PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850360

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850360

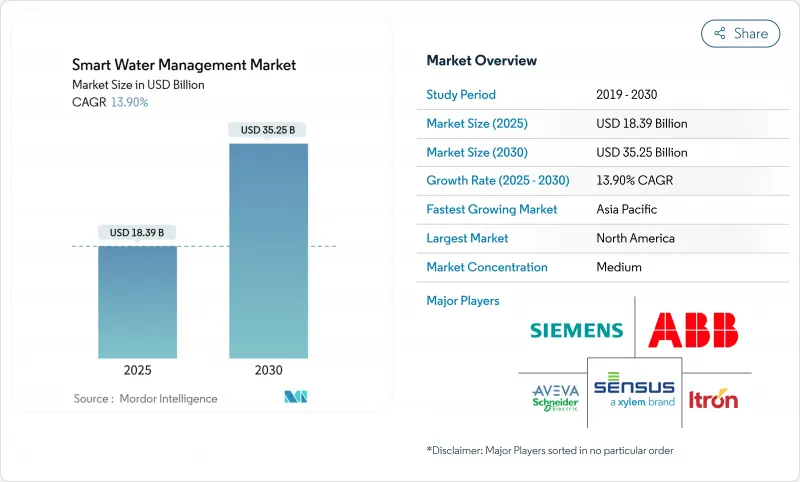

Smart Water Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The smart water management market size is estimated at USD 18.39 billion in 2025 and is forecast to reach USD 35.25 billion by 2030, advancing at a 13.9% CAGR during the period.

Rapid scale-up reflects utilities' shift from incremental leak reduction to data-driven efficiency programs that counter rising water stress and tighter environmental mandates. Utilities now favor integrated monitoring, analytics, and control platforms that transform legacy distribution networks into predictive, self-optimizing systems. Investment momentum is reinforced by the maturation of LPWAN connectivity, proven digital-twin applications, and sizeable government stimulus packages that earmark funds for digital water infrastructure. Traditional metering and SCADA frameworks, once considered adequate, are therefore giving way to end-to-end, cloud-enabled architectures that can document measurable performance improvements.

Global Smart Water Management Market Trends and Insights

Growing Need to Manage Increasing Global Water Demand

Severe drought cycles push utilities to treat real-time consumption optimization as mission-critical infrastructure. France recorded 30% precipitation deficits in 2025, prompting usage restrictions across 14 departments-more than double the 2024 count . Greater Lyon responded by installing 5,500 leak sensors and 10,000 connected meters, saving 33,000 m3 per day.These results underscore how predictive analytics turn conservation from public messaging into verifiable supply-demand balancing. Regions with chronic scarcity, especially the Western US and parts of the Mediterranean, now regard digital water platforms as prerequisites for service continuity, cementing long-run demand for the smart water management market.

Rising Pressure to Curb Non-Revenue Water (NRW) Losses

Mounting regulatory scrutiny converts NRW reduction into a survival metric for utilities. Orange County utilities recovered more than USD 4 million annually after smart meter roll-outs, while Jacksonville identified 1 billion gallons of losses previously undetected . In Europe, certain French networks still lose over 50% of transported water, triggering compliance deadlines. AI-enabled systems such as Siemens' SIWA Leak Finder helped Sweden's VA SYD cut NRW from 10% to 8%, proving immediate operational returns. Financial penalties and performance-based rate structures make leak analytics adoption non-discretionary, fueling steady expansion of the smart water management market.

Capital-Intensive Nature of Metering and Network Upgrades

Full-scale smart water deployments require substantial capital outlays that can exceed smaller utilities' borrowing capacity. Thames Water signed a GBP 50 million framework to deploy 1 million smart meters by 2030, illustrating the upfront spend needed for broad coverage. Where political sensitivities keep tariffs low, long payback periods hinder board approvals, particularly in emerging economies lacking concessional finance. These budget constraints fragment uptake rates and temper the smart water management market's near-term growth.

Other drivers and restraints analyzed in the detailed report include:

- Government Smart-City and Sustainability Mandates

- Rapid Adoption of LPWAN Connectivity (LoRaWAN, NB-IoT)

- Interoperability Gaps Across Legacy OT/IT Systems

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Solutions held 53.7% revenue in 2024 as utilities gravitated toward unified suites that span metering, leak detection, analytics, and control. Professional services, managed services, and outcome-based contracts now grow at 16.2% CAGR because utilities realize technology value only when data science and change-management skills are embedded. Enterprise asset management modules integrate with hydraulic modeling engines to predict pipe failures well ahead of visible leaks, reducing emergency repair spend. Distribution network monitoring overlays geospatial analytics onto SCADA data, letting operators prioritize capital projects according to risk scores instead of age alone.

Vendor roadmaps converge around cloud-native architectures that support application marketplaces and low-code customization, which lowers future integration cost. As a result, the smart water management market sees utilities negotiating multi-year platform agreements that bundle licensing with guaranteed operational improvements. Smaller operators embrace managed services to offset talent shortages, while larger counterparts co-develop algorithms with vendors to protect intellectual property advantages. These trends cement solutions as the economic anchor of the smart water management market.

Smart Water Management Market is Segmented by Component (Solution, Services), End User (Residential, Commercial, Industrial / Public Utilities), Communication Technology (Cellular (2G/3G/4G/5G, NB-IoT), LPWAN (LoRaWAN, Sigfox), and More), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 27.9% of 2024 revenue, large municipal utilities swiftly issue tenders for meter data management, edge analytics, and cyber-security hardening. Schneider Electric's plan to inject USD 700 million into US facilities by 2027 reflects expectations of sustained procurement pipelines . Canada's prairie provinces accelerate leak analytics to counter irrigation-driven withdrawals, while Mexico's northern states pilot LPWAN networks to reduce theft and illegal tapping. Mature telecom backbones and a deep integrator base minimize deployment risk, reinforcing regional leadership in the smart water management market.

APAC is the fastest-growing territory at 14.3% CAGR, propelled by China's mandate that every national-level smart city include end-to-end digital water supervision . Provincial grants subsidize cloud platforms that link urban drainage models with real-time rainfall feeds, blending flood prevention with consumption management. Japan's MLIT catalog hard-codes performance benchmarks, ensuring funding flows only to utilities that deploy interoperable meter-to-analytics stacks . Australia increases desalination reliance and thus prizes early leak detection to lower energy intensity, while India rolls out prepaid meters in drought-prone Madhya Pradesh under public-private partnerships. This policy mosaic keeps the smart water management market on an accelerated trajectory across APAC.

- Xylem Inc. (incl. Sensus)

- Itron Inc.

- ABB Ltd.

- Siemens AG

- Schneider Electric SE (+AVEVA)

- Honeywell International Inc.

- IBM Corporation

- SUEZ Water Technologies and Solutions

- Badger Meter Inc.

- Landis+Gyr AG

- Kamstrup A/S

- Trimble Water

- Huawei Technologies Co. Ltd.

- Esri

- Evoqua Water Technologies

- Sebata Holdings Ltd.

- Hitachi Ltd.

- Arad Group

- TaKaDu Ltd.

- i2O Water Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing need to manage increasing global water demand

- 4.2.2 Rising pressure to curb Non-Revenue Water (NRW) losses

- 4.2.3 Government smart-city and sustainability mandates

- 4.2.4 Rapid adoption of LPWAN connectivity (LoRaWAN, NB-IoT)

- 4.2.5 Digital-twin platforms enabling predictive pipe failure modelling

- 4.2.6 US and EU infrastructure stimulus funds earmarked for digital water

- 4.3 Market Restraints

- 4.3.1 Capital-intensive nature of metering and network upgrades

- 4.3.2 Interoperability gaps across legacy OT/IT systems

- 4.3.3 Cyber-security vulnerabilities in converged water OT networks

- 4.3.4 Tariff-driven cost inflation for IoT components post-2025

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Rivalry

- 4.8 Assesment of Macroeconomic Factors on the market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 By Solution

- 5.1.1.1 Enterprise Asset Management

- 5.1.1.2 Distribution Network Monitoring

- 5.1.1.3 Supervisory Control and Data Acquisition (SCADA)

- 5.1.1.4 Meter Data Management (MDM)

- 5.1.1.5 Analytics

- 5.1.1.6 Other Solutions

- 5.1.2 By Services

- 5.1.2.1 Professional Services

- 5.1.2.2 Managed Services

- 5.1.1 By Solution

- 5.2 By End User

- 5.2.1 Residential

- 5.2.2 Commercial

- 5.2.3 Industrial / Public Utilities

- 5.3 By Communication Technology

- 5.3.1 Cellular (2G/3G/4G/5G, NB-IoT)

- 5.3.2 LPWAN (LoRaWAN, Sigfox)

- 5.3.3 RF Mesh / Wi-SUN

- 5.3.4 Satellite and Others

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 South America

- 5.4.2.1 Brazil

- 5.4.2.2 Argentina

- 5.4.2.3 Rest of South America

- 5.4.3 Europe

- 5.4.3.1 United Kingdom

- 5.4.3.2 Germany

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Rest of Europe

- 5.4.4 Asia-Pacific

- 5.4.4.1 China

- 5.4.4.2 Japan

- 5.4.4.3 South Korea

- 5.4.4.4 India

- 5.4.4.5 Australia

- 5.4.4.6 Rest of Asia-Pacific

- 5.4.5 Middle East and Africa

- 5.4.5.1 Middle East

- 5.4.5.1.1 Saudi Arabia

- 5.4.5.1.2 United Arab Emirates

- 5.4.5.1.3 Turkey

- 5.4.5.1.4 Rest of Middle East

- 5.4.5.2 Africa

- 5.4.5.2.1 South Africa

- 5.4.5.2.2 Nigeria

- 5.4.5.2.3 Egypt

- 5.4.5.2.4 Rest of Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Xylem Inc. (incl. Sensus)

- 6.4.2 Itron Inc.

- 6.4.3 ABB Ltd.

- 6.4.4 Siemens AG

- 6.4.5 Schneider Electric SE (+AVEVA)

- 6.4.6 Honeywell International Inc.

- 6.4.7 IBM Corporation

- 6.4.8 SUEZ Water Technologies and Solutions

- 6.4.9 Badger Meter Inc.

- 6.4.10 Landis+Gyr AG

- 6.4.11 Kamstrup A/S

- 6.4.12 Trimble Water

- 6.4.13 Huawei Technologies Co. Ltd.

- 6.4.14 Esri

- 6.4.15 Evoqua Water Technologies

- 6.4.16 Sebata Holdings Ltd.

- 6.4.17 Hitachi Ltd.

- 6.4.18 Arad Group

- 6.4.19 TaKaDu Ltd.

- 6.4.20 i2O Water Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment