PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687312

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687312

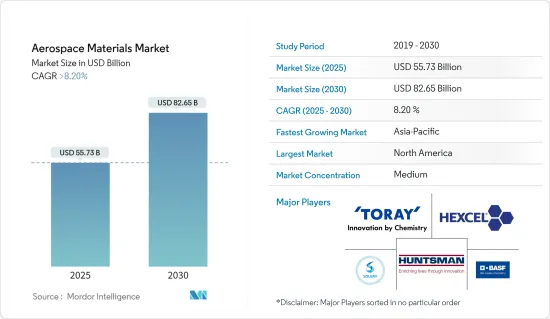

Aerospace Materials - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Aerospace Materials Market size is estimated at USD 55.73 billion in 2025, and is expected to reach USD 82.65 billion by 2030, at a CAGR of greater than 8.2% during the forecast period (2025-2030).

The COVID-19 pandemic negatively impacted the market in 2020. Passenger air travel facilities were temporarily shut down because of the pandemic and the lockdowns imposed to curb the spread of the virus. However, the market showed significant growth in 2021 and is continuing to grow in recent years.

Key Highlights

- Over the medium term, the increasing usage of composites in aircraft manufacturing, the growing space industry, and increasing government spending on defense in the United States and European countries are expected to drive the market's growth.

- On the flip side, the high manufacturing cost of carbon fibers and the declining usage of alloys are the key factors anticipated to restrain the growth of the target industry during the forecast period.

- The use of carbon nanotubes and nano-additives with epoxy adhesives is likely to create opportunities for the market in the coming years.

- North America is expected to dominate the market due to the high demand for commercial aircraft, growing government support in military spending, and expanding opportunities in the spacecraft segment.

Aerospace Materials Market Trends

The Demand for General and Commercial Aircraft is Increasing

- General and commercial aircraft are used for various purposes, including civil aviation (both private and commercial) and passenger and freight transportation.

- The aerospace industry is experiencing stagnant growth owing to the strengthening of passenger travel demand. The backlog of new aircraft orders and the constant resurgence of business aircraft may further contribute to its growth.

- Demand for private travel has increased as the number of high- and ultra-high-net-worth individuals has increased globally, resulting in the procurement of helicopters and business jets with improved cabin interiors.

- According to IATA (International Air Transport Association), the annual growth of global air traffic in 2023 increased by 36.9% in 2022.

- The aerospace industry is undergoing rapid technological advancements and innovation, creating upswings for aircraft manufacturing industries. According to the Boeing Commercial Outlook 2023-2042, with a resurgence in international traffic and domestic air travel back to pre-pandemic levels, the company has projected global demand for 48,575 new commercial jets by 2042.

- China is one of the largest aircraft manufacturers and one of the largest markets for domestic air passengers. Moreover, the country's aircraft parts and assembly manufacturing sector has been increasing, with over 200 small aircraft parts manufacturers.

- As per IBEF (India Brand Equity Foundation) and IATA forecasts, India's aviation market is expected to be the world's third-largest by 2024. The aviation sector has witnessed various investments and developments in recent times. For instance, in January 2022, Tata Sons acquired 100% shares of the state-run Air India by offering INR 18,000 crore (USD 2.4 billion). In June 2024, the National Company Law Tribunal (NCLT) approved the merger of Air India and Vistara to form the largest international carrier in India.

North America is Expected to Dominate the Market

- North America is expected to dominate the market due to increasing demand from countries like the United States and Canada.

- The United States has the largest aviation market in North America and one of the world's largest fleet sizes. Strong exports of aerospace components to countries such as France, China, and Germany, along with robust consumer spending in the United States, have been driving the aerospace industry's manufacturing activities, which is expected to induce a positive momentum for the country's aerospace material market.

- From 2022 to 2023, the amount of money the United States government allocated for defense rose by USD 55 billion, partly because of extra military assistance provided to back Ukraine during its continuous battle. The United States allocates more funds to defense than the next eight nations. Also, the United States government has signed the Fiscal 2023 National Defense Authorization Act into law, allotting USD 816.7 billion to the Department of Defense.

- The General Aviation Manufacturers Association (GAMA) announced that business aircraft manufacturers had a strong performance in the third quarter of 2023. In addition, the United States manufacturers saw an increase in production, delivering 512 aircraft in Q3 2023, a rise from 473 in the previous quarter, marking an 8.2% growth. This represents 70% of the total global shipments in the third quarter.

- According to the Aerospace Industries Association of Canada (AIAC), the aerospace industry generates CAD 31 billion (USD 23 billion) in annual revenue. Approximately 80% of Canada's aerospace industry is civil-oriented, and 20% is military-oriented.

- Montreal is the world's third-largest aerospace hub after Seattle, Washington, and Toulouse, France. Aerospace leads the Canadian manufacturing sector in innovation-related investment, with an annual expenditure of over USD 1.4 billion on R&D activities.

Aerospace Materials Industry Overview

The global aerospace materials market is partially consolidated in nature. Some of the major players in the market (no particular order) include BASF SE, Toray Industries Inc., Hexcel Corporation, Solvay, and Hunstman International LLC.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Use of Composites in Aircraft Manufacturing

- 4.1.2 Growing Space Industry

- 4.1.3 Increasing Government Spending on Defense in the United States and European Countries

- 4.2 Restraints

- 4.2.1 High Manufacturing Cost of Carbon Fibers

- 4.2.2 Declining Usage of Alloys

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size by Value)

- 5.1 Type

- 5.1.1 Structural

- 5.1.1.1 Composites

- 5.1.1.1.1 Glass Fiber

- 5.1.1.1.2 Carbon Fiber

- 5.1.1.1.3 Aramid Fiber

- 5.1.1.1.4 Other Composites

- 5.1.1.2 Plastics

- 5.1.1.3 Alloys

- 5.1.1.3.1 Titanium

- 5.1.1.3.2 Aluminium

- 5.1.1.3.3 Steel

- 5.1.1.3.4 Super

- 5.1.1.3.5 Magnesium

- 5.1.1.3.6 Other Alloys

- 5.1.2 Non-structural

- 5.1.2.1 Coatings

- 5.1.2.2 Adhesives and Sealants

- 5.1.2.2.1 Epoxy

- 5.1.2.2.2 Polyurethane

- 5.1.2.2.3 Silicone

- 5.1.2.2.4 Other Adhesives and Sealants

- 5.1.2.3 Foams

- 5.1.2.3.1 Polyethylene

- 5.1.2.3.2 Polyurethane

- 5.1.2.3.3 Other Foams

- 5.1.2.4 Seals

- 5.1.1 Structural

- 5.2 Aircraft Type

- 5.2.1 General and Commercial

- 5.2.2 Military and Defense

- 5.2.3 Space Vehicles

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 Russia

- 5.3.3.7 Rest of Europe

- 5.3.4 Rest of the World

- 5.3.4.1 South America

- 5.3.4.2 Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 Acerinox SA (VDM Metals)

- 6.4.3 Akzo Nobel NV

- 6.4.4 Aluminum Corporation of China Limited (Chalco)

- 6.4.5 Arkema

- 6.4.6 ATI

- 6.4.7 Axalta Coating Systems

- 6.4.8 BASF SE

- 6.4.9 Beacon Adhesives Inc.

- 6.4.10 Carpenter Technology Corporation

- 6.4.11 Corporation VSMPO-AVISMA

- 6.4.12 DELO Industrie Klebstoffe GmbH & Co. KGaA

- 6.4.13 Evonik Industries AG

- 6.4.14 Greiner AG

- 6.4.15 Henkel AG & Co. KGaA

- 6.4.16 Hentzen Coatings Inc.

- 6.4.17 Hexcel Corporation

- 6.4.18 Howmet Aerospace

- 6.4.19 Huntsman International LLC

- 6.4.20 HYOSUNG

- 6.4.21 ISOVOLTA AG

- 6.4.22 Jiangsu Hengshen Co. Ltd

- 6.4.23 Mankiewicz Gebr & Co.

- 6.4.24 Mitsubishi Chemical Corporation

- 6.4.25 Nanjing Yunhai Special Metal Co. Ltd

- 6.4.26 NIPPON STEEL CORPORATION

- 6.4.27 PPG Industries Inc.

- 6.4.28 Precision Castparts Corp.

- 6.4.29 Reliance Industries Ltd

- 6.4.30 Rogers Corporation

- 6.4.31 SGL Carbon

- 6.4.32 Socomore

- 6.4.33 Solvay

- 6.4.34 Tata Steel (Corus)

- 6.4.35 The Sherwin-Williams Company

- 6.4.36 Toray Industries Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Use of Carbon Nanotubes and Nano Additives with Epoxy Adhesives