PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687347

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687347

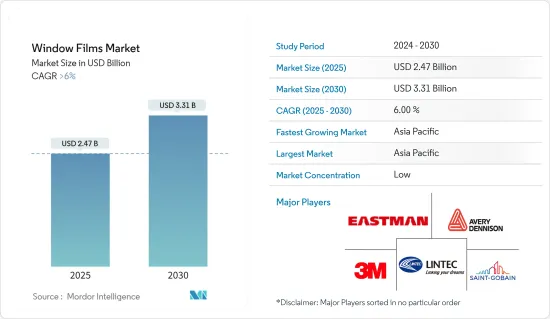

Window Films - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Window Films Market size is estimated at USD 2.47 billion in 2025, and is expected to reach USD 3.31 billion by 2030, at a CAGR of greater than 6% during the forecast period (2025-2030).

The COVID-19 pandemic in 2020 adversely affected the construction industry. The industry faced challenges due to logistics and raw materials' unavailability. This also negatively impacted the window films market. However, the automotive industry's upsurge in production and sales post-pandemic propelled the market's growth and recovery.

Key Highlights

- Over the medium term, the major factors driving the market's growth are increasing emphasis on reducing carbon footprint and increasing safety and security concerns among consumers.

- However, some technical expertise is required to install window films, and the technicality and installation issues need to be improved to increase the growth of the window film market. Also, the growth in the smart glass market may cause hindrances to the window film market.

- Also, the growing concern for ultraviolet (UV) protection is projected to create new growth opportunities for the industry.

- Asia-Pacific is expected to dominate the market and will likely witness the highest annual growth rate during the forecast period.

Window Films Market Trends

The Building and Construction Segment to Dominate the Market

- Window films are utilized in the construction industry for solar control. They can reflect solar radiation heat and maintain a comfortable temperature inside buildings. Window films are used in the construction sector for solar control due to their ability to reflect the heat from solar radiation and maintain a comfortable ambiance in terms of the temperature inside the structure or building.

- In the construction segment, window films, such as decorative, ultraviolet (UV) block, privacy, anti-glare, anti-graffiti, insulating films, and safety and security films, are used. The global construction industry is expected to reach USD 8 trillion by 2030, primarily driven by countries like India, China, and the United States.

- China is amid a construction mega-boom. The country has the largest building construction market in the world, making up 20% of all construction investment globally. The country is expected to spend nearly USD 13 trillion on buildings by 2030.

- According to the National Bureau of Statistics (NBS), in China, the construction industry's business activity index (BASI) rose to 56.9 as of December 2023 from 55.9 in November 2023. The BASI score above 50 indicates growth in the industry, and the October 2023 BASI score was 53.5.

- According to the Department for Promotion of Industry and Internal Trade of India, the foreign direct investment (FDI) equity inflow for the construction development sector in India was worth USD 125 million in 2022. The United States' spending on private construction grew in 2022 and was nearly four times larger than construction spending in the public sector. The United States holds a significant share of the construction industry, which recorded an annual expenditure of over USD 1,793 million in 2022.

- According to the US Census Bureau (USCB), construction spending in December 2023 was estimated at a seasonally adjusted annual rate of USD 2,096.0 billion, 0.9% above the revised November estimate of USD 2,078.3 billion. Moreover, the construction value was USD 1,978.7 billion in 2023, 7.0%higher than the USD 1,848.7 billion spent in 2022.

- Therefore, the aforementioned developments are expected to drive the demand for window films in the construction industry through the years to come.

Asia-Pacific to Dominate the Market

- Asia-Pacific is expected to dominate the market, with China and India accounting for the largest share. China has the largest GDP in the region. China is one of the fastest emerging economies, and it has become one of the biggest production houses in the world today. The country's manufacturing sector is one of the major contributors to the country's economy. China is one of the major countries in Asia-Pacific with ample construction activities, with the industrial and construction industries accounting for approximately 50% of the GDP.

- Demographics in the country are expected to continue to spur growth in residential construction. Rising household income levels combined with the population migrating from rural to urban areas are expected to continue to drive demand for the residential construction segment in the country. Increased focus on affordable housing by both the public and private sectors will drive growth in the residential construction segment.

- India is the largest market for the construction industry, with an increase in the real estate and urban development segment. According to the Indian Brand Equity Foundation (IBEF), the Indian real estate industry will likely reach USD 1 trillion by 2030 and contribute approximately 13% to the country's GDP by 2025. This will increase the demand for the window film market and propel its market in the region.

- Although the demand for construction is good, the automotive industry in India is also increasing. For instance, according to the Society of Indian Automobile Manufacturers (SIAM) India, the passenger vehicle production volume reached 4.58 million in 2023, registering a 25.5% growth over 3.65 million in 2022. Moreover, in 2023, over 15.86 million units of two-wheelers were sold domestically across the country.

- Also, according to OICA, automotive production in China reached 30.16 million in 2023, an annual increase of 10.6%.

- Also, Oxford Economics estimates that China, the United States, and India will account for 51% of all construction work done worldwide by 2037. This means a huge global construction volume will occur in the two Asia-Pacific countries and can significantly grow the demand for window films during the forecast period.

- Due to all such factors, the market for window films in the region is expected to grow steadily during the forecast period.

Window Films Industry Overview

The global window films market is fragmented, with the top two companies holding significant shares in the global market. Some of the major players in the market (not in any particular order) include Eastman Chemical Company, 3M, Avery Dennison Corporation, Saint-Gobain, and Lintec Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand for Safety and Security Window Films

- 4.1.2 Increasing Emphasis on Reducing Carbon Footprint

- 4.2 Restraints

- 4.2.1 Technical, Warranty, and Installation Issues

- 4.2.2 Growing Smart Glass Market

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Solar Control and UV Blocking Films

- 5.1.2 Decorative Films

- 5.1.3 Safety and Security Films

- 5.1.4 Privacy Films

- 5.1.5 Insulating Films

- 5.1.6 Other Types

- 5.2 End-user Industry

- 5.2.1 Automotive

- 5.2.2 Building and Construction

- 5.2.2.1 Residential

- 5.2.2.2 Commercial

- 5.2.2.3 Infrastructural and Institutional

- 5.2.3 Marine

- 5.2.4 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Thailand

- 5.3.1.6 Vietnam

- 5.3.1.7 Malaysia

- 5.3.1.8 Indonesia

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Russia

- 5.3.3.6 Turkey

- 5.3.3.7 NORDIC

- 5.3.3.8 Spain

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Qatar

- 5.3.5.4 Nigeria

- 5.3.5.5 United Arab Emirates

- 5.3.5.6 Egypt

- 5.3.5.7 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 Armolan Greece

- 6.4.3 Avery Dennison Corporation

- 6.4.4 Eastman Chemical Company

- 6.4.5 HYOSUNG CHEMICAL

- 6.4.6 Johnson Window Films Inc.

- 6.4.7 LINTEC Corporation

- 6.4.8 NEXFIL

- 6.4.9 Rayno Window Film

- 6.4.10 Saint-Gobain

- 6.4.11 TORAY INDUSTRIES INC.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Concerns Regarding UV Protection