PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687781

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687781

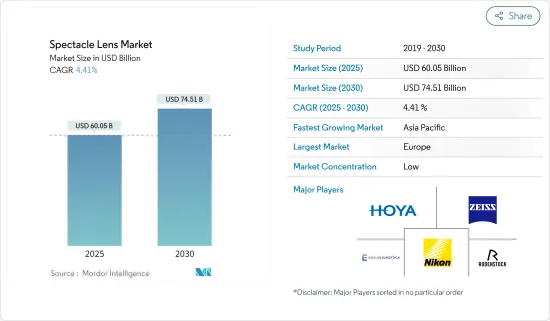

Spectacle Lens - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Spectacle Lens Market size is estimated at USD 60.05 billion in 2025, and is expected to reach USD 74.51 billion by 2030, at a CAGR of 4.41% during the forecast period (2025-2030).

Increasing optical disorders and the growing demand for vision correction are anticipated to fuel market growth during the forecast period. The rising awareness of vision impairment conditions and available vision correction solutions is driving the demand for spectacle lenses. The adoption of digital technologies, such as smartphones, laptops, and computers, has led to an increase in digital eye strain, resulting in vision-related problems.

The growing burden of ophthalmic diseases is expected to increase demand for the spectacle lens. Certain ophthalmic conditions require specialized lenses to maintain the refractive index, thereby boosting market growth. For instance, according to a study published in the Digital Medicine and Healthcare Technology journal in November 2022, the shift from the physical to the virtual world in recent years has led to an increase in complaints of digital eye strain. Low blue light levels may also increase the risk of developing myopia and near-sightedness in children, further increasing the demand for spectacle lenses.

In addition, according to the 2023 Glaucoma Report, glaucoma was the second leading cause of blindness worldwide, and roughly 3 million people in the United States were diagnosed with the disease in 2023. Thus, the high glaucoma burden is expected to increase demand for spectacle lenses to improve vision, which is likely to contribute to the market's growth over the forecast period.

The increasing product launches and approvals to meet the growing demand for corrective lenses are also expected to contribute to the growth of the market studied. For instance, in November 2023, Shamir Optical Industry unveiled its latest innovation, the Shamir Optimee, a cutting-edge myopia management spectacle lens. This new offering features the innovative Shamir Focusflow technology, ensuring a distinct central vertical zone tailored to the child's prescription.

Similarly, in December 2022, Vision Science and Technology Co. Ltd (VST), a start-up backed by the Hong Kong Polytechnic University (PolyU), launched an innovative spectacle lens that aims to slow down myopia progression. VST incorporated two patented technologies developed by PolyU to safeguard children's vision health.

Thus, all aforementioned factors, such as the growing burden of ophthalmic diseases and vision impairment and product launches by the market players, are expected to contribute to the market's growth over the forecast period. However, quality issues of lenses are expected to hamper the market's growth over the forecast period.

Spectacle Lens Market Trends

The Prescription Glass Segment is Expected to Exhibit the Significant Growth over the Forecast Period

Prescription glasses are eyeglasses whose lenses are customized to correct the wearer's specific vision defects. They are designed to improve or correct conditions such as myopia (near-sightedness), hyperopia (farsightedness), presbyopia, and astigmatism. As the burden of eye diseases increases, so does the demand for prescription glasses, which is expected to contribute to the segment's growth during the forecast period.

The International Myopia Institute (IMI) released its 2023 update on the Facts and Findings Infographic, projecting that 50% of the global population will be affected by myopia, with 10% experiencing high myopia by 2050. As a result, the rising incidence of refractive errors due to myopia and presbyopia is driving the demand for prescription lenses, which is expected to further contribute to segmental growth.

Major players' continuous efforts to provide prescription lenses and offer maximum benefits to users are also expected to fuel the segment's growth. Additionally, the presence of reputable players in prescription glasses and vision correction committed to enhancing global eye health is another factor driving the segment's growth.

For example, Essilor International, a global ophthalmology company, provided prescription lenses to nearly 7.4 billion people worldwide in 2022, according to its 2023 update. Additionally, in May 2024, Innovative eyewear brand NEVEN launched a new line of high-quality, affordable prescription glasses in partnership with manufacturer Robertson Optical Laboratories Inc. Therefore, the presence of such market players is expected to fuel the segment's growth during the forecast period.

North America is Expected to Hold a Significant Share of the Market Over the Forecast Period

North America is expected to hold a significant share of the global spectacle lens market. The United States and Canada have well-structured healthcare systems, resulting in numerous global market players engaged in product development. Additionally, the increasing prevalence of eye disorders among the target population is a significant factor fueling the market's growth in the region.

The growing burden of vision impairment is expected to increase demand for spectacle lenses, thereby boosting the market growth. For instance, according to the Centers for Disease Control and Prevention's (CDC) December 2022 data, over 12 million people aged over 40 in the United States suffered from vision impairment every year. Moreover, the economic cost of major vision problems is projected to increase to USD 373 billion by 2050. These figures indicate a significant burden of disease among the target population in North America.

Furthermore, the constant increase in the elderly population in the United States, coupled with a shift toward vision correction usage among key demographics, has led to an absolute increase in the usage rates for most types of eyewear in the country. For instance, according to the Census Government data published in May 2023, the number of Americans aged 65 and older was projected to increase from 58 million in 2022 to 82 million by 2050. This trend is expected to contribute to the market's growth over the forecast period.

Several companies in the United States have been playing major roles in the spectacle lens market, accelerating the market's growth through numerous product launches and innovations. For instance, in March 2022, EssilorLuxottica and CooperCompanies finalized their joint venture agreement for SightGlass Vision. SightGlass Vision's diffusion optics technology incorporates thousands of micro-dots into the lens, softly scattering light to reduce contrast on the retina and intended to reduce myopia progression in children.

Consequently, such developments and the burden of eye disorders among the target population are expected to propel the growth of the spectacle lens market in North America.

Spectacle Lens Industry Overview

The spectacle lens market is fragmented and consists of several major players. In terms of market share, few of these major players currently dominate the market. The presence of major market players, such as Carl Zeiss Meditec AG, EssilorLuxottica (Essilor), Hoya Corporation (Seiko Optical Products Co. Ltd), and GKB Ophthalmics Ltd, is increasing the overall competitive rivalry of the market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Demand for Vision Correction

- 4.2.2 Increasing Prevalence of Optical Disorders

- 4.3 Market Restraints

- 4.3.1 Quality Issues of Lens

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD million)

- 5.1 By Type

- 5.1.1 Single Vision

- 5.1.2 Bifocal

- 5.1.3 Trifocal

- 5.1.4 Progressive

- 5.2 By Coating Type

- 5.2.1 Anti-reflective Coating

- 5.2.2 Scratch-Resistant Coating

- 5.2.3 Anti-fog Coating

- 5.2.4 UV Protection

- 5.2.5 Other Coating Types

- 5.3 By Usage

- 5.3.1 Prescription Glass

- 5.3.2 OTC Reading Glass

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 United Kingdom

- 5.4.2.2 Germany

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Carl Zeiss AG (Carl Zeiss Meditec AG)

- 6.1.2 EssilorLuxottica (Essilor)

- 6.1.3 GKB Ophthalmics Ltd

- 6.1.4 Hoya Corporation (Seiko Optical Products Co. Ltd)

- 6.1.5 Rodenstock GmbH

- 6.1.6 Tokai Optical Co. Ltd

- 6.1.7 Nikon Corporation

- 6.1.8 Fielmann AG

- 6.1.9 Wanxin Optics

- 6.1.10 Inspecs Group PLC (Norville (20/20) Ltd)

7 MARKET OPPORTUNITIES AND FUTURE TRENDS