PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1686640

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1686640

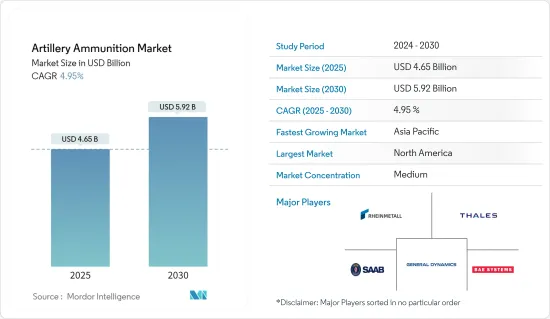

Artillery Ammunition - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Artillery Ammunition Market size is estimated at USD 4.65 billion in 2025, and is expected to reach USD 5.92 billion by 2030, at a CAGR of 4.95% during the forecast period (2025-2030).

Artillery ammunition represents a significant advancement in military technology, allowing for precise target engagement and a marked reduction in collateral damage. As warfare evolves, the emphasis on precision and the need to minimize civilian harm have become paramount, driving the demand for this advanced ammunition.

The global market landscape is dynamic and influenced by several key trends. One notable trend is the heightened emphasis on integrating advanced targeting systems and enhancing network-centric warfare capabilities. In addition, the industry's growth is driven by a surging demand for munitions tailored for asymmetric warfare environments, marking a shift away from traditional large-scale military operations.

The increase in the military spending of various countries supports the various military initiatives to update military weapons and ammunition, which is expected to generate demand for artillery ammunition. The development of new and advanced artillery ammunition by the ammunition manufacturing companies with extended range, increased lethality, and integrated sensors to increase accuracy is anticipated to attract the armies of various countries for their future procurement, thereby leading the market to witness significant growth during the forecast period.

Regulatory challenges constrain market growth, especially concerning international arms treaties and export controls. The complexities of developing and transferring advanced military technologies frequently lead to elevated costs and extended development timelines. Additionally, in contrast to traditional unguided artillery, the steep price of precision-guided munitions may dissuade certain nations, especially those with a constrained defense budget.

Artillery Ammunition Market Trends

120mm & Above Segment Anticipated to Witness Highest Growth During the Forecast Period

The segment for artillery ammunition of 120mm and above is poised for substantial growth during the forecast period. Key drivers of this expansion include heightened defense spending by multiple nations, a push for more advanced artillery capabilities, and a global trend toward bolstering defense mechanisms. Furthermore, the integration of cutting-edge technology in ammunition development promises to enhance artillery systems' range, lethality, and precision in the foreseeable future.

Major players in the market are heavily investing in R&D for advanced artillery ammunition, signaling a robust focus on the 120 mm and above segment. As a testament to this trend, in April 2023, Switzerland unveiled its intent to bolster its artillery capabilities. They announced the acquisition of an additional batch of 120mm mortar systems, specifically tailored for the General Dynamics European Land Systems Piranha IV 8x8 armored vehicle. Further solidifying this commitment, the Swiss Federal Office for Armaments inked a deal with GDELS-Mowag, securing 16 more Morser 16 120mm mortar systems units.

In July 2024, Elbit Systems Ltd. secured a USD 220 million contract from the Israel Ministry of Defense for its "Iron Sting" precision-guided mortar munitions. Designed for 120mm mortars, these munitions utilize advanced GPS and laser guidance technologies, achieving high-precision targeting capabilities up to 10 kilometers. The Iron Sting is equipped with a sophisticated multi-mode fuze system, featuring Point Detonation (PD), Point Detonation Delay (PDD), and Proximity Sensor (PRX) functionalities. This two-year upgrade aims to bolster the ground combat effectiveness and accuracy of the Israeli Defense Forces. In February 2023, Ukraine's state arms company announced a joint production of artillery shells with a NATO member from Central Europe, signaling intentions to collaborate on developing and producing other arms and military hardware. Additionally, as tensions escalated in the Russia-Ukraine conflict, Ukroboronprom commenced production of 120-mm mortar rounds in Ukraine.

Thus, the advancements in terms of research and development and production of advanced 120mm and above artillery ammunition by various key players in the market will lead to the 120mm and above segment witnessing significant growth in the market during the forecast period.

Asia-Pacific to Witness Highest Growth During the Forecast Period

Regional security threats, including territorial disputes and geopolitical tensions, are escalating in Asia. In response, nations are intensifying their focus on bolstering defense capabilities, leading to a surge in demand for artillery ammunition. Countries like China, India, and South Korea are channeling investments into advanced artillery systems, viewing them as deterrents against potential threats. This urgency to uphold a formidable defense posture is driving the acquisition of high-caliber artillery munitions, a trend poised to sustain the region's artillery ammunition market growth.

Numerous nations in the Asia Pacific are modernizing their military forces. They're phasing out older artillery systems in favor of advanced models, which demand compatible ammunition. This modernization effort addresses aging equipment and aims to integrate cutting-edge technology for enhanced combat effectiveness. As nations pivot towards sophisticated artillery solutions-like self-propelled howitzers and rocket-assisted projectiles-the demand for specialized ammunition rises, fueling market expansion.

Multinational defense exercises and alliances in the Asia Pacific cultivate a collaborative military training environment. These joint exercises often spotlight artillery's pivotal role in achieving tactical goals, amplifying the demand for artillery ammunition. Participating nations are thus motivated to bolster their artillery ammunition reserves, ensuring they're well-equipped for both training and operational demands, further propelling market growth.

Across the Asia Pacific, defense budgets are witnessing significant boosts, acting as a primary catalyst for the artillery ammunition market. Governments are channeling these funds into defense equipment acquisitions, artillery ammunition included, as part of their national security strategies. This financial commitment not only facilitates direct ammunition purchases but also champions domestic production, nurturing a vibrant defense industrial base in the region.

In January 2023, the Ethiopia government purchased 32 SH-15 (PCL-181) self-propelled howitzers from China. The PCL-181 is a truck-mounted, 155mm self-propelled howitzer used by China's People's Liberation Army (PLA) Ground Force. These howitzers are light enough to be airlifted by most medium transport aircraft, including C-295, C-130, and Y-9, making it a more flexible option for Ethiopia's rapid reaction units. PCL-181) self-propelled howitzers are compatible with all standard 155mm NATO ammunition and indigenous ammunition developed by China North Industries Corporation (NORINCO).

Artillery Ammunition Industry Overview

The artillery ammunition market exhibits a semi-consolidated structure, with several players commanding notable market shares. Key players include General Dynamics Corporation, Rheinmetall AG, BAE Systems plc, THALES, and Saab AB.

Market leaders prioritize developing cutting-edge artillery ammunition systems for global defense personnel. Increased investments in R&D for these advanced systems signal promising opportunities ahead. Furthermore, manufacturers are adopting technologies such as extended-range cannon artillery platforms, bolstering the market's growth prospects during the forecast period.

In August 2023, Rheinmetall AG unveiled a next-gen 120mm KE ammunition tailored to counter modern protection technologies. In September 2023, General Dynamics Ordnance and Tactical Systems clinched a USD 218 million contract from the US Army to boost production of the 155 mm M1128 artillery shells. This contract is a segment of a larger multiyear agreement, totaling USD 974 million, underscoring the focus on enhancing artillery capabilities.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Buyers/Consumers

- 4.4.2 Bargaining Power of Suppliers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Caliber

- 5.1.1 Below 120mm

- 5.1.2 120mm & Above

- 5.2 Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.2 Europe

- 5.2.2.1 United Kingdom

- 5.2.2.2 France

- 5.2.2.3 Germany

- 5.2.2.4 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 Japan

- 5.2.3.3 India

- 5.2.3.4 South Korea

- 5.2.3.5 Rest of Asia-Pacific

- 5.2.4 Latin America

- 5.2.4.1 Brazil

- 5.2.4.2 Mexico

- 5.2.4.3 Rest of Latin America

- 5.2.5 Middle East and Africa

- 5.2.5.1 United Arab Emirates

- 5.2.5.2 Saudi Arabia

- 5.2.5.3 South Africa

- 5.2.5.4 Israel

- 5.2.5.5 Rest of Middle East and Africa

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 General Dynamics Corporation

- 6.2.2 Rheinmetall AG

- 6.2.3 BAE Systems plc

- 6.2.4 Saab AB

- 6.2.5 Nammo AS

- 6.2.6 MESKO S.A.

- 6.2.7 THALES

- 6.2.8 The Indian Ordnance Factories

- 6.2.9 Singapore Technologies Engineering Ltd.

- 6.2.10 MSM Group

- 6.2.11 Elbit Systems Ltd.

- 6.2.12 KNDS N.V.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS