PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687714

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687714

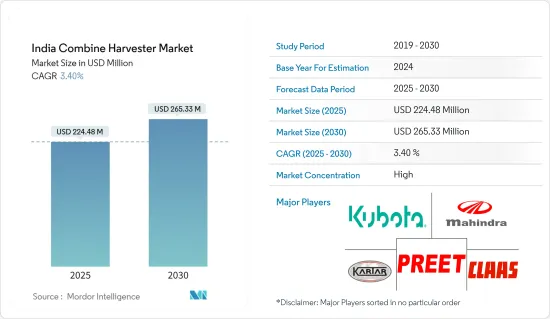

India Combine Harvester - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The India Combine Harvester Market size is estimated at USD 224.48 million in 2025, and is expected to reach USD 265.33 million by 2030, at a CAGR of 3.4% during the forecast period (2025-2030).

Key Highlights

- Indian Council of Agricultural Research (ICAR), in India, harvesting and threshing operations for major cereals, pulses, oil seeds, millets, and cash crops (excluding rice and wheat) are nearly 32% mechanized. Notably, mechanization levels for harvesting and threshing in rice and wheat exceed 60%. This trend emphasizes the growing adoption of combine harvesters, which streamlines harvesting and threshing, bolstering market expansion.

- Additionally, the area under cultivation of various crops has been rising during the study period. For instance, according to the FAOSTAT Statistics, the total area for cultivating coarse cereals across India increased from 95.1 million hectares in 2019 to 99.6 million hectares in 2022. This seems like a great potential for combine harvesters.

- Throughout the study period, prominent brands such as Preet 987, Mahindra Arjun 605, Kartar 4000, Dasmesh 9100 Self Combine Harvester, New Holland TC5.30, and Kubota HARVESTING DC-68G-HK have established a significant presence in the country. The rising adoption of these combines in India can be largely attributed to a notable shortage of farm labor.

- The Indian government extends subsidies on various agricultural inputs, including machinery. In 2022, under the Chief Minister's Samagra Gramya Unnayan Yojana (CMSGUY) - a scheme by the Assam Government aimed at village development - two farmer-producer companies (FPCs) in Assam's Chirang District were granted combined harvester machinery at a remarkable 90% subsidized rate. Such initiatives, making combined harvester machinery more accessible through subsidies, are poised to amplify their adoption and further fuel market growth.

India Combine Harvester Market Trends

High Cost of Farm Labor

Agriculture is a major source of livelihood for a large group of the population. As per the Indian Economic Survey 2022 -23, the agriculture sector employs nearly 45.76% of the Indian workforce. The rise in urbanization trends observed in the country is a result of the expanding population. According to the World Bank data, the degree of urbanization increased from 34.9% to 36.4% from 2020 to 2023. This resulted in the migration of rural households to the nearby cities, leading to the scarcity of farm labor in the country. For instance, the workforce employed in agriculture dropped from 44.3% to 42.9% from 2020 to 2022, as per the World Bank data.

Likewise, the scarcity of farm labor also increased wage rates, which increased the overall production costs of the farmers. As per the Government of India statistics, the annual average daily wage rate for female field (Agriculture) labor, at all India levels, has reported at ₹ 328.51 (USD 4.0) in 2022, registering an increase of 8.32% over the previous year. Likewise, in the case of male field (agriculture) labor, the daily wage rate at all India levels was reported at ₹ 394.52 (USD 4.8) in 2022, registering an increase of 8.55 percent over the previous year. This resulted in a restrain in employing them in farms, favoring the adoption of combine harvesters by the farmers in the country.

The agricultural industry of the country heavily relies on manual labor, and the decreasing workforce in agriculture has led to major challenges in performing farming operations such as harvesting. As a solution to this problem, the usage of advanced harvesting machinery has become increasingly popular for performing these agricultural operations effectively and efficiently.

Rising Grain Cultivation in India Fuels Demand for Self-Propelled Combine Harvesters

In India, cereals play a pivotal role in the culinary landscape, positioning the nation as a leading producer and consumer of these staples. As the consumption of cereal crops rises, so does the need for expanded cultivation. This trend is evident, with harvested areas for cereals and grains on the upswing. For instance, according to FAOSTAT, the area harvested under cereals increased from 95.1 million hectares in 2019 to 99.6 million hectares in 2022. Given that combines, especially self-propelled ones, are predominantly utilized for cereals, this uptick in cultivation directly boosts the demand for such equipment, propelling the market growth.

Equipped with a robust engine, self-propelled combine harvesters excel in the fields, ensuring efficient harvesting and heightened productivity. This boost in productivity is a key driver for the segment's expansion. Predominantly, these harvesters find their application in Northern, Western, and Central India, catering mainly to rice, wheat, and other seasonal crops. Moreover, the lucrative custom hiring of these harvesters by large farmers, especially in major rice-wheat regions like Punjab and Haryana, has led to a surge in adoption among other farmers.

In response to the expanding areas dedicated to grain crops, manufacturers are rolling out specialized combine harvester products tailored for these crops. A case in point is Swaraj Division, a Mahindra and Mahindra Ltd subsidiary, which unveiled its Gen2 8100 EX self-propelled combine harvester in October 2021. This model aims to enhance productivity and performance for paddy farmers, ensuring optimal grain yield across extensive acreage.

India Combine Harvester Industry Overview

The Indian combined harvester market is consolidated. Claas India, Preet Group, Kubota Corporation, Mahindra & Mahindra Ltd, and Kartar Agro Industries Private Limited are the major market players. Companies compete based on product quality and promotion and focus on strategic initiatives to account for prominent market shares. They are also heavily investing in developing new products while collaborating with and acquiring other companies, which may increase their market shares while strengthening their R&D activities.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Need to Enhance Crop Production

- 4.2.2 Increase In Government Support

- 4.2.3 Demand for Farm Mechanization

- 4.3 Market Restraints

- 4.3.1 High Cost of Combine Harvesters

- 4.3.2 Small and Fragmented Land Holdings

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Self-propelled Combine Harvester

- 5.1.2 Track Combine Harvester

- 5.1.3 Tractor-powered Combine Harvester

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 PREET Group

- 6.3.2 John Deere India Pvt. Ltd

- 6.3.3 CLAAS India

- 6.3.4 Tractors and Farm Equipment (TAFE) Ltd

- 6.3.5 Mahindra Tractors

- 6.3.6 Kubota Agricultural Machinery India Pvt. Ltd

- 6.3.7 Dasmesh Group

- 6.3.8 Balkar Combines

- 6.3.9 Kartar Agro Industries Pvt. Ltd

- 6.3.10 Sonalika Group

7 MARKET OPPORTUNITIES AND FUTURE TRENDS