PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1686665

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1686665

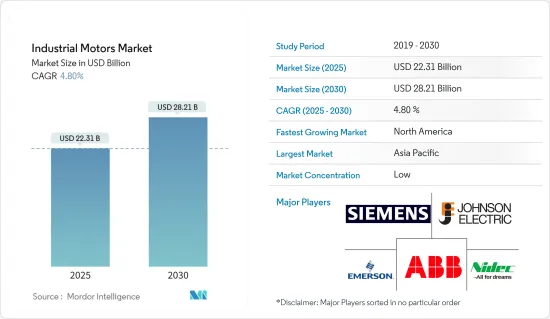

Industrial Motors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Industrial Motors Market size is estimated at USD 22.31 billion in 2025, and is expected to reach USD 28.21 billion by 2030, at a CAGR of 4.8% during the forecast period (2025-2030).

An industrial motor is an electrical machine that converts electrical energy into mechanical energy to perform various tasks in industrial settings. Industrial motors are designed to provide power and motion to different equipment and machinery used in manufacturing, oil and gas, construction, transportation, etc. These motors are typically more robust and powerful than motors used in residential or commercial applications, as they need to withstand heavy loads and operate in demanding environments.

Key Highlights

- Motors drive industrial production. Innovative methods in motor monitoring, alignment, testing, and connections save time and costs and enhance safety. Concurrently, energy-saving motors and intelligent drives elevate efficiency and performance and simplify troubleshooting.

- With a global push towards energy efficiency and sustainability, manufacturers are increasingly opting for energy-efficient motors. These choices aim to reduce energy consumption and operating costs, with IE4 efficiency motors standing out for their significant energy savings over older models.

- Global industrialization has heightened the demand for energy-efficient motors. As industries establish and expand, the need for motors that curtail energy consumption and operating costs becomes paramount. These energy-efficient motors enhance efficiency and minimize energy loss, leading to notable cost savings over time. This growing demand spans multiple sectors, including manufacturing, agriculture, construction, and transportation.

- Automation systems are pivotal for manufacturing, engineering, construction, and power generation, driving enhanced efficiency and productivity. Industrial automation is witnessing rapid advancements fueled by artificial intelligence (AI), cloud computing, Big Data, and the Internet of Things (IoT).

- Despite the advantages, several challenges hinder the widespread adoption of energy-efficient motors. Fundamental limitations include the associated costs: energy, maintenance, and initial purchase. Furthermore, producing energy-efficient motors demands superior materials, advanced manufacturing techniques, and rigorous testing and certification. These requirements can inflate production costs for manufacturers, leading to higher consumer prices.

Industrial Motors Market Trends

The Oil and Gas Segment is Expected to Witness Growth

- The oil and gas sector is currently leading the market due to its need for industrial motors to power a range of processes, including drilling, extraction, refining, and transportation. Due to increasing awareness of climate change and the necessity of decreasing CO2 emissions, the oil and gas industry is progressively acknowledging the significance of energy-efficient motors.

- Due to the significant use of AC induction motors in pumps, compressors, and turbines, as well as their application for extraction, processing, and transport of oil and gas from drilling sites into refineries, which are sold to consumers, it is estimated that these motors will be trendy within the oil and gas industry. In addition, low-voltage induction motors are used in refineries for drive pumps, compressors, and agitators to convert crude oil into multiple products such as gasoline, diesel, and jet fuel.

- Rapid urbanization in developing nations accompanies a considerable increase in energy demand. Consequently, the consumption of liquid fuels and natural gas rises. For instance, according to BP, natural gas production amounted to 4.08 trillion cubic meters in 2023. The escalating global need for electricity and fuel has increased the demand for oil and natural gas.

- With rising oil and gas demand, the market for E&P machines, equipment, and components is growing. As a result, the need for AC motors used in different capacities within the downstream and upstream segments of the oil and gas industry is also increasing.

- According to Baker Hughes, North America hosts oil and gas rigs globally. As of August 2024, the region boasted 781 land rigs and 23 offshore rigs. In 2023, the global count of oil rigs surpassed 1,800 units on average.

North America is Expected to Hold Significant Market Share

- Industrial motor markets are mainly driven by the increasing focus of industries on Industry 4.0 within the United States. Industrial automation encourages manufacturers to produce more effective products, with solid growth expected throughout the projection period. This pattern would result in a desire to develop new industrial motor machines. The spread of industrial automation across all sectors is expected to be evenly distributed. Consequently, to cope with industrial automation's growth, the market for industrial motors is predicted to develop in the United States.

- As industries and consumers seek to reduce energy consumption and minimize their carbon footprint, there is a growing demand for energy-efficient solutions. Industrial electric motors are known for their higher efficiency and lower energy losses than traditional motors.

- Oil and gas is an industry in which drilling operations are carried out to extract crude oil and natural gas from reservoirs using drilling rigs. Electric motors are a common source of power for drilling equipment. According to Baker Hughes, North America leads the world in hosting oil and gas rigs. As of August 2024, the region boasted 781 land rigs and an additional 23 offshore. By the end of 2023, the United States had 500 active rotary oil rigs and 120 gas rigs, contributing to a total rotary rig count of 622.

- Canada has implemented energy efficiency regulations to remove inefficient motors from the market. The guidelines for motor efficiency, provided by NEMA MG-1, are available to Canada's businesses through these performance standards. These regulations cover three-phase induction motors with power between 1 and 500 horsepower. These performance standards cover most motors used in manufacturing and industrial applications. Compliance with these energy standards is mandatory for business owners.

- The Government has taken several initiatives to foster Canada's manufacturing sector, including tax reductions on new investments, various trade agreements with different countries, investment in new technologies, and many skill training programs. The Canadian Government has also invested in local companies and entrepreneurs to ensure they have the tools necessary for success.

- For instance, in July 2024, Hitachi Energy Canada secured CAD 30 million (USD 21.54 million) in funding from the Government of Canada. This funding will help set up a new HVDC simulation center in Montreal and modernize the power transformer factory in Varennes. These initiatives aim to meet North America's surging demand for sustainable energy.

Industrial Motors Market Overview

The degree of competition depends on various factors affecting the market, such as brand identity, powerful competitive strategy, and degree of transparency.

The industrial motors market comprises various prominent players such as ABB Ltd., Emerson Electric Co., Nidec Industrial Solutions, Johnson Electric Holdings Limited, and Siemens AG, among others. The brand identity associated with the companies has a major influence in this market. As strong brands are synonymous with good performance, long-standing players are expected to have the upper hand.

In a market where the sustainable competitive advantage through innovation is considerably high, the competition is only going to increase, considering the anticipated surge in demand from new customers from the end-user industries like mining, oil and gas, energy. With the presence of large market incumbents, market penetration levels are also high

Owing to their market penetration and the ability to offer advanced products, the competitive rivalry is expected to continue to be high. Although the market comprises various players, only a handful are prominent in the market for their high standards and excellent quality.

With the growing consolidation technological advancement, and geopolitical scenarios, the studied market has been witnessing fluctuation. In addition to this, the major industry player depends on their affiliates for raw materials vendors, considering their ability to invest, which result from their revenues.

The level of innovation, time-to-market, and performance are the key terms by which the players differentiate themselves in the market studied.

Overall, the intensity of the competitive rivalry in the studied market is growing and expected to be high during the forecast period owing to the growth of the industry.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Demand for Energy Efficiency Owing to Government Regulations

- 5.1.2 Growing Shift towards Smart Motors

- 5.2 Market Challenges

- 5.2.1 Portability Issues

- 5.2.2 High Initial Investment for Procuring New Equipment and Upgrading Existing Equipment

6 MARKET SEGMENTATION

- 6.1 By Type of Motor

- 6.1.1 Alternating Current (AC) Motors

- 6.1.2 Direct Current (DC) Motor

- 6.1.3 Other Types of Motors (Servo and Electronically Commutated Motors (EC))

- 6.2 By Voltage

- 6.2.1 High Voltage

- 6.2.2 Medium Voltage

- 6.2.3 Low Voltage

- 6.3 By End User

- 6.3.1 Oil & Gas

- 6.3.2 Power Generation

- 6.3.3 Mining & Metals

- 6.3.4 Water & Wastewater Management

- 6.3.5 Chemicals & Petrochemicals

- 6.3.6 Discrete Manufacturing

- 6.3.7 Other End Users

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia

- 6.4.4 Australia and New Zealand

- 6.4.5 Latin America

- 6.4.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ABB Ltd.

- 7.1.2 Emerson Electric Co.

- 7.1.3 Siemens AG

- 7.1.4 Nidec Industrial Solutions

- 7.1.5 Johnson Electric Holdings Limited

- 7.1.6 Arc Systems Inc.

- 7.1.7 Ametek Inc.

- 7.1.8 Toshiba Electronic Devices and Storage Corporation

- 7.1.9 Wolong Industrial Motors

- 7.1.10 Allen - Bradly Co. LLC (Rockwell Automation Inc.)

- 7.1.11 Maxon Motor AG

- 7.1.12 Franklin Electric Co. Inc.

- 7.1.13 Fuji Electric Co. Ltd

- 7.1.14 ATB Austria Antriebstechnik AG

- 7.1.15 Menzel Elektromotoren GmbH

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET