Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687108

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687108

North America Pet Nutraceuticals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 228 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

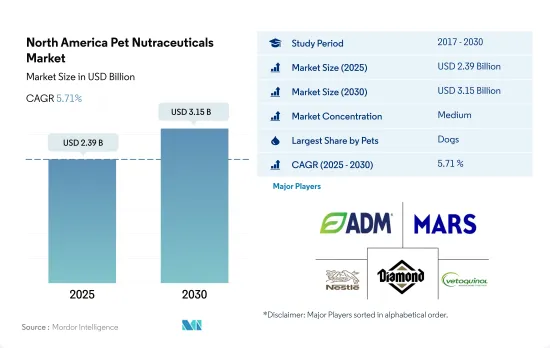

The North America Pet Nutraceuticals Market size is estimated at 2.39 billion USD in 2025, and is expected to reach 3.15 billion USD by 2030, growing at a CAGR of 5.71% during the forecast period (2025-2030).

Dogs are the major consumers of nutraceuticals as they are susceptible to many health problems, such as joint problems and digestive issues

- Pet nutraceuticals are supplements that are specifically formulated to improve the health and well-being of pets. In 2022, they accounted for 2.8% of the North American pet food market. The share of nutraceuticals increased by 9.9% in 2022 compared to 2017, mainly due to the increasing awareness among pet owners about the importance of preventive healthcare. In 2021, a study revealed that four in 10 cat and dog owners in the United States had paid more attention to their pet's health since the start of the pandemic.

- Dogs accounted for the majority of the nutraceuticals market, valued at USD 1.24 billion, followed by cats and other pet animals at USD 581.4 million and USD 226 million, respectively. The larger share of dogs is mainly due to their larger population compared to other pets. In 2022, there were 144 million dogs in the region, while cats and other pet animals accounted for 96.5 million and 104.9 million, respectively. The United States has the largest pet population in the region, accounting for 69% (239 million). Additionally, dogs are known to suffer from a wider range of health issues, such as joint problems, skin allergies, and digestive issues, which has led to increased demand for nutraceuticals in the region. Joint/mobility, vitamin deficiency, general health, skin coat, and immunity are among the most popular conditions where pet owners are spending money on both dogs and cats.

- The growing trend of humanization among pet owners, the aging pet population, growing specialized needs, and the rise of e-commerce channels are the major factors driving the market, and it is projected to register a CAGR of 5.6% during the forecast period.

The United States dominated the North American nutraceutical market, led mainly by the vitamins and minerals segment

- The North American pet nutraceuticals market has witnessed significant growth in recent years and is expected to continue this trend over the forecast period. One of the primary drivers of this growth has been the increasing pet humanization trend, with pet owners increasingly treating their pets as family members and focusing on their overall health and well-being.

- The United States dominated the North American market, accounting for an 88.7% share by value in 2022 . Its dominance was mainly due to the higher pet population in the country, which reached 239.1 million pets in 2022, accounting for about 69.2% of the North American pet population. With this huge pet population, the US pet nutraceuticals market value is anticipated to record a CAGR of 5.0% during the forecast period.

- Canada has the second-largest share in the North American market, valued at USD 126.4 million in 2022. It has the second-largest share because of a lower number of households adopting pets compared to the United States. The country is expected to record a CAGR of 9.1% during the forecast period as there is an increase in awareness about pet health and growing pet expenditure. For instance, the pet population in Canada was 28.3 million in 2022.

- Mexico accounted for about 3.8% of the market share in 2022. The limited market share of the country was mainly due to its limited pet population. However, with the rising trend in pet humanization, the Mexican market is anticipated to register a CAGR of 9.4% during the forecast period.

- The pet nutraceuticals market in the Rest of North America is anticipated to record a CAGR of 10.6% during the forecast period. The growing focus of pet owners on pet health and well-being is anticipated to boost the segment during the forecast period.

North America Pet Nutraceuticals Market Trends

The increasing adoption of cats by young adults and millennials is driving the cat food market

- There is an increase in the adoption of cats as pets in North America owing to the high demand for companionship and lesser expenditure on pet food for cats than dogs. In the region, cats as pets increased by 13.6% between 2017 and 2022 due to a rise in pet humanization and because cats require less area to live than dogs. For instance, in the United States, households owning a cat as a pet was 26% in 2020, which increased to 53.5% in 2022.

- The United States, Canada, and Mexico witnessed higher adoption of cats as pets during the pandemic because of the work-from-home culture leading to a demand for companionship and a higher number of pet owners being millennials. For instance, in 2022, millennials amounted to 33% of pet parents in the United States. In 2020, 40% of the pet cat population was adopted from animal shelters in the United States. Additionally, pet parents purchased cats from pet stores due to high income, and in 2020, 43% of cat parents in the United States purchased cats from pet stores. Therefore, cats as pets in the region increased by 5.34% between 2020 and 2022.

- Young cats are being adopted more than adult cats in the region, with the United States leading in terms of that number. For instance, in 2021, the adopted cat population in the United States was 684,144, and young cats accounted for 53.5% of the cats adopted. The higher population of young cats and millennials being pet parents is expected to help in the growth of pet food products during the forecast period. An increase in the adoption and purchase of cats and an increase in pet humanization are expected to help in the growth of the pet population.

Dogs accounted for higher expenditure as they consume a larger quantity of food than cats and have higher susceptibility to digestive issues

- Pet expenditure is increasing in North America. The rise in pet expenditure is due to the availability of different types of pet food and the growing premiumization of pet food products in the United States and Canada. Pet expenditure is projected to increase as pet parents increasingly treat their pets as family members and the awareness about specialized pet food rises. In 2020, there was a rise in pet supplement sales by about 200% as pet parents wanted their pets to have higher immunity and improved digestive systems, in line with greater awareness about pet health needs.

- The highest expenses of pet parents are on pet food, which is estimated to increase during the forecast period. For instance, pet food accounted for 42.4% of pet expenses in the United States in 2022. The expenditure share of dog food is higher than that of cats because the dog population is higher and because they consume a larger quantity of food than cats. Pet parents provide premium pet food to their pets and use services such as pet grooming and pet daycare in the region as they consider them as family members. In the United States, about 40% of pet parents purchased premium pet food, and USD 11.4 billion was spent on services such as pet grooming and pet walking in 2022.

- Pet parents purchase pet food through online retailers, supermarkets, and pet stores. Higher pet food sales are generated through online retailers as a variety of pet food products are available on e-commerce sites; also, the pandemic increased the number of online orders. In the United States, online sales of pet care products, including food, increased from 32% in 2020 to 40% in 2022. Premiumization and rising awareness about the benefits of quality food are factors anticipated to boost pet expenditure in the region.

North America Pet Nutraceuticals Industry Overview

The North America Pet Nutraceuticals Market is moderately consolidated, with the top five companies occupying 56.78%. The major players in this market are ADM, Mars Incorporated, Nestle (Purina), Schell & Kampeter Inc. (Diamond Pet Foods) and Vetoquinol (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 55140

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Pet Population

- 4.1.1 Cats

- 4.1.2 Dogs

- 4.1.3 Other Pets

- 4.2 Pet Expenditure

- 4.3 Regulatory Framework

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Sub Product

- 5.1.1 Milk Bioactives

- 5.1.2 Omega-3 Fatty Acids

- 5.1.3 Probiotics

- 5.1.4 Proteins and Peptides

- 5.1.5 Vitamins and Minerals

- 5.1.6 Other Nutraceuticals

- 5.2 Pets

- 5.2.1 Cats

- 5.2.2 Dogs

- 5.2.3 Other Pets

- 5.3 Distribution Channel

- 5.3.1 Convenience Stores

- 5.3.2 Online Channel

- 5.3.3 Specialty Stores

- 5.3.4 Supermarkets/Hypermarkets

- 5.3.5 Other Channels

- 5.4 Country

- 5.4.1 Canada

- 5.4.2 Mexico

- 5.4.3 United States

- 5.4.4 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 ADM

- 6.4.2 Alltech

- 6.4.3 Clearlake Capital Group, L.P. (Wellness Pet Company Inc.)

- 6.4.4 Dechra Pharmaceuticals PLC

- 6.4.5 Mars Incorporated

- 6.4.6 Nestle (Purina)

- 6.4.7 Nutramax Laboratories Inc.

- 6.4.8 Schell & Kampeter Inc. (Diamond Pet Foods)

- 6.4.9 Vetoquinol

- 6.4.10 Virbac

7 KEY STRATEGIC QUESTIONS FOR PET FOOD CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.