PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1686664

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1686664

Africa Agricultural Machinery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

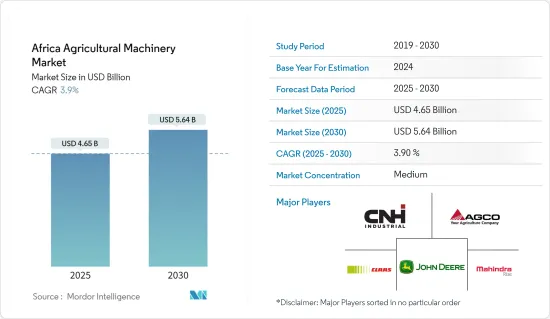

The Africa Agricultural Machinery Market size is estimated at USD 4.65 billion in 2025, and is expected to reach USD 5.64 billion by 2030, at a CAGR of 3.9% during the forecast period (2025-2030).

Key Highlights

- Africa's agriculture machinery market is steadily expanding, fueled by the continent's push to modernize farming practices. This modernization aims to enhance productivity and tackle pressing food security challenges. For instance, according to the United Nations Economic Commission for Africa, its population expanded from 283 million in 1960 to more than 1.5 billion in 2023 - a more than five-fold increase-and is projected to increase by 950 million and touch 2.5 billion by 2050. Such growth amplifies the demand for food, and modern machinery stands as a pivotal solution to boost crop yields and meet this escalating demand.

- In South Africa, commercial farmers play a crucial role in the agricultural sector. Recently, according to the Wisconsin Economic Development Corporation, approximately 32,000 commercial farmers produce 80% of the country's agricultural value. These farmers view mechanization as a cornerstone for enhancing profits and ensuring the sustainability of their operations. This perspective bodes well for the market's growth trajectory. The South African Agricultural Machinery Association (SAAMA) has sales of about 9,181 tractors and 373 combined harvesters for 2022, underscoring the nation's steady march towards agricultural mechanization.

- In Ethiopia, while most farmers operate on small landholdings and large-scale mechanization remains rare, the government is actively promoting growth in both agriculture and the machinery sector. One of its flagship initiatives, the Growth and Transformation Plan (GTP II), aims to invigorate these sectors. A key strategy under this plan involves leasing vast arable lands to international entities, paving the way for large-scale commercial farming. This move is not only bolstering equipment sales but also propelling the agricultural machinery market's expansion in Ethiopia. With government backing and heightened investments from major players, the region witnesses robust growth in agricultural mechanization.

Africa Agricultural Machinery Market Trends

Tractors is the Significant Segment by Product Type

Agriculture is pivotal to Africa's economic development. Despite boasting the world's largest expanse of uncultivated arable land, Africa's agricultural productivity lags behind other developing regions. Current crop yields in Africa stand at just 56% of the global average. To meet the rising food demand spurred by population growth and swift urbanization, Africa must boost its crop yields in the coming decades. Mechanization, particularly through tractors, presents a viable solution to bridge this yield gap.

In Africa, tractors are indispensable, facilitating everything from plowing and tilling to planting and harvesting. Research by Agri Evolution Alliance underscores the vast potential for agricultural machinery in Africa, with tractors leading the charge. Government support is anticipated to drive sector development. For instance, the Ghanaian government provides subsidized tractors to entrepreneurs operating 89 centers for tractor rental and servicing.

Tractor sales have shown an upward trend in recent years. The South African Agricultural Machinery Association (SAAMA) reports that tractor sales in South Africa increased from 7,680 units in 2021 to 9,181 units in 2022. Given Africa's predominant smallholder farms, compact tractors, typically under 100 HP, reign supreme. Manufacturers are tailoring models to suit African needs-prioritizing affordability, durability, and ease of maintenance. In Africa's fragmented land holdings, small and medium-sized tractors shine, as opposed to larger, costlier machinery.

In 2021, the European Agricultural Machinery Industry Association (CEMA) and the Food and Agriculture Organization of the United Nations (FAO) extended their memorandum of understanding (MoU) on sustainable agricultural mechanization until 2025. This renewed agreement emphasizes the importance of automated and intelligent agricultural machinery, precision agriculture, digital data management, and accurate statistical data on agricultural machinery use, particularly in African countries. These initiatives are likely to stimulate growth in the agricultural machinery including tractor market.

South Africa Dominates the Market

Among African nations, South Africa stands out as the largest market. Historically, the South African agricultural economy transitioned from relying on food aid to emphasizing domestic production, a shift initiated by the Green Revolution, championed by the World Food Program of the United Nations. South Africa now has major potential for the growth of the agriculture and agriculture machinery market.

Moreover, South Africa holds the title of the leading cereal producer in Sub-Saharan Africa. Maize dominates its production, trailed by wheat, soybeans, and sunflower seeds. According to the FAOSTAT, the total cereal production in South Africa reached 18.7 million metric tons in 2022, with maize accounting for approximately 16.1 million metric tons. Such robust production levels have spurred a push towards mechanization and investments in cutting-edge agricultural equipment. Additionally, South Africa outpaces its continental counterparts in mechanization rates, showcasing notable tractor penetration and the prevalent use of harvesters, planters, and irrigation systems. This advanced mechanization empowers South African farmers to boost efficiency and productivity, particularly in large-scale crop farming, where labor costs surpass those in many other African nations.

The presence of several global companies, like John Deere, Mahindra, and AGCO Corporation, may enable the easy introduction of products in the South African market. In 2022, John Deere launched X9 Series combine harvesters at NAMPO Harvest Day 2022. It has since created a massive buzz around the incredible operational capacity and performance of the all-new class 11 Combine to arrive on South African shores.

Africa Agricultural Machinery Industry Overview

The African agricultural machinery market is relatively consolidated. The major players in the market include Deere & Company, AGCO Corporation, CNH Industrial NV, Mahindra & Mahindra Ltd, and Claas KGaA mbH. Major players in the market have extended their product portfolio and broadened their businesses to maintain their positions in the market. Expanding the product portfolio by introducing new and innovative products into the market is the most adopted strategy by these companies.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Declining Agricultural Labor

- 4.2.2 Rising Technological Advancements

- 4.2.3 Growing Government Support to Enhance Farm Mechanization

- 4.3 Market Restraints

- 4.3.1 Increasing Farm Expenditure

- 4.3.2 Security Concerns in Modern farming Machinery

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Product Type

- 5.1.1 Tractors

- 5.1.2 Plowing and Cultivating Machinery

- 5.1.3 Planting and Fertilizing Machinery

- 5.1.4 Harvesting Machinery

- 5.1.5 Haying and Forage Machinery

- 5.1.6 Irrigation Machineries

- 5.1.7 Other Product Types

- 5.2 Geography

- 5.2.1 South Africa

- 5.2.2 Rest of Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Tractors and Farm Equipment Limited (TAFE)

- 6.3.2 Claas KGaA mbH

- 6.3.3 AGCO Corporation

- 6.3.4 Mahindra & Mahindra Ltd

- 6.3.5 Deere & Company

- 6.3.6 CNH Industrial NV

7 MARKET OPPORTUNITIES AND FUTURE TRENDS