PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910501

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910501

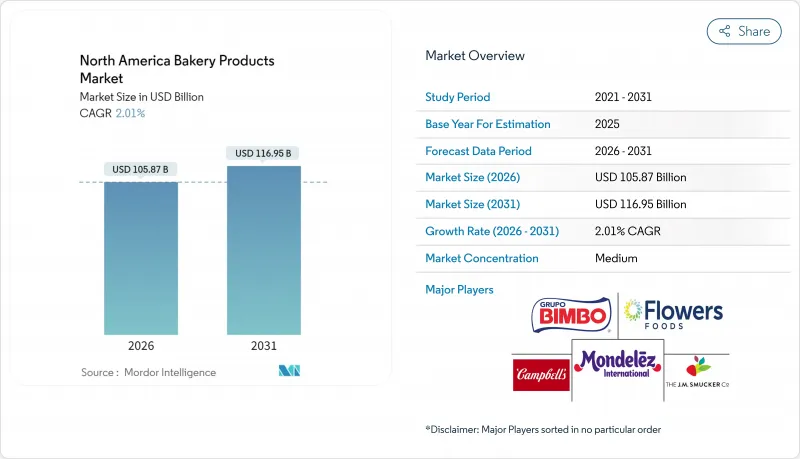

North America Bakery Products - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The North America bakery products market is expected to grow from USD 103.78 billion in 2025 to USD 105.87 billion in 2026 and is forecast to reach USD 116.95 billion by 2031 at 2.01% CAGR over 2026-2031.

The adoption of premiumization strategies drives this growth, the consistent demand for staple foods, and manufacturers' efforts to develop healthier product formulations. Manufacturers are focusing on frozen bakery products and organic options, which help extend shelf life while catering to the rising demand for health-conscious products. Cross-border trade plays a crucial role in maintaining efficient supply chains, with Mexico emerging as a key contributor to regional growth. Wealthier consumers are willing to pay more for products with high-protein content or clean-label ingredients. These trends highlight the dynamic nature of the North America bakery products market as it adapts to evolving consumer needs and economic conditions. The competitive landscape of the North America bakery products market is moderately concentrated. Leading players such as Grupo Bimbo S.A.B. de C.V., Flowers Foods Inc., and Mondelez International Inc. are utilizing their extensive manufacturing capabilities and distribution networks to maintain their market positions.

North America Bakery Products Market Trends and Insights

Convenience-driven breakfast demand

Demand for convenient breakfast options is changing the North American bakery market. Busy urban lifestyles and more commuter traffic mean less time for home-cooked meals, leading consumers to choose portable options like pastries, breads, and doughnuts. As of 2025, World Population Review lists biscuits and doughnuts as some of the most popular breakfast items in the United States, showing the strong role of baked goods in morning routines. Reflecting this trend, in February 2025, NuStef Baking, the maker of reko pizzelles, introduced TeaFusions waffle cookies, a tea-infused snack designed for consumers looking for convenience and a treat. The rising demand for grab-and-go options in convenience stores, cafes, and workplace cafeterias highlights the need for quick and portable breakfast choices.

Increasing demand for packaged and processed foods

Packaged bakery products are becoming more popular as consumers move away from fresh bakery counters to pre-packaged options that are easier to store, carry, and use. Large-scale producers benefit from lower costs, less waste, and better distribution, ensuring these products are widely available in stores. In 2024, the United States leads in consuming ultra-processed foods (UPFs), which make up about 60% of daily calorie intake, as per MedRxiv, showing how packaged and processed foods are a big part of everyday diets. Younger consumers, especially Gen Z and millennials, are driving this trend by choosing packaged bakery snacks, resealable packs, and long-lasting breads that fit their busy lifestyles and need for quick, affordable options. The increased availability of these products in supermarkets and convenience stores further supports their growing popularity among younger households.

Consumer shift toward healthier alternatives

Health-conscious consumers are increasingly moving away from traditional sugary pastries and opting for healthier alternatives like high-protein bars, fruit snacks, and gluten-free breads. According to the American Heart Association, as of 2024, 68% of Americans recognized the importance of healthy eating for long-term well-being. The 2024 International Food Information Council (IFIC) Survey reveals that 66% of consumers were actively trying to reduce their sugar intake, a noticeable increase from 61% in previous years. To meet this growing demand, bakery manufacturers are reformulating their products by reducing sugar content and adding more fiber. They are also incorporating ingredients like whole grains, plant-based proteins, and functional additives to create healthier options. However, these changes require significant research and development efforts, as altering recipes can impact taste and consumer satisfaction. Brands that successfully balance health benefits with indulgent flavors are more likely to retain customer loyalty.

Other drivers and restraints analyzed in the detailed report include:

- Snackification trend among millennials and youth

- Product innovation and flavor diversification

- Regulatory pressure on additives and labeling

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Breads remain the most popular category in the North American bakery market, holding 51.03% of the market share in 2025. Their popularity comes from their versatility, convenience, and role in everyday meals like breakfast, sandwiches, and snacks. Consumers are increasingly choosing whole-grain, high-fiber, and protein-enriched options, reflecting a growing focus on health and wellness. Retailers dedicate significant shelf space to breads, making them easily accessible and frequently purchased. This steady demand highlights the category's strength, even as consumers explore new bakery products and trends.

Although breads lead in volume, cakes and pastries are expected to grow faster, with a projected 3.91% CAGR from 2026 to 2031. This growth is driven by consumer interest in unique flavors, indulgent treats, and their role in celebrations. Innovations like fusion pastries and single-serve options are particularly appealing to millennials, Gen Z, and urban households. Premium and seasonal offerings also encourage repeat purchases and support higher price points. As consumers balance indulgence with health concerns, manufacturers are introducing cleaner, functional, or portion-controlled options to maintain interest and drive market growth.

Fresh bakery products held a major share in the North American market in 2025, accounting for 72.45% of the total market share. Their fresh aroma, taste drive their popularity, and the overall experience of buying directly from in-store bakeries. Consumers often prefer freshly baked breads, pastries, and specialty items because they associate these products with higher quality and better flavor. Retailers enhance this appeal by offering open bakery counters and on-site baking, which creates a more engaging shopping experience. These strategies not only attract customers but also encourage impulse purchases and build long-term customer loyalty.

Frozen bakery products are expected to grow at a faster pace, with a 4.44% CAGR from 2026 to 2031, nearly double the growth rate of fresh items. Advances in freezing technology have significantly improved the quality of frozen products, helping them retain their taste, texture, and appearance. This makes frozen bakery items a convenient option for busy consumers, especially those in urban areas who may not have time for frequent shopping trips. Frozen products also offer the advantage of a longer shelf life, which appeals to households looking for practical and time-saving solutions. Manufacturers are responding to this demand by expanding their frozen product lines to include ready-to-bake breads, pastries, and desserts.

The North America Bakery Products Market is Segmented by Product Type (Breads, Cakes and Pastries, and More), Form (Fresh and Frozen), Category (Conventional, Organic/Clean Label, and More), Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, and More), and Geography (United States, Canada, Mexico and Rest of North America). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Grupo Bimbo S.A.B. de C.V.

- Flowers Foods Inc.

- Mondelez International, Inc.

- General Mills Inc.

- Mars Inc.

- Campbell Soup Company

- The J.M. Smucker Company

- GRUMA S.A.B. de C.V.

- Alpha Baking Company Inc.

- Bake'n Joy

- Sara Lee Frozen Bakery

- Y?ld?z Holding

- H&S Bakery, Inc.

- Mckee Foods Corporation

- Rich Products Corporation

- King's Hawaiian Holding Co.

- Rise Baking Company

- B&G Foods, Inc.

- Hostess Brands

- Bridor inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Convenience-driven breakfast demand

- 4.2.2 Increasing demand for packaged and processed foods

- 4.2.3 Product innovation and flavor diversification

- 4.2.4 Surging seasonal and festive demand

- 4.2.5 Rising preference for multigrain and high-fiber bakery products

- 4.2.6 Snackification trend among millennials and youth

- 4.3 Market Restraints

- 4.3.1 Short shelf life of fresh bakery products

- 4.3.2 Consumer shift toward healthier alternatives

- 4.3.3 Volatility in raw material prices

- 4.3.4 Regulatory pressure on additives and labeling

- 4.4 Regulatory Outlook

- 4.5 Consumer Behaviour Analysis

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Breads

- 5.1.2 Cakes and Pastries

- 5.1.3 Biscuits and Cookies

- 5.1.4 Morning Goods

- 5.1.5 Other Product Types

- 5.2 By Form

- 5.2.1 Fresh

- 5.2.2 Frozen

- 5.3 By Category

- 5.3.1 Conventional

- 5.3.2 Organic/Clean Label

- 5.3.3 Protein/Functional

- 5.4 By Distribution Channel

- 5.4.1 Supermarkets/Hypermarkets

- 5.4.2 Convenience Stores

- 5.4.3 Specialty/Bakery Stores

- 5.4.4 Online Retail Stores

- 5.4.5 Other Distribution Channels

- 5.5 By Geography

- 5.5.1 United States

- 5.5.2 Canada

- 5.5.3 Mexico

- 5.5.4 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials (if available), Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Grupo Bimbo S.A.B. de C.V.

- 6.4.2 Flowers Foods Inc.

- 6.4.3 Mondelez International, Inc.

- 6.4.4 General Mills Inc.

- 6.4.5 Mars Inc.

- 6.4.6 Campbell Soup Company

- 6.4.7 The J.M. Smucker Company

- 6.4.8 GRUMA S.A.B. de C.V.

- 6.4.9 Alpha Baking Company Inc.

- 6.4.10 Bake'n Joy

- 6.4.11 Sara Lee Frozen Bakery

- 6.4.12 Y?ld?z Holding

- 6.4.13 H&S Bakery, Inc.

- 6.4.14 Mckee Foods Corporation

- 6.4.15 Rich Products Corporation

- 6.4.16 King's Hawaiian Holding Co.

- 6.4.17 Rise Baking Company

- 6.4.18 B&G Foods, Inc.

- 6.4.19 Hostess Brands

- 6.4.20 Bridor inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK