PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687056

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687056

Insect Feed - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

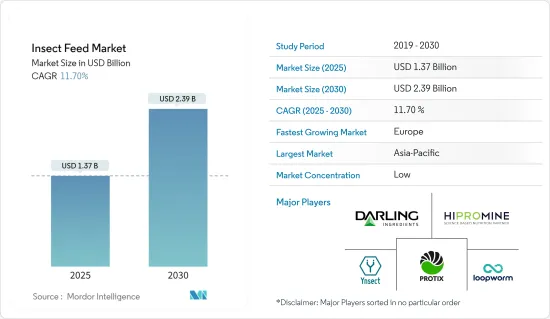

The Insect Feed Market size is estimated at USD 1.37 billion in 2025, and is expected to reach USD 2.39 billion by 2030, at a CAGR of 11.7% during the forecast period (2025-2030).

The increasing global demand for farmed fish has led to a rise in fishmeal and fish oil prices. Insect feed serves as a viable protein-rich alternative for aquafeed. Research on insect meals as fishmeal alternatives has been ongoing for the past 20 years, with promising results in aquaculture species feeding. According to the ITC Trade Map, the import value of fish in 2023 reached USD 26 million, an 8.6% increase from USD 23.9 million in 2021. Insects are gaining recognition as viable animal feed due to their high energy and protein content. Insect feed offers advantages over fresh or unprocessed dried insects, as it can be easily mixed with other feed components like ground grains and soy to form pellets of the desired composition, enabling more convenient animal feeding.

The insect feed sector has less commercial-scale production compared to conventional animal feed products. However, significant factors, including new investments by international organizations, were observed during the study period due to the market's increasing global demand. In June 2024, the International Finance Corporation (IFC) invested USD 2 million in ProNuvo, a Costa Rica-based company specializing in sustainable insect-based animal feed production. These growing investments by international organizations demonstrate confidence in the market's expansion. Additionally, insects' high feed conversion ratio, low space requirements, and supportive regulatory environment drive the insect feed market growth.

Insect Feed Market Trends

Growing Demand for Insect Protein in Aquaculture

Insects like black soldier fly larvae (BSFL) and mealworms offer a sustainable alternative to traditional feed ingredients in aquaculture due to their high protein content, essential amino acids, and other nutrients. Various organizations and companies are developing insect-based aquaculture feeds. In 2024, India's Central Marine Fisheries Research Institute (CMFRI) successfully created a BSFL-based aquafeed, which has shown positive results in improving fish growth and reducing fishmeal dependency. To advance this innovation, CMFRI has partnered with Amala Ecoclean to adapt the feed for different fish species and farming environments, aiming for commercial production.

The expanding aquaculture industry, driven by increasing global seafood demand, particularly in Asia and Europe, is creating a corresponding need for high-quality feed ingredients. This growth is reflected in the Food and Agriculture Organization of the United Nations (FAO) State of World Fisheries and Aquaculture (SOFIA) 2024 report, which states that global aquatic animal production reached 185.4 million metric tons in 2022, with 79% originating from Asia and Europe. Looking ahead, the report forecasts a 10% increase in aquatic animal production by 2032, reaching 205 million tonnes, and a 12% rise in apparent consumption, providing an average of 21.3 kg per capita in 2032. These projections underscore the importance of developing sustainable feed solutions, such as insect-based alternatives, to support the industry's growth while minimizing environmental impact.

Asia-Pacific Dominates the Market

In Asia-Pacific, increasing meat consumption has driven demand for nutritious insect feed in recent years. China leads the region's insect feed market, with meat consumption showing consistent growth. According to the Organization for Economic Co-operation and Development (OECD) in 2023, the per capita consumption of poultry meat in China, the Philippines, and Indonesia was 9.9 kg, 9.4 kg, and 8 kg respectively. To meet the growing demand for nutritious meat, livestock is being fed protein-rich insects, fostering the development of the insect feed industry for livestock, particularly poultry and swine, in China.

India ranks as the second-largest market for insect feed after China. The gradual increase in demand for meat and meat-based products has raised concerns about malnutrition, as significant areas of farmland are allocated to grow resource-intensive poultry products. In response to this trend, companies like Arthro Biotech are emerging as key players in the insect protein industry. In 2024, Arthro Biotech became the first Indian black soldier fly (BSF) insect protein producer to receive EU TRACES Certification, with a current production capacity of 500 metric tons of insect protein per annum.

The growth of the insect feed market is further propelled by the expansion of companies in the region. A notable example is Entobel, a global leader in the sustainable production of functional insect-based ingredients for animal feed and plant nutrition. In 2023, Entobel set an industry record by opening the largest insect protein production plant in Asia, located in Vietnam. This state-of-the-art facility produces black soldier fly (BSF) in 50 levels of vertical rearing, utilizing advanced sensors and data analytics, demonstrating the industry's commitment to innovation and large-scale production to meet the growing demand for insect-based feed in the Asia-Pacific region.

Insect Feed Industry Overview

The global insect feed market is characterized by fragmentation, with numerous new entrants holding small market shares. Key players such as Hipromine SA, Protix, Loopworm, Ynsect, and Darling Ingredients Inc. dominate the market. These companies employ strategies including acquisitions, partnerships, and expansions to enhance their research capabilities and marketing efforts in the insect feed industry.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 High Feed Conversion Ratio of Insects

- 4.2.2 Innovations in Insect Farming and Processing

- 4.2.3 Demand for Sustainable and Alternative Protein Source

- 4.3 Market Restraints

- 4.3.1 Regulatory and Legislative Barriers

- 4.3.2 Cultural and Consumer Acceptance

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Animal Type

- 5.1.1 Aquaculture

- 5.1.2 Poultry

- 5.1.3 Swine

- 5.1.4 Other Animal Types

- 5.2 Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Mexico

- 5.2.1.4 Rest of North America

- 5.2.2 Europe

- 5.2.2.1 Germany

- 5.2.2.2 United Kingdom

- 5.2.2.3 France

- 5.2.2.4 Russia

- 5.2.2.5 Spain

- 5.2.2.6 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 Japan

- 5.2.3.3 India

- 5.2.3.4 Rest of Asia-Pacific

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of South America

- 5.2.5 Middle East and Africa

- 5.2.5.1 United Arab Emirates

- 5.2.5.2 Egypt

- 5.2.5.3 Rest of Middle East and Africa

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Hipromine SA

- 6.3.2 nextProtein

- 6.3.3 Darling Ingredients Inc.

- 6.3.4 Protix BV

- 6.3.5 InnovaFeed SAS

- 6.3.6 Nasekomo AD

- 6.3.7 Ynsect

- 6.3.8 Beta Hatch Inc.

- 6.3.9 Entomo Farms

- 6.3.10 Hexafly Enterprises Limited

- 6.3.11 Loopworm Private Limited

7 MARKET OPPORTUNITIES AND FUTURE TRENDS