PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687348

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687348

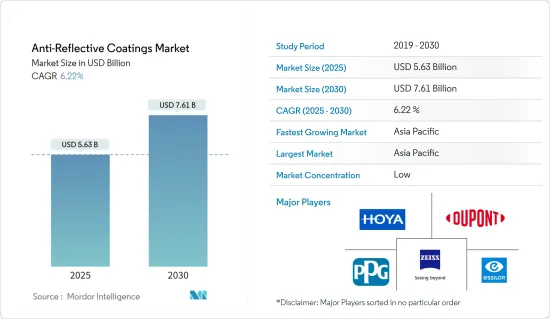

Anti-Reflective Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Anti-Reflective Coatings Market size is estimated at USD 5.63 billion in 2025, and is expected to reach USD 7.61 billion by 2030, at a CAGR of 6.22% during the forecast period (2025-2030).

Due to specific rules and regulations imposed by countries, the demand in various sectors slowed during the COVID-19 pandemic. However, the industry recovered in 2021, rebounding the demand in the market.

Key Highlights

- Over the short term, the increasing demand for eyewear applications and rising demand from the solar power generation industry are expected to boost the market's growth.

- Additionally, the high cost of anti-reflective coatings and stringent environmental regulations are expected to hinder the market's growth.

- However, developing thin-film fabrication technologies will likely create lucrative growth opportunities in the market.

- Asia-Pacific is expected to dominate the anti-reflective coatings market and be the fastest-growing market during the forecast period.

Anti-Reflective Coatings Market Trends

The Demand for Eyewear Applications is Increasing

- Anti-reflective glasses offer an affordable solution to glare from various electronic displays, including computer screens, televisions, and flat panels.

- These coatings reduce glare, enhance display readability, lessen eye strain, and improve visual clarity.

- According to the US Department of Health & Human Services, nearsightedness affects about 23.9% of the United States's population over 40 (about 34 million people).

- According to the World Health Organization (WHO), as of August 2023, around 2.2 billion people worldwide had near or distant vision impairment. Moreover, the global costs of productivity losses associated with vision impairment are estimated to be USD 411 billion.

- The Vision Council highlights that the United States optical market was valued at USD 65.6 billion in 2023, further underlining its significance. The country boasts approximately 44,850 brick-and-mortar optical retail outlets, with a striking 93% of US adults regularly sporting some form of eyewear.

- This is expected to enhance the demand for respective eye lenses while addressing these impairments, further enhancing the demand for anti-reflective coatings in the country.

China is Expected to Dominate the Asia-Pacific Region

- Asia-Pacific has dominated the global market due to the increasing demand for semiconductors, electronics, solar panels, and other manufacturing operations. While China's solar industry is experiencing a boom, it grapples with overcapacity and escalating trade tensions. Western nations are pressuring Beijing to limit exports, fearing a potential oversupply. According to data from the National Energy Administration (NEA), in 2023, China installed more solar panels than any other nation. This achievement bolstered its already leading position in the global renewable energy landscape. In a remarkable display, China added 216.9 gigawatts of solar power in 2023, surpassing its 2022 record of 87.4 gigawatts.

- Also, as of the first quarter of 2024, China maintained its momentum in solar panel installations, albeit slower than the 154% surge seen in 2023. In March 2024, China's cumulative solar capacity reached 660 gigawatts, a stark contrast to the United States' 179 gigawatts by the end of 2023, as reported by the NEA.

- China has the world's largest electronics production base, which includes electronic products, such as smartphones, TVs, wires, cables, portable computing devices, gaming systems, and other personal electronic devices, and recorded the highest growth in the electronics segment. The country serves the domestic demand for electronics and exports electronic output to other countries.

- In 2023, China's semiconductor industry witnessed robust growth, with the total output of integrated circuits (ICs) reaching 351.4 billion pieces, marking a 6.9% increase from the previous year, as per the Ministry of Industry and Information Technology.

- Additionally, the Semiconductor Industry Association highlights China's strides in semiconductor manufacturing. Projections suggest that China's global semiconductor capacity share could surge by 13% in 2024, reaching 8.6 million monthly wafers.

- Thus, due to the above-mentioned factors, China is poised to maintain its dominance in the Asia-Pacific market.

Anti-Reflective Coatings Industry Overview

The anti-reflective coatings market is fragmented due to major players, including DuPont, PPG Industries Inc., Hoya Vision Care Company, Zeiss International, and Essilor (not in any particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand from Eyewear Applications

- 4.1.2 Rising Demand from the Solar Power Generation Industry

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 High Cost of Anti-reflective Coatings

- 4.2.2 Stringent Environmental Regulations

- 4.2.3 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 By Deposition Method

- 5.1.1 Chemical Vapor Deposition

- 5.1.2 Electronic Beam Deposition

- 5.1.3 Sputtering

- 5.1.4 Other Deposition Methods

- 5.2 By Application

- 5.2.1 Semiconductors

- 5.2.2 Electronic Devices

- 5.2.3 Eyewear

- 5.2.4 Solar Panels

- 5.2.5 Automotive Displays

- 5.2.6 Other Applications

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Malaysia

- 5.3.1.6 Thailand

- 5.3.1.7 Indonesia

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 NORDIC countries

- 5.3.3.7 Turkey

- 5.3.3.8 Russia

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 Qatar

- 5.3.5.3 United Arab Emirates

- 5.3.5.4 Nigeria

- 5.3.5.5 Egypt

- 5.3.5.6 South Africa

- 5.3.5.7 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles (Overview, Financials, Products and Services, and Recent Developments)

- 6.4.1 AccuCoat Inc.

- 6.4.2 AGC Inc.

- 6.4.3 Beneq

- 6.4.4 DuPont

- 6.4.5 Edmund Optics Inc.

- 6.4.6 EKSMA Optics UAB

- 6.4.7 ESSILOR OF AMERICA INC.

- 6.4.8 Honeywell International Inc.

- 6.4.9 HOYA

- 6.4.10 Majestic Optical Coatings LLC

- 6.4.11 Optical Coatings Japan

- 6.4.12 Optics Balzers AG

- 6.4.13 Optimum RX Group

- 6.4.14 PPG Industries Inc.

- 6.4.15 Spectrum Direct

- 6.4.16 Torr Scientific Ltd

- 6.4.17 ZEISS

- 6.4.18 Zygo

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Development of Thin Film Fabrication Technologies

- 7.2 Other Opportunities