PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852089

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852089

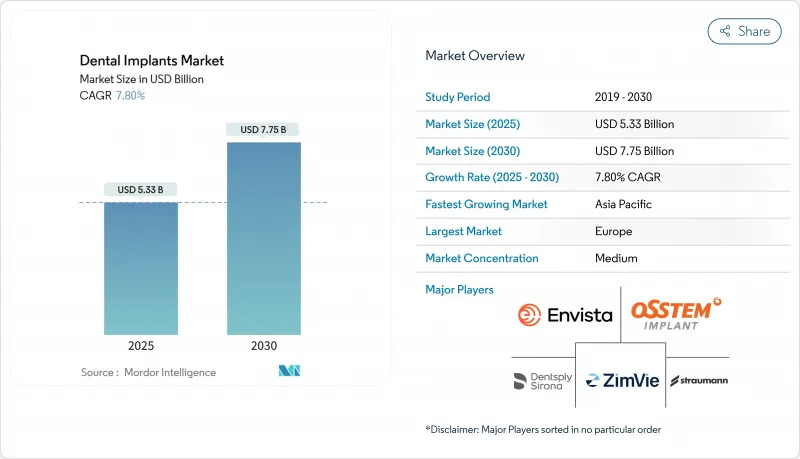

Dental Implants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

Titanium's mechanical reliability remains unmatched having 85.1% market share in 2024, yet zirconia's superior soft-tissue response is driving adoption with 10.8 % CAGR by 2030.

The dental implants industry is valued at USD 5.33 billion in 2024 and is expected to advance to USD 7.75 billion by 2030, reflecting a compound annual growth rate (CAGR) of 7.8%. Momentum is building around faster-healing immediate-load protocols that rely on nanoscale surface engineering, a shift that shortens treatment cycles and allows clinics to accommodate more cases without expanding chair capacity. A steady move from titanium toward zirconia, driven by concerns about metal hypersensitivity and by patients' aesthetic expectations, has opened product white space for manufacturers that can master ceramic processing at scale. Broader reimbursement in Europe and selective coverage expansions elsewhere are widening patient access, but they are also pushing suppliers to defend margins by bundling fixtures with digital planning software and post-operative care kits rather than competing on price alone. Clinics that fully adopt intraoral scanning, CBCT, and CAD/CAM technology are reporting higher case-acceptance rates, prompting implant makers to position scanners and treatment-planning platforms as strategic gateways into long-term hardware sales. In parallel, interest in AI-assisted diagnostics and robotic placement systems is rising, and companies that can weave these tools into a cohesive workflow are beginning to reset the competitive baseline.

Global Dental Implants Market Trends and Insights

Growing Adoption of Immediate-Load Implants Enabled by Novel Surface Treatments

Immediate-load protocols are progressing at an 11.7% CAGR, materially faster than the overall market. At a clinical level, success hinges on surface chemistry that can accelerate fibrin attachment without compromising long-term bone remodeling. The latest generation of nano-textured coatings is delivering that duality, shortening functional healing windows from months to weeks and enabling practices to advertise same-month restorations. A second-order implication is that practice scheduling efficiency improves because fewer appointments are required per patient, which releases latent chair capacity; many multi-site dental service organizations are translating that capacity into incremental hygiene visits, effectively cross-subsidizing lower implant unit margins.

Integration of Digital Dentistry Workflows Boosting Implant Case Volumes

Digital treatment planning, powered by intraoral scanners, CBCT imaging and CAD/CAM design, is redefining what constitutes standard-of-care diagnostics. Practices that migrate to fully digital workflows often report double-digit increases in case acceptance because patients can visualize outcomes before surgery. A deeper implication is that data captured during these digital encounters creates a feedback loop for iterative product improvement; in fact, some manufacturers now collect anonymized scan data to fine-tune thread geometry for specific bone densities, turning the installed scanner base into a real-time R&D asset.

Shortage of Trained Implantologists in Tier-2 Cities

The supply deficit of implantologists outside major metropolitan areas is acute in India and China, constraining procedure volumes. Equipment vendors are responding with turnkey systems that integrate guided surgery kits, pre-set drilling protocols and remote mentor support. This model effectively lowers the competency threshold required to deliver predictable outcomes, which in turn accelerates geographical diffusion. Investors are tracking training program enrollments as a leading indicator for provincial demand, suggesting that early capital deployment in education may yield first-mover advantages when those regions cross critical adoption thresholds.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of National Implant Reimbursement Schemes

- Prevalence of Peri-implantitis Driving Replacement Implant Sales

- Lack of Awareness in Developing Countries

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Fixtures account for 76% of implant revenue in 2024, but abutments are advancing at a 9.2% CAGR as the market pivots toward mass-customization. Digital libraries now enable laboratories to design patient-specific abutments that optimize emergence profiles and gingival aesthetics. A practical consequence is that procurement teams at multi-site clinics increasingly negotiate separate contracts for fixtures and prosthetic components, decoupling what had been a single-vendor bundle. Suppliers that cannot prove cross-component precision fit risk being excluded from these modular purchasing frameworks.

Several academic meta-analyses have found no statistically meaningful difference in bone-to-implant contact between surface-modified zirconia and conventional titanium, eroding the last major clinical argument against full-ceramic fixtures. Should ongoing longitudinal studies continue to confirm peri-implant soft-tissue stability, insurers may eventually adjust premium differentials, further solidifying zirconia's growth path. For now, early mover brands capture higher margins by positioning zirconia as a lifestyle upgrade rather than a strictly medical improvement.

The Dental Implants Market Report is Segmented by Component (Fixture [Endosteal Implants, and More] and Abutment), Material (Titanium Implants and Zirconium Implants), Design (Tapered Implants and Parallel-Walled Implants), Procedure Type (Immediate-Load Implant and Conventional), End User (Dental Hospitals & Clinics, and More), Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

With 34% of global revenue in 2024, Europe's mature implant sector is characterized by high willingness to pay for premium ceramics and a dense network of continuing-education institutes. Market size visibility is strong; Germany alone is expected to remain above USD 1 billion in 2025 based on industry disclosures. Because reimbursement systems increasingly mandate evidence of peri-implant maintenance protocols, suppliers now bundle follow-up kits with each implant, re-framing post-operative care as a built-in feature. That bundling reduces compliance friction for clinicians and subtly locks practices into proprietary consumables, fortifying vendor stickiness.

Asia-Pacific's dental implants market size is projected to post a 9.9 % CAGR from 2025 to 2030, outpacing all other regions. China, India and Japan drive volume, yet divergent regulatory pathways require nuanced commercial playbooks. Notably, regional distributors are investing in cross-border e-commerce to serve medical tourists who prefer scheduling surgeries abroad but purchasing consumables locally. This dual-track demand pattern creates inventory challenges that agile manufacturers can exploit through decentralized 3D printing hubs, reducing lead times without over-stocking.

North America's aging demographic underpins durable demand. By 2030, individuals aged 65 plus will exceed those under 18 in the United States, and more than 150 million Americans are missing at least one tooth. With only about one million implants placed annually, latent penetration remains vast. Technology adoption accelerates market capture; for instance, practices that integrate AI-driven diagnostic tools report faster treatment plan acceptance, reinforcing a virtuous cycle where software adoption boosts procedure volumes, which then finances further software upgrades.

- Straumann Group

- Dentsply Sirona

- ZimVie

- Osstem Implant Co., Ltd.

- Envista

- Dentium Co., Ltd.

- Thommen Medical

- Ivoclar Vivadent

- Solventum Corporation

- Ziacom Medical SL

- BioHorizons IPH Inc.

- Bicon

- MegaGen Implant Co., Ltd.

- Kyocera Medical Corporation

- GC Corporation

- BEGO GmbH & Co. KG

- Blue Sky Bio LLC

- Cortex Dental Implants Industries Ltd.

- DIO

- AlphaBio Tec.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Adoption of Immediate-Load Implants Enabled by Novel Surface Treatments

- 4.2.2 Integration of Digital Dentistry Workflows Boosting Implant Case Volumes

- 4.2.3 Expansion of National Implant Reimbursement Schemes

- 4.2.4 Prevalence of Peri-implantitis Driving Replacement Implant Sales

- 4.2.5 Rise of Implants Among Aesthetics-Driven Patient Segments

- 4.2.6 Consolidation of Dental Service Organizations Elevating Bulk Procurement

- 4.3 Market Restraints

- 4.3.1 Shortage of Trained Implantologists in Tier-2 Cities

- 4.3.2 Lack of Awareness in Developing Countries

- 4.3.3 Metal Hypersensitivity Litigations Curtailing Titanium Demand

- 4.3.4 Regulatory Certification Delays Hindering New Product Launches

- 4.4 Supply-Chain Analysis

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Component

- 5.1.1 Fixture

- 5.1.1.1 Endosteal Implants

- 5.1.1.2 Subperiosteal Implants

- 5.1.1.3 Transosteal Implants

- 5.1.1.4 Intramucosal Implants

- 5.1.2 Abutment

- 5.1.1 Fixture

- 5.2 By Material

- 5.2.1 Titanium Implants

- 5.2.2 Zirconium Implants

- 5.3 By Design

- 5.3.1 Tapered Implants

- 5.3.2 Parallel-Walled Implants

- 5.4 By Procedure Type

- 5.4.1 Immediate-Load Implant Procedure

- 5.4.2 Conventional Procedure

- 5.5 By End User

- 5.5.1 Dental Hospitals & Clinics

- 5.5.2 Dental Laboratories

- 5.5.3 Academic & Research Institutes

- 5.6 Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 Australia

- 5.6.3.5 South Korea

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East and Africa

- 5.6.4.1 GCC

- 5.6.4.2 South Africa

- 5.6.4.3 Rest of Middle East and Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.3.1 Institut Straumann AG

- 6.3.2 Dentsply Sirona Inc.

- 6.3.3 ZimVie Inc

- 6.3.4 Osstem Implant Co., Ltd.

- 6.3.5 Envista Holdings (Nobel Biocare Services AG)

- 6.3.6 Dentium Co., Ltd.

- 6.3.7 Thommen Medical AG

- 6.3.8 Ivoclar Vivadent AG

- 6.3.9 Solventum Corporation

- 6.3.10 Ziacom Medical SL

- 6.3.11 BioHorizons IPH Inc.

- 6.3.12 Bicon LLC

- 6.3.13 MegaGen Implant Co., Ltd.

- 6.3.14 Kyocera Medical Corporation

- 6.3.15 GC Corporation

- 6.3.16 BEGO GmbH & Co. KG

- 6.3.17 Blue Sky Bio LLC

- 6.3.18 Cortex Dental Implants Industries Ltd.

- 6.3.19 DIO Corporation

- 6.3.20 AlphaBio Tec.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment