time from weeks to minutes. Tata AIA breached 1 million app downloads in 2024, underscoring mobile's scalability. App-centric micro-covers with flexible premiums align with sporadic income patterns and reduce acquisition costs by up to 40%. IRDAI's e-insurance mandate further entrenches mobile as the dominant servicing channel across the India online insurance market.

Regulatory Sandbox & Upcoming Bima Sugam Platform

IRDAI's sandbox allows controlled trials of IoT-enabled products, giving early movers a compliance edge. Bima Sugam will unify purchase, comparison, and servicing via open APIs, letting insurers plug into fintech ecosystems for embedded offers. Sandbox-backed usage-based covers in motor and health validate dynamic pricing models powered by real-time data. The "insurance for all by 2047" roadmap underpins a nationwide push into rural areas, reinforcing technology-led distribution. Clearer data-sharing norms inside Bima Sugam reduce compliance opacity and attract fresh capital into the India online insurance industry.

Low Insurance Literacy & Trust Deficit Online

IRDAI surveys show sub-30% insurance literacy, holding back digital uptake despite booming connectivity. Complex jargon and English-only screens deter buyers unfamiliar with coverage nuances. Mis-selling episodes and the 2024 Star Health data breach deepened skepticism, particularly where in-person advice is customary. Rural customers gravitate toward agents who offer personal reassurance over abstract portals. Absence of widely advertised grievance channels for online policies compounds reluctance to embrace the India online insurance market.

Other drivers and restraints analyzed in the detailed report include:

- UPI AutoPay / E-Mandate for Friction-Less Premium Payments

- Usage-Based Motor Insurance via Telematics

- Data-Privacy Compliance Costs under the Digital Personal Data Protection Act

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Property & Casualty accounted for 41.76% of the India online insurance market in 2025, a lead cemented by mandatory motor cover and streamlined digital renewals. Life and Health lines show steady online traction, with health benefiting from post-pandemic awareness and cashless hospital networks. Specialty Lines, though smaller in absolute terms, are projected to expand at a 15.62% CAGR to 2031, spearheaded by cyber insurance for digitizing SMEs and niche offerings like pet cover in major metros. Cyber premiums in Asia-Pacific are set to grow at 50% annually, and India captures a rising share as businesses recognize data-breach exposure. IRDAI's sandbox has also green-lighted parametric and micro-covers, broadening product breadth within the India online insurance market.

Across all lines, regulatory nudges sustain innovation. Health insurers integrate telemedicine to deliver value beyond claims, while life insurers embed investment features and flexible pay schedules. Outcome-based covers, where premiums reflect behavior or results, are moving mainstream in motor and health, nudging incumbents toward data-rich underwriting models. Embedded insurance inside fintech apps blurs conventional line definitions, letting customers assemble multi-risk bundles. As micro-income segments come online, bite-sized term, crop, and accident policies construct on-ramps that expand the India online insurance market size among first-time buyers.

The India Online Insurance Market Report is Segmented by Insurance Type (Life Insurance, Health Insurance, Property & Casualty, Specialty Lines), Customer Segment (Retail/Individual, SME/Commercial, Large Enterprise/Corporate), Device Platform (Mobile App, Desktop/Web), and Geography (India). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Policybazaar

- Acko General Insurance

- ICICI Lombard

- HDFC Life

- Bajaj Allianz General Insurance

- Tata AIA Life

- SBI General Insurance

- Go Digit Insurance

- Reliance General Insurance

- Max Life Insurance

- Star Health & Allied Insurance

- Kotak Mahindra Life

- Edelweiss Tokio Life

- Future Generali India

- Liberty General Insurance

- National Insurance Company

- New India Assurance

- Oriental Insurance

- United India Insurance

- Zuno General Insurance

- Paytm Insurance Broking

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Table of Contents - India Online Insurance Market

2 Introduction

- 2.1 Study Assumptions & Market Definition

- 2.2 Scope of the Study

3 Research Methodology

4 Executive Summary

5 Market Landscape

- 5.1 Market Overview

- 5.2 Market Drivers

- 5.2.1 Smartphone-driven first-time policy purchases

- 5.2.2 Regulatory sandbox & upcoming Bima Sugam platform

- 5.2.3 UPI AutoPay / e-mandate for friction-less premium payments

- 5.2.4 Usage-based motor insurance via telematics

- 5.2.5 Insurtech funding resilience in India

- 5.2.6 Embedded insurance with e-commerce & BNPL players

- 5.3 Market Restraints

- 5.3.1 Low insurance literacy & trust deficit online

- 5.3.2 Data-privacy compliance costs under Digital Personal Data Protection Act

- 5.3.3 Price-cap pressure on digital health products

- 5.3.4 Fraud & claims-leakage risks in digital channels

- 5.4 Value / Supply-Chain Analysis

- 5.5 Regulatory Landscape

- 5.6 Technological Outlook

- 5.7 Porter's Five Forces

- 5.7.1 Threat of New Entrants

- 5.7.2 Bargaining Power of Buyers

- 5.7.3 Bargaining Power of Suppliers

- 5.7.4 Threat of Substitutes

- 5.7.5 Competitive Rivalry

6 Market Size & Growth Forecasts

- 6.1 By Insurance Type

- 6.1.1 Life Insurance

- 6.1.2 Health Insurance

- 6.1.3 Property & Casualty (Motor, Home, Commercial, Liability)

- 6.1.4 Specialty Lines (Cyber, Pet, Marine, Travel)

- 6.2 By Customer Segment

- 6.2.1 Retail / Individual

- 6.2.2 SME / Commercial

- 6.2.3 Large Enterprise / Corporate

- 6.3 By Device Platform

- 6.3.1 Mobile App

- 6.3.2 Desktop / Web

7 Competitive Landscape

- 7.1 Market Concentration

- 7.2 Strategic Moves

- 7.3 Market Share Analysis

- 7.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 7.4.1 Policybazaar

- 7.4.2 Acko General Insurance

- 7.4.3 ICICI Lombard

- 7.4.4 HDFC Life

- 7.4.5 Bajaj Allianz General Insurance

- 7.4.6 Tata AIA Life

- 7.4.7 SBI General Insurance

- 7.4.8 Go Digit Insurance

- 7.4.9 Reliance General Insurance

- 7.4.10 Max Life Insurance

- 7.4.11 Star Health & Allied Insurance

- 7.4.12 Kotak Mahindra Life

- 7.4.13 Edelweiss Tokio Life

- 7.4.14 Future Generali India

- 7.4.15 Liberty General Insurance

- 7.4.16 National Insurance Company

- 7.4.17 New India Assurance

- 7.4.18 Oriental Insurance

- 7.4.19 United India Insurance

- 7.4.20 Zuno General Insurance

- 7.4.21 Paytm Insurance Broking

8 Market Opportunities & Future Outlook

- 8.1 White-space & Unmet-Need Assessment