PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687298

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687298

ASEAN Construction Machinery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

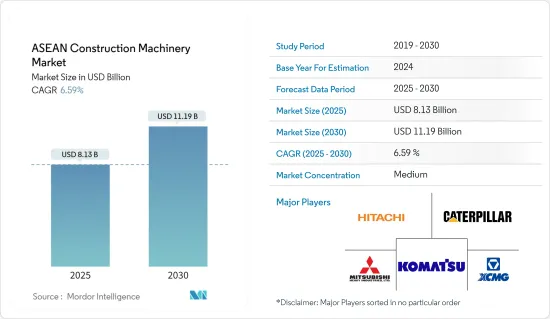

The ASEAN Construction Machinery Market size is estimated at USD 8.13 billion in 2025, and is expected to reach USD 11.19 billion by 2030, at a CAGR of 6.59% during the forecast period (2025-2030).

The COVID-19 pandemic had a negative impact on the market studied, primarily attributed to halted construction and manufacturing activities. In addition, governments across the ASEAN countries paused the pipeline projects and reduced the workforce over the sites. This has led to a reduction in construction output. However, the market is anticipated to witness significant growth during the forecast period due to the increase in construction activities, which is likely to be primarily attributed to increasing government support and restoration of construction activities worldwide.

Over the medium term, demand for construction machinery in the ASEAN region is driven by increased infrastructure spending. Additionally, with growth in the manufacturing industry in the region, manufacturers from all across the world are planning to shift their operations to the Southeast Asian nations due to lower costs, increasing domestic consumption, and improving and expanding infrastructure, which, in turn, resulted in higher demand for construction machinery.

Moreover, the government initiatives encouraging infrastructure activities and the rising adoption of technologically advanced machinery, both electrified and autonomous, tend to offer new opportunities for players operating in the market. The construction industry is getting smarter. Digitalization, connectivity, and automation are driving the development forward, substantially impacting construction projects. Moreover, renting companies are geared to invest in new technologies to cope with the growing demand for advanced construction machinery and replace the older ones with new or upgraded machinery fleet.

Factors such as rapid urbanization, industrialization, followed by rising government investments in the development of infrastructure, and expansion and growth activities of the real estate and construction companies across the region are expected to enhance demand in the market.

ASEAN Construction Machinery Market Trends

Concrete and Road Construction To Propel The Demand

- COVID-19 significantly impacted the ASEAN construction sector over the past year. Construction work of all sizes and incomes was forced to stop due to the strict lockdown and social distance regulations. As a result, neither the labor nor the equipment typically employed for construction was utilized.

- Companies that sold, rented, or leased out the machinery for a set time were negatively impacted. The demand for heavy-duty equipment was completely lost due to the construction industry's complete shutdown. Due to China's complete closure to trade, there was no need to use the machinery because raw material transportation was also stopped.

- Over the past few years, the road construction equipment market has witnessed significant growth, mainly due to increased road development programs initiated by regional governments.

- The need for construction equipment has been rising in response to the increase in road construction operations, and the importation of these machines is fueling this demand. The primary factors, led by the rising investment in building projects in the ASEAN region, have helped Singapore's heavy machinery exports to the rest of the ASEAN region rise consistently over the years. The Philippines and Thailand are two instances of ASEAN countries with fast economic growth. Thailand's imports of heavy machinery from Singapore have increased at the second-fastest rate in the region.

- With the rise in road construction activities, the demand for construction machinery has been increasing, which is supported by importing these machines. Exports of heavy machinery from Singapore to the rest of the ASEAN region have grown steadily over the years, supported by the key drivers and increased investment in construction projects in the ASEAN region. Two examples of high-growth opportunities in ASEAN are the Philippines and Thailand, among others. Singapore's heavy machinery exports to Thailand have the second-fastest growth in the region.

- Thus, various measures implemented by governments in the ASEAN area to promote infrastructure projects and increase government engagement in project planning, coordination, and financing are anticipated to fuel market expansion during the forecast period.

Increasing Demand for Construction Machinery in Vietnam

Vietnam's rising construction and infrastructure development projects are mostly to credit for the country's recent growth in the market for construction equipment.

Vietnam's machinery and equipment industry has grown significantly over the past ten years. This is demonstrated by the fact that between 2010 and 2019, the net revenue reported by businesses in this industry grew by 14.3% annually. Until 2020, Vietnam had over 2,200 businesses that produced machinery and equipment, bringing in a combined USD 4.6 billion.

Under the Public-Private Partnership model, a number of public infrastructure projects are undertaken, such as the expansion of Vietnam's airport. The Vietnamese government intends to invest USD11 billion in airport development over the following five years, with the project scheduled to begin in 2022.

By 2030, the government intends to spend 65 billion on road improvements. By 2030, the building of a road network is anticipated to account for around 48% of all investments made in the transportation sector. The Long Thanh Airport (USD16 billion), the Ho Chi Minh City Metro (USD6.2 billion), the North-South Express (USD18.5 billion), the Hanoi Ring Road (USD368 million), the Hai Van Tunnel 2 (USD312 million), and the Lien Chieu Port in Da Nang (USD147 million) are all significant road construction projects that will be completed in 2022.

Considering all the ongoing and future construction activities in Vietnam, the crane market is expected to witness steady growth over the forecast period, propelling the country's construction machinery market.

ASEAN Construction Machinery Industry Overview

The ASEAN construction machinery market is characterized by numerous international and regional players, resulting in a highly competitive market environment. The big players have increased their R&D expenditure exponentially to integrate innovation with excellence in performance. The demand for high-performance, highly efficient, and safe handling equipment from the end market is expected to make the market more competitive over the forecast period.

In March 2022, Iridium Communications Inc. announced that it had jointly developed a Link-Belt excavator with Sumitomo Construction Machinery Co., Ltd. Through this partnership, SCM initially integrated Iridium's Short Burst Data Service into its Remote CARE service platform.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Increasing Construction Activity May Drive the Market

- 4.2 Market Restraints

- 4.2.1 High Equipment Cost may Hamper the Market

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value USD Million)

- 5.1 Machinery Type

- 5.1.1 Cranes

- 5.1.2 Excavators

- 5.1.3 Loaders

- 5.1.4 Backhoe

- 5.1.5 Motor Graders

- 5.1.6 Other Machinery Types

- 5.2 Application

- 5.2.1 Concrete and Road Construction

- 5.2.2 Earth Moving

- 5.2.3 Material Handling

- 5.3 Geography

- 5.3.1 Indonesia

- 5.3.2 Thailand

- 5.3.3 Vietnam

- 5.3.4 Singapore

- 5.3.5 Malaysia

- 5.3.6 Philippines

- 5.3.7 Rest of ASEAN

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Hitachi Construction Machinery Co.

- 6.2.2 Caterpillar Inc.

- 6.2.3 Mitsubishi Corporation

- 6.2.4 Komatsu Ltd.

- 6.2.5 Xuzhou Construction Machinery Group Co., Ltd.

- 6.2.6 Liebherr Group

- 6.2.7 CNH Industrial

- 6.2.8 JC Bamford Excavators Ltd (JCB)

7 MARKET OPPORTUNITIES AND FUTURE TRENDS