PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1686638

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1686638

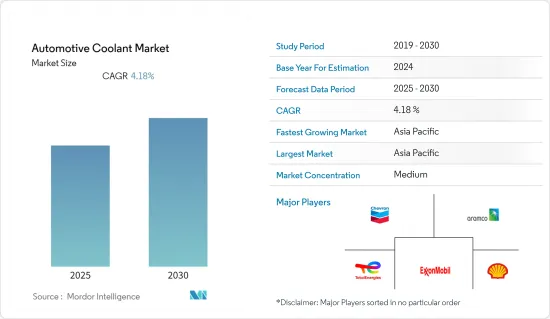

Automotive Coolant - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Automotive Coolant Market is expected to register a CAGR of 4.18% during the forecast period.

The COVID-19 pandemic had a substantial impact on the global economic landscape. Concerns about potential business closures and recession hit the automotive coolant market. Moreover, registrations of new vehicles have been on a decline as lockdown orders have restricted the number of vehicles running on roads. However, the automotive industry is now recovering from the losses and paving the way to introduce quality products to cater to the rising demand from consumers across the globe. The automotive industry witnessed significant growth in terms of production in 2022, and is further anticipated to grow during the forecast period. With th increasing vehicles on road, the demand for coolant is antiicpated to increase signfiicantly during the forecats period.

Over the medium term, The market's expansion is being fueled by the automotive sector growing throughout the world. In recent years, there has been an increase in demand for passenger vehicles, which has aided market expansion. Furthermore, end user acceptance of reusable coolant types has been boosted by strict regulatory requirements for the safe disposal of antifreeze material and its recycling.

Key automakers are still offering diesel and gasoline vehicles which have fueled up the engine coolant demand across the globe. Key coolant manufacturers are providing resistance-free chemicals inside the coolant which avoid the corrosion of engine components. In addition, coolant has also played the most crucial role in upbringing the vehicle mileage thus, anticipating a high adoption rate over the study period.

The rise in demand for vehicles and automakers and continuous investments in R&D for the development of cost-effective, environment-friendly, and less toxic products with a high life are likely to boost the automotive coolant market during the forecast period. Moreover, the easy and abundant availability of various materials, including ethylene glycol, propylene glycol, and glycerin, in developed countries helps new entrants develop such products and also drives the automotive coolant market.

Automotive Coolant Market Trends

Passenger Car Segment Likely to Dominate the Market

The passenger car segment is likely to hold a significant share of the market by the end of the forecast period owing to a rise in the demand for utility vehicles in highly populated countries such as China, India, and Brazil.

Automobile manufacturers are introducing newer brands and products to offer customized coolant and lubricant solutions for customers, expanding the automotive coolant market's share. Several global OEMs are investing in the country through either joint ventures with established players or after FDI norms have been invested directly in setting up their production units or enhancing their sales and dealership networks across the country. For instance,

- In December 2021, ExxonMobil announced that it had finalized corporate plans, which include increasing its spending to USD 15 billion on greenhouse gas emission-reduction projects over the next six years while maintaining disciplined capital investments in its industry-leading portfolio.

- In May 2021, Chevron Corporation and Noble Midstream Partners LP announced that they had completed the previously announced acquisition, which resulted in Noble Midstream becoming an indirect, wholly-owned subsidiary of Chevron.

Moreover, high demand for e-class, crossovers, SUVs, and hatchbacks is driving the passenger vehicle segment, which, in turn, is likely to boost the automotive coolant market. The rise in preferences for private transport and purchasing power of consumers is driving the passenger vehicle segment of the market.

The Passenger car segment of the market during the forecast period is to grow at a faster pace owing to rising vehicle production and the growing focus of key OEMs on launching innovative products to attract a wide range of consumers in wake of rising vehicle sales across major regions in the world.

Asia-Pacific dominating the Market

Asia-Pacific held a leading share of the global automotive coolant market due to the higher volume of vehicles produced in major countries, including India, China, and Japan, and lower manufacturing and labor costs across the region. India is expected to witness prominent growth due to the rising demand for vehicles during the forecast period. Moreover, the availability of inexpensive labor and raw material in the region, coupled with the increasing number of local manufacturers, is likely to propel the market in Asia-Pacific during the forecast period.

India is presently the sixth-biggest passenger vehicle manufacturer globally and the second-leading commercial vehicle developer. Rapid industrialization has given way to improvements in the infrastructure, which is likely to benefit the regional market's progress. The swelling number of small and medium enterprises has elevated the demand for light passenger vehicles and heavy-duty trucks.

Indian PSU oil players, like IOCL, HPCL, BPCL, etc., and private players like RIL are continuously increasing their crude oil production capacity. As ethylene glycol is a crude oil by-product, the increasing production and refining capacity of crude oil may increase the availability of ethylene glycol in India, simultaneously boosting the domestic production of coolants in the country.

Major key players expanding their manufacturing facilities to enhance the product portfolios across the region, which in turn is likely to witness major growth for the market during the forecast period. For instance,

- In August 2022, Shell Lubricants announced it sell electric vehicle battery coolants in India. Shell Lubricant India had increased its production capacity at its lubricant oil-blending plant at Taloja in Maharashtra recently, and it now plans further expansions for a few more India- as well as South Asia-specific products.

The increasing domestic production of coolants may significantly help coolant manufacturers cater to the rising demand for coolants in the country. This is projected to fuel the automotive coolant market in the region over the next few years.

Automotive Coolant Industry Overview

The automotive coolant market is dominated by several key players such as ExxonMobil Corp., TotalEnergies Inc., Valvoline Inc., and others. The companies are focusing on geographic expansion for increasing their customer base and enhancing revenue generation. For instance,

- In March 2023, Aramco, The Saudi Arabian Oil Company acquired Valvoline Inc. for USD 2.65 billion, through one of its wholly-owned subsidiaries. Through this acquisition, Aramco will expand its coolant products across the globe.

- In May 2022, Hella received the first large-volume series order for its new Coolant Control Hub (CCH). Series production is expected to start in 2024 at Hella's electronics plant in San Jose Iturbide, Mexico.

- In August 2021, Valvoline Inc. launched new coolant technology specifically designed for modern engines, called Valvoline Antifreeze Coolant HT-12(TM) Green and Valvoline Antifreeze Coolant HT-12 Pink.

- In April 2021, Valvoline expanded its company-owned Quick-Lube Network with the acquisition of 16 service centers in Texas.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value - USD)

- 5.1 By Vehicle Type

- 5.1.1 Passenger Car

- 5.1.2 Commercial Vehicle

- 5.2 By Chemical Type

- 5.2.1 Ethylene Glycol

- 5.2.2 Propylene Glycol

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 India

- 5.3.3.2 China

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.4.1 South America

- 5.3.4.2 Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 BP PLC ( Castrol)

- 6.2.2 Chevron Corp.

- 6.2.3 ExxonMobil Corp.

- 6.2.4 Saudi Aramco Group

- 6.2.5 TotalEnergies SE

- 6.2.6 Royal Dutch Shell PLC

- 6.2.7 Indian Oil Corp. Ltd

- 6.2.8 JXTG Holdings Inc.

- 6.2.9 Prestone Products Corp.

- 6.2.10 Amsoil Inc.

- 6.2.11 Voltronic GmbH

- 6.2.12 American Mfg Co. (Rudson)

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

8 IN-USE VEHICLE DATA, BY GEOGRAPHY, 2018-2028

- 8.1 North America

- 8.2 Europe

- 8.3 Asia Pacific

- 8.4 Rest of the World