PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852162

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852162

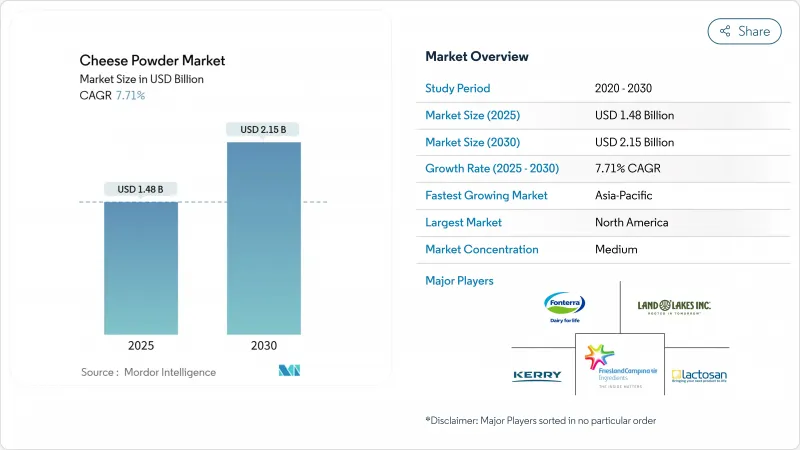

Cheese Powder - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The cheese powder market size is estimated to be USD 1.48 billion in 2025 and is expected to grow to USD 2.15 billion by 2030, with a CAGR of 7.71% during 2025-2030.

Growth drivers include the expansion of convenience food products such as instant noodles, packaged snacks, and ready-to-eat meals, along with the increasing quick-service restaurant (QSR) presence in developing markets like India, China, and Southeast Asian countries. The elimination of cold-chain logistics requirements reduces operational costs and extends product shelf life. Rising protein demand in snacks, ready meals, and bakery mixes, particularly in health-conscious consumer segments, further supports market expansion. Moreover, manufacturers use spray-dried cheese to mitigate raw-milk price volatility in the supply chain, while improved microencapsulation technology enhances flavor profiles and enables applications across multiple food categories. Together, these factors underline the growth trajectory of the cheese powder market, including seasonings, dips, and processed foods. Besides, the Asia-Pacific region shows strong growth potential due to increasing disposable incomes, urbanization, busy lifestyles, and growing adoption of Western food consumption patterns among younger demographics.

Global Cheese Powder Market Trends and Insights

Expansion of Western food chains in developing countries

The cheese powder market expansion is primarily attributed to Western fast-food chain penetration in developing economies, where it functions as a key ingredient for maintaining flavor consistency and operational efficiency. For instance, McDonald's reported that China dominated its Asia-Pacific and Middle East operations in 2024 with over 6,800 restaurants. Japan maintained the second position with approximately 2,900 restaurants, while Australia operated about 1,000 restaurants . These chains implement standardized supply chains and generate stable demand patterns, addressing dairy distribution challenges in regions with limited cold storage infrastructure. This market development results in local food producers creating products that align with increased consumer demand for cheese-flavored items. Subway's implementation of cheese powder in its Parmesan Oregano bread demonstrates the influence of international chains on market dynamics and product development. This implementation by major fast-food chains has prompted local manufacturers to develop cheese-flavored products in response to market demand. This trend continues to fuel the cheese powder market in developing economies.

Increase in demand for convenience food products

Changes in consumer lifestyles, particularly the increasing demand for quick and efficient meal preparation, have fundamentally transformed food purchasing patterns across global markets. Convenience products continue to experience robust growth in demand despite various economic challenges and market fluctuations. Cheese powder delivers multiple significant benefits to consumers and manufacturers: extended shelf life significantly reduces shopping frequency, instant reconstitution dramatically decreases preparation time, and precise portion control effectively minimizes food waste. The escalating consumer demand for diverse cheese flavors in savory snacks has prompted manufacturers to substantially expand their flavor offerings and develop increasingly refined taste profiles. This market evolution has resulted in the introduction of new premium and artisanal cheese powder varieties that deliver complex and authentic cheese flavors. Manufacturers are implementing advanced processing technologies and enhancing their flavor development capabilities to create innovative products that accurately replicate natural cheese taste while maintaining the practical advantages of powder form. Such innovations significantly expand the cheese powder market by aligning with consumer demand for practical and tasty food options.

Labeling and regulatory compliances

Regulatory complexity in food additive declarations and nutritional labeling imposes significant compliance costs and market entry barriers, especially for small manufacturers without dedicated regulatory teams. The FDA's requirements for cheese product standards mandate detailed ingredient declarations and processing method disclosures, which affect product formulations and increase documentation needs. International expansion further complicates compliance as different regulatory frameworks across regions require manufacturers to develop multiple product formulations and labeling approaches. The Codex General Standard for food additive labeling requires comprehensive ingredient transparency, which manufacturers often consider commercially sensitive information, potentially restricting innovation in proprietary formulations. The rise of "clean label" regulations requires manufacturers to reformulate products using ingredients that consumers perceive as natural, leading to increased production costs and technical complexities. These regulatory dynamics pose ongoing challenges for the cheese powder market.

Other drivers and restraints analyzed in the detailed report include:

- Long shelf life and ease of storage

- Rising demand for cheese-based snacks

- Health concerns related to saturated fats and cholesterol

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Cheddar powder holds the largest market share at 37.56% in 2024, supported by established supply chains and consistent flavor performance in spray drying processes. Its dominance underlines cheddar's vital role in the cheese powder market. North American manufacturers of snacks, seasonings, and bakery products consider cheddar essential for delivering salty-savory profiles. The market for cheddar-based powder formulations shows steady growth potential, driven by increasing demand for convenient meal kits. Mozzarella powder, though currently holding a smaller market share, is expected to grow at a 10.29% CAGR, driven by expanding pizza consumption globally. According to DEFRA, in 2022/2023, per capita pizza consumption in the United Kingdom reached 85 grams weekly, with retail pizza products (frozen and non-frozen) accounting for 68 grams and takeaway pizza products contributing 17 grams .

Cheddar's market leadership is reinforced by consistent milk-solid supply and standardized aging processes that facilitate procurement. Mozzarella production requires time-sensitive curd supplies, prompting processors to develop integrated facilities in growing pizza markets. The mozzarella segment of the cheese powder market is projected to reduce the gap with cheddar after 2030. Manufacturers developing cheddar-mozzarella powder combinations seek to combine stretching properties with mature flavor profiles, particularly for baked goods applications. Such innovation adds diversity to the cheese powder market, particularly in premium categories. Premium snack manufacturers utilize microcapsulation technology for blue and parmesan variants to preserve distinct aromas without requiring refrigeration. Market position across cheese powder types is determined by flavor stability, cost-effectiveness, and consumer recognition.

The Cheese Powder Market Report is Segmented by Product Type (Cheddar, Parmesan, Mozzarella, Blue Cheese, and Other Types), Application (Food Processing and HoReCa/Foodservice), and Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America accounted for 36.54% of global revenue in 2024, supported by established cheese consumption patterns, extensive quick-service restaurant networks, and efficient supply chains that reduce delivery times. The United States continues to be the primary market, while Mexico contributes to growth through modernized drying facilities serving snack exporters. Canada strengthens its regional position through its value-added dairy ingredients, despite stable per-capita consumption. This maturity highlights North America's established position in the cheese powder market. However, health-focused product reformulation, rising energy costs, and market saturation in retail channels limit growth potential during the forecast period.

Europe maintains a consistent volume, reinforced by strict quality regulations that benefit established manufacturers. Germany and France lead conventional consumption, while Italy's mozzarella powder exports grow due to increasing global pizza consumption. Post-Brexit trade barriers have shifted some UK demand to EU manufacturers, slightly increasing the continental market share. Environmental regulations promoting lower-carbon drying systems may influence future plant investments, potentially benefiting companies with access to renewable energy sources.

Asia-Pacific represents the market's highest growth potential, with a projected CAGR of 9.25% through 2030. Increasing urbanization, expanding middle class, and improved retail networks drive demand in China and India, followed by Indonesia and Vietnam. Consumer acceptance of cheese-flavored snacks increases as social media and food delivery applications introduce Western cuisine. Government initiatives to increase domestic milk production reduce import dependence, encouraging joint ventures in spray-drying operations. Japan's developed market prefers premium parmesan powders, while Australia utilizes seasonal milk surplus for cheddar powder exports. These factors establish the region as the primary growth driver in the cheese powder market through 2030.

- Kerry Group plc

- Fonterra Co-operative Group

- Land O Lakes Inc.

- Lactosan A/S

- FrieslandCampina Ingredients

- Glanbia plc

- Dairy Farmers of America

- Agropur Ingredients

- Ornua Ingredients

- Commercial Creamery Company

- Bluegrass Ingredients Inc.

- Aarkay Food Products Ltd.

- Hoosier Hill Farm

- Archer Daniels Midland Company

- Grozette B.V.

- Grande Custom Ingredients Group

- All American Foods

- Batory Foods

- Lactalis Ingredients

- Food Source International

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Expansion of Western Food-Chains in Developing Countries

- 4.2.2 Increase in Demand for Convience Food Products

- 4.2.3 Long Shelf Life and Ease of Storage Compared to Regular Cheese

- 4.2.4 Technological Advancements in Spray Drying and Microencapsulation

- 4.2.5 Increasing demand for Cheese based Snacks

- 4.2.6 Versatility in Food Applications

- 4.3 Market Restraints

- 4.3.1 Labeling and Regulatory Compliances

- 4.3.2 Health Concerns Related to Saturated Fats and Cholesterol

- 4.3.3 Energy-intensive Drying Technologu facing Decarbonization Costs

- 4.3.4 Raw Material and Price Volatility

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Cheddar

- 5.1.2 Parmesan

- 5.1.3 Mozzarella

- 5.1.4 Blue Cheese

- 5.1.5 Other Types

- 5.2 By Application

- 5.2.1 Food Processing

- 5.2.1.1 Bakery and Confectionery

- 5.2.1.2 Dairy

- 5.2.1.3 Soups, Sauces and Condiments

- 5.2.1.4 Ready Meals

- 5.2.1.5 Other Applications

- 5.2.2 HoReCa/Foodservice

- 5.2.1 Food Processing

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Germany

- 5.3.2.3 Spain

- 5.3.2.4 France

- 5.3.2.5 Italy

- 5.3.2.6 Netherlands

- 5.3.2.7 Poland

- 5.3.2.8 Belgium

- 5.3.2.9 Sweden

- 5.3.2.10 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 Australia

- 5.3.3.5 Indonesia

- 5.3.3.6 South Korea

- 5.3.3.7 Thailand

- 5.3.3.8 Singapore

- 5.3.3.9 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Chile

- 5.3.4.5 Peru

- 5.3.4.6 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 United Arab Emirates

- 5.3.5.4 Turkey

- 5.3.5.5 Morocco

- 5.3.5.6 Egypt

- 5.3.5.7 Rest of Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials (if available), Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Kerry Group plc

- 6.4.2 Fonterra Co-operative Group

- 6.4.3 Land O Lakes Inc.

- 6.4.4 Lactosan A/S

- 6.4.5 FrieslandCampina Ingredients

- 6.4.6 Glanbia plc

- 6.4.7 Dairy Farmers of America

- 6.4.8 Agropur Ingredients

- 6.4.9 Ornua Ingredients

- 6.4.10 Commercial Creamery Company

- 6.4.11 Bluegrass Ingredients Inc.

- 6.4.12 Aarkay Food Products Ltd.

- 6.4.13 Hoosier Hill Farm

- 6.4.14 Archer Daniels Midland Company

- 6.4.15 Grozette B.V.

- 6.4.16 Grande Custom Ingredients Group

- 6.4.17 All American Foods

- 6.4.18 Batory Foods

- 6.4.19 Lactalis Ingredients

- 6.4.20 Food Source International

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK